Patagonia Gold Corp. ("Patagonia" or the "Company") (TSX.V:PGDC) is pleased to announce that it has entered into a binding letter agreement dated 1 April, 2025 (the "Option Agreement") with Oroplata S.A., an Argentinean subsidiary of Newmont Corporation (NYSE: NEM, TSX: NGT, ASX: NEM, PNGX: NEM) ("Newmont"). The Option Agreement grants Newmont an option (the "Option") to acquire a 100% undivided interest in the Company's Tornado and Huracan gold and silver properties, including a separate exploration permit named "El Diablo" (collectively, the "Properties") in return for making aggregate cash payments of US$ 1,500,000, as described below.

Summary of the Terms of the Option Agreement

- The term of the Option is six years (the "Term of the Option").

- OPTION PERIOD. The price to be paid by Newmont for the granting of the right to explore the Properties and to purchase the Option ("Option Price") is as follows:

- US$ 50,000 payable to the Company within five days from the execution of the Option Agreement ("Closing");

- US$ 50,000 payable on the day that is 12 months after Closing.

- US$ 100,000 payable on the day that is 24 months after Closing.

- US$ 100,000 payable on the day that is 36 months after Closing.

- US$ 100,000 payable on the day that is 48 months after Closing

- US$ 100,000 payable on the day that is 60 months after Closing

- US$ 50,000 payable to the Company within five days from the execution of the Option Agreement ("Closing");

- EXERCISE OF THE OPTION. Newmont can exercise the Option and acquire the Properties at any time within the Term of the Option by:

- paying US$ 1,000,000 to the Company;

- paying any outstanding amount of the Option Price; and

- granting a net smelter returns ("NSR") royalty to the Company, derived from all future production from the Properties, based on the following applicable percentage of NSR: (i) 1%, if the gold price is less than US$1,499; (ii) 1.5%, if the gold price is between US$1,500 and US$2,999; and (iii) 2%, if the gold price is above US$3,000.

- paying US$ 1,000,000 to the Company;

- Newmont shall have the option to terminate the Option Agreement at any time after giving the Company not less than 60 days written notice of termination.

About the Properties

The Company obtained the Properties, other than the El Diablo permit, in 2019 through an application submitted to the Provincial Mining Department and are 100% owned by the Company and have no royalty obligations other than the Provincial royalties. Limited exploration work has been carried out on the Properties.

