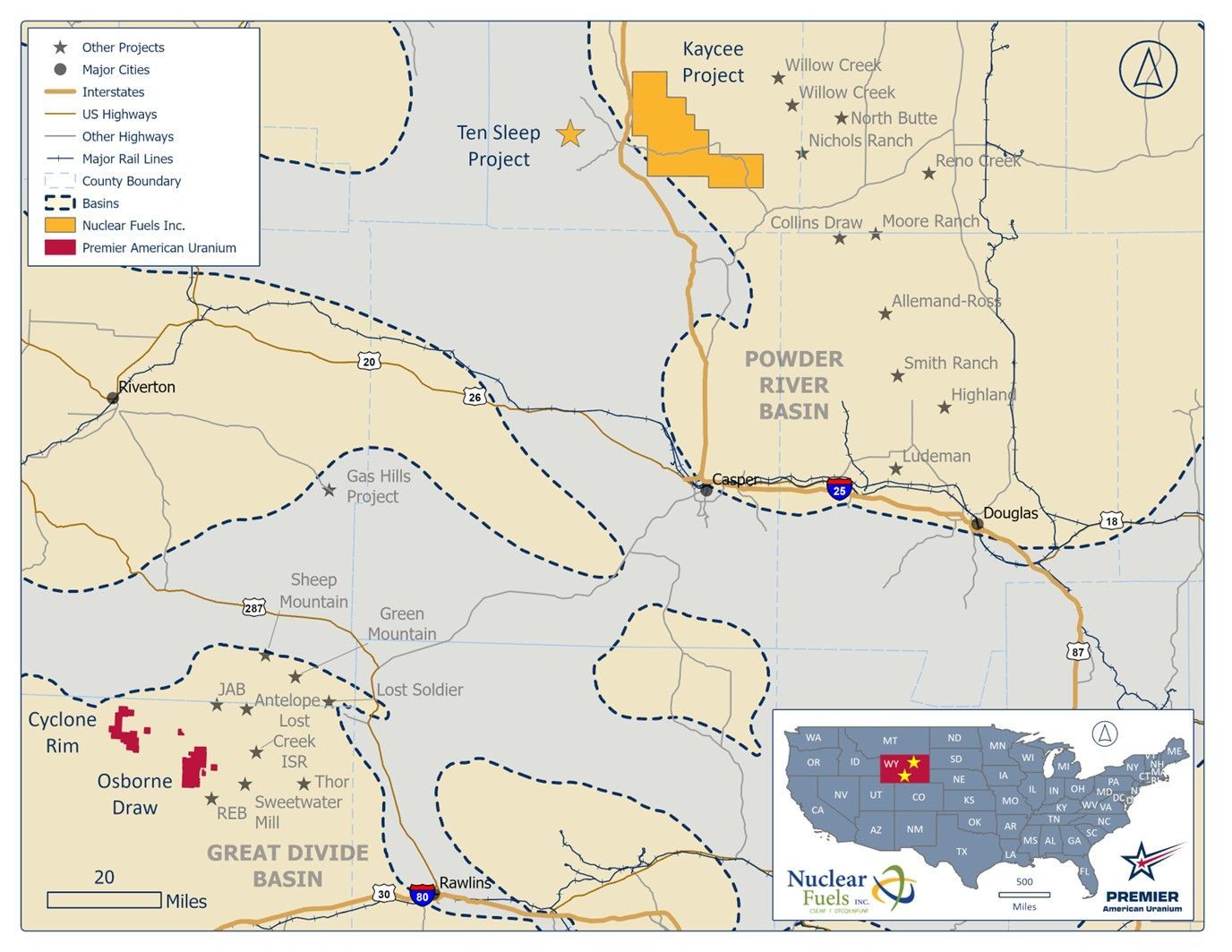

Premier American Uranium Inc. ("PUR" or "Premier American Uranium") (TSXV: PUR, OTCQB: PAUIF) and Nuclear Fuels Inc. ("NF" or "Nuclear Fuels") (CSE: NF, OTCQX: NFUNF) are pleased to announce that they have entered into an arm's length definitive agreement (the " Arrangement Agreement ") dated June 4, 2025, pursuant to which Premier American Uranium has agreed to acquire all of the issued and outstanding common shares of Nuclear Fuels (the " NF Shares ") by way of a court-approved plan of arrangement (the " Arrangement " or the " Transaction "). Nuclear Fuels holds a 100% interest in the Kaycee Uranium Project (" Kaycee ") located in Wyoming's prolific Powder River Basin (Figure 1). The Kaycee Project spans a 35-mile trend of altered and mineralized sandstones, supported by over 4,200 drill holes and 430 miles of mapped roll fronts. In addition to Kaycee, Nuclear Fuels also holds five exploration-stage projects across key uranium districts in Wyoming, Utah, and Arizona.

Under the terms of the Arrangement, shareholders of Nuclear Fuels (" NF Shareholders ") will receive 0.33 of a common share of Premier American Uranium (each whole share, a " PUR Share ") for each NF Share held (the " Exchange Ratio "). Existing shareholders of Premier American Uranium and Nuclear Fuels will own approximately 59% and 41% (on a basic shares outstanding basis), respectively, of the pro forma outstanding PUR Shares on closing of the Arrangement. The Exchange Ratio implies consideration of C$0.43 per NF Share based on the 20-day volume weighted average price (" VWAP20 ") of PUR Shares on the TSX Venture Exchange (the " TSXV ") on June 4, 2025. The Transaction represents a premium of 54% to the closing price of the NF Shares on the Canadian Securities Exchange (the " CSE ") and a 46% premium to the VWAP20 of NF Shares on the CSE for the period ending June 4, 2025 1 . The implied equity value of the combined company (the " Company ") is estimated at approximately C$102 million 2 .

Strategic Rationale for the Transaction

- Establishes America's leading uranium explorer with a consolidated portfolio of 12 projects across key U.S. uranium districts, including estimated mineral resource of 18.6 Mlbs U 3 O 8 Indicated and 4.9 Mlbs U 3 O 8 Inferred at its Cebolleta Project in New Mexico 3 and exploration potential at several other projects in Wyoming, as indicated by the results of historical exploration