June 22, 2023

Iceni Gold Limited (ASX: ICL) (Iceni or the Company) is pleased to provide an exploration update on the 14 Mile Well Project.

Highlights

- Since listing on the ASX, Iceni embarked on a tenement wide fieldwork program, including UFF+ soil and rock chip sampling. These include over 15,000 soil samples that have been tested for 50 elements.

- Analysis of UFF+ soil and rock chip assays have identified new and significant nickel and lithium targets, in addition to the existing gold targets, within Iceni’s 14 Mile Well tenement package. These include:

- Four large UFF+ nickel soil anomalies (1.6-4.5kms long).

- Two large UFF+ lithium soil and rock chip anomalies (3-10km long) with a strong association with Li-Cs-Be-Rb.

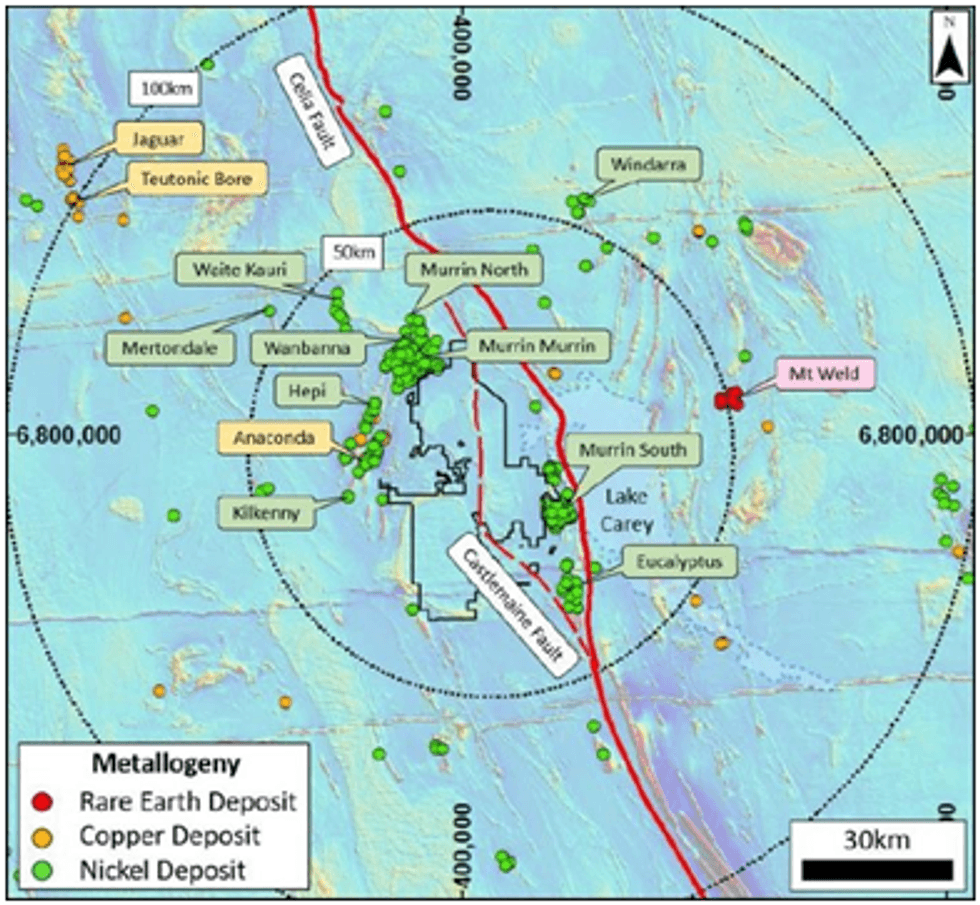

- The Leonora-Laverton District hosts a number of Australia’s significant critical minerals projects and some of these are located within a 50km radius of Iceni’s 14 Mile Well Project.

- Iceni will further evaluate the critical minerals prospectivity at 14 Mile Well while maintaining the primary focus on discovering a world class gold deposit.

Technical Director David Nixon commented:

“The presence of potential nickel and lithium targets at the 14 Mile Well Project, in addition to our primary gold targets, adds significant exploration upside and supports the Company’s decision to complete the tenement wide soil sampling campaign from the outset following the IPO.

