Tartisan Nickel Corp. (CSE:TN)(OTC PINK:TTSRF)(FSE:A2D) ("Tartisan", or the "Company") is pleased to announce that the Company has mobilized two diamond drill rigs to the Company's flagship Kenbridge Nickel Property to undertake a 10,000 meter diamond drilling program. The drill program is designed to test the on strike and down dip potential for additional nickel sulphide mineralization to enhance the size and grade of the Kenbridge Deposit. Tartisan will additionally drill the Kenbridge North, where two sizable, standalone electromagnetic (EM) targets have been recently interpreted from the winter 2021 ground Time Domain Electromagnetic (TDEM) survey

Tartisan Nickel Corp. recently completed a $4.48 million flow-through share financing which will allow the Company to complete the proposed drill program and commence the additional permitting and geotechnical work necessary to advance the Kenbridge Nickel Project towards a feasibility study. A Preliminary Economic Study is in progress on the current Mineral Resource Estimate which is scheduled to be completed during Q3 2021.

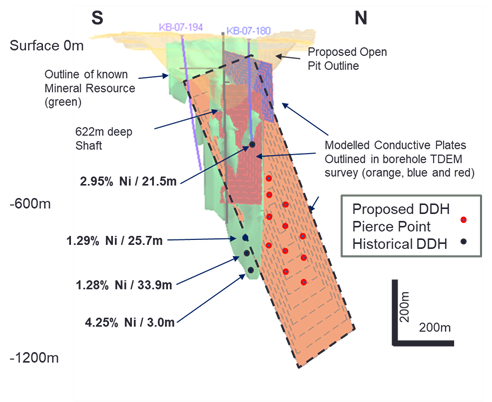

Geological evaluation of the Kenbridge Deposit indicates there is significant potential to expand the Mineral Resource laterally and at depth stepping out from high-grade intersections such as hole KB07-180 (2.95% Ni, 0.82% Cu / 21.5m including 7.2% Ni, 0.67% Cu / 5.5m) and also at depth. The deepest hole (end of hole K2010 = 880 m below surface) intersected mineralization grading 4.25% nickel and 1.38% copper over 3.3 m, indicating that the Deposit remains open at depth. (SEDAR, June 1, 2021)

