July 18, 2025

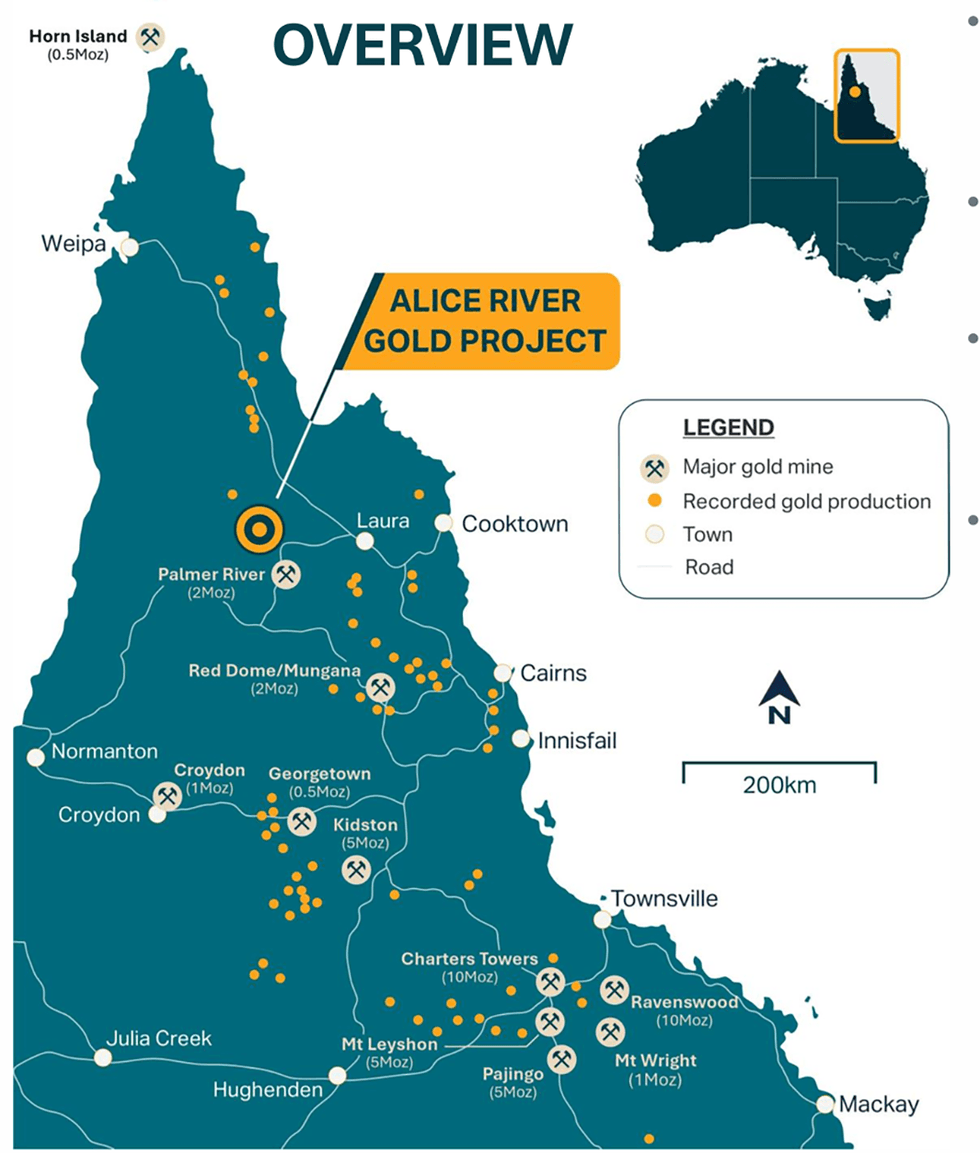

Pacgold (ASX:PGO) is an Australian gold exploration company advancing the high-potential Alice River Gold Project in Northern Queensland. Led by a technically driven and experienced team with proven success across exploration, resource development, and capital markets, Pacgold is applying a systematic, discovery-focused approach to unlock the project’s value.

The company holds a dominant 377 sq km land package, including eight mining leases, along the highly prospective Alice River Fault Zone (ARFZ) — a major structural corridor interpreted to host an intrusion-related gold system analogous to globally significant deposits such as Fort Knox (USA) and Hemi (WA).

The Alice River Gold Project is a large-scale, greenstone-hosted gold system located in Northern Queensland, centered along the regionally significant Alice River Fault Zone (ARFZ). The project covers 377 sq km of contiguous tenure, including eight granted mining leases.

