(TheNewswire)

Toronto, Ontario TheNewswire - April 6, 2022 Noble Mineral Exploration Inc. ( "Noble" or the "Company" ) (TSXV:NOB ) ( FRANKFURT:NB7 ) ( OTC:NLPXF) announced that it has entered into an agreement with six parties (the " Vendors ") to acquire approximately 695 mining claims (the "Claims" ) near Hearst, Ontario, covering an area of approximately 144 square km (the "Transaction" ).

The Transaction will provide Noble with control over a contiguous area of ~ 14 km by ~ 12.5 km.

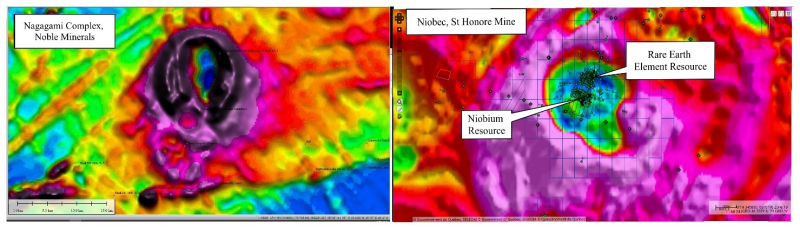

Figure 1: Comparison of the Nagagami Complex to the Niobec Mine in Quebec. Background on both images is residual magnetic field.

Transaction Terms

Pursuant to the Transaction, Noble will acquire the Claims through the issuance of 500,000 common shares of Noble which will be subject to a four month hold period.

Under the Transaction, the Vendors will retain a 2% NSR with Noble having the right to buy back 50% of the royalty for $1,000,000. The Transaction is subject to approval of the Company's Board of Directors and the TSX Venture Exchange.

Highlights of the Nagagami Property (See Noble Press Release Dated Dec. 16, 2021)

-

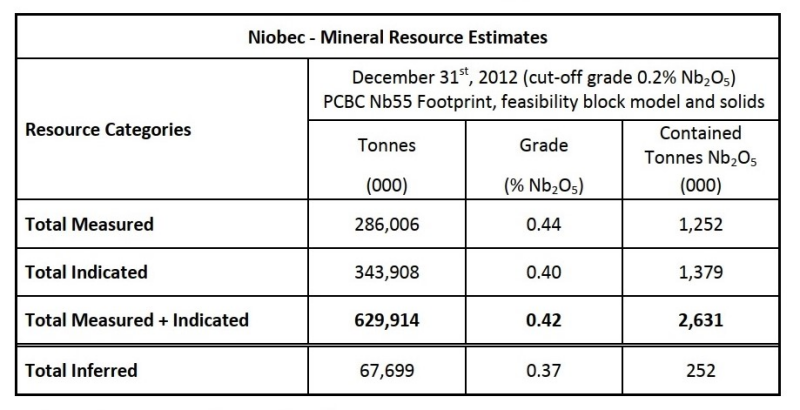

The exploration model for the Nagagami Carbonatite/Alkalic Complex is based on a Niobec-style of mineralization (Quebec), where Niobium has been produced since 1976 and there is also a Rare Earth Element resource. In December 2013 Niobec reported a mineral resource estimate as:

Table 1: Mineral Resource Estimates for the Niobec Mine set out in an Iamgold NI 43-101 Technical Report, Update on Niobec Expansion, December 2013. Note: Mineral Resource is not a Mineral Reserve and do not have any demonstrated economic viability.

-

The Nagagami Project falls within the Ontario Government Critical Minerals Directive issued this year, which prioritizes finding local sources of strategic materials.

-

Around the world, governments are implementing policies that are accelerating innovative technology that rely heavily on critical and strategic minerals as raw materials for electric vehicles, clean energy and information communications technology

-

The Nagagami Complex has had minimal exploration including a limited amount of drilling by Algoma in the 1960's in search of iron deposits.

-

Noble has initiated talks with the council of the Constance Lake Fist Nation on how best to proceed with this project.

Significance of Niobium and Rare Earth Elements

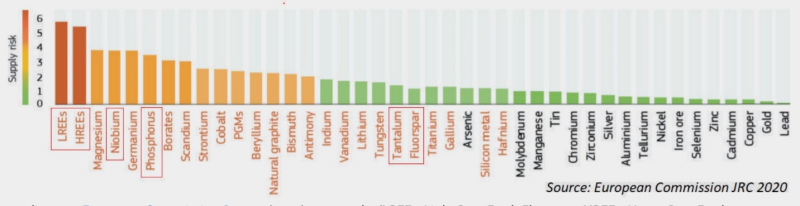

According to a European Commission Report (2020), R are E arth elements (LREEs: Light Rare Earth Elements; HREEs: Heavy Rare Earth Elements) have the greatest supply risk of raw materials for key technologies . N iobium rank s #4 . Noble Minerals is exploring for these commodities in a safe and mining-friendly jurisdiction.

