Northern Lights Resources Corp. (the "Company" or "Northern Lights") (CSE:NLR)(OTCQB:NLRCF) is pleased to announce a summary of results achieved by the Company in 2020 and an outlook for 2021

While the impact of the Covid-19 Pandemic has resulted in delays to permits and logistics associated with carrying out exploration work, during 2020 Northern Lights significantly advanced the Company's two flagship properties - the Secret Pass Gold Project in Arizona and the Medicine Springs Silver Lead Zinc project in Nevada.

Corporate Update

Northern Lights raised a total of $2.8 million during the year to fund project exploration and company overheads.

The Northern Lights team grew during the year with the addition of Project Geologist Paul Warren and the appointment of Shawn Balaghi as Manager of Investor Relations.

In December, Northern Lights listed and began trading on the OTCQB exchange. The OTCQB is expected to increase the Company's shareholding base in the US.

Project Update

1. Secret Pass Gold Project

During 2020, Northern Lights completed a Phase 1 Exploration program at Secret Pass. The Phase 1 exploration program included:

- Evaluation and compilation of historic geological information into a GIS system.

- Completion of drone aeromagnetic and photogrammetry mapping survey over the entire mineral claim area.

- Reinterpretation of historic IP survey.

- Geological and drainage mapping over entire mineral claim area.

- Completion of 400 pan concentrate / screen concentrate sampling program over selected areas of alteration throughout the license area (assays pending). This survey will show background gold presence and highlight additional target zones.

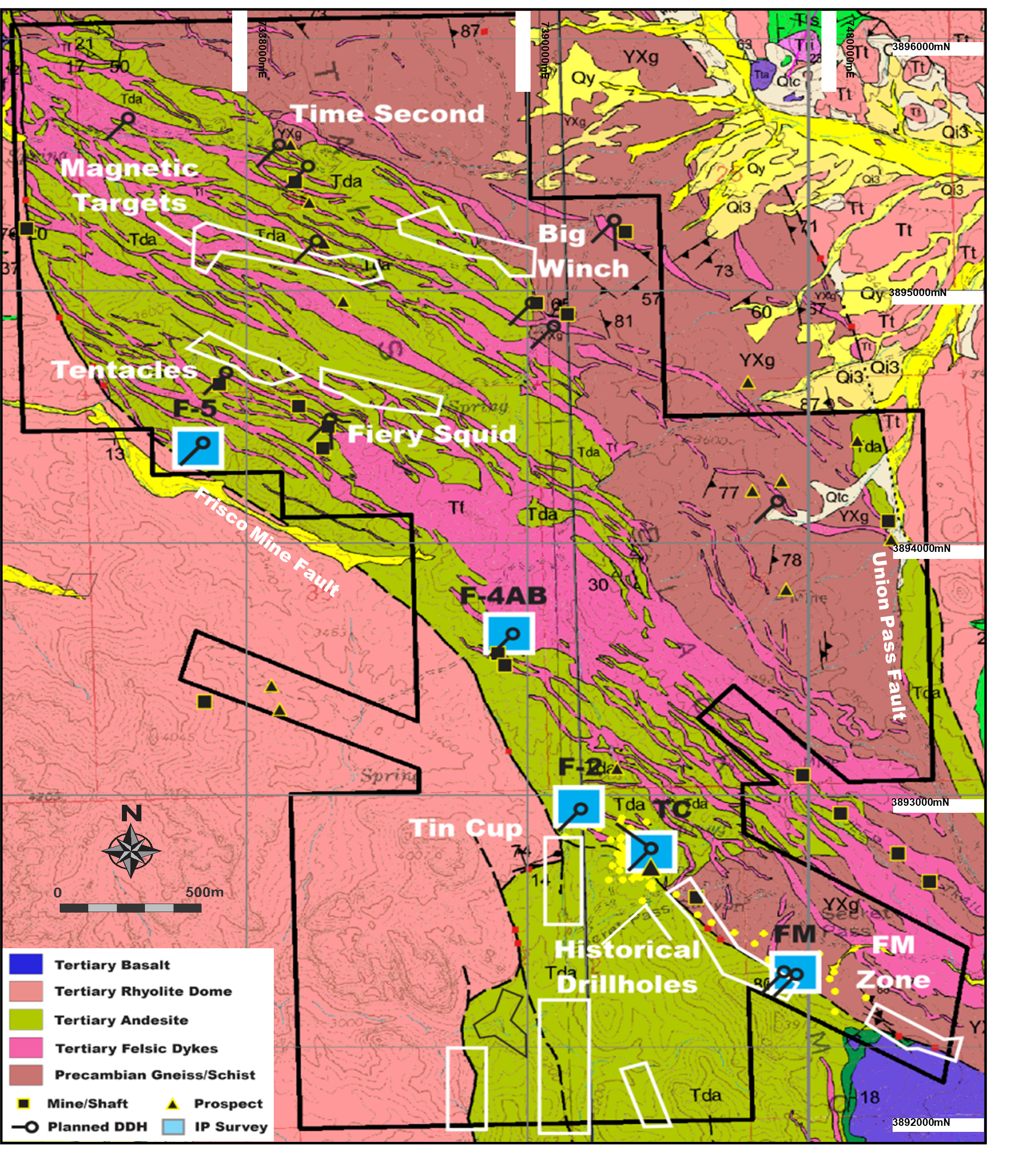

In additional to the Tin Cup and FM Zones, Northern Lights has identified over additional 20 prospective targets for further exploration at Secret Pass.

