November 13, 2024

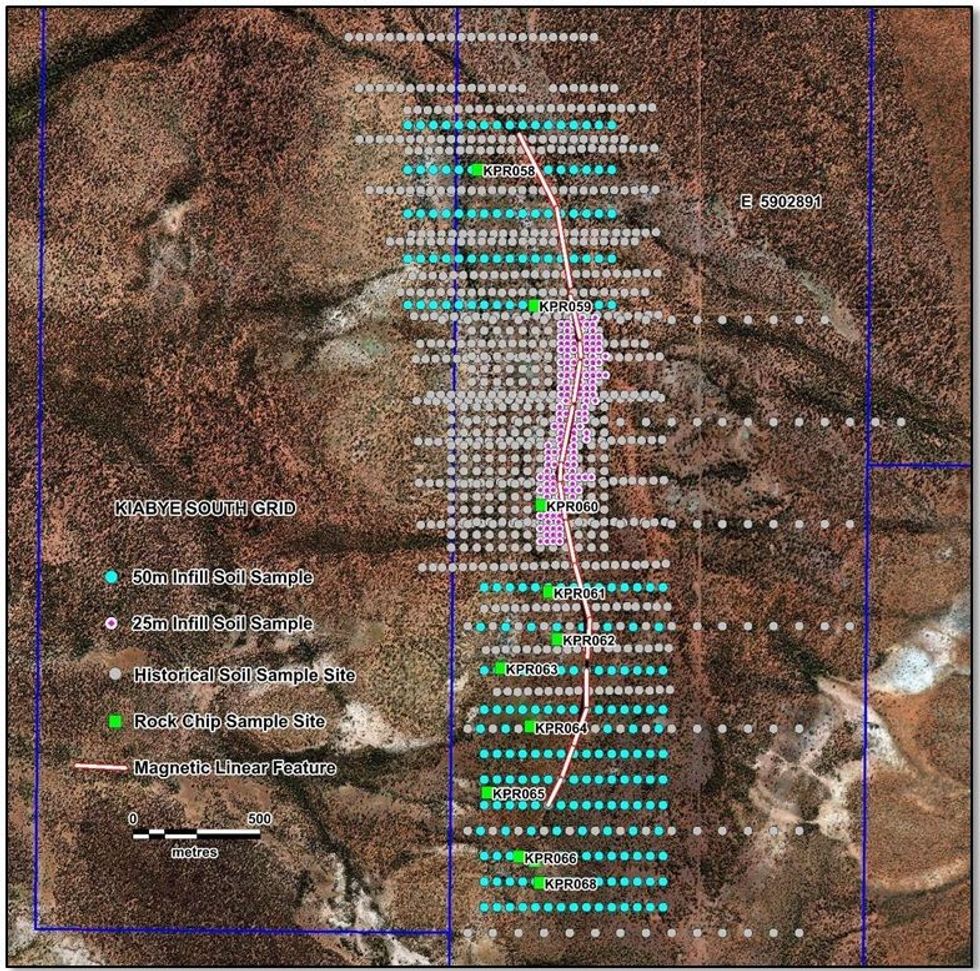

Red Mountain Mining Limited (“RMX” or the “Company”) is pleased to advise that a recent infill soil sampling program with rock chip sampling at Kiabye was completed with the rock chip assays becoming available. The recent soil sampling involved the collection of 520 soil samples at 25m and 100m infill over the Kiabye South target and infill and extension sampling at the Northern anomaly and Reef 2 target at 50m spacing. At total of 11 rock chip samples were taken during the exercise with 10 taken along the Kiabye South Target.

HIGHLIGHTS

- Gossan discovery produces 1.12% Ni, 0.95% Co and 0.07% Cu from an area not previously tested for Nickel or Cobalt mineralisation.

- The gossan is Iron and manganese rich with detectable Pt and Pd.

