- WORLD EDITIONAustraliaNorth AmericaWorld

August 24, 2022

Critical Resources Limited (ASX:CRR) (“Critical Resources” or “the Company”) is pleased to advise that following continued drilling success at Mavis Lake, the Company has approved an extension to its current drilling campaign at the Company’s 100 per cent-owned Mavis Lake Lithium Project (“the Project”) in Ontario, Canada.

Highlights

- Outstanding results from Phases 1 and 2 and fast-tracked approvals has allowed for the commencement of phase 3 of the current drilling program at Mavis Lake

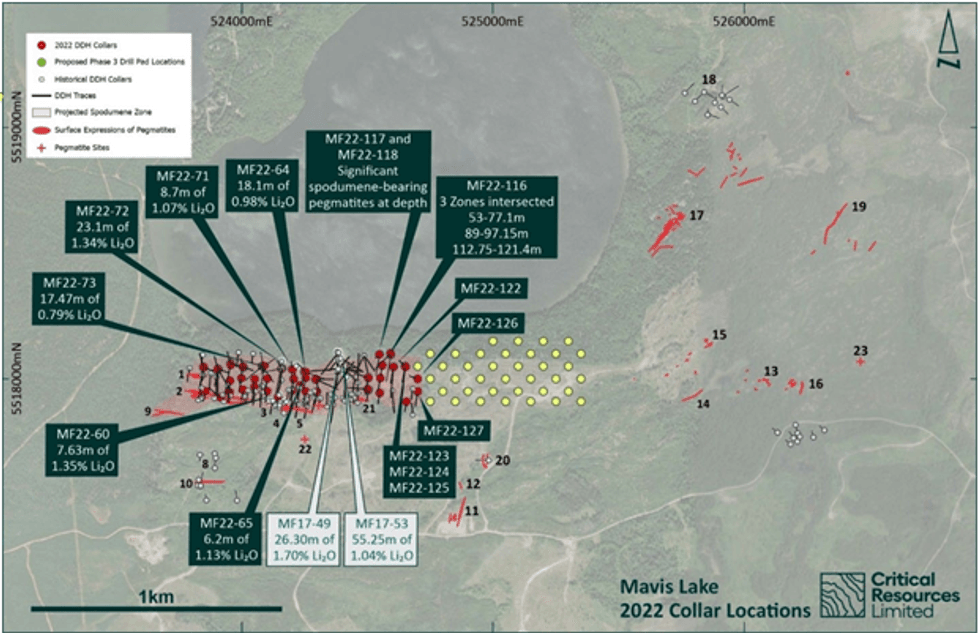

- Phase 3 program aims to continue along strike, extending the mineralisation to the east towards known pegmatite outcroppings

- The Phase 3 extension program designed to prove continuity along strike and add scale to a potential resource

- Program extension follows further intercepts of spodumene-bearing pegmatite in the most recent drill holes

The extension will be used to extend the main zone area towards the east. The 10,000m phase 1 and 2 campaigns provided structural data on pegmatite geometries and trends in the main zone. Phase 3 drilling will step out with an increased drill hole spacing of 100m and will continue to target extension towards the east. All drilling from Phases 1, 2 and 3 will contribute towards JORC resource modelling.

Figure 1: Plan map of Historic, Active, and Proposed (Phase 3) Drill Collar Locations

Phase 3 drilling was approved after assessing the continued results from Phase 2, where drilling continues to intersect multiple spodumene-bearing pegmatites and strike extension to the east. The abundance of spodumene mineralisation (confirmed through visual assessment) appears to have increased in multiple zones with visual estimates as high as 40% spodumene laths within pegmatite over 6.25m in MF22-1231. Full details on drill holes MF22-122, MF22-123, MF22-124, MF22-125, MF22-126 and MF22-127 can be seen in Appendix 1.

Figure 2: Close up of large white spodumene laths within the zone of MF22-123 from 50.9 to 57.15m downhole

Assay work continues and results will be released as received.

A total of 9,481m of approved drilling has been completed to date, with the Company’s primary focus having been infill drilling and now extension drilling.

Immediate 100m drill-hole spacing will continue to test strike length and down-dip continuity to further delineate the spodumene-bearing pegmatites and underpin the development of a maiden JORC compliant resource.

Critical Resources Chairman Robert Martin commented:

“Having recently been on the ground at Mavis Lake and seeing the results that our in-country geologist, geological consultants and drilling crews are achieving, it was a very easy decision to increase the current program. Having consistently intercepted spodumene-bearing pegmatites and increasing strike length in a previously untested area is an excellent outcome, we believe our phase three program will continue this trend.

We look forward to the phase three drilling program confirming our view that the mineralised zones are continuing to the east, towards an area that has known and mapped pegmatites, providing a potential strike length up to 3km long.

The Company’s confidence in the asset, as we work towards delineating a maiden JORC Compliant Resource, is strong and as such we have began early stage planning and permitting for a Phase Four program.”

Click here for the full ASX Release

This article includes content from Critical Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

CRR:AU

The Conversation (0)

21 June 2022

Critical Resources

High-grade Lithium Portfolio, in a Tier 1 Location, Aligned with the World’s Green Energy Transition

High-grade Lithium Portfolio, in a Tier 1 Location, Aligned with the World’s Green Energy Transition Keep Reading...

27 February

UK Enters Commercial Lithium Production with Geothermal Plant Launch

The UK has entered commercial lithium production for the first time as Geothermal Engineering Ltd (GEL) began operations in its plant at Cornwall, anchoring the government's hopes of a domestic battery metals supply chain.The Redruth-based facility marks the country’s first commercial-scale... Keep Reading...

26 February

Zimbabwe Imposes Immediate Ban on Raw Mineral and Lithium Exports

Zimbabwe has imposed an immediate ban on exports of all raw minerals and lithium concentrates, halting shipments already in transit as the government tightens control over the country’s mining sector.Mines and Mining Development Minister Polite Kambamura announced Wednesday that the suspension... Keep Reading...

19 February

Top Australian Mining Stocks This Week: Lithium Valley Results Boost Gold Mountain

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.Mining giant BHP (ASX:BHP,NYSE:BHP,LSE:BHP) reported strong half-year copper results, saying that its copper operations accounted for... Keep Reading...

17 February

Howard Klein Doubles Down on Strategic Lithium Reserve as Project Vault Takes Shape

Before the Trump administration revealed plans for Project Vault, Howard Klein, co-founder and partner at RK Equity, proposed the idea of a strategic lithium reserve. “The goal of a strategic lithium reserve is to stabilize prices and allow the industry to develop,” he told the Investing News... Keep Reading...

17 February

Sigma Lithium Makes New Lithium Fines Sale, Unlocks US$96 Million Credit Facility

Sigma Lithium (TSXV:SGML,NASDAQ:SGML) has secured another large-scale sale of high-purity lithium fines and activated a production-backed revolving credit facility as it ramps up operations in Brazil.The lithium producer announced it has agreed to sell 150,000 metric tons (MT) of high-purity... Keep Reading...

12 February

Albemarle Lifts Lithium Demand Forecast as Energy Storage Surges

Albemarle (NYSE:ALB) is raising its long-term lithium demand outlook after a breakout year for stationary energy storage, underscoring a shift in the battery materials market that is no longer driven solely by electric vehicles.The US-based lithium major reported fourth quarter 2025 net sales of... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00