April 30, 2024

Norfolk Metals Ltd (ASX:NFL) (Norfolk or the Company) is pleased to report on its activities during the 3-month period ended 31 March 2024.

ORROROO URANIUM PROJECT

- Maiden drill campaign completed successfully delineating uranium in 10 of 17 holes drilled

- Exploration continuing with land access engagements, geophysics and subsequent drill program(s) planning in progress

- Additional permit EL6948 granted expanding project area to 723km² total of 100% owned exploration tenure

ROGER RIVER GOLD PROJECT

- Soil study completed with successful reanalysis of historical samples

CORPORATE UPDATE (including activities subsequent to quarterly period end)

- Exclusivity and due diligence deed executed for Las Alteras uranium project in Argentina

- Strong financial position with $2.91m cash at March 2024 quarter end which was increased subsequently through a strategic placement of $415,746

Orroroo Uranium Project, South Australia

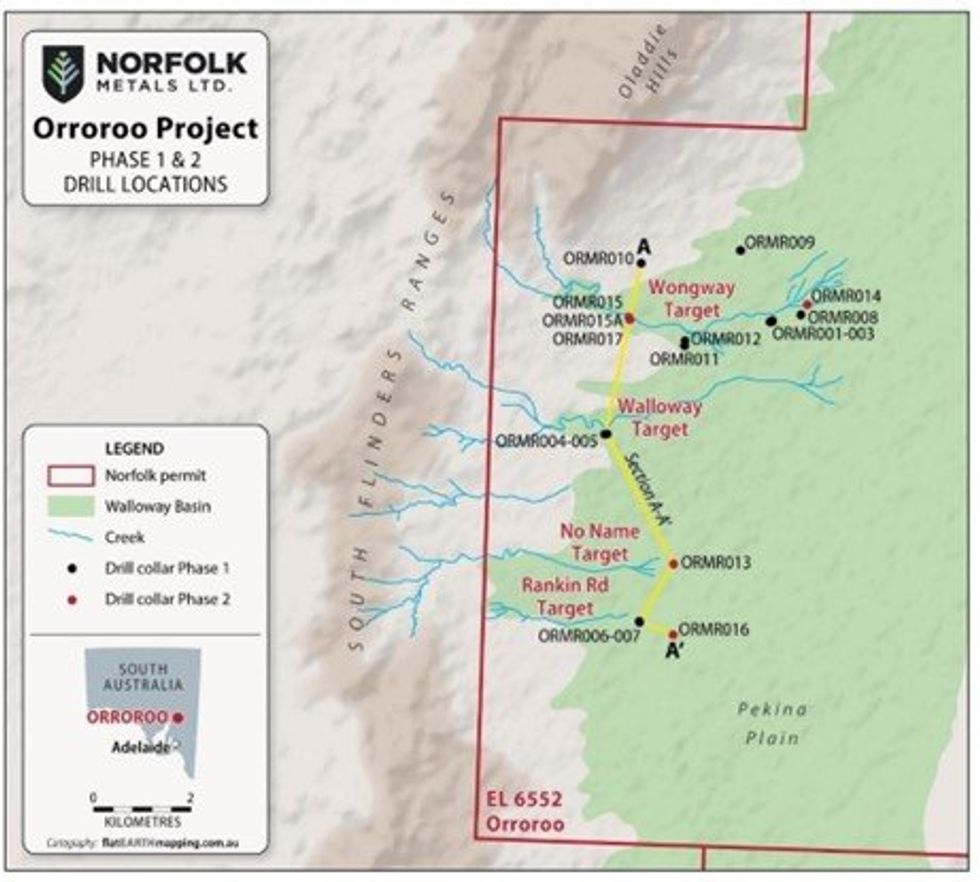

Norfolk Metals Ltd (Norfolk or the Company) is pleased to advise the maiden drill program was completed with a further 5 holes drilled across EL6552 being drilled in Phase 2 of the program in January 2024, taking the total number of holes completed in the maiden program to seventeen (17) (Figure 1). Phase 2 of the program sought to test the palaeochannel model at the Wongway Creek Target (formerly Target 1) where suitable drill access was available. A total of three (3) holes were drilled along the river traverse of the Wongway Creek Target testing both upstream and downstream regions. One (1) hole was drilled downstream of the No Name Creek Target (formerly Target 3) as well as the Rankin Rd Target (formerly Target 4). The completion of the maiden drill program has successfully delineated uranium in ten (10) of the seventeen (17) holes providing data for the Company to further develop a geological model of the Walloway Basin (Figure 3). Most importantly, the interpreted uranium bearing floodplain intersected upstream of Wongway Creek gives Norfolk confidence in the palaeochannel model and future exploration efforts can be planned accordingly. Peak grade of 796ppm pU308 was intersected in ORMR007.