Figure 1 - Secret Pass Geology Prospects and Drill Targets

For enhanced image, click here

Northern Lights is currently permitting the Phase 1 diamond drill program, 11 holes for a total 1,900 meters, at Secret Pass. The processing of the Phase 1 drill permits has been slowed by Covid-19 Pandemic but the Company expects to receive the required permits in the near future.

This initial Phase 1 drill program will focus on confirming the presence of high-grade gold mineralization identified by historic drilling and providing structural information as well as to test for the potential of continued mineralization at depth at Tin Cup.

Also, the Phase 1 program will include two holes at the newly identified Fiery Squid zone located approximately 2 km to the north of the Tin Cup zone. A historic grab sample from the dumps adjacent to the shaft at Fiery Squid yielded 6 g/t Au. The Fiery Squid zone is an intense sericite-altered, quartz-veined set of contacts developed between a swarm of rhyolite intrusions and host andesite situated in the middle of a 1000 x 500 metre zone of iron oxide alteration.

The Company is currently active preparing the workshop in Kingman Arizona that will be used for core cutting and logging.

Once drill permits have been granted, Northern Lights will immediately mobilize Altar Drilling from Tucson to the project site to commence the Phase 1 drill program. Secret Pass Project site is accessible year around for drilling and exploration activities.

2. Medicine Springs Project

The Medicine Springs Project, located in Elko County Nevada has potential to host a large-scale silver rich carbonate replacement deposit.

Work completed to date by Northern Lights on the Medicine Springs project includes an aeromagnetic survey, a 800 sample ionic soil geochemistry survey and detailed geological mapping. Northern Lights has identified a length of 3,000 m x 700m width silver zinc lead anomaly that will be a focus of upcoming drilling on the project.

On October 5, Northern Lights announced that it had entered into a Option/Joint Venture Agreement with Reyna Silver, a TSX.V listed exploration company. The geological team at Reyna Silver is led by Dr. Peter Megaw, a world-renowned geologist with proven expertise and track record of success in developing carbonate replacement deposits. Under the terms of the Agreement, Reyna Silver can earn up to 80% equity in the Medicine Springs Project by completing exploration expenditures of US$2.4 million and paying a cash payment of US$1m to Northern Lights by no later than December 31, 2023.

Northern Lights has a free carry for all project expenditures until Reyna Silver have spent a minimum of US$4 million on the project.

The scientific and technical data contained in this news release was reviewed and approved by Gary Artmont (Fellow Member AUSIMM #312718), Head of Geology and qualified person to Northern Lights Resources, who is responsible for ensuring that the geologic information provided in this news release is accurate and who acts as a "qualified person" under National Instrument 43-101 Standards of Disclosure for Mineral Projects.

For further information, please contact:

Albert Timcke, Executive Chairman and President

Email: rtimcke@northernlightsresources.com

Tel: +1 604 608 6163

Jason Bahnsen, Chief Executive Officer

Email: Jason@northernlightsresources.com

Tel: +1 604 608 6163

Shawn Balaghi, Investor Relations

Email: shawn@northernlightsresources.com

Tel: +1 604 773 0242

About Northern Lights Resources Corp.

Northern Lights Resources Corp is a growth-oriented exploration and development company that is advancing two projects: The 100% owned, Secret Pass Gold Project located in Arizona; and the Medicine Springs silver-zinc-lead Project located in Elko County Nevada where Northern Lights, in joint venture with Reyna Silver are earning 100% ownership.

Northern Lights Resources trades under the ticker of "NLR" on the CSE. This and other Northern Lights Resources news releases can be viewed at www.sedar.com and www.northernlightsresources.com.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION: This news release includes certain "forward-looking statements" under applicable Canadian securities legislation. Forward-looking statements include, but are not limited to, statements with respect to: the terms and conditions of the proposed private placement; use of funds; the business and operations of the Company after the proposed closing of the Offering. Forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable, are subject to known and unknown risks, uncertainties, and other factors which may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking statements. Such factors include, but are not limited to: general business, economic, competitive, political and social uncertainties; delay or failure to receive board, shareholder or regulatory approvals; and the uncertainties surrounding the mineral exploration industry. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward looking statements. The Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

SOURCE: Northern Lights Resources Corp.

View source version on accesswire.com:

https://www.accesswire.com/623570/Review-of-2020--Outlook-for-2021