September 08, 2022

NiCAN Limited ("NiCAN" or the "Company") ( TSXV: NICN) has received outstanding assay results from the first two diamond drill holes drilled in 2022 at the Wine project in Manitoba. These drill holes were part of NiCAN's initial drilling campaign at the Wine project and were drilled vertically to gain an understanding of the overall thickness and orientation of mineralization encountered in the historical drilling.

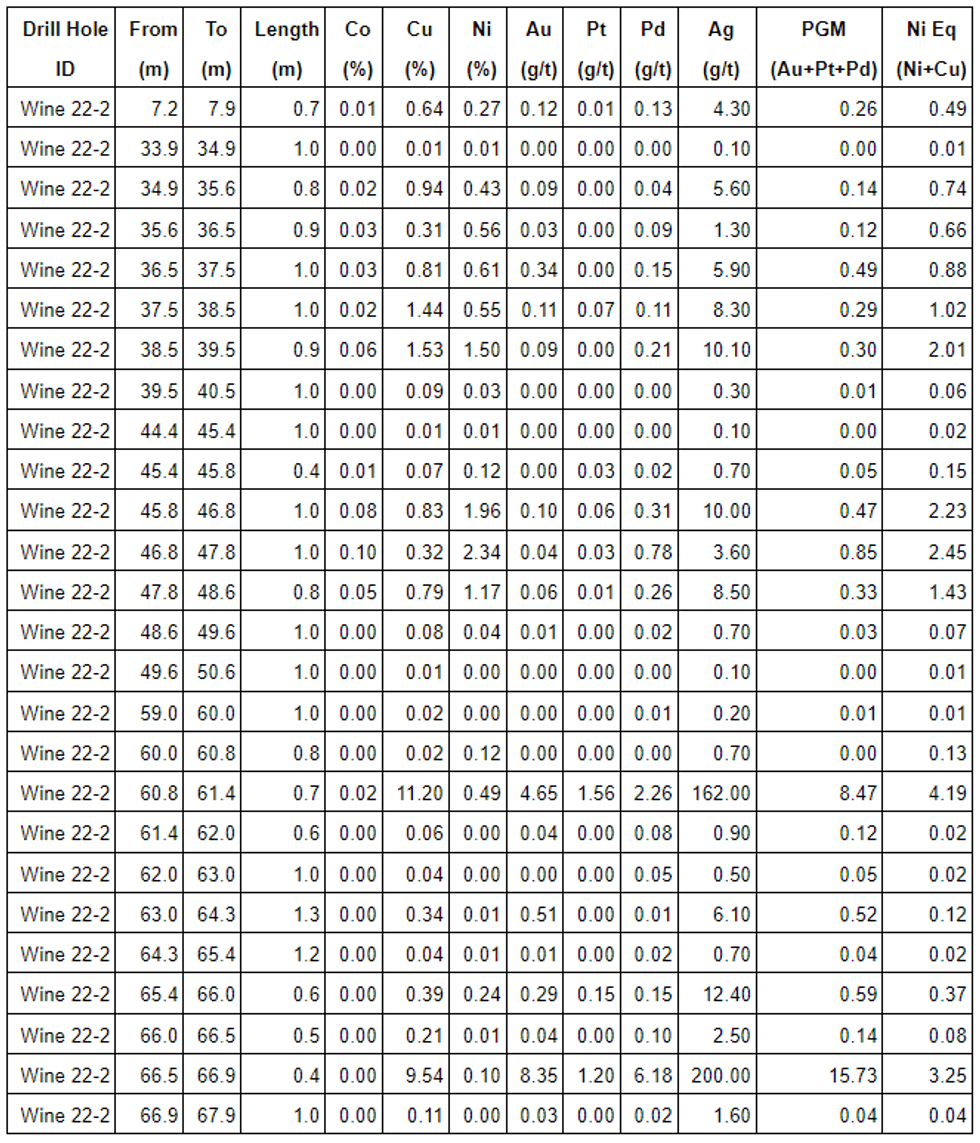