*peak grade(s) noted are the direct detection of pU308 over a 0.02m interval by Prompt Fission Neutron downhole logging within a composite intersection with a cut-off grade greater than 100ppm pU308.

Floodplain Interpretation

The pre-drilling model was targeting the presence of prospective palaeochannels approximately 100 to 150 metres to the south of the modern-day creeks associated with uranium intersected in historical Linc Energy Wells. Drilling results from Phase 1 indicated that the uranium in the Linc Energy Wells appeared to be associated with a secondary permeability created by downward displacement of the sediments resulting from basement faulting or soft sediment deformation. Phase 2 drilling continued to test the targeted prospective palaeochannels located to the south of the modern-day creeks at closer than expected distance of 50m. Younger palaeochannels were seen south of the modern-day creeks in ORMR004 (Walloway Creek Target) and ORMR016 (Rankin Rd Target) at the base of the regolith. This further supports the model of palaeochannels occurring south of the modern-day creeks due to a change in regional slope.

Drillhole ORMR015A was drilled 50m south of the modern-day creek at Wongway Creek Target. Drilling upstream from previous holes enabled easier location of the targeted prospective and potentially wider palaeochannel. This hole encountered what appears to be a silt dominated floodplain with minor gravel and two elevated gamma anomalies signifying uranium towards the top of this unit as well as the base of this unit (Figure 2). This unit appears to be the middle section of a palaeochannel between the sand and gravel dominated incising part of a palaeochannel and the clay dominated edge of a floodplain.

Click here for the full ASX Release

This article includes content from Norfolk Metals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

NFL:AU

The Conversation (0)

03 August 2021

Norfolk Metals

ASX-listed uranium explorer

ASX-listed uranium explorer Keep Reading...

30 March 2025

Norfolk to earn-into Chilean Copper Project

Norfolk Metals (NFL:AU) has announced Norfolk to earn-into Chilean Copper ProjectDownload the PDF here. Keep Reading...

26 March 2025

Trading Halt

Norfolk Metals (NFL:AU) has announced Trading HaltDownload the PDF here. Keep Reading...

31 January 2025

Quarterly Activities/Appendix 5B Cash Flow Report

Norfolk Metals (NFL:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

19h

Rick Rule: Gold Price During War, Silver Strategy, Oil Stock Game Plan

Rick Rule, proprietor at Rule Investment Media, shares updates on his current strategy in the resource space, mentioning gold, silver, oil and agriculture. He also reminds investors to pay more attention to gold's underlying drivers than to current events.Click here to register for the Rule... Keep Reading...

19h

Lobo Tiggre: Gold, Oil in Times of War, Plus My Shopping List Now

Lobo Tiggre of IndependentSpeculator.com shares his thoughts on how gold, silver and oil could be impacted by the developing situation in the Middle East. He cautioned investors not to chase these commodities if prices run. Don't forget to follow us @INN_Resource for real-time updates!Securities... Keep Reading...

20h

TomaGold: New High-grade Deep Discovery at Berrigan Mine

TomaGold (TSXV:LOT) President, CEO and Director David Grondin said the company is focusing on its flagship Berrigan mine in Chibougamau, Québec, following a large, significant discovery at depth.Berrigan is 4 kilometers northwest of the city of Chibougamau and has existed for about 50 years.... Keep Reading...

20h

Oreterra Metals Fully Financed for Maiden Discovery Drilling at Trek South

Oreterra Metals (TSXV:OTMC) is set to launch its first-ever discovery drill program at the Trek South porphyry copper-gold prospect in BC, Canada, a pivotal moment following a corporate restructuring that culminated in the company emerging under its new name on February 2.Speaking at the... Keep Reading...

04 March

Aurum Hits High-Grade Gold at Napie, Cote d'Ivoire

Aurum Resources (AUE:AU) has announced Aurum Hits High-Grade Gold at Napie, Cote d'IvoireDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00