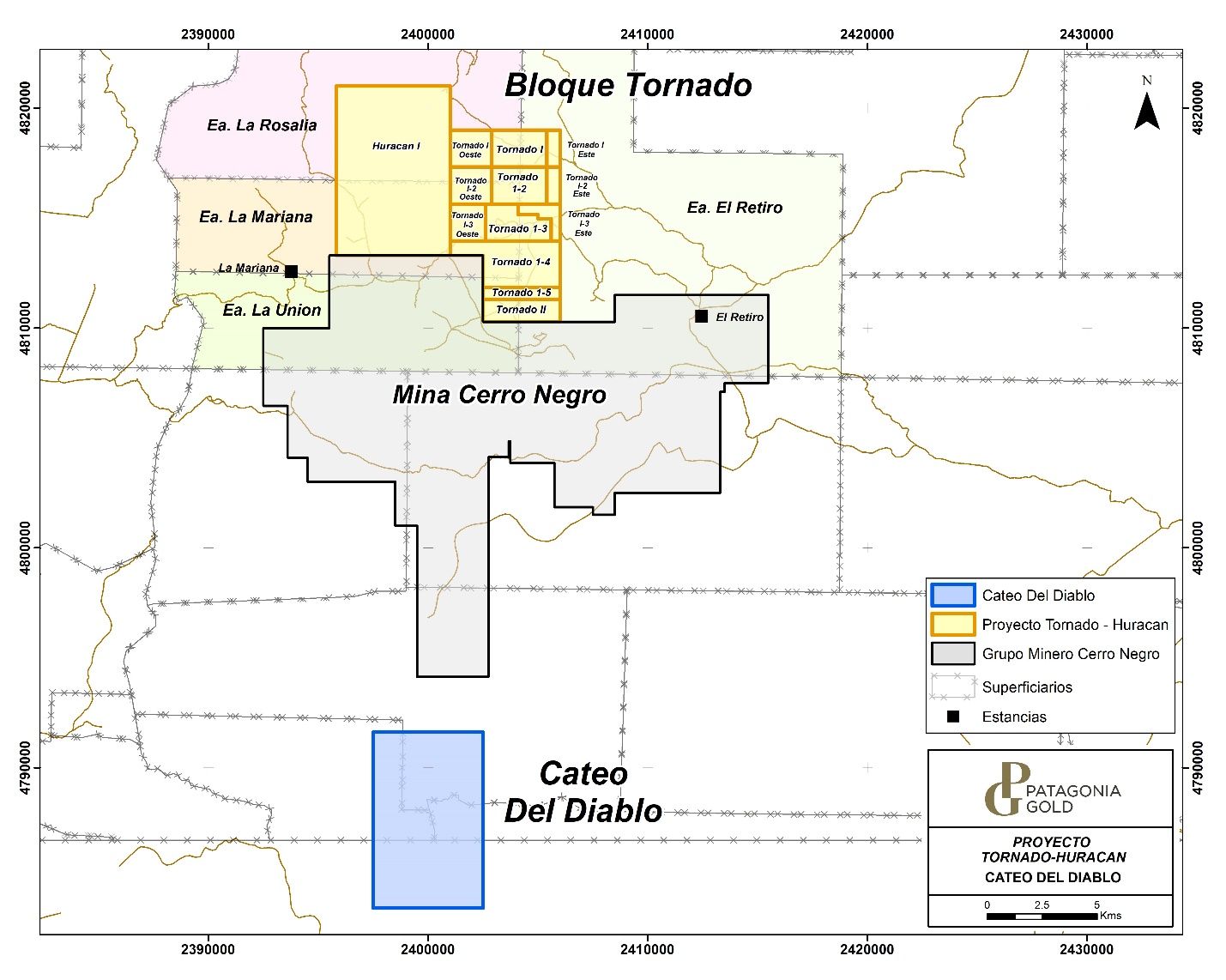

The Properties are approximately 11,900 hectares in size and are owned by Minera Minamalú S.A. ("MMSA"), a subsidiary of the Company. The Properties are located within the prospective Deseado Massif geologic region of the Santa Cruz province in southern Argentina, situated approximately 60 km to the SSE of the community of Perito Moreno in the northwest portion of the province. and are located between the multi-million ounce producing San Jose/Huevos Verdes and Cerro Negro mines operated by Hochschild Mining plc / McEwen Mining Inc. and Newmont, respectively (please see map herein).

The Company completed 3,102 meters of diamond drilling in 9 core holes in Tornado and Huracán which returned anomalous mineralization with values up 0.59 grams of gold per tonne over 8.8 drill meters (see results issued in a May 18 and May 27, 2022 press releases at www.patagoniagold.com and under the Company's SEDAR+ profile on www.sedarplus.ca).

Mr. Christopher van Tienhoven, Chief Executive Officer of Patagonia, stated: "Newmont is the right candidate to take on the Properties to explore and develop their potential. Patagonia is focused on the development of its Calcatreu property in Rio Negro and looking at alternatives for the development of Cap Oeste underground in Santa Cruz. The Company continues to streamline its large property portfolio and evaluating further joint venture engagements and potential disposal of non-strategic properties."

Qualified Person's Statement

Donald J. Birak, an independent consulting geologist, Registered Member of SME, Fellow of AusIMM, and qualified person as defined by National Instrument 43-101, has reviewed and approved the scientific and technical information in this news release.

About Patagonia Gold

Patagonia Gold Corp. is a South America focused, publicly traded, mining company listed on the TSX Venture Exchange. The Company seeks to grow shareholder value through exploration and development of gold and silver projects in the Patagonia region of Argentina. The Company is primarily focused on the Calcatreu project in Rio Negro and the development of the Cap-Oeste underground project. Patagonia, indirectly through its subsidiaries or under option agreements, has mineral rights to over 415 properties in several provinces of Argentina and is one of the largest landholders in the province of Santa Cruz, Argentina.

For more information, please contact:

Christopher van Tienhoven, Chief Executive Officer

Patagonia Gold Corp.

T: +54 11 5278 6950

E: cvantienhoven@patagoniagold.com

FORWARD-LOOKING STATEMENTS

This news release contains certain forward-looking statements, including, but not limited to, statements with respect to, among other things, timing and receipt of payment of the Option Price, the exercise of the Option, granting of the NSR royalty, streamlining the Company's property portfolio, evaluating further joint venture engagements and potentially disposing of non-material properties, the development of the Calcatreu project, the advancement and development of gold and silver projects in the Patagonia region of Argentina, including the Calcatreu property, and the anticipated growth in shareholder value. Wherever possible, words such as "may", "will", "should", "could", "expect", "plan", "intend", "anticipate", "believe", "estimate", "predict" or "potential" or the negative or other variations of these words, or similar words or phrases, have been used to identify these forward-looking statements. These statements reflect management's current beliefs and are based on information currently available to management as at the date hereof.

Forward-looking statements involve significant risk, uncertainties and assumptions. Many factors could cause actual results, performance or achievements to differ materially from the results discussed or implied in the forward-looking statements. Factors that could cause future results to differ materially from those anticipated in forward-looking statements in this news release include, among other things, (i) the risk that the Company may not be able to secure the requisite approvals for the Option Agreement, (ii) changes in law, (iii) unforeseen circumstances and events affecting the Company's ability to implement its business strategies and pursue business opportunities, (iv) the state of the capital markets, (v) the availability of funds and resources to pursue the Company's proposed plans, and (vi) general economic, market and business conditions. For a more detailed discussion of additional risks and other factors that could cause actual results to differ materially from those expressed or implied by forward-looking statements in this news release, please refer to the Company's filings with Canadian securities regulators available on SEDAR+ at www.sedarplus.ca . All such risk factors should be considered carefully, and readers should not place undue reliance on the forward-looking statements in this news release. Although the forward-looking statements contained in this news release are based upon what management believes to be reasonable assumptions, the Company cannot assure readers that actual results will be consistent with these forward-looking statements. These forward-looking statements are made as of the date of this news release, and the Company assumes no obligation to update or revise them to reflect new events or circumstances, except as required by law.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/c02bd3d6-aa63-47b4-aef9-1097e92f8674