drilling (Figure 2) and recent NI 43-101 technical reports. The combined project portfolio will span over 104,000 acres and includes projects from near-term development to early-stage exploration, supported by an extensive geological database that is expected to enable efficient resource conversion and targeted discovery potential. Additional assets in Colorado, Utah, and Arizona provide further growth potential.

- Enhanced presence in Wyoming, where the Company will have completed the most exploration drilling amongst Wyoming-focused in-situ recovery ("ISR") explorers in 2024. The Transaction unites PUR's Cyclone Project in the Great Divide Basin with NF's Kaycee Project in the Powder River Basin—two of Wyoming's most important productive ISR regions. In 2024, the companies completed an aggregate of 368 holes on their respective properties totaling 209,490 feet, representing one of the largest ISR drilling exploration programs in the U.S. Both projects stand to benefit from shared technical expertise ahead of the 2025 drill season.

- Compelling catalysts to de-risk development include, a planned mineral resource update and PEA for Cebolleta expected to be completed in summer 2025, with potential expansion drilling to follow. Located in the prolific Grants Mineral Belt of New Mexico, which has produced over 347 Mlbs U₃O₈ 4 , Cebolleta is strategically positioned for potential future development. In May 2025, four Grants District uranium projects were added to the U.S. Federal FAST-41 permitting dashboard, underscoring the district's growing strategic significance.

- Backed by founding shareholders Sachem Cove and IsoEnergy, along with sector leaders enCore Energy Corp. and Mega Uranium, the Company will have strong strategic ownership, deep development expertise, and a clear mandate for U.S. uranium consolidation. Estimated post-transaction ownership includes Sachem Cove Partners LLC (23.2%), enCore Energy Corp. (9.5%), IsoEnergy Ltd. (5.4%) and Mega Uranium Ltd. (2.3%).

- Fully funded for growth, with C$14M in cash 6 , the Company is expected to have financial flexibility to aggressively advance the combined portfolio and evaluate further M&A opportunities .

- Stronger capital markets profile, with a more diversified shareholder base and enhanced market capitalization, the Company is expected to have broader institutional, retail investor and ETF interest and increased visibility among research analysts .

