TSX.V:OGN)(OTCQX:OGNRF) Orogen Royalties Inc. ("Orogen" or the "Company") is pleased to announce the closing of the transaction (previously announced June 9, 2022) with Advance Lithium Corp. ("Advance") (AALI) whereby Orogen acquired 3% net smelter royalties on three prospective mineral licenses (the "Royalties") in the Lake Victoria Gold Fields ("LVG") in western Kenya

As consideration, Orogen paid Advance US$120,000 for the Royalties and transferred its interest in the Sarape Gold project to Advance. Orogen will retain a 1.5% net smelter return royalty on the Sarape project ("Sarape Royalty").

About the Western Kenya Gold Royalties

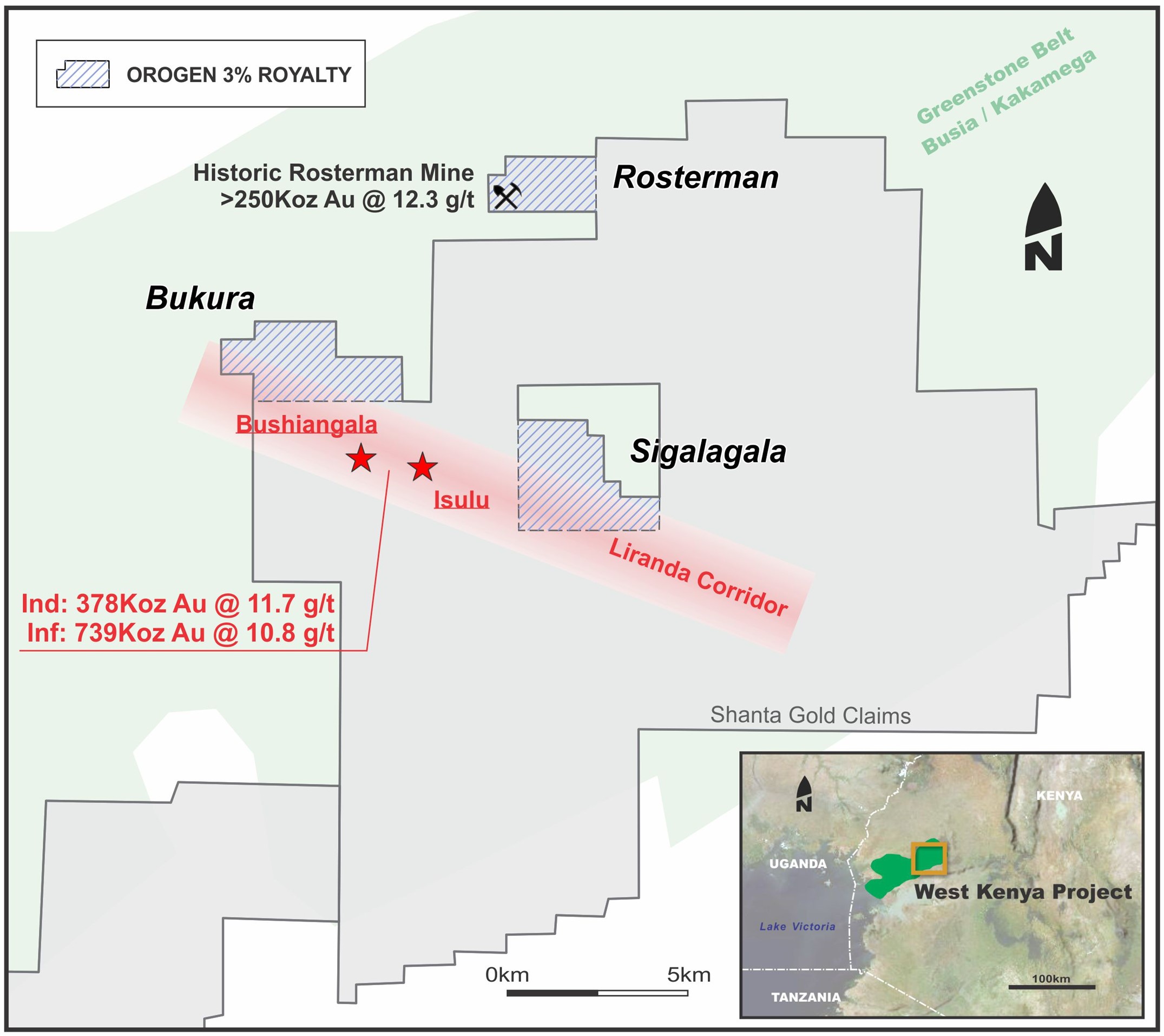

The Rosterman, Sigalagala, and Bukura royalties cover 19.75 square kilometres of prospective ground held by Shanta Gold Limited ("Shanta Gold") (SHG.L) in the Liranda Corridor, a structural zone within the northern-most greenstone belt in the LVG.

Two licenses (Sigalagala and Bukura) are located approximately four kilometres east and two kilometres northwest of the Isulu and Bushiangala deposits, respectively, that are currently being advanced by Shanta Gold (Figure 1). Indicated resources of 378,000 ounces gold grading 11.70 grams per tonne ("g/t") and inferred resources of 739,000 ounces gold grading 10.80 g/t gold at Isulu and Bushiangala were announced in March 20221. Recent infill drilling at