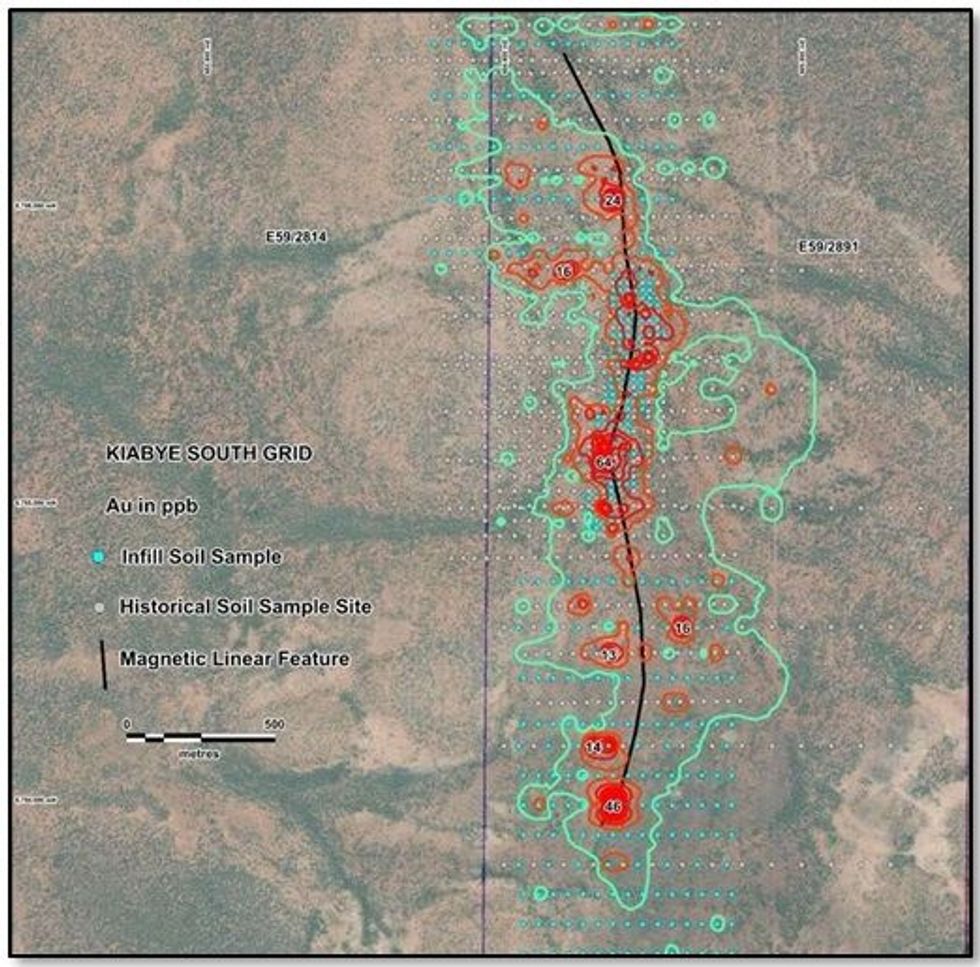

- Soil gold assays highlighting a N-S magnetic feature with gold leakage points along a strike length of over 2km.

- Soil assay results for Flicka Lake in Canada are expected shortly.