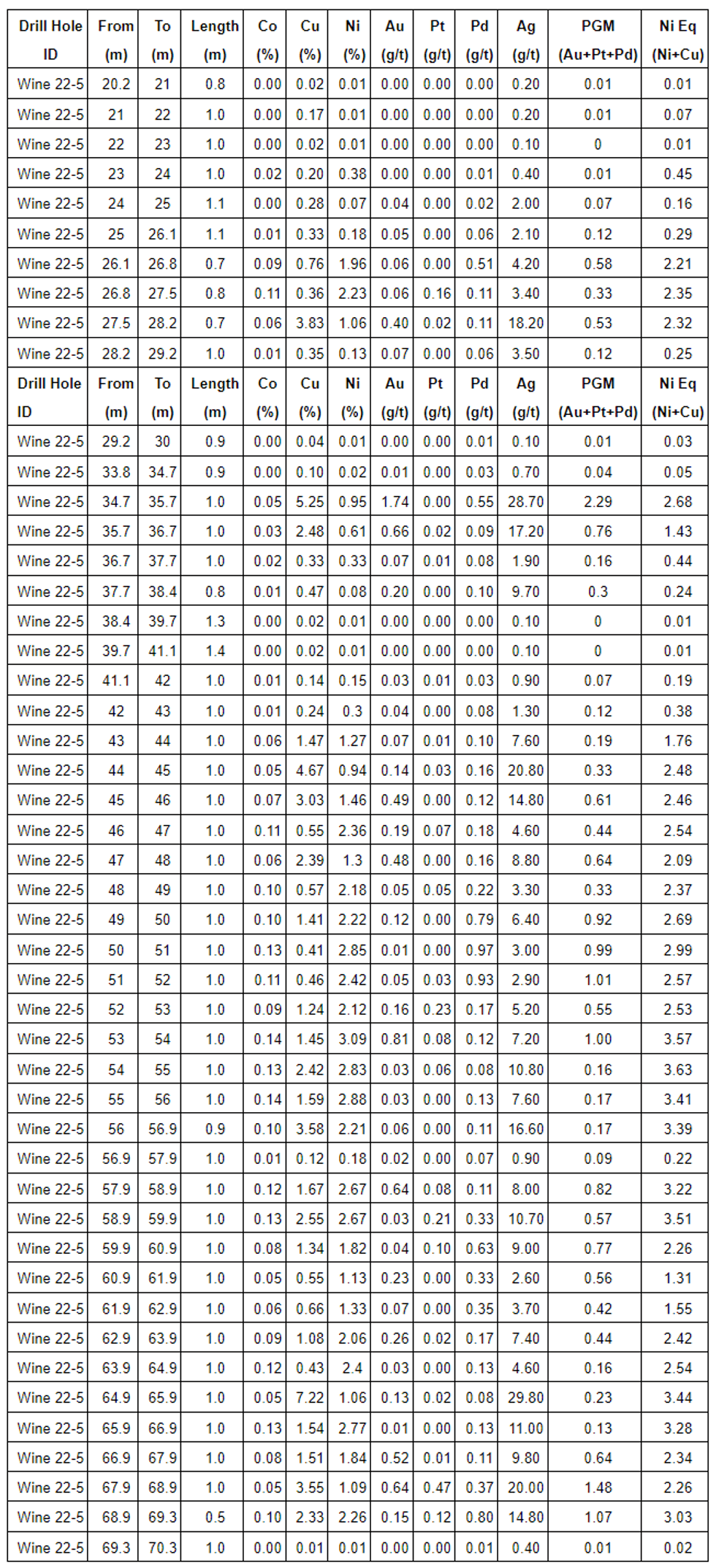

Highlights (complete assays are set out in Tables 1 and 2):

- Diamond drill hole Wine-22-05 intersected three distinct zones of mineralization including 27.3 metres at 2.01% Ni, 1.81% Cu, 0.09% Co, 0.20 g/t Au and 0.28 g/t Pd from 43.0 to 69.3 metres (NiEq of 2.61%)

- Diamond drill hole Wine-22-02 intersected four zones of mineralization including 2.8 metres at 1.87% Ni, 0.64% Cu, 0.08% Co and 0.46 g/t Pd from 45.8 to 48.6 metres (NiEq of 2.08%).