Figure 2: Supply Risk Associated with Mined Minerals

Niobium

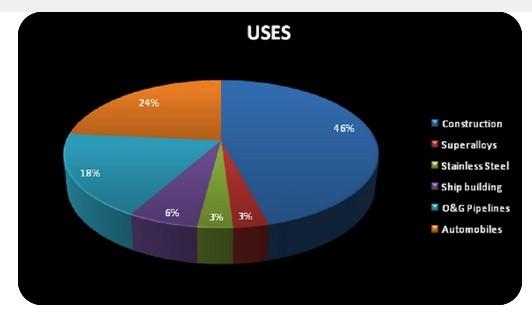

Niobium is an extraordinary and highly versatile super - alloy material and is a critical and strategic material essential to many defense and civilian applications . For example, as an alloying element in high-strength and stainless steel, as a super - alloy for aerospace and land-based power generation, and in superconductors.

For instance, 200 grams of niobium added to the steel of a mid-sized automobile reduces its weight by 100 kg, increasing fuel efficiency by 5% ( World Steel Institute ) . The use of niobium in vehicles today is already helping to avoid the emission of an estimated 62 million ton s of CO2 per year, according to Niobec (North-America‘s only niobium producer).

North America sources all of its niobium from Brazil (~83%), Canada (~12%) and others (~5%). With only 3 primary niobium mines globally , all of which have Chinese stakeholders, a more reliable, long-term niobium supply in North America is needed to secure critical minerals supply chains for strategic industries.

Figure 3: Niobium Applications

Rare Earths Elements

According to the European Commission (2020), R are E arth Elements (LREE & HREE) are highlighted as having the greatest supply risk of raw materials for key technologies. 97% of the world ' s Rare Earth Elements are controlled by China.

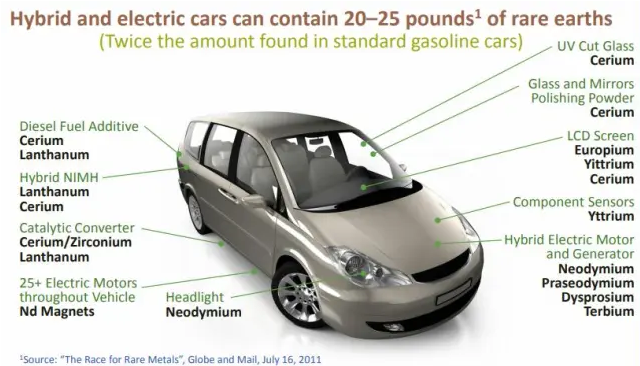

There are approximately 20 to 25 pounds of Rare Earths in each Electronic Vehicle produced.

Rare Earth Elements are essential for transitioning to G reen e nergy . Their importance is not limited to applications in cars, but also in solar panels, windmills, solar photovoltaic, computers, electronics, the smart grid and more. This highlights the need for a secure, domestic supply.

Figure 4: Amount of Rare Earths Required in the Manufacture of an Electric Vehicle

Vance White, President and CEO of Noble, said "we are pleased to do our part in the exploration of a domestic source of Niobium and Rare Earth Elements. We have started negotiations with the council of the Constance Lake First Nation to explore ways that they can participate in this important project."

Michael Newbury PEng (ON), a "qualified person" as such term is defined by National Instrument 43-101, has reviewed the data disclosed in this news release, and has otherwise reviewed and approved the technical information in this news release on behalf of Noble.

About Noble Mineral Exploration Inc.:

Noble Mineral Exploration Inc. is a Canadian-based junior exploration company which, in addition to its shareholdings in Canada Nickel Company Inc., Spruce Ridge Resources Ltd. and MacDonald Mines Exploration Ltd., and its interest in the Holdsworth gold exploration property in the area of Wawa, Ontario, will continue to hold approximately 40,000 hectares of mineral rights in the Timmins-Cochrane areas of Northern Ontario known as Project 81, as well as an additional ~11,000 hectares in the Timmins area and ~14,000 hectares of mining claims in Central Newfoundland. Project 81 hosts diversified drill-ready gold, nickel-cobalt and base metal exploration targets at various stages of exploration. It also holds its recently acquired the ~14,000 hectare Nagagami Carbonatite Complex near Hearst, Ontario, as well as the Buckingham Graphite Property, the Laverlochere Nickel, Copper, PGNM property and the Cere-Villebon Nickel, Copper, PGM property, all of which are in the province of Quebec. More detailed information is available on the website at www.noblemineralexploration.com .

Noble's common shares trade on the TSX Venture Exchange under the symbol "NOB".

Cautionary Statement:

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. No stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein.

The foregoing information may contain forward-looking statements relating to the future performance of Noble Mineral Exploration Inc. Forward-looking statements, specifically those concerning future performance, are subject to certain risks and uncertainties, and actual results may differ materially from the Company's plans and expectations. These plans, expectations, risks and uncertainties are detailed herein and from time to time in the filings made by the Company with the TSX Venture Exchange and securities regulators. Noble Mineral Exploration Inc. does not assume any obligation to update or revise its forward-looking statements, whether as a result of new information, future events or otherwise.

Contacts:

H. Vance White, President

Phone: 416-214-2250

Fax: 416-367-1954

Email: info@noblemineralexploration.com

Investor Relations

Email: ir@noblemineralexploration.com

Copyright (c) 2022 TheNewswire - All rights reserved.