(TheNewswire)

Volcanic Gold Mines Inc. (TSXV:VG) is pleased to report that the drilling at the Holly property in eastern Guatemala is progressing well. Having completed four holes at the La Pena vein zone, the rig has now been moved 600m east along the trace of the Jocotan Fault Zone (JFZ) to test the El Pino vein zone

The plan for initial drilling at La Pena and El Pino targets is to test the down dip potential of the vein zones, following up on the initial drilling that was conducted there in 2002/3. The first hole in 2002 at La Pena (HDD-01) intersected a broad 14.2m intersect of 4.5 g/t Au and 151g/t Ag. The follow-up hole HDD-07 drilled to cut the vein zone 25m below returned a lower grade 3m @ 3.1 g/t Au and 61 g/t Ag. No further drilling has been conducted at the Holly property since 2003.

It is management's belief that the 2002/3 drilling was very limited, high in the epithermal system, and did not test the system for structural intersections with the regional scale Jocotan fault. Volcanic's well funded, systematic drill program targeting the down dip potential of these shoots will lead to a better understanding of the controls on the gold mineralization within the Holly property.

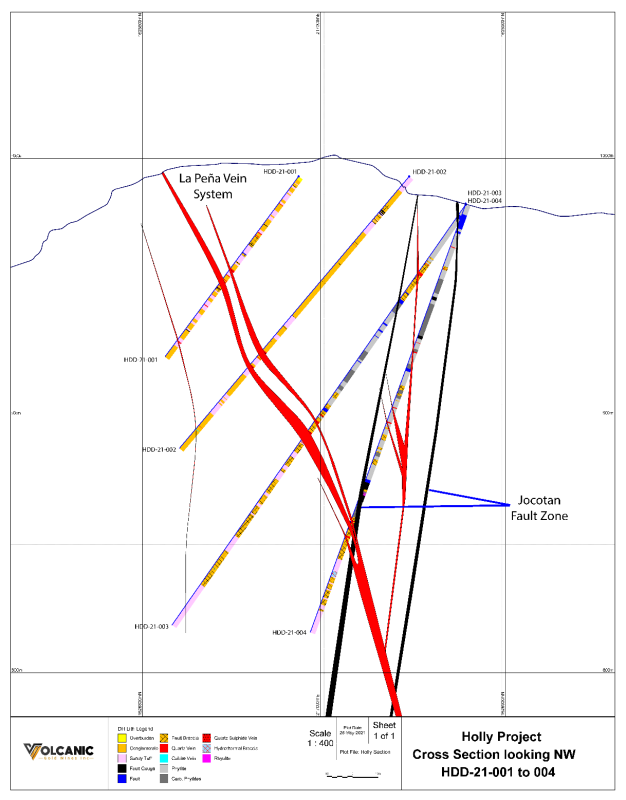

The four holes completed in the present program at La Pena indicate that the narrow (0.2m to 0.3m) high grade gold/silver veins that carried the grade in the 2002 program appear to converge at depth, indicating a potentially robust epithermal sytem exists at La Pena. However, assay results for the first three drill holes are still 3 to 4 weeks away, and there is no guarantee that the gold content will continue to depth.

A cross section sketch of the recently completed drilling at La Pena will be posted on Volcanic's website, as well as photographs of the core in the main zones of interest.

The Company is currently moving forward with logistics planning to mobilize a second drill to Guatemala to commence drilling in early June on the Banderas property, where we believe that as with Holly, historic drilling was too shallow and did not test the extensive structural zones identified.

Figure 1: Holly section showing holes HDD21-001 to 004

Technical Information

Bruce Smith, M.Sc. (Geology), a member of the Australian Institute of Geoscientists, is Volcanics's Qualified Person as defined by National Instrument 43-101 - Standards of Disclosure for Mineral Projects. Mr. Smith has 27 years of mineral exploration experience and has prepared and approved the technical information contained in this news release.

Terms of Guatemala Radius Gold and Volcanic Gold Mines option

Pursuant to an option agreement signed in May 2020 with Radius Gold Inc. (TSXV:RDU), Volcanic can earn a 60% interest in the Holly and Banderas projects by spending the cumulative amount of US$7.0 million on exploration of the properties within 48 months from the date of the agreement. An initial US$1M must be spent on exploration within the 12 months of receiving the required drill permits, which expenditure will include a minimum 3,000m of drilling on the properties.

Following the exercise of the Option, Volcanic will enter into a standard 60/40 Joint Venture in order to further develop the Properties. Volcanic has also been granted an exclusive right to evaluate all other property interests of Radius in Guatemala with a right to acquire an interest in any or all other such properties on reasonable terms.

About Volcanic

Volcanic brings together an experienced and successful mining, exploration and capital markets team focused on building multi-million -ounce gold and silver resources in underexplored countries. Through the strategic acquisition of mineral properties with demonstrated potential for hosting gold and silver resources, and by undertaking effective exploration and drill programs, Volcanic intends to become a leading gold-silver company.

For further information, visit our website at www.volgold.com .

Volcanic Gold Mines Inc.

Simon Ridgway, President and CEO

Neither the TSX Venture Exchange nor the Investment Industry Regulatory Organization of Canada accepts responsibility for the adequacy or accuracy of this release.

Forward-looking statements

Certain statements contained in this news release constitute forward-looking statements within the meaning of Canadian securities legislation. All statements included herein, other than statements of historical fact, are forward- looking statements and include, without limitation, statements about the Company's plans for exploration work in Guatemala. Often, but not always, these forward looking statements can be identified by the use of words such as "estimate", "estimates", "estimated", "potential", "open", "future", "assumed", "projected", "used", "detailed", "has been", "gain", "upgraded", "offset", "limited", "contained", "reflecting", "containing", "remaining", "to be", "periodically", or statements that events, "could" or "should" occur or be achieved and similar expressions, including negative variations.

Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any results, performance or achievements expressed or implied by forward-looking statements. Such uncertainties and factors include, among others, whether the Company's planned exploration work will proceed as intended; changes in general economic conditions and financial markets; the Company or any joint venture partner not having the financial ability to meet its exploration and development goals; risks associated with the results of exploration and development activities, estimation of mineral resources and the geology, grade and continuity of mineral deposits; unanticipated costs and expenses; and such other risks detailed from time to time in the Company's quarterly and annual filings with securities regulators and available under the Company's profile on SEDAR at www.sedar.com. Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results to differ from those anticipated, estimated or intended.

Forward-looking statements contained herein are based on the assumptions, beliefs, expectations and opinions of management, including but not limited to: that the Company's stated goals and planned exploration and development activities will be achieved; that there will be no material adverse change affecting the Company or its properties; and such other assumptions as set out herein. Forward-looking statements are made as of the date hereof and the Company disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events or results or otherwise, except as required by law. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, investors should not place undue reliance on forward-looking statements.

Copyright (c) 2021 TheNewswire - All rights reserved.