Colin Healey, CEO of Premier American Uranium, commented, "Premier American Uranium is proud to pursue this Transaction to combine our assets with those of Nuclear Fuels. Kaycee is an exciting ISR prospect that, in combination with our own Cyclone Project, is expected to position PUR as one of the most active uranium explorers in Wyoming. While we target resource growth in Wyoming, we will continue to advance our Cebolleta Project in New Mexico along the development curve. This is the second major acquisition for Premier American Uranium within the last 12 months, and it adheres to our goal of growth during a time of pronounced optimism in the nuclear space. Finally, the joining of strengths and backers of the two companies is a notable merit to the deal, with IsoEnergy, enCore Energy Corp., Mega, and Sachem Cove all on the pro forma share register."

Greg Huffman, CEO, President & Director of Nuclear Fuels, further added, "We believe this Transaction offers numerous merits for NF Shareholders. Primarily, we welcome the diversification and depth of the expanded asset portfolio across the key U.S. uranium jurisdictions, most notably a doubling down on exposure in Wyoming. An exploration focus is too rare amongst U.S. uranium miners, and the combined company will seek to fill that gap. Additionally, the strength of the combined shareholder registers and the increasingly important role of ETF ownership is expected to underpin the Company's prospects going forward."

About the Kaycee Project

Historic exploration at the Kaycee Project, including over 3,800 drill holes has confirmed uranium mineralization over more than 1,000 vertical feet in all three historically productive sandstones within the Powder River Basin, making the Kaycee Project unique as the only project in the Powder River Basin where all three formations—Wasatch, Fort Union, and Lance—are known to be mineralized and potentially amenable to ISR extraction. The majority of the mineralized trends have not yet been well-explored with drilling concentrated only on approximately 10% of the trend.

In September 2024, Nuclear Fuels released a NI 43-101 technical report for the Kaycee Project entitled "NI 43-101 Technical Report, Kaycee Uranium Project, Johnson County, WY, USA" with an effective date of December 31, 2023. The technical report, prepared by WWC Engineering, identified an exploration target of 9.6 million tons at an average grade of 0.060% to 14.8 million tons at an average grade of 0.101 U 3 O 8 % 5 supported by available historical data from previous operators and recent exploration conducted by Nuclear Fuels.

Nuclear Fuels acquired the Kaycee Project from enCore Energy Corp. (" enCore ") in 2022 and has completed 411 exploration drill holes totalling 225,260 feet over the past two years. enCore retains a buyback option to acquire a 51% interest in Kaycee by making a cash payment equal to 2.5 times the exploration expenditures incurred by Nuclear Fuels and carrying the Kaycee project through to commercial production (with 49% of post-exercise project expenditures recoverable from net proceeds of commercial production). This buyback option is exercisable by enCore upon Nuclear Fuels establishing a NI 43-101 compliant estimate of measured and indicated mineral resources of greater than 15 Mlbs U 3 O 8 , or 20 Mlbs U 3 O 8 measured and indicated plus inferred resources, so long as total measured and indicated resources is at least 10 Mlbs U 3 O 8 .

Figure 1: Location of Nuclear Fuels' Kaycee Project in Wyoming's Powder River Basin, situated near Premier American Uranium's Cyclone Project in the neighbouring Great Divide Basin.

Figure 2: Pro forma portfolio of 12 projects across key U.S. uranium districts.

Transaction Details

Pursuant to the terms of the Arrangement Agreement, all of the issued and outstanding NF Shares will be exchanged for PUR Shares based on the Exchange Ratio. Outstanding and unexercised warrants and stock options to purchase NF Shares will additionally be adjusted in accordance with their terms based on the Exchange Ratio.

The Arrangement Agreement includes standard deal protections, including non-solicitation and fiduciary out provisions with respect to Nuclear Fuels and a right-to-match in favour of Premier American Uranium, as well as certain representations, covenants and conditions that are customary for a transaction of this nature and a termination fee of $2 million payable to Premier American Uranium in certain circumstances.