Note: Nickel Equivalent ("NiEq") was calculated using copper and nickel values only.

Brad Humphrey, President, and CEO of NiCAN commented, "This is an excellent result from our initial drilling at the Wine project. This drilling program was designed to improve our understanding of the Wine Occurrence, confirm the mineralization encountered in the historical drilling and determine the orientation of the mineralized body. Intersecting multiple zones containing high nickel equivalent values is very encouraging."

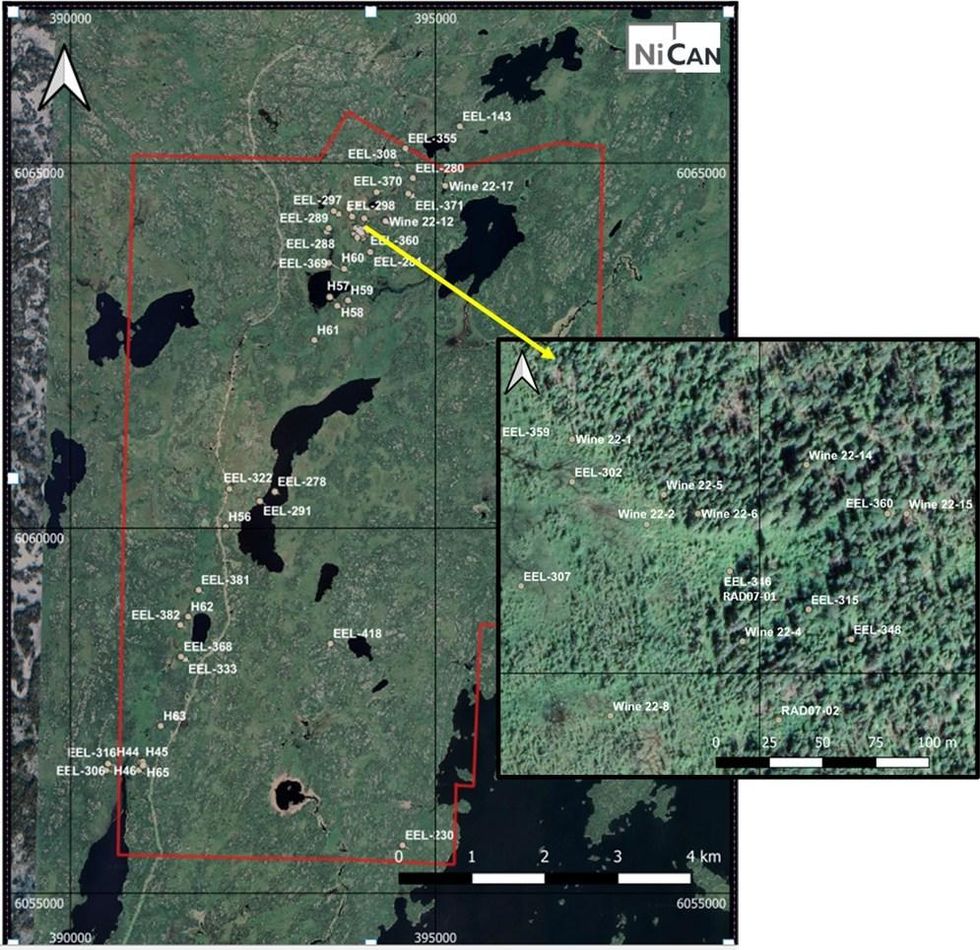

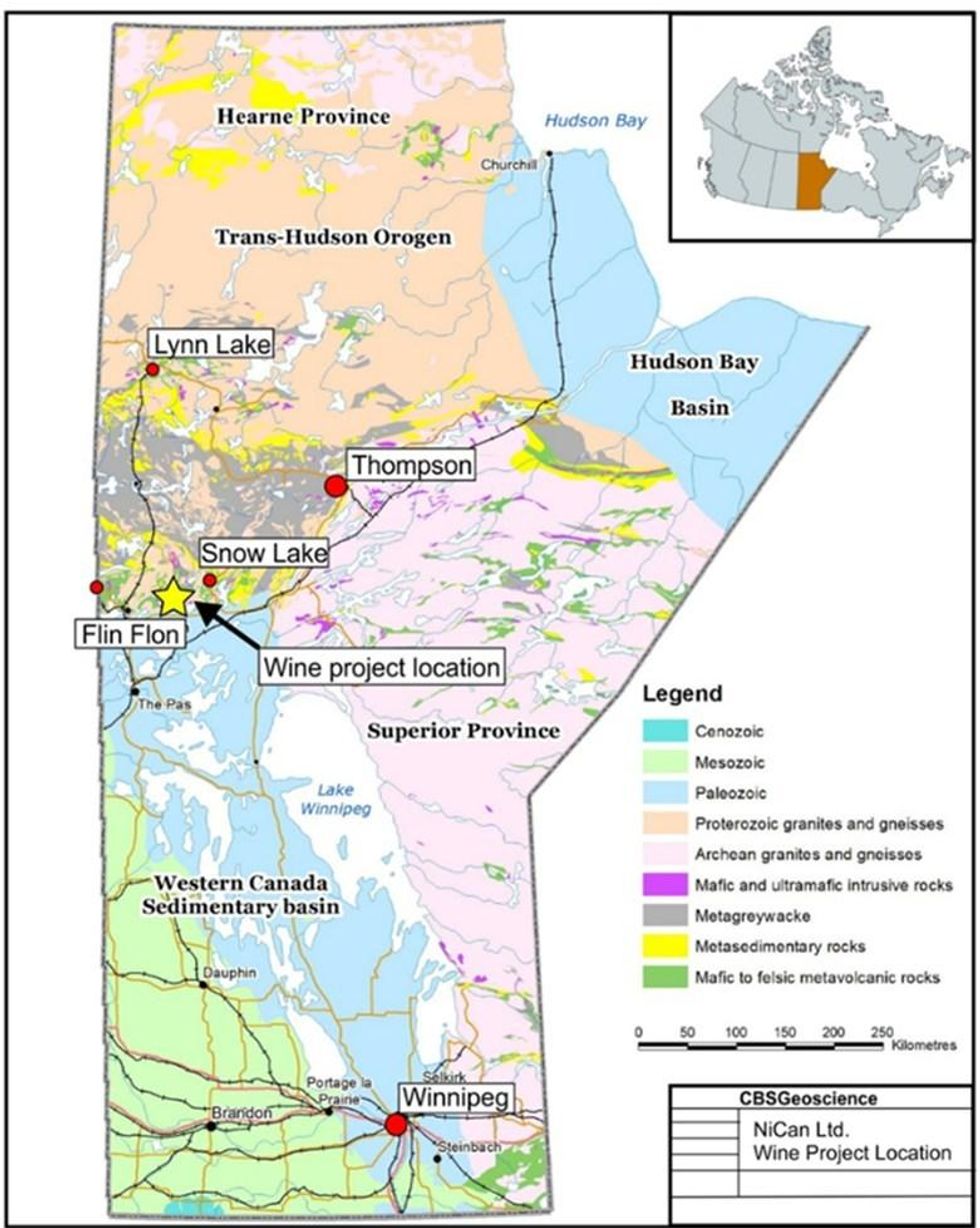

2022 Exploration ProgramThe 56.8 km2 Wine property is located west of Snow Lake in Manitoba (Figure 4). The initial 2022 exploration program included