Northern Dynasty Minerals Ltd. (TSX:NDM)(NYSE American:NAK) ("Northern Dynasty" or the "Company") announces it has released a comprehensive study authored by IHS Markit, a leading global source of critical information and insight, entitled ‘Economic Contribution Assessment of the Proposed Pebble Project to the US national and state economies.' Commissioned by the Company, the IHS Markit report is an independent expert study that provides a detailed review of the significant economic benefits the proposed Pebble Project would have both nationally and at the state level, particularly for Alaskans. The report focuses on two potential scenarios - the Proposed Project and the Production Year 5 Potential Expansion with Gold Plant scenario[1] - consistent with those presented in the Company's Preliminary Economic Assessment (the "2021 PEA"), the results of which were first published on September 9, 2021. More information on the Economic Contribution Assessment study can be found on the Company's website at the following link (https:www.northerndynastyminerals.comresponsible-miningeconomic-benefits). All currency values are presented in U.S. dollars

"We believe that the Pebble Project would have a significant impact on the economic prosperity of Alaska, resulting from direct high paying jobs, significant purchases of equipment and supplies, and substantial government revenues and supply and service contracts," said Mr. Ron Thiessen, Northern Dynasty President and CEO. "But what is also clear is that renewable energy systems utilize roughly five to nine times more copper than conventional power generation systems, and electric vehicles require three to four times as much as internal combustion engine vehicles. The Pebble Project could help the U.S. reduce its dependence on imports of copper metal as demand surges during the transition from an oil-based economy to electricity."

"It's also important to remember that the benefits of the Pebble Project are in addition to the fishing, sport fishing and tourism industries already operating in this part of Alaska," Thiessen said. "We have always recognized the importance of the environment at Pebble and the importance of the Bristol Bay subsistence and commercial fishery. We accordingly have designed our project carefully with a number of innovative approaches to protect the environment and to ensure the project can coexist with the fishery, as was shown in the Final Environmental Impact Statement of 2020."

Economic activity, jobs created

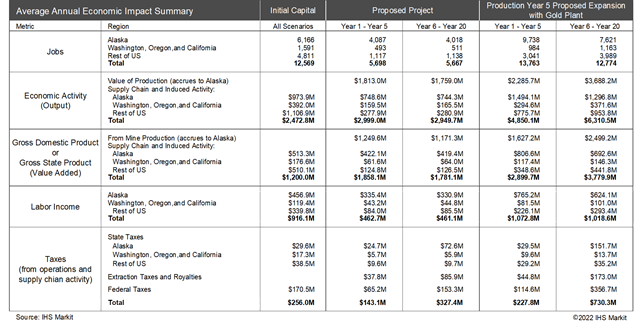

As summarized in the table below, IHS Markit assessed the annual average economic contributions to employment, gross state product and other key metrics from the Proposed Project and the Production Year 5 Potential Expansion with Gold Plant scenario. The results are presented for three time horizons:

- The Initial capital phase, which is common to both scenarios;

- Year 1 through Year 5. Differences in the economic contributions between the scenarios are due to the capital investments required to expand mine capacity and add the gold plant in the Year 5 expansion scenario. For example, during this period, the Proposed Project is estimated to support 5,698 full-time high-paying jobs across the United States; the Production Year 5 Potential Expansion with Gold Plant scenario would support an estimated 13,763 jobs; and

- Year 6 through Year 20, which allows for comparing the difference in "steady state" mining operations of both scenarios. For example, the Proposed Project is estimated to support 5,667 full-time high-paying jobs across the United States, whereas the Production Year 5 Potential Expansion with Gold Plant scenario would support an estimated 12,774 jobs.