The Transaction will be effected by way of a plan of arrangement completed under the Business Corporations Act (British Columbia). The Transaction will require approval by at least 66 2/3% of the votes cast by NF Shareholders and, if required by Multilateral Instrument 61-101 - Protection of Minority Security Holders in Special Transactions, a simple majority of the votes cast by NF Shareholders excluding certain interested or related parties, in each case by shareholders present in person or represented by proxy at a special meeting of NF Shareholders to be called in connection with the Transaction (the " NF Special Meeting ").

The NF Special Meeting is expected to be held in the third quarter of 2025. An information circular detailing the terms and conditions of the Transaction will be mailed to the NF Shareholders in connection with the NF Special Meeting. All NF Shareholders are urged to read the information circular once available, as it will contain important additional information concerning the Transaction.

Closing of the Transaction is subject to the receipt of applicable regulatory approvals and the satisfaction of certain other closing conditions customary in transactions of this nature, including, without limitation, court and stock exchange approval. Closing of the Transaction is anticipated to occur in the third quarter of 2025.

None of the securities to be issued pursuant to the Transaction have been or will be registered under the United States Securities Act of 1933, as amended (the " U.S. Securities Act "), or any state securities laws, and any securities issuable in the Transaction are anticipated to be issued in reliance upon available exemptions from such registration requirements pursuant to Section 3(a)(10) of the U.S. Securities Act and applicable exemptions under state securities laws. This press release does not constitute an offer to sell or the solicitation of an offer to buy any securities.

Management and Board of Directors

On closing of the Transaction, the Company's board of directors is expected to be comprised of up to five members from the current directors or management of Premier American Uranium and two nominees from the current directors or management of Nuclear Fuels. The Company will be managed by the current executive team of Premier American Uranium, led by Colin Healey as CEO.

Nuclear Fuels Special Committee and Fairness Opinion

Nuclear Fuels established a special committee of its Board of Directors (the " Special Committee ") to review the Transaction. The Special Committee engaged Evans & Evans, Inc. (" Evans & Evans ") to provide a fairness opinion with respect to the Transaction.

The fairness opinion provided by Evans & Evans confirmed that, as of the date of such opinion, and based upon and subject to the assumptions, limitations and qualifications stated in such opinion, the consideration to be received by NF Shareholders pursuant to the Transaction is fair, from a financial point of view, to NF Shareholders.

The Special Committee unanimously recommended that the Board of Directors of Nuclear Fuels approve the Arrangement and that NF Shareholders vote in favour of the Transaction at the NF Special Meeting.

Board Recommendations and Voting Support

The Arrangement has been unanimously approved by the boards of directors of both Premier American Uranium and Nuclear Fuels, and Nuclear Fuels' board unanimously recommends that its shareholders vote in favour of the Transaction.

Each of the officers and directors of Nuclear Fuels, along with enCore Energy Corp., holding collectively 21.19% of the outstanding NF Shares, have entered into customary voting support agreements with Premier American Uranium pursuant to which they have agreed, among other things, to vote their NF Shares in favour of the Transaction.

Haywood Securities Inc. has provided a fairness opinion to the Board of Directors of Premier American Uranium, to the effect that, as of the date of such opinion, and based upon and subject to the assumptions, limitations and qualifications set out in such opinion, the consideration to be paid by Premier American Uranium pursuant to the Transaction is fair, from a financial point of view, to Premier American Uranium.

Canaccord Genuity Corp. has provided a fairness opinion to the Board of Directors of Nuclear Fuels, to the effect that, as of the date of such opinion, and based upon and subject to the assumptions, limitations and qualifications set out in such opinion, the consideration to be received by NF Shareholders pursuant to the Transaction is fair, from a financial point of view, to NF Shareholders.

Advisors and Counsel

Haywood Securities Inc. is acting as financial advisor to Premier American Uranium. Cassels Brock & Blackwell LLP is acting as legal counsel to Premier American Uranium.

Canaccord Genuity Corp. is acting as financial advisor to Nuclear Fuels. Morton Law LLP is acting as legal counsel to Nuclear Fuels.

Qualified Persons

The scientific and technical information contained in this news release has been prepared in accordance with the Canadian regulatory requirements set out in NI 43-101 and reviewed and approved on behalf of Premier American Uranium by Dean T. Wilton, PG, CPG, MAIG, and on behalf of Nuclear Fuels by Mark Travis, CPG, each of whom are consultants and contractors of Premier American Uranium and Nuclear Fuels, respectively, and each a "Qualified Person" as defined by NI 43-101.