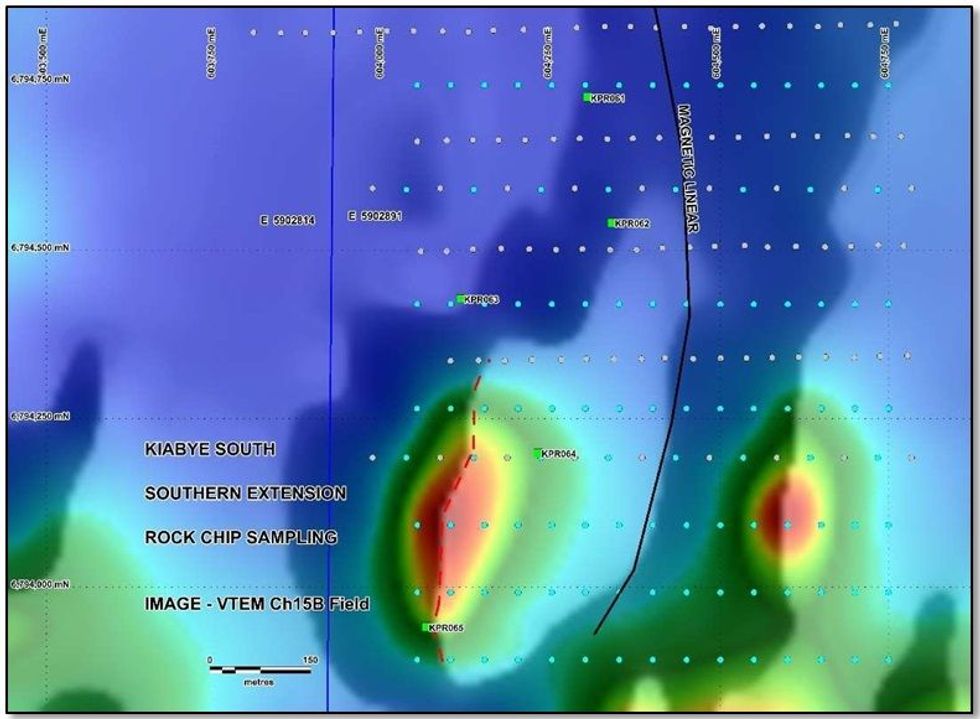

One rock chip sample (KPR065) of a gossan in the southern part of the Kiabye South Target was highly anomalous reporting strong Nickel and Cobalt results:

- 11,222ppm Ni, 9,565ppm Co, 756ppm Cu, 95.2ppb Pd, 22.6ppb Pt and 7ppb Au

The gossan sample KPR065 resides in an area approximately 1.4km south of the historical Nickel exploration pits with no evidence onsite of previous workings. This site also sits on the south margin of a VTEM anomaly with a shallow conductive feature, see Figure 3.

The follow-up phase of rock chip and soil sampling at the Kiabye Gold Project, covers previously identified gold target areas over the central portion of the Kiabye Greenstone Belt in the Yilgarn‘s Murchison Domain, southeast of Mount Magnet. In particular, the soil sampling focused on the Kiabye South area with 25m infill sampling over a 2,500m North-South magnetic linear target where historical shallow drill (RAB) site N15 (14m) reported 1m @3.45 g/t in the last metre of the hole and is located near surface rock sample with 0.728ppm Au (RMX 5/8/2024). On the marginal extensions of the target infill sampling was conduct to complete 50m centers or e 50x100 spacings on the more marginal areas in the south. See Figure 2 for locations.

Soil gold assays highlight a N-S magnetic feature with gold leakage points and strike length of over 2km.

Two soil sampling programs were conducted for gold over several historical targets within the Kiabye Project area. The main targets were Kiabye South, Northern anomaly and Reef 2.

At Kiabye South results indicate several anomalous samples which coincide with a N- S magnetic feature, a possible demagnetized zone associated with an interpreted shear/fault zone where the anomalous gold possible represents mineralised leakage points along the structure. These points represent future drill targets to test the structure.

Click here for the full ASX Release

This article includes content from Red Mountain Mining, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

18h

Rick Rule: Gold Price During War, Silver Strategy, Oil Stock Game Plan

Rick Rule, proprietor at Rule Investment Media, shares updates on his current strategy in the resource space, mentioning gold, silver, oil and agriculture. He also reminds investors to pay more attention to gold's underlying drivers than to current events.Click here to register for the Rule... Keep Reading...

18h

Lobo Tiggre: Gold, Oil in Times of War, Plus My Shopping List Now

Lobo Tiggre of IndependentSpeculator.com shares his thoughts on how gold, silver and oil could be impacted by the developing situation in the Middle East. He cautioned investors not to chase these commodities if prices run. Don't forget to follow us @INN_Resource for real-time updates!Securities... Keep Reading...

19h

TomaGold: New High-grade Deep Discovery at Berrigan Mine

TomaGold (TSXV:LOT) President, CEO and Director David Grondin said the company is focusing on its flagship Berrigan mine in Chibougamau, Québec, following a large, significant discovery at depth.Berrigan is 4 kilometers northwest of the city of Chibougamau and has existed for about 50 years.... Keep Reading...

19h

Oreterra Metals Fully Financed for Maiden Discovery Drilling at Trek South

Oreterra Metals (TSXV:OTMC) is set to launch its first-ever discovery drill program at the Trek South porphyry copper-gold prospect in BC, Canada, a pivotal moment following a corporate restructuring that culminated in the company emerging under its new name on February 2.Speaking at the... Keep Reading...

04 March

Aurum Hits High-Grade Gold at Napie, Cote d'Ivoire

Aurum Resources (AUE:AU) has announced Aurum Hits High-Grade Gold at Napie, Cote d'IvoireDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00