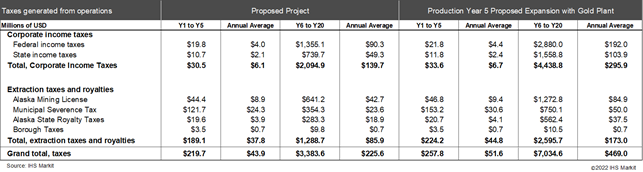

Significant taxes expected to be generated

The results for the Proposed Project and the Production Year 5 Potential Expansion scenario with Gold Plant option are summarized below. As these two scenarios represent the lowest and highest investment and production activity, these results provide an expected range of taxes that could be generated by the Pebble Project: $43.9 million to $51.6 million annually, on average, during the Year 1 - Year 5 time-horizon. As expanded capacity and the gold plant come online, the total taxes generated by the Production Year 5 Potential Expansion with Gold Plant rise to $469.0 million versus $225.6 million for the Proposed Project. The state and local taxes could average $135.3 million and $277.0 million.

Pebble Performance Dividend could provide substantial payments to eligible and enrolled residents in the region

Northern Dynasty, through its Pebble Partnership subsidiary, created the Pebble Performance Dividend ("PPD") as a means to share profits from mining operations with individual residents in southwest Alaska. As currently conceived, residents who are at least 18 years of age and have maintained a primary residence in the following Bristol Bay communities for a minimum of twelve months would be eligible to sign up during an enrollment window:

- Bristol Bay Borough: King Salmon, Naknek; South Naknek;

- Dillingham Census Area: Aleknagik; Clark's Point; Dillingham; Ekuk; Ekwok; Koliganek; Manokotak; New Stuyahok; Portage Creek; Togiak; Twin Hills; and

- Lake and Peninsula Borough: Chignik; Chignik Lagoon; Chignik Lake; Egegik; Iguigig; Iliamna; Ivanof Bay; Kokhanok; Levelock; Newhalen; Nondalton; Pedro Bay, Perryville; Pilot Point; Pope-Vannoy Landing; Port Alsworth; Port Heiden; Ugashik.

Based on data from the 2020 United States census, there are approximately 5,000 residents of the Bristol Bay communities that would qualify to receive the PPD. During the several year period from the commencement of development to the point at which capital costs have been recovered, a minimum of $3,000,000 would be distributed annually among the program participants. After capital costs are recovered, 3% of net profits would be distributed to program participants, annually.

For the Operations Phase (Year 1 - Year 20), IHS Markit estimates these payments as follows:

- Proposed Project: annual average PPD payments of $10.9 million. Assuming all eligible residents enroll, each participant would receive approximately $2,175 annually; a household of three would receive close to $6,500 annually during the Operations Phase; and

- Production Year 5 Expansion scenario with gold plant option: annual average PPD payments of $39.1 million. Assuming all eligible residents enroll, each participant would receive approximately $7,825 annually; a household of three would receive almost $23,500 annually during the Operations Phase. Over the potential 90-year lifetime of the mine, these annual payments could average $72.0 million or $14,400 per eligible recipient.

"The Pebble Performance Dividend would distribute payments of several thousand dollars a year to eligible Western Alaska residents, a meaningful benefit for one of the lowest-income regions in the U.S." Mr. Thiessen added. "This benefit is additional when there is more than one eligible recipient in the family, making its impact even more significant."

More information on the PPD is available at (https://www.pebbledividend.com/).

About IHS Markit (www.ihs.com)

IHS Markit (NYSE: INFO) is a world leader in critical information, analytics and solutions for the major industries and markets that drive economies worldwide. The company delivers next-generation information, analytics and solutions to customers in business, finance and government, improving their operational efficiency and providing deep insights that lead to well-informed, confident decisions. IHS Markit has more than 50,000 business and government customers, including 80 percent of the Fortune Global 500 and the world's leading financial institutions. Headquartered in London, IHS Markit is committed to sustainable, profitable growth.

About Northern Dynasty Minerals Ltd.

Northern Dynasty is a mineral exploration and development company based in Vancouver, Canada. Northern Dynasty's principal asset, owned through its wholly owned Alaska-based U.S. subsidiary, Pebble Limited Partnership, is a 100% interest in a contiguous block of 1,840 mineral claims in Southwest Alaska, including the Pebble deposit, located 200 miles from Anchorage and 125 miles from Bristol Bay. The Pebble Partnership is the proponent of the Pebble Project, an initiative to develop one of the world's most important mineral resources.