These new nickel and lithium anomalies are reinforced by multi-element soil geochemistry and have geochemical signatures known to be associated with lithium and nickel mineralisation in the Yilgarn.

The lithium anomalies have a similar tenor and extent to other published lithium anomalies within the Yilgarn Craton that host major lithium projects such as Mt Holland*.

Iceni will follow-up on these exciting targets in parallel to its focus on gold.”

*Mt Holland soil anomaly map in Phelps-Barber, Trench & Groves (2022) Recent pegmatite-hosted spodumene discoveries in Western Australia: insights for lithium exploration in Australia and globally. Applied earth Science, 131:2, 100-113.

Introduction

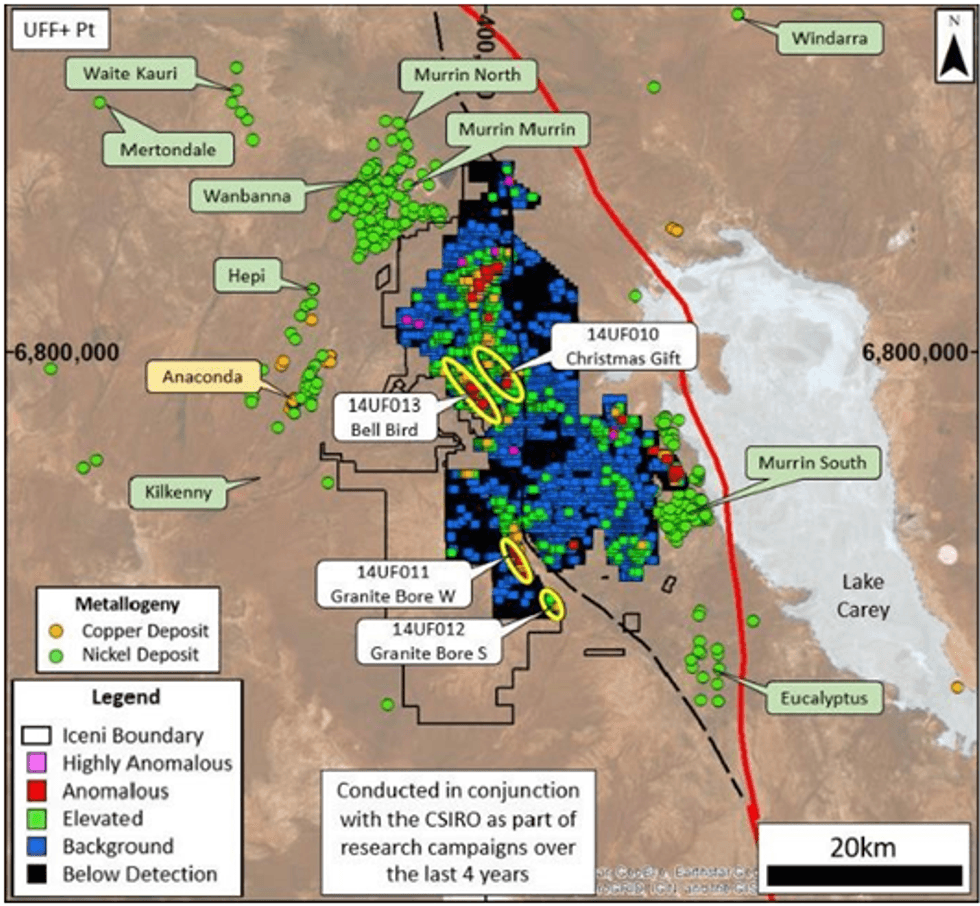

Over a two-year period UFF+ sampling was conducted across the entire tenement package on a regular grid pattern (nominally 100m x 400m). The 15,180 soil samples were taken and analysed for 50 elements, along with other soil properties, including soil sizing, colour, conductivity, acidity, and short wave infra-red analysis (SWIR), to identify clay mineralogy.

The CSIRO developed the UFF+ soil sampling technique to see through deep cover and identify the anomalies derived from mineralisation hidden below.

New generative targeting work conducted by Iceni, assisted by the reviews from the CSIRO and Tower Geoscience consulting geochemist Dr Chris Salt, has led to the identification of a number of new nickel and lithium targets that complement the existing gold targets within the 14 Mile Well project.