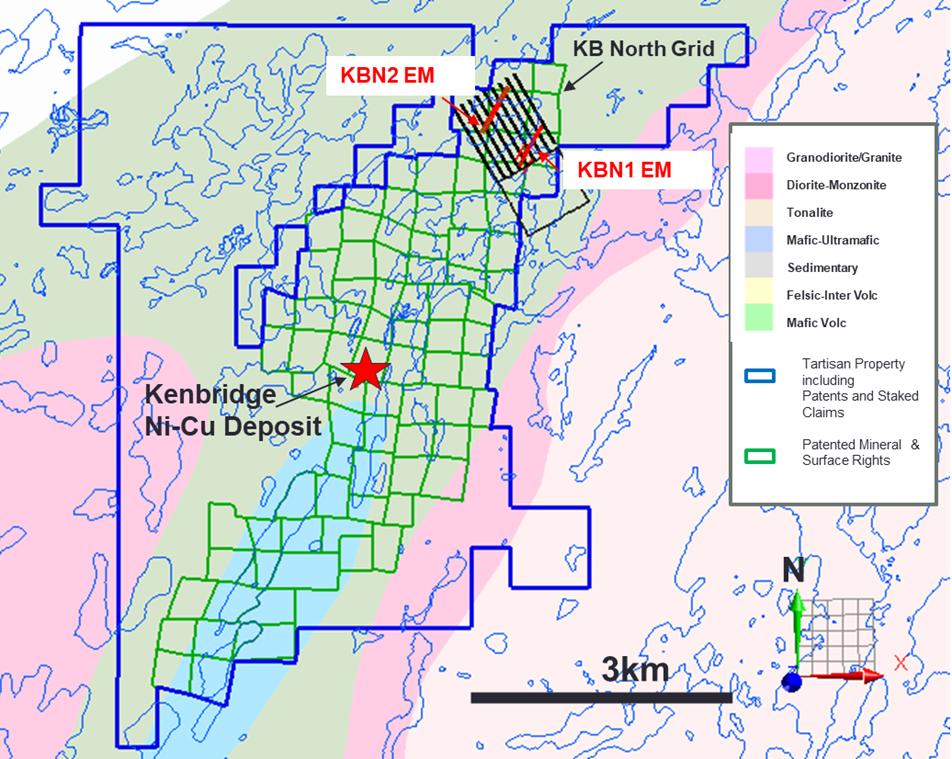

The Company performed a surface TDEM survey at Kenbridge North, 2.5km to the north of the Kenbridge Deposit. The Kenbridge North target is interpreted to represent similar rock types that host the Kenbridge Deposit. Combined with the EM signature this is a high priority drill target similar to the Kenbridge deposit model. (SEDAR, May5, 2021)

Tartisan CEO Mark Appleby states, "The Tartisan 2021 drill program will test multiple high probability targets as we look to significantly add to the Mineral Resource Estimate at the Kenbridge Deposit and drill a significant (400 meter) conductor at Kenbridge North. Tartisan is committed to the rapid advancement of the Kenbridge Nickel Project and becoming a provider of Class 1 Nickel and copper within the North American supply chain".

Kenbridge Nickel Project

As outlined in the Technical Report and Updated Mineral Resource Estimate (SEDAR, June 1, 2021), mineral resource estimates were done for pit constrained and out-of-pit nickel, copper, and cobalt Mineral Resources. Total Measured & Indicated Mineral Resources based on a Net Smelter Return (NSR) cut-off value of CDN$15 per tonne for pit constrained Mineral Resources and CDN$60 per tonne NSR for out-of-pit Mineral Resources is 7.47 Mt at 0.6% Ni and 0.32% Cu for a total of 95 Mlb of contained nickel. An additional 0.985 Mt at 1.0% Ni and 0.62% Cu (22 Mlb contained nickel) were calculated as Inferred Mineral Resources. The pit constrained Measured & Indicated Mineral Resources total 5.24 Mt of 0.5% nickel; 0.26% copper; and 0.009% cobalt at an NSR cut-off value of CDN$15/tonne. The out- of- pit Measured & Indicated Mineral Resources total 2.23 Mt of 0.9% nickel; 0.45% copper; and 0.006% cobalt. Inferred Mineral Resources out-of-pit total 0.985 Mt at 1.00% nickel; 0.62% copper; and 0.003% cobalt, at an NSR cut-off value of CDN$60/tonne.

The Kenbridge Property is located in the Kenora Mining District, Fort Francis area, Ontario, Canada with good access to roads and power. The Kenbridge Deposit has an existing shaft to a depth of 2,042 ft (622 m), with level stations at 150 ft. (45 m) intervals below the shaft collar and two levels developed at 350 ft (107 m) and 500 ft (152 m) below the shaft collar.

Figure 1: Kenbridge North Target, Regional Geology and Tartisan land position. KBN1 EM and KBN2 EM are electromagnetic conductors identified from the recent (TDEM) ground survey.

Figure 2: The Kenbridge Deposit, Long Section of Kenbridge Ni-Cu Resource (green outline) viewing west. Diamond drilling will test on strike to the north and down plunge of the Resource. Modelling of TDEM data collected from historical drill holes outlined a large conductive plate (orange) interpreted to represent sulphide mineralization.