Stephen Hodgson, P.Eng, a qualified person who is not independent of Northern Dynasty has reviewed and approved the scientific and technical information contained in this news release.

For further details on Northern Dynasty and the Pebble Project, please visit the Company's website at www.northerndynastyminerals.com or contact Investor services at (604) 684-6365 or within North America at 1-800-667-2114. Review Canadian public filings at www.sedar.com and U.S. public filings at www.sec.gov.

Ronald W. Thiessen

President & CEO

U.S. Media Contact:

Dan Gagnier

Gagnier Communications

(646) 569-5897

Forward Looking Information and other Cautionary Factors

This release includes certain statements that may be deemed "forward-looking statements" under the United States Private Securities Litigation Reform Act of 1995 and under applicable provisions of Canadian provincial securities laws. All statements in this release, other than statements of historical facts, which address permitting, development and production for the Pebble Project are forward-looking statements. The IHS Markit report is based on the production scenarios and related assumptions as presented in the 2021 PEA which has been filed on SEDAR and is available on EDGAR. The 2021 PEA is preliminary in nature, and includes Inferred mineral resources that are considered too speculative geologically to have economic considerations applied to them that would enable them to be categorized as mineral reserves. There is no assurance that the 2021 PEA will be realized. Mineral Resources that are not mineral reserves do not have demonstrated economic viability, and there is no assurance that the Pebble Project mineral resources will ever be upgraded to reserves. The 2021 PEA assumes that the Proposed Project will ultimately be able to obtain the required permits from the USACE and state of Alaska authorities to enable development of the Proposed Project. Neither the 2021 PEA, nor the mineral resource estimates on which the 2021 PEA is based, have been adjusted for any risk that the Pebble Partnership may not be able to successfully appeal the record of decision issued by the USACE on November 25, 2020 denying the granting of the required permit under the Clean Water Act. Any changes to the production scenarios outlined in the 2021 PEA as a result of these factors could have a material impact on the projections implied by the IHS Markit report. These include statements regarding (i) the timing of the appeal process and the ability to successfully appeal the negative Record of Decision and secure the issuance of a positive Record of Decision by the USACE, (ii) the political and public support for the permitting process, (iii) the ability of the Pebble Project to ultimately secure all required federal and state permits, (iv) future metals prices, including the price of copper, (v) the right-sizing and de-risking of the Pebble Project, (vi) the design and operating parameters for the Pebble Project mine plan, including projected capital and operating costs, (vii) exploration potential of the Pebble Project, (viii) future demand for copper and gold, (ix) the potential addition of partners in the Pebble Project, (x) if permitting is ultimately secured, the ability to demonstrate that the Pebble Project is commercially viable, (xi) the EPA's Proposed Determination process under the CWA and the impact of this process on the ability of the Pebble Partnership to develop the Pebble Project, and (xii) the ability and timetable of NDM to develop the Pebble Project. Although NDM believes the expectations expressed in these forward-looking statements are based on reasonable assumptions, such statements should not be in any way be construed as guarantees that the Pebble Project will secure all required government permits, establish the commercial feasibility of the Pebble Project, achieve the required financing or develop the Pebble Project.