an airborne geophysical survey, partial resampling of a historical drill hole, downhole geophysical (electro-magnetic) surveys and 17 diamond drill holes, 1,600 metres in total, testing an area known as the Wine Occurrence, as well as seven other nearby geophysical anomalies. The objective of this program was to confirm the presence of nickel-copper mineralization at the Wine Occurrence and improve NiCAN's understanding of the geological model and the orientation of the mineralization, which will be used to better target future drilling programs.

NiCAN anticipates receiving and releasing the assay and geophysical survey results, following quality control, over the next several weeks. The results from this initial exploration work will be used to refine the geological model and to design a follow up Phase 2 exploration plan.

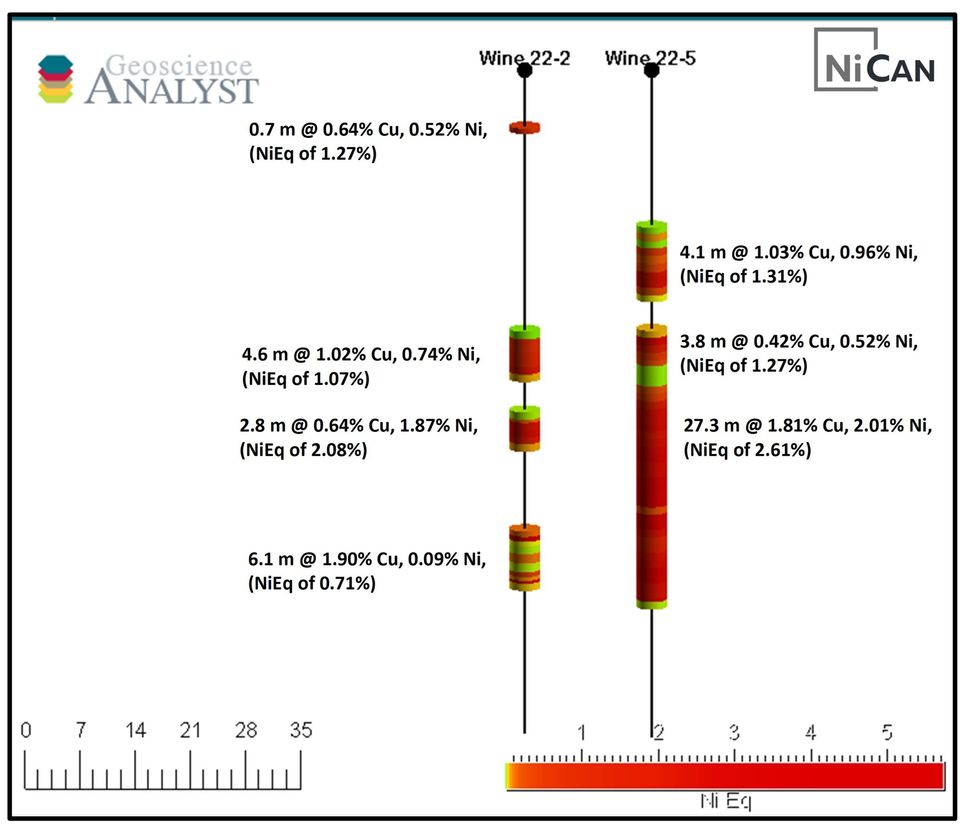

Wine-22-02Immediately following the overburden, drill hole Wine-22-02 intersected 0.7 metres averaging 0.64% Cu and 0.27% Ni (NiEq of 0.49%) from 7.2 to 7.9 metres. This was followed by three additional mineralized intersections down hole, including 4.6 metres averaging 1.02% Cu and 0.74% Ni (NiEq of 1.07%), 0.3% Co and 0.28 g/t PGMs ("Au+Pt+Pd") from 34.9 to 39.5 metres; 2.8 meters averaging 0.64% Cu and 1.87% Ni (NiEq of 2.08%), 0.08% Co and 0.56 g/t PGMs from 45.8 to 48.6 metres as well as 6.1 metres averaging 1.9% Cu, 0.09% Ni (NiEq of 0.71%), 0.003% Co and 2.49 g/t PGMs from 60.8 to 66.9 metres (Figure 1).

