Blue Moon Metals Inc. (TSXV:MOON)(OTC PINK:BMOOF)(FSE:8SX0) (the "Company") is pleased to provide shareholders with an update on 2020 accomplishments and plans for 2021

Patrick McGrath, Chief Executive Officer of Blue Moon Metals, stated "I am extremely pleased with the advancement of the Blue Moon Project over the past year. In 2021, our plan is to build on the recent successful drill programs now that we have regained a 100% interest in the Blue Moon Project by continuing testing for expansion of the deposit with the objective of increasing the size and grade of the resource. With the receipt of drill permit extension, we are set for a 2021 drilling campaign and will provide an overview of our primary drill targets shortly."

BLUE MOON PROJECT 2020 PROJECT HIGHLIGHTS:

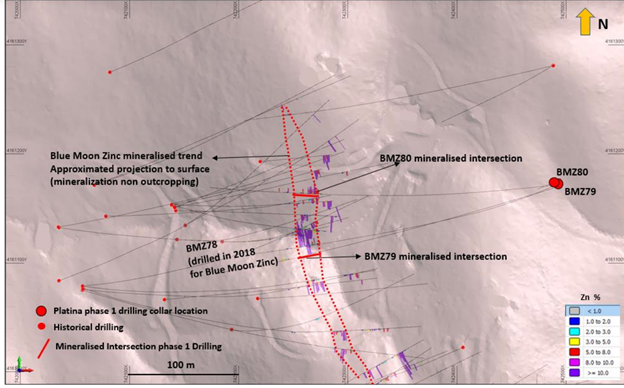

- Recent drill Holes, BMZ-79 and BMZ-80 all intersected significant intersections for zinc, copper, gold and silver demonstrating a higher-grade core of the deposit is present including intercepts of 7.47 metres at 25.55% zinc, 0.87% copper, 0.68 g/t gold and 17 g/t silver for a zinc equivalents ("ZnEq") of 28.46% in hole BMZ-79 and 19.58 metres at 8.41% zinc, 0.49% copper, 1.22 g/t gold and 82.75 g/t silver for a ZnEq of 12.41% in hole BMZ-80. (News Releases dated January 24, 2020 and February 3, 2020). These results have yet to be incorporated in the existing NI 43-101 Mineral Resource. Please refer to map below for location of the drill holes.

- Drilling has now demonstrated the massive sulphide lenses are traceable for 900 metres along plunge and open to surface and depth.

- Regaining a 100% interest in the project after Blue Moon's former partner funded work demonstrating both continuity and the presence of a high-grade central zone of mineralization.

- Buyback of a 2% NSR which leaves the property virtually royalty free.

- The Company received an extension of the drill permit to June 26, 2023.

Plan view showing Blue Moon's drill hole collar location (BMZ-79 and BMZ-80) both placed on same pad as BMZ-78.

Figure includes surface projection of mineralization interval intercepted by BMZ-79/80 as well as approx surface VMS zone

ZINC EQUIVALENT CALCULATION METHOD (ZnEq)

The ZnEq formula and the underlying parameters used in its formulation are set out below:

Metal | Price (US$) | Recovery (%) | Factor |

Zinc | 1.30/lb | 95 | 24.70 |

Silver | 17.00/oz | 65 | 11.05 |

Copper | 3.00/lb | 93 | 55.80 |

Gold | 1,250.00/oz | 70 | 875.00 |

Lead | 1.00/lb | 95 | 19.00 |

The metal prices and the recoveries selected represent reasonable estimates of long-term metal prices and potential recoveries of metal in concentrate as detailed in the NI 43-101 filed on SEDAR on November 20, 2018.

The equation to calculate ZnEq is as follows: ZnEq = (Zn%*24.70 + Cu%*55.80 + Pb%*19.00 + Ag(oz/t)*11.05 + Au(oz/t)*875.00) / 24.70

ABOUT Blue Moon Mining

Blue Moon Mining (TSXV:MOON)(OTC PINK:BMOOF) is currently advancing its Blue Moon polymetallic deposit which contains zinc, gold, silver and copper. The property is well located with existing local infrastructures including paved highways three miles from site; a hydroelectric power generation facility a few miles from site, three hour drive to the Oakland port and a four hour drive to service centre of Reno. The deposit is open at depth and along strike. The Blue Moon 43-101 Mineral Resource includes 7.8 million inferred tons at 8.07% zinc equivalent (4.95% zinc, 0.04 oz/t gold, 0.46% copper, 1.33 oz/t silver), containing 771 million pounds of zinc, 300,000 ounces of gold, 71 million pounds of copper, and 10 million ounces of silver. The 43-101 Mineral Resource report dated November 14, 2018 was authored by Gary Giroux, P. Eng., and Lawrence O'Connor, a QP, and entitled "Resource Estimate for the Blue Moon Massive Sulphide Occurrence". The 43-101 and related press release with details on the resource are available on the company's website and were filed on www.sedar.com on November 20, 2018. The Company also holds 100% of the Yava polymetallic project in Nunavut that is in the same volcanic lithologies and south of Glencore's Hackett River deposit. More information is available on the company's website.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Qualified Persons

John McClintock, P. Eng, a Director of the Company, is a qualified person as defined by NI 43-101, has reviewed the scientific and technical information that forms the basis for this press release.

For more information please contact:

Patrick McGrath, CEO

+1 (832) 499-6009

pmcgrath@bluemoonmining.com

Investor Contact:

Kevin Shum

Investor Relations

+1 (647) 725-3888 ext702

kevin@jeminicapital.com

Resource estimates included in this news release are forward-looking statements. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions set forth in the relevant technical report and otherwise, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Factors that could cause actual results to differ materially from those in forward-looking statements include market prices for zinc, the results of future exploration, uncertainties related to the ability to obtain necessary permits, licenses and titles, changes in government policies regarding mining, continued availability of capital and financing, and general economic, market or business conditions. Investors are cautioned that any such statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the forward-looking statements. Readers are cautioned not to place undue reliance on this forward-looking information, which is given as of the date it is expressed in this press release, and the Company undertakes no obligation to update publicly or revise any forward-looking information, whether as a result of new information, future events or otherwise, except as required by applicable securities laws.

The securities referenced in this news release have not and will not be registered under the U.S. Securities Act of 1933 and may not be offered or sold in the United States absent registration or an applicable exemption from registration requirements.

SOURCE: Blue Moon Metals Inc.

View source version on accesswire.com:

https://www.accesswire.com/642672/Blue-Moon-Metals-Announces-2021-Project-Plan-2020-Exploration-Summary