Bushiangala announced in May 2022 include drill-hole 336 grading 19.2 g/t gold over 4.0 metres and 1,015 g/t gold over 0.5 metres within a 13.8 metre interval grading 46.7 g/t gold.2 Bukura and Sigalagala cover the extensions of the shear zone that forms the structural setting for Isulu and Bushiangala.

The Rosterman license lies approximately eight kilometres north of the Isulu and Bushiangala deposits in the immediate proximity of the historic Rosterman Mine where approximately 250,000 ounces of gold grading 12.3 g/t were produced. An interpreted splay fault travels northeast from the mine and coincides with a coherent gold soil anomaly extending over 1.8 kilometres. The extensive and strong soil geochemistry appears to be related to the historic Rosterman Mine and defines an attractive drill target.

Figure 1 - Claim locations of Bukura, Sigalagala, and Rosterman licenses in the Liranda Corridor.

About the Sarape Royalty

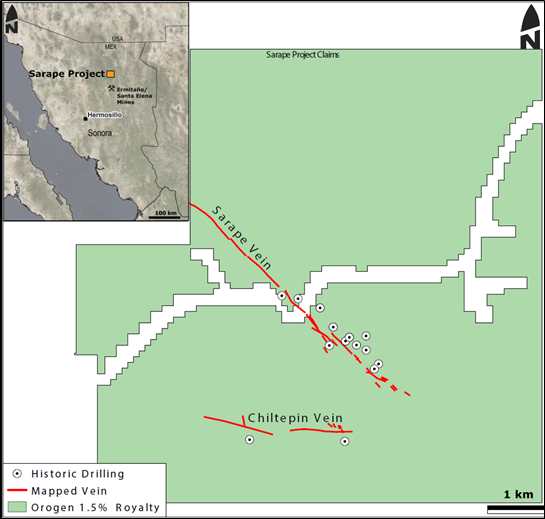

The Sarape Royalty covers 58 square kilometres of prospective ground in the Rio Sonora Valley in Sonora, Mexico (Figure 2). The project, now owned by Advance, is situated within 16 kilometres of the Santa Elena and Ermitaño Mines (First Majestic Silver Corp.) where Orogen is receiving royalty payments pursuant to a 2% NSR royalty, Las Chispas Deposit (SilverCrest Metals Inc.) and Mercedes Mine (Bear Creek Mining Corp.)