For additional information regarding PUR's Cebolleta Project, including the current mineral resource estimate, please refer to the Technical Report entitled "The Cebolleta Uranium Project Cibola County, New Mexico, USA" with an effective date of April 30, 2024, prepared by SLR International Corporation, available under PUR's profile on www.sedarplus.ca .

For additional information regarding PUR's Cyclone Project including the exploration target, please refer to the Technical Report entitled "Technical Report on the Cyclone Rim Uranium Project, Great Divide Basin, Wyoming, USA" with an effective date of June 30, 2023, prepared by Douglas L. Beahm, P.E., P.G., available under PUR's profile on www.sedarplus.ca.

For additional information regarding Nuclear Fuels' Kaycee Project, including the exploration target, please refer to the Technical Report entitled "NI 43-101 Technical Report, Kaycee Uranium Project, Johnson County, WY, USA" with an effective date of December 31, 2023, prepared by WWC Engineering, available under NF's profile on www.sedarplus.ca .

About Premier American Uranium Inc.

Premier American Uranium is focused on the consolidation, exploration, and development of uranium projects in the United States, aiming to strengthen domestic energy security and support the transition to clean energy. One of Premier's key strengths is the extensive land holdings in three prominent uranium-producing regions in the United States: the Grants Mineral Belt of New Mexico, the Great Divide Basin of Wyoming and the Uravan Mineral Belt of Colorado.

With current resources and defined resource exploration targets, Premier American Uranium is actively advancing its portfolio through work programs. Premier American Uranium benefits from strong partnerships, with backing from Sachem Cove Partners, IsoEnergy Ltd., Mega Uranium Ltd., and other institutional investors. The Company's distinguished team has extensive experience in uranium exploration, development, permitting, and operations, as well as uranium-focused mergers and acquisitions—positioning PUR as a key player in advancing the U.S. uranium sector.

About Nuclear Fuels Inc.

Nuclear Fuels Inc. is a uranium exploration company advancing early-stage, district-scale ISR amenable uranium projects towards production in the U.S. Leveraging extensive proprietary historical databases and deep industry expertise, Nuclear Fuels is well-positioned in a sector poised for significant and sustained growth on the back of strong government support. Nuclear Fuels has consolidated the Kaycee district under single-company control for the first time since the early 1980s. Currently planning its 2025 drill program following successful 2023 and 2024 drilling, the Company aims to expand on historic resources across a 35-mile trend with over 430 miles of mapped roll-fronts defined by 3,800 drill holes. The Company's strategic relationship with enCore Energy Corp., America's Clean Energy Company™, offers a mutually beneficial "pathway to production," with enCore owning an equity interest and retaining the right to back-in to 51% ownership in the flagship Kaycee Project in Wyoming's prolific Powder River Basin.

Contact Information

| Premier American Uranium Inc. Colin Healey CEO 1 (833) 223-4673 info@premierur.com www.premierur.com | Nuclear Fuels Inc. Greg Huffman CEO 1 (647) 519-4447 info@nfuranium.com www.nfuranium.com |

