- NORTH AMERICA EDITIONAustraliaNorth AmericaWorld

December 18, 2024

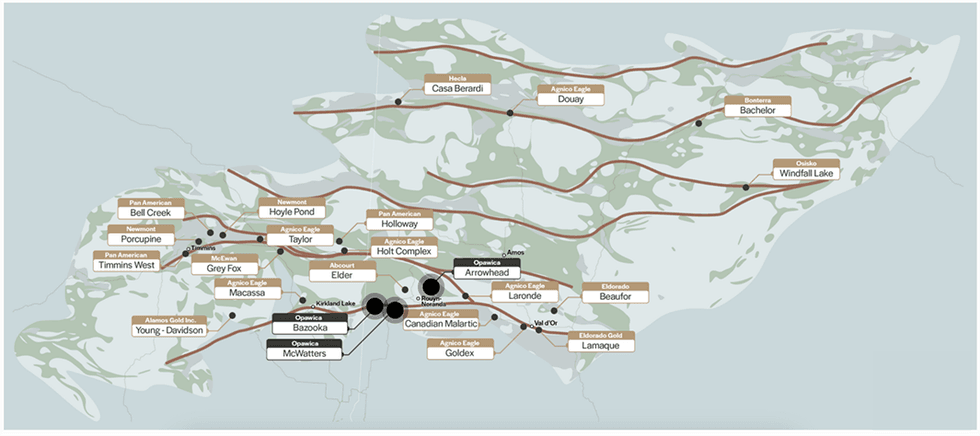

Opawica Exploration (TSXV:OPW) is a Vancouver-based junior exploration company exploring and developing precious metal properties in Canada. Opawica's flagship properties — Arrowhead, Bazooka and McWatters — are situated in the Abitibi Greenstone Belt, one of the most prolific gold-producing regions in the world. These projects benefit from exceptional geological potential and established mining infrastructure adjacent to some of the world’s largest gold producers.

The Bazooka gold project spans 1,200 hectares along 7 km of the Cadillac-Larder Lake Break in Quebec. It is contiguous with Yamana Gold’s Wasamac property and Yorbeau Resources’ Rouyn property. Located near operational gold mines, the property has excellent access to roads, power and water, facilitating year-round exploration.

Key Projects

Key ProjectsGold mineralization at the Bazooka project is associated with quartz-carbonate-sericite and talc-chlorite schists within sedimentary and ultramafic to mafic volcanic rocks. The Main Zone features significant silicification and visible free gold.

Company Highlights

- Opawica Exploration is focused on unlocking the value of its flagship projects through aggressive exploration and data-driven decision-making.

- Its flagship Bazooka project is strategically located along the Cadillac Fault Zone and features high-grade mineralization with significant historical and recent drilling success.

- The Arrowhead property, the company’s second flagship project, is located near major mining operations and is characterized by multiple mineralized zones and extensive drilling efforts confirming historical gold trends.

- The McWatters property represents a high-potential opportunity for resource expansion with visible gold showings and limited past exploration.

- The company’s portfolio of assets is in the Abitibi Greenstone Belt, one of the most prolific gold-producing regions globally, benefiting from exceptional geological potential and established mining infrastructure.

- Historical exploration on the properties includes over US$5 million in spending, extensive drilling campaigns revealing bonanza-grade intercepts, and validating mineralization potential.

This Opawica Exploration profile is part of a paid investor education campaign.*

Click here to connect with Opawica Exploration (TSXV:OPW) to receive an Investor Presentation

OPW:CA

The Conversation (0)

17 December 2024

Opawica Explorations

Advancing high-potential gold assets in the prolific Abitibi Greenstone Belt

Advancing high-potential gold assets in the prolific Abitibi Greenstone Belt Keep Reading...

13h

Brazilian State Firm Seeks Injunction to Block Equinox Gold-CMOC Asset Sale

A Brazilian state-run mining company is seeking an emergency court injunction to block the sale of one of Equinox Gold's (TSX:EQX,NYSEAMERICAN:EQX) Brazilian assets. Bloomberg reported that Companhia Baiana de Produção Mineral (CBPM) has asked the Bahia State Court of Justice to immediately... Keep Reading...

14h

Silver Hammer Closes CDN$3,913,617 Non-Brokered Private Placement Pursuant to Listed Issuer Exemption

Silver Hammer Mining Corp. (CSE: HAMR,OTC:HAMRF) (the "Company" or "Silver Hammer") is pleased to announce that further to its news release dated February 2, 2026, it has closed its previously announced non-brokered private placement pursuant to the Listed Issuer Exemption ("LIFE") (the... Keep Reading...

22 February

High-Grade Near-Surface Graphite Intersected at Millennium

Metal Bank (MBK:AU) has announced High-Grade Near-Surface Graphite Intersected at MillenniumDownload the PDF here. Keep Reading...

22 February

Boundiali Resource Grows to 3Moz - Indicated Up 49%

Aurum Resources (AUE:AU) has announced Boundiali Resource Grows to 3Moz - Indicated Up 49%Download the PDF here. Keep Reading...

22 February

High-grade Assays incl 4m @ 26.7g/t Au in Sandstone Drilling

Brightstar Resources (BTR:AU) has announced High-grade assays incl 4m @ 26.7g/t Au in Sandstone drillingDownload the PDF here. Keep Reading...

22 February

High-Grade Gold in Initial White Dam Drilling Results

Pacgold (PGO:AU) has announced High-Grade Gold in Initial White Dam Drilling ResultsDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00