Pacgold controls over 30 km of strike length along the ARFZ — a major crustal-scale structure that has only recently been the focus of systematic exploration using modern techniques, offering significant untapped discovery potential.

Company Highlights

- District-scale Discovery Potential: Pacgold controls more than 377 sq km of tenure and more than 30 km of strike length across the Alice River Fault Zone (ARFZ), a fertile, underexplored structural corridor in Northern Queensland.

- Maiden Resource: In May 2025, the company published a 474,000 oz gold mineral resource estimate (MRE), covering just five percent of the total strike, confirming high-grade mineralization and strong potential for expansion.

- Aggressive Exploration Strategy: More than 10,000 metres of RC drilling campaign is underway, complemented by air-core and diamond programs, aimed at growing the Central Zone resource and testing multiple regional targets.

- Attractive Valuation Entry: With a market capitalization of just ~AU$10 million and an EV of AU$8.5 million (as of Q1 2025), Pacgold provides a low-cost entry into a potentially Tier 1 gold system.

- Experienced Leadership: The board includes proven mine developers and discovery geologists with prior success at Chalice, AngloGold Ashanti, BHP and Sibanye-Stillwater.

This Pacgold profile is part of a paid investor education campaign.*

Click here to connect with Pacgold (ASX:PGO) to receive an Investor Presentation

PGO:AU

Sign up to get your FREE

Pacgold Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

17 July 2025

Pacgold

Advancing Tier-1 exploration at Alice River in Northern Queensland and leveraging near-term gold production at White Dam in South Australia

Advancing Tier-1 exploration at Alice River in Northern Queensland and leveraging near-term gold production at White Dam in South Australia Keep Reading...

29 January

Quarterly Activities/Appendix 5B Cash Flow Report

Pacgold (PGO:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

28 January

Further High Grade Antimony Results from St George Drilling

Pacgold (PGO:AU) has announced Further High Grade Antimony Results from St George DrillingDownload the PDF here. Keep Reading...

06 January

Imminent Gold Production and Cashflow from White Dam Project

Pacgold (PGO:AU) has announced Imminent Gold Production and Cashflow from White Dam ProjectDownload the PDF here. Keep Reading...

21 December 2025

Maiden Drilling Intersects High Grade Antimony at St George

Pacgold (PGO:AU) has announced Maiden Drilling Intersects High Grade Antimony at St GeorgeDownload the PDF here. Keep Reading...

17 December 2025

Trading Halt

Pacgold (PGO:AU) has announced Trading HaltDownload the PDF here. Keep Reading...

16h

Flow Metals to Acquire the Monster IOCG Project in Yukon

Flow Metals Corp. (CSE: FWM) ("Flow Metals" or the "Company") is pleased to report that it has entered into an option agreement dated February 9, 2026 (the "Option Agreement") with Go Metals Corp. ("Go Metals") to acquire the Monster IOCG project (the "Monster Project"), located approximately 90... Keep Reading...

09 February

Investor Presentation

Aurum Resources (AUE:AU) has announced Investor PresentationDownload the PDF here. Keep Reading...

09 February

Dr. Adam Trexler: Physical Gold Market Broken, Crisis Unfolding Now

Dr. Adam Trexler, founder and president of Valaurum, shares his thoughts on gold, identifying a key issue he sees developing in the physical market. "There's a crisis in the physical gold market," he said, explaining that sector participants need to figure out how to serve investors who want to... Keep Reading...

09 February

Trevor Hall: Bull Markets Don’t Always Mean Big Returns

Clear Commodity Network CEO and Mining Stock Daily host Trevor Hall opened his talk at the Vancouver Resource Investment Conference (VRIC) with a strong message: It is still possible to go broke in a bull market.“I want to start with the simple but uncomfortable truth: most investors don't lose... Keep Reading...

09 February

How Near-term Production is Changing the Junior Gold Exploration Model

Junior gold companies have traditionally been defined by exploration: identifying prospective ground, drilling to delineate a resource and, ideally, monetising that discovery through a sale or joint venture with a larger producer. While this model has delivered success in the past, changing... Keep Reading...

09 February

Gold Exploration in Guinea: An Emerging Opportunity in West Africa

While much of West Africa’s gold exploration spotlight has historically fallen on countries like Ghana and Mali, Guinea is increasingly emerging as a quiet outlier — a country with proven gold endowment, expansive underexplored terrain and a growing number of active exploration programs. Despite... Keep Reading...

Latest News

Sign up to get your FREE

Pacgold Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00