Since the IPO in 2021 the Company has identified 12 new significant soil and rock chip anomalies:

- Four UFF+ nickel soil anomalies.

- Two large rock chip/UFF+ lithium anomalies.

- Six large UFF+ gold anomalies (included in ASX releases dated 21 December 2022, 10 November 2022, 20 September 2022, 31 August 2022 and 14 February 2022).

Nickel Projects

Three significant nickel projects are situated within a 50km radius of the Iceni tenement package:

- Murrin Murrin Project (Glencore), operating, 2021 production: 33,700t Ni and 2,800t Co.

- Kilkenny/Eucalyptus Project (Alliance Nickel), under construction, planned annual production: 20,000t Ni and 1,400t Co.

- Windarra Nickel Project (Poseidon), re-development, historic production (1974-1978 and 1981-1989) 7.191Mt at 1.59% Ni for 84,630t Ni.

Nickel Soil Targets

The 14 Mile Well project sits immediately adjacent to the Murrin Murrin and Kilkenny/Eucalyptus nickel projects which adjoin tenement boundaries with Iceni’s 14 Mile Well project.

Work from the CSIRO UFF+ soil program has identified a number of nickel and multi-element anomalies associated with mafic-ultramafic rocks within the 14 Mile Well project. These anomalies include:

- 14UF010 Christmas Gift – 2.5km long platinum, nickel and chrome anomaly.

- 14UF011 Granite Bore West – 4km long platinum, nickel and chrome anomaly.

- 14UF012 Granite Bore South – 1.5km long platinum, palladium and nickel anomaly.

- 14UF013 Bell Bird – 4.5km long platinum, nickel and chrome anomaly.

Lithium Geochemistry Targets

As a result of the UFF+ soils campaign a significant gold anomaly 14UF001 - Breakaway Well was discovered on the southwestern boundary of the project within the Monument Granite (in ASX release dated 1 October 2021).

Click here for the full ASX Release

This article includes content from Iceni Gold, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

ICL:AU

The Conversation (0)

06 March

Adrian Day: Gold Dips Bought Quickly, Price Run Not Over Yet

Adrian Day, president of Adrian Day Asset Management, shares his latest thoughts on what's moving the gold price, emphasizing that its bull run isn't over yet. "It's monetary factors that are driving gold — that's what's fundamentally driving gold," he said. "Monetary factors, lack of trust in... Keep Reading...

06 March

Brien Lundin: Gold, Silver Stock Run Just Starting, Get in Now

Brien Lundin, editor of Gold Newsletter and New Orleans Investment Conference host, shares his stock-picking strategy at a time when high metals prices are beginning to lift all boats. In his view, gold and silver equities may still only be in the second inning. Don't forget to follow us... Keep Reading...

06 March

Venezuela Gold Set for US Market in Brokered Deal

A new US-Venezuela gold deal could soon channel hundreds of kilograms of bullion from the South American nation into American refineries.Venezuela’s state-owned mining company, Minerven, has agreed to sell between 650 and 1,000 kilograms of gold dore bars to commodities trading house Trafigura... Keep Reading...

05 March

Rick Rule: Gold Price During War, Silver Strategy, Oil Stock Game Plan

Rick Rule, proprietor at Rule Investment Media, shares updates on his current strategy in the resource space, mentioning gold, silver, oil and agriculture. He also reminds investors to pay more attention to gold's underlying drivers than to current events.Click here to register for the Rule... Keep Reading...

05 March

Lobo Tiggre: Gold, Oil in Times of War, Plus My Shopping List Now

Lobo Tiggre of IndependentSpeculator.com shares his thoughts on how gold, silver and oil could be impacted by the developing situation in the Middle East. He cautioned investors not to chase these commodities if prices run. Don't forget to follow us @INN_Resource for real-time updates!Securities... Keep Reading...

05 March

TomaGold: New High-grade Deep Discovery at Berrigan Mine

TomaGold (TSXV:LOT) President, CEO and Director David Grondin said the company is focusing on its flagship Berrigan mine in Chibougamau, Québec, following a large, significant discovery at depth.Berrigan is 4 kilometers northwest of the city of Chibougamau and has existed for about 50 years.... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00