The main Sarape vein varies in width from three to twelve metres and has been mapped and sampled over a strike length of five kilometres. The Chiltepin vein averages three metres in width on surface and has been traced over a strike length of 2.5 kilometres. Both veins display high-level epithermal features and elevated gold-silver values.

Previous operators drill tested a range of elevations over only 1.5 kilometres of strike length on the Sarape Vein. Drill results outlined a zone of brecciation and tan-green quartz development with minor gold and silver values at approximately 150-200 metres below surface. More than 3.5 kilometres of the Sarape vein and over two kilometres of the Chiltepin vein remain untested by drilling.

Figure 2 - Claim location map of the Sarape Project in Sonora, Mexico

Qualified Person Statement

All technical data, as disclosed in this press release, has been verified by Laurence Pryer, Ph.D., P.Geo., Exploration Manager for Orogen. Dr. Pryer is a qualified person as defined under the terms of National Instrument 43-101.

Certain technical disclosure in this release is a summary of previously released third-party information and the Company is relying on the interpretation provided. Additional information can be found on the links in the footnotes.

About Orogen Royalties Inc.

Orogen Royalties is focused on organic royalty creation and royalty acquisitions on precious and base metal discoveries in western North America. The Company's royalty portfolio includes the Ermitaño gold and silver deposit in Sonora, Mexico (2% NSR royalty) operated by First Majestic Silver Corp. and the Silicon gold project (1% NSR royalty) in Nevada, U.S., being advanced by AngloGold Ashanti. The Company is well financed with several projects actively being developed by joint venture partners.

On Behalf of the Board

Paddy Nicol

President & CEO

To find out more about Orogen, please contact Paddy Nicol, President & CEO at 604-248-8648, and Marco LoCascio, Vice President of Corporate Development at 604-248-8648. Visit our website at www.orogenroyalties.com.

Orogen Royalties Inc.

1015 - 789 West Pender Street

Vancouver, BC

Canada V6C 1H2

info@orogenroyalties.com

- Shanta Gold - https://shantagold.com/_resources/MRE%20Update%20v2%20without%20Ramula%20Pit%20Shell.pdf

- Shanta Gold - https://shantagold.com/_resources/news/nr-20220523.pdf

Forward Looking Information

This news release includes certain statements that may be deemed "forward looking statements". All statements in this presentation, other than statements of historical facts, that address events or developments that Orogen Royalties Inc. (the "Company") expect to occur, are forward looking statements. Forward looking statements are statements that are not historical facts and are generally, but not always, identified by the words "expects", "plans", "anticipates", "believes", "intends", "estimates", "projects", "potential" and similar expressions, or that events or conditions "will", "would", "may", "could" or "should" occur.

Although the Company believe the expectations expressed in such forward looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results may differ materially from those in the forward looking statements. Factors that could cause the actual results to differ materially from those in forward looking statements include market prices, exploitation and exploration successes, and continued availability of capital and financing, and general economic, market or business conditions. Furthermore, the extent to which COVID-19 may impact the Company's business will depend on future developments such as the geographic spread of the disease, the duration of the outbreak, travel restrictions, physical distancing, business closures or business disruptions, and the effectiveness of actions taken in Canada and other countries to contain and treat the disease. Although it is not possible to reliably estimate the length or severity of these developments and their financial impact as of the date of approval of these condensed interim consolidated financial statements, continuation of the prevailing conditions could have a significant adverse impact on the Company's financial position and results of operations for future periods.

Investors are cautioned that any such statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the forward looking statements. Forward looking statements are based on the beliefs, estimates and opinions of the Company's management on the date the statements are made. Except as required by securities laws, the Company undertakes no obligation to update these forward looking statements in the event that management's beliefs, estimates or opinions, or other factors, should change.

SOURCE: Orogen Royalties Inc.

View source version on accesswire.com:

https://www.accesswire.com/709572/Orogen-Closes-Acquisition-of-Kenyan-and-Mexican-Royalties