Overview

Mineral exploration and development company NiCAN Ltd (TSXV:NICN) is pursuing a portfolio of highly prospective yet underexplored projects in known nickel belts in Manitoba, one of the top nickel-producing provinces in Canada.

As the world’s sixth largest nickel producer, Canada continues to be an important jurisdiction for nickel mining with an estimated 133,581 tonnes of nickel in concentrate produced in 2021.NiCAN’s promising land package in Manitoba has the potential of being well-positioned to meet the rising demand for nickel, largely driven by the developing electric vehicle (EV) market. Manitoba’s nickel deposits also contain copper, cobalt and PGMs as a valuable byproduct of production.

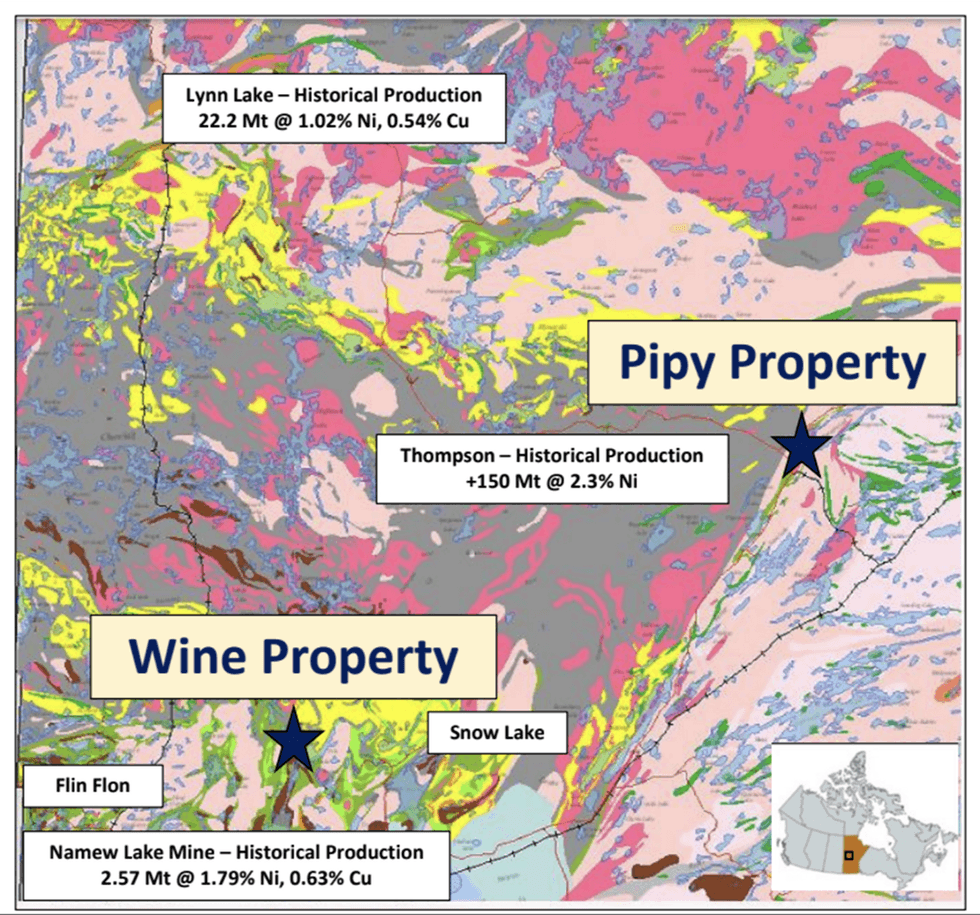

NiCAN’s flagship asset, the Wine project, is within the prolific Flin Flon-Snow Lake Greenstone Belt of Manitoba. The Pipy project, NiCAN’s second asset, is only 15 kilometers away from the world-class Thompson nickel deposit, indicating the project's potential.

NiCAN reported additional strong drill results from the Wine Project in Manitoba, including 8.6 meters of 2.22 percent NiEq from its 2022 reconnaissance diamond drilling program. The company also intersected new mineralization approximately 850 meters to the northeast of the Wine occurrence as part of its 2023 winter drilling program.

The Wine project is in close proximity to significant base metal projects, including Reed Lake Mine, Spruce Point Mine and the Rail Deposit. Furthermore, the Flin Flon-Snow Lake Greenstone Belt hosts dozens of other precious and base metal mines, indicating the potential for additional discoveries at the Wine project.

NiCAN’s Pipy project is underlain by the Pipe Formation, which hosts the renowned Thompson Nickel mines to the south. Despite its proximity to the Thompson mine, the asset has received minimal exploration attention since the 1960s, allowing NiCAN to apply modern technologies to capitalize on the untapped asset.

The company recently doubled its land position at the Pipy project. NiCAN has already compiled and corrected historical data and completed a UAV high-definition magnetometer survey.

Experienced mining executives lead NiCAN with expertise in exploration, project development, mining operations and financing mining assets. Additionally, the company’s board of directors brings additional expertise in international law and corporate financing. The team focuses on nickel projects in attractive and renowned jurisdictions for nickel exploration.

Company Highlights

- NiCAN is an exploration and development mining company focusing on its highly prospective nickel projects in Manitoba, Canada.

- The company’s flagship asset, the Wine project, is within the world-class Flin Flon-Snow Lake Greenstone Belt of Manitoba, known for containing more than two dozen precious and base metal mines.

- NiCAN’s first phase of drilling at its Wine project returned: 27.3 meters of 2.01 percent nickel, 1.81 percent copper or 2.61 percent nickel equivalent (NiEq), plus 0.09 percent cobalt and 0.54 g/t platinum group metals (PGM)

- The Wine project is in close proximity to several significant deposits, such as the Reed Lake Mine and Spruce Point Mine.

- NiCAN’s Pipy project is in the same geological region as the world-class Thompson mine, located only 15 kilometers to the south.

- NiCAN doubled its land position at the Pipy project and is targeting high-grade nickel sulphide mineralization similar to the Thompson T1 and T3 mines.

- Phase I exploration program at Pipy property is awaiting permit approval

- Phase II drilling program of more than 2,000 meters at the Wine property is currently underway

- The company is led by an experienced management team and board of directors with expertise in project development, asset exploration and financing of mining assets.

Get access to more exclusive Nickel Investing Stock profiles here