Forward-looking statements are necessarily based upon a number of factors and assumptions that, while considered reasonable by NDM as of the date of such statements, are inherently subject to significant business, economic and competitive uncertainties and contingencies. Assumptions used by NDM to develop forward-looking statements include the following assumptions, all of which are subject to risks (i) the Pebble Project will ultimately obtain all required environmental and other permits and all land use and other licenses , (ii) any feasibility studies prepared for the development of the Pebble Project will be positive, (iii) NDM's estimates of mineral resources will not change, and NDM will be successful in converting mineral resources to mineral reserves, (iv) NDM will be able to establish the commercial feasibility of the Pebble Project, (v) NDM will be able to secure the financing required to develop the Pebble Project, and (vi) any action taken by the EPA in connection with the Proposed Determination will ultimately not be successfully in restricting or prohibiting development of the Pebble Project. The likelihood of future mining at the Pebble Project is subject to a large number of risks and will require achievement of a number of technical, economic and legal objectives, including (i) obtaining necessary mining and construction permits, licenses and approvals without undue delay, including without delay due to third party opposition or changes in government policies, (ii) finalization of the mine plan for the Pebble Project, (iii) the completion of feasibility studies demonstrating that any Pebble Project mineral resources that can be economically mined, (iv) completion of all necessary engineering for mining and processing facilities, (v) the ability of NDM to secure a partner for the development of the Pebble Project, and (vi) receipt by NDM of significant additional financing to fund these objectives as well as funding mine construction, which financing may not be available to NDM on acceptable terms or on any terms at all. NDM is also subject to the specific risks inherent in the mining business as well as general economic and business conditions, such as the current uncertainties with regard to COVID-19. Investors should also consider the risk factors identified in its Annual Information Form for the year ended December 31, 2020, as filed on SEDAR and included in the Company's annual report on Form 40-F filed by the Company with the SEC on EDGAR, and the Company's Management Discussion and Analysis for the nine months ended September 30, 2021, as filed on SEDAR and EDGAR, for a discussion of the risks that may impact our forward-looking statements.

The National Environment Policy Act Environmental Impact Statement process requires a comprehensive "alternatives assessment" be undertaken to consider a broad range of development alternatives, the final project design and operating parameters for the Pebble Project and associated infrastructure may vary significantly from that currently contemplated.

For more information on the Company, Investors should review the Company's filings with the United States Securities and Exchange Commission at www.sec.gov and its home jurisdiction filings that are available at www.sedar.com.

[1] The currently proposed project detailed in the 2021 PEA is the Proposed Project and is consistent with the Project Description in the Pebble EIS, published by the US Army Corps of Engineers ("USACE") in July 2020. It does not include an onsite gold plant. With the exception of the Proposed Project, all development alternatives evaluated in the 2021 PEA are presented to demonstrate the optionality inherent in the polymetallic Pebble deposit by presenting a broad range of potential pathways for future mine development. The 2021 PEA also models other options for potential development in the future, to show how the project life could be extended and metal production enhanced through an expansion at different points in time or via alternative treatment scenarios. Neither Northern Dynasty nor the Pebble Partnership has proposed or intends to propose any of these development alternatives in the near-term for regulatory approval. Any future development options beyond the Proposed Project would require extensive federal, state and local permitting processes and approvals before proceeding, which would be in addition to the initial permits and approvals required for the Proposed Project.

The Proposed Project envisions a 20-year operation, with an open pit feeding a conventional flotation process plant at 180,000 tons per day. Over its 20-year life the plant would process 1.3 billion tons of material from the mine. Related infrastructure includes an access road to a port facility on Cook Inlet, concentrate transport pipeline and related storage and shipping facilities at the port, a natural gas pipeline from Cook Inlet to the mine site, and a combined cycle natural gas fired power plant. The Production Year 5 Potential Expansion Scenario with Gold Plant would see the process plant expanded to 270,000 tons per day, with the expanded production commencing in Year 5. The open pit mine would be expanded to produce 8.6 billion tons of material fed to the process plant over a 90-year life. A secondary gold recovery plant would be added to the process plant coincident with the expansion in Year 5. The related infrastructure would be expanded commensurate with the expanded plant throughput.

SOURCE: Northern Dynasty Minerals Ltd.

View source version on accesswire.com:

https://www.accesswire.com/690592/Northern-Dynasty-Economic-Contribution-Assessment-Study-for-Alaskas-Pebble-Project-Shows-Project-Could-Support-Thousands-of-Jobs-and-Billions-of-Dollars-of-Economic-Impact-Annually-While-Reducing-the-Need-for-the-US-to-Import-Copper-to-Meet-its-Green