There appears to be a strong correlation between intersections of higher-grade copper assays and elevated PGM grades. An 11.20% Cu assay from 60.8 to 61.4 metres also returned 6.0 g/t Au, 1.01 g/t Pt and 1.47 g/t Pd. Another significant copper assay of 9.47% Cu from 66.5 to 66.9 metres also returned 8.35 g/t Au, 1.20 g/t Pt and 6.18 g/t Pd.

All mineralized intersections were hosted by gabbro with the last three hosted by a distinct light-coloured gabbro unit.

Wine-22-05Wine-22-05 was drilled 16 metres northeast of Wine-22-02 and intersected three zones of mineralization starting at 25.0 metres downhole. They include 4.1 metres averaging 1.03% Cu and 0.96% Ni (NiEq of 1.31%), 0.05% Co and 0.29 g/t PGMs from 25.0 to 29.1 metres; 3.8 metres averaging 2.42% Cu and 0.52% Ni (NiEq of 1.27%), 0.03% Co and 0.92 g/t PGMs from 34.8 to 38.4 metres and 27.3 metres averaging 1.81% Cu and 2.01% Ni (NiEq of 2.61%), 0.09% Co, 0.46 g/t PGMs from 43.0 to 69.3 metres. All were hosted by the light-coloured gabbro unit (Figure 1).