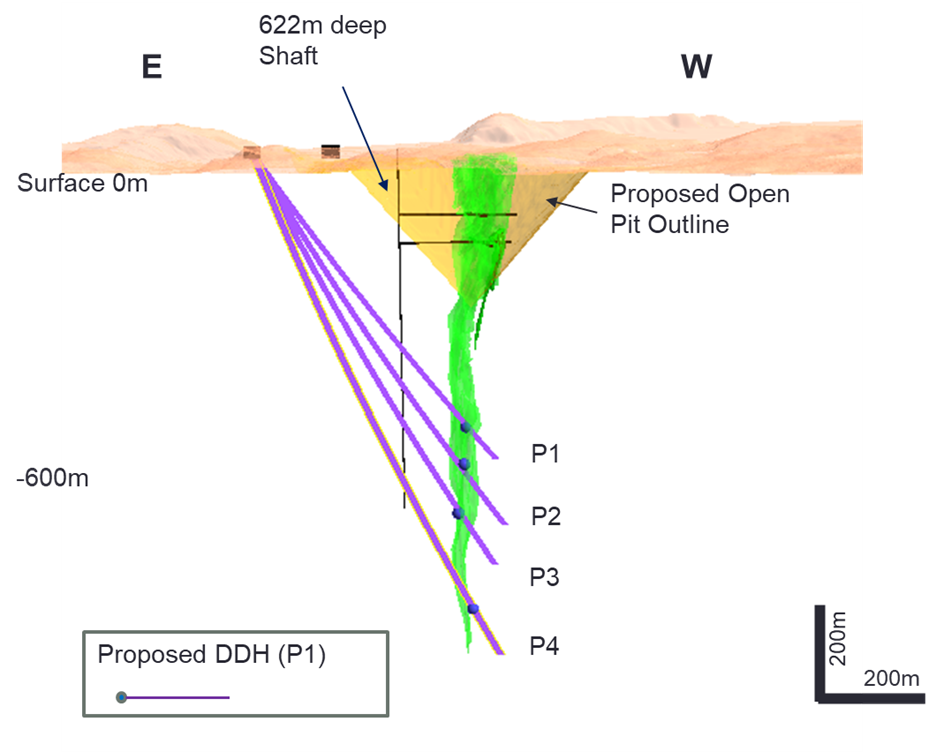

Figure 3: The Kenbridge Deposit, Cross Section showing drill targets P1, P2, P3 and P4 at Kenbridge Ni-Cu Resource viewing south. Diamond drilling will test on strike to the north and down plunge of the Resource. Resource outline (green) is for reference purposes.

About Tartisan Nickel Corp.

Tartisan Nickel Corp. is a Canadian based mineral exploration and development company whose flag ship asset is the Kenbridge Nickel Deposit located in the Kenora Mining District, Ontario. Tartisan also owns; the Sill Lake Silver Property in Sault St. Marie, Ontario as well as the Don Pancho Manganese-Zinc-Lead-Silver Project in Peru.

Tartisan Nickel Corp. owns an equity stake in; Eloro Resources Limited, Class 1 Nickel and Technologies Limited, Peruvian Metals Corp. and Silver Bullet Mines Inc.

Tartisan Nickel Corp. common shares are listed on the Canadian Securities Exchange (CSE:TN)(OTC PINK:TTSRF)(FSE:A2D). Currently, there are 113,196,329 shares outstanding (122,491,844 fully diluted).

Dean MacEachern P.Geo. is the Qualified Person under NI 43-101 and has read and approved the technical content of this News Release.

For further information, please contact Mark Appleby, President & CEO and a Director of the Company, at 416-804-0280 (info@tartisannickel.com). Additional information about Tartisan Nickel Corp. can be found at the Company's website at www.tartisannickel.comor on SEDAR at www.sedar.com.

This news release may contain forward-looking statements including but not limited to comments regarding the timing and content of upcoming work programs, geological interpretations, receipt of property titles, potential mineral recovery processes, etc. Forward-looking statements address future events and conditions and therefore, involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements.

The Canadian Securities Exchange (operated by CNSX Markets Inc.) has neither approved nor disapproved of the contents of this press release.

SOURCE: Tartisan Nickel Corp.

View source version on accesswire.com:

https://www.accesswire.com/653266/Tartisan-Nickel-Corp-Commences-10000-Meter-Drill-Program-at-the-Kenbridge-Nickel-Deposit-and-on-the-Kenbridge-North-Target