Cautionary Statements

This news release contains "forward-looking information" within the meaning of applicable Canadian securities legislation. Forward-looking information and statements are based on numerous assumptions, including assumptions regarding the completion of the Arrangement, including receipt of required shareholder, regulatory, court and stock exchange approvals; the ability of the parties to satisfy, in a timely manner, the other conditions to the closing of the Arrangement; the prospects of the combined company following completion of the Arrangement; that the anticipated benefits of the Arrangement will be realized; the anticipated timing of completion of the Arrangement; anticipated strategic and growth opportunities for the combined company; expectations regarding the U.S. uranium industry, including the demand for uranium; the exploration targets for the Cebolleta Project and the Kaycee Project, the prospects of the Cebolleta Project, including mineralization of the Cebolleta Project and plans with respect to preparation of an updated mineral resource estimate and preliminary economic assessment on the Cebolleta Project; any expectation with respect to any permitting, development or other work that may be required to bring any of the projects into development, expectations as to future exploration potential for any of the projects, any expectations as to the outcome or success of any proposed programs for the projects, any expectations that market conditions will warrant future production from any of the projects, and any other activities, events or developments that the companies expect or anticipate will or may occur in the future. Generally, but not always, forward-looking information and statements can be identified by the use of words such as "plans", "expects", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates", or "believes" or the negative connotation thereof or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "might" or "will be taken", "occur" or "be achieved" or the negative connotation thereof. Such forward-looking information and statements are based on numerous assumptions, including assumptions regarding the combined company following completion of the Arrangement; that the anticipated benefits of the Arrangement will be realized; that the Arrangement will be completed on the terms and timing currently anticipate; that all conditions to closing of the Arrangement will be satisfied, including receipt of required shareholder, regulatory, court and stock exchange approvals; the ability of the parties to satisfy, in a timely manner, the other conditions to the closing of the Arrangement, that financing will be available if and when needed and on reasonable terms, and that third party contractors, equipment and supplies and governmental and other approvals required to conduct the parties' planned exploration and development activities will be available on reasonable terms and in a timely manner. Although the assumptions made by Premier American Uranium and Nuclear Fuels in providing forward-looking information or making forward-looking statements are considered reasonable by management of each company at the time, there can be no assurance that such assumptions will prove to be accurate.

Forward-looking information also involves known and unknown risks and uncertainties and other factors, which may cause actual events or results in future periods to differ materially from any projections of future events or results expressed or implied by such forward-looking information or statements, including, among others: the failure to obtain shareholder, regulatory, court or stock exchange approvals in connection with the Arrangement, failure to complete the Arrangement, failure to realize the anticipated benefits of the Arrangement or implement the business plan for the combined company, negative operating cash flow and dependence on third party financing, uncertainty of additional financing, no known current mineral reserves or resources, reliance on key management and other personnel, potential downturns in economic conditions, actual results of exploration activities being different than anticipated, changes in exploration programs based upon results, and risks generally associated with the mineral exploration industry, environmental risks, changes in laws and regulations, community relations and delays in obtaining governmental or other approvals and the risk factors with respect to Premier American Uranium and with respect to Nuclear Fuels set out in the companies' most recent annual management discussion and analysis and other filings which have been filed with the Canadian securities regulators and available under Premier American Uranium's and Nuclear Fuels' respective profiles on SEDAR+ at www.sedarplus.ca.

Although Premier American Uranium and Nuclear Fuels have attempted to identify important factors that could cause actual results to differ materially from those contained in the forward-looking information or implied by forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking information and statements will prove to be accurate, as actual results and future events could differ materially from those anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking statements or information. Premier American Uranium and Nuclear Fuels undertake no obligation to update or reissue forward-looking information as a result of new information or events except as required by applicable securities laws.

_______________________

1 Premium is calculated using the 20-day VWAP of PUR Shares and NF Shares over all Canadian exchanges for the period ending June 4, 2025.

2 Calculated using the closing share price of PUR Shares on the TSXV on June 4, 2025 and the pro forma basic shares outstanding of the Company.

3 See NI 43-101 Technical Report on the Cebolleta Uranium Project Cibola County, New Mexico, USA – effective date April 30, 2024, prepared by SLR International Corporation.

4 Uranium resources in the Grants uranium district, New Mexico: An update Virginia T. McLemore, Brad Hill, Niranjan Khalsa, and Susan A. Lucas Kamat 2013.

6 Premier American Uranium Financial Statements as at March 31, 2025, Nuclear Fuels Financial Statements as at December 31, 2024.

5 The potential quantity and grade of the exploration targets are conceptual in nature, there has been insufficient exploration to define a mineral resource and it is uncertain if further exploration will result in the target being delineated as a mineral resource; See NI 43-101 Technical Report on the Kaycee Uranium Project Johnson County, Wyoming, USA – effective date September 6, 2024, prepared by WWC Engineering.

Photos accompanying this announcement are available at :

https://www.globenewswire.com/NewsRoom/AttachmentNg/16e8e370-62c6-4088-826d-24c83f821270

https://www.globenewswire.com/NewsRoom/AttachmentNg/71533f9a-f05b-448c-bd00-2e64919946aa