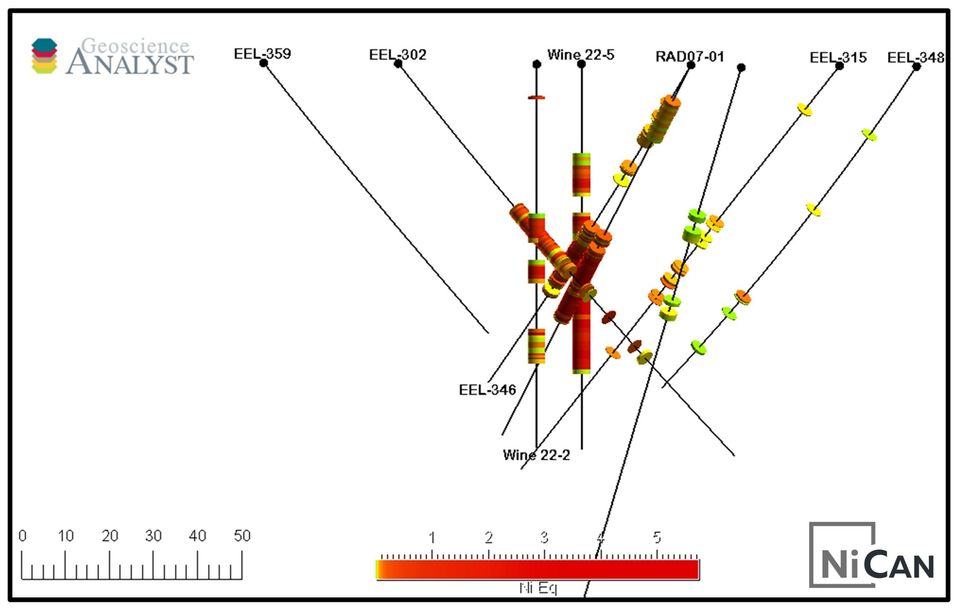

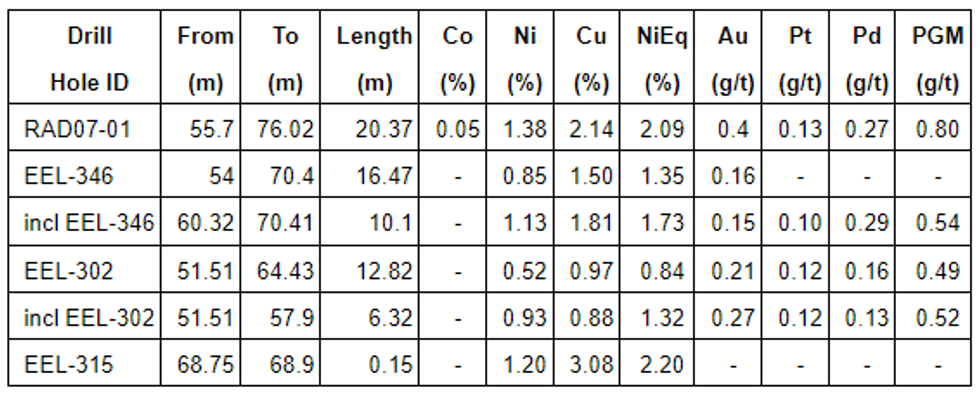

The initial mineralized zone encountered in drill hole Wine-22-05, which intersected 4.6 metres averaging 1.02% Cu and 0.74% Ni (NiEq of 1.07%), is interpreted to be a separate zone than that intersected in drill hole Wine-22-02. Further work is required to determine this zone's extent and characterization. Subsequent zones intersected in the drill hole can be correlated to those in drill hole Wine-22-02, as well as historical drill hole RAD07-01 (20.4 metres averaging 1.38% Ni and 2.14% Cu (NiEq of 2.09% Ni)), EEL-346 (16.5 metres averaging 0.85% Ni and 1.50% Cu (NiEq of 1.35% Ni)) and EEL-302 (12.8 metres averaging 0.52% Ni and 0.97% Cu (NiEq of 0.84% Ni)) (Figure 2) (see press release dated August 23, 2022).

On the section where drill hole Wine-22-05 intersects proximal to historical drill holes EEL-346 and RAD07-01, the mineralized zone is estimated at a true width of 16 metres and a thickness of 27 metres.

* Historical drill hole assays are listed in Table 3

All core samples were sent to the Saskatchewan Research Council ("SRC") in Saskatoon (an accredited laboratory) by secure transport for base and precious metal assay. Base metals were assayed by their ICP3 package, which includes a total of 35 analytes by ICP-OES (Inductively Coupled Plasma – Optical Emission Spectroscopy). Partial digestions were performed on a 0.5 gram aliquot of sample pulp which was digested in a mixture of HCl:HNO3, in a hot water bath and then diluted to 15 ml using deionized water. Over-limits for copper, nickel and cobalt had an aliquot of 1.0 gram sample pulp digested in a concentration of HCl:HNO3. The digested volume was then made up with deionized water for analysis by ICP-OES. Fire Assay Techniques involved a 30 gram aliquot of sample pulp which was mixed with a standard fire assay flux in a clay crucible and a silver inquart added prior to fusion. After the mixture was fused, the melt was poured into a form which was cooled. The lead bead was then recovered and cupelled until only the precious metal bead remained. The bead was then parted in dilute HNO3. The precious metals were then dissolved in aqua regia and then diluted for analysis by ICP-OES

Laboratory Quality Control protocols were applied to the assay sample package by SRC. NiCAN submitted a regular schedule of standards, blanks and duplicates into the sample stream for Quality Control measures. Drill core samples are split in half using a diamond saw with half saved for reference and the other half shipped for assay. In the case of duplicate samples the half core is quarter split with the two quarter splits sent for separate assay.

NiCAN does not have any historic QA/QC data for the 2007 or earlier drill results.

Note: NiEq includes Ni and Cu values only - Ni+(Cu x 0.33)

Qualified PersonMr. Bill Nielsen, P.Geo, a consultant to NiCAN, who is a qualified person under National Instrument 43-101 – Standards of Disclosure of Mineral Projects ("NI 43-101") has reviewed and approved the scientific and technical information in this press release.

About NiCANNiCAN Limited is a mineral exploration company, trading under the symbol "NICN" on the TSX-V. The Company is actively exploring two nickel projects, both located in well-established mining jurisdictions in Manitoba, Canada.

To receive news releases by e-mail, please register using the NiCAN website at www.nicanltd.com.

Cautionary Note Regarding Forward-Looking Statements

The information contained herein contains certain "forward-looking information" under applicable securities laws concerning the proposed financing, business, operations and financial performance and condition of NiCAN Limited. Forward-looking information includes, but is not limited to, the size and timing of the drill program, results of the drill program, NiCAN's ability to identify mineralization similar to that found in prior drill holes, the benefits and the potential of the properties of the Company; future commodity prices (including in relation to NiEq calculations); drilling and other exploration potential; costs; and permitting. Forward-looking information may be characterized by words such as "plan," "expect," "project," "intend," "believe," "anticipate", "estimate" and other similar words, or statements that certain events or conditions "may" or "will" occur. Forward-looking information is based on the opinions and estimates of management at the date the statements are made and are based on a number of assumptions and subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking information. Many of these assumptions are based on factors and events that are not within the control of the Company and there is no assurance they will prove to be correct. Factors that could cause actual results to vary materially from results anticipated by such forward-looking information includes changes in market conditions, fluctuating metal prices and currency exchange rates, the possibility of project cost overruns or unanticipated costs and expenses and permitting disputes and/or delays. Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results not to be anticipated, estimated or intended. There can be no assurance that forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. The Company undertakes no obligation to update forward-looking information if circumstances or management's estimates or opinions should change except as required by applicable securities laws. The reader is cautioned not to place undue reliance on forward-looking information.

Neither TSX-V nor its Regulation Services Provider (as that term is defined in policies of the TSX-V) accepts responsibility for the adequacy or accuracy of this release.

NICN:CA

Sign up to get your FREE

NiCan Limited Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

22 May 2023

NiCan Limited

Exploring Prospective and Underexplored Nickel Assets in Manitoba

Exploring Prospective and Underexplored Nickel Assets in Manitoba Keep Reading...

3h

Bahia Metals Corp. Completes Initial Public Offering of $5,750,000, with Full Exercise of Over-Allotment Option

Bahia Metals Corp. (CSE: BMT) ("Bahia" or the "Company") is pleased to announce that it has successfully completed its initial public offering (the "IPO") of 11,500,000 units of the Company (the "Units") at a price of $0.50 per Unit, inclusive of the full exercise of the 15% over-allotment... Keep Reading...

04 February

FPX Nickel Reports Confirmatory Results from Geotechnical Drilling at the Baptiste Nickel Project

FPX Nickel Corp. (TSX-V: FPX, OTCQX: FPOCF) ("FPX" or the "Company") is pleased to report assay results from select drill holes completed during its 2025 engineering field investigation program at the Baptiste Nickel Project ("Baptiste" or the "Project") in central British Columbia.As previously... Keep Reading...

16 January

Top 5 Canadian Mining Stocks This Week: Homeland Nickel Gains 132 Percent

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV and CSE, starting with a round-up of Canadian and US news impacting the resource sector.The Ontario government said Tuesday (January 13) that it is accelerating permitting and... Keep Reading...

08 January

Nickel Market Recalibrates After Explosive Trading Week

Nickel prices stabilized on Thursday (January 8) after a turbulent week that saw the market swing sharply higher before retreating as traders reassessed the balance between existing supply risks and a growing overhang of inventory.Three-month nickel on the London Metal Exchange (LME) hovered... Keep Reading...

Latest News

Sign up to get your FREE

NiCan Limited Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00