TriStar Gold Inc. (TSXV: TSG) (OTCQX: TSGZF) (the Company or TriStar) is pleased to announce an interim mineral resource estimate for the Castelo de Sonhos gold project in Pará State Brazil. This model incorporates new information available at the end of 2020; drilling is still ongoing so an updated estimate will be completed in the upcoming months to be used in the prefeasibility study. The interim estimate shows that the CDS Project now has:

1.5 Moz of gold in the Indicated category at a grade of 1.2 g/t contained in 40.1 Mt and

0.7 Moz in the Inferred category at a grade of 1.0 g/t gold contained in 22.2 Mt.

"This interim resource estimate already exceeds what we had targeted as a base for the preliminary feasibility study (PFS). We're continuing to drill, and will have more drill results to add when resources are updated for the PFS. Grade remains strong, especially in Esperança South which anchors the project." says Nick Appleyard, TriStar's President and CEO. " This interim model will be used to target any remaining drilling needed to eliminate gaps and to better delineate the extension that has opened up on the northern end of Esperança South, as well as to locate geotechnical investigations for pit wall stability."

Table 1, Mineral resource estimate1 for the Castelo de Sonhos gold project (with an effective date of December 31, 2020) above a reporting cutoff 2 of 0.3 g/t Au. The Qualified Person is TriStar's Vice President Mo Srivastava.

| Region | Classification | Tonnage (Mt) | Grade (g/t Au) | Metal Content3 (Moz Au) |

| Esperança South | Indicated | 24.5 | 1.3 | 1.1 |

| Inferred | 10.4 | 1.1 | 0.4 | |

| Esperança East | Indicated | 2.4 | 1.1 | 0.1 |

| Inferred | 9.4 | 0.9 | 0.3 | |

| Esperança Center | Indicated | 13.1 | 0.8 | 0.3 |

| Inferred | 2.4 | 0.9 | 0.1 | |

| Project Total | Indicated | 40.1 | 1.2 | 1.5 |

| Inferred | 22.2 | 1.0 | 0.7 |

1Project totals may appear not to sum correctly since all numbers have been rounded to reflect the precision of Inferred and Indicated mineral resource estimates.

2The reporting cutoff corresponds to the marginal cutoff grade for an open pit with processing + G&A cost of $US 12/t, metallurgical recovery of 98% and a gold price of $US 1,250/oz. To meet the requirement of "reasonable prospect for eventual economic extraction" the mineral resources must also fall within a bounding pit shell with 55° walls. These are mineral resources and not reserves and as such do not have demonstrated economic viability.

3The metal content estimates reflect gold in situ, and do not include factors such as external dilution, mining losses and process recovery losses.

4TriStar is not aware of any environmental, permitting, legal, title, taxation, socio-economic, marketing or political factors that might materially affect these mineral resource estimates.

Resource Estimation

Data base

The drill hole collar data base used for the model is the one available at the end of January 2021, at which point in time assays were available for all reverse circulation holes up through RC-20-550 and for all diamond drill holes up through CSH-20-491.

Geological model

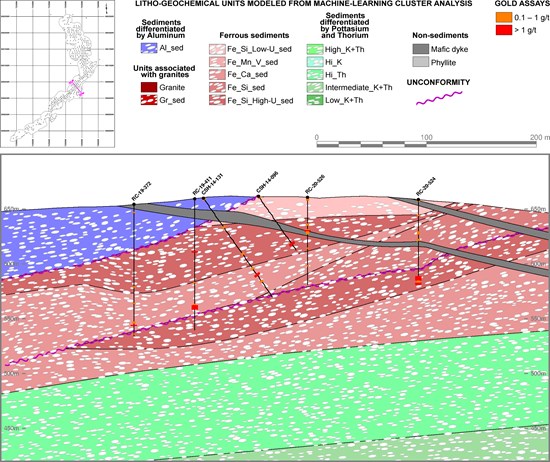

Shown in Figure 1, are examples of the litho-geochemical units and erosional surfaces on a cross-section interpreted with the help of GoldSpot Discoveries. Across the entire plateau, 15 units were interpreted and rendered as wire-framed solids. Some of these are sedimentary units that run sub-parallel to the bowl-shaped stratigraphy of the plateau's meta-sediments. Others do not run parallel to the general bedding direction; instead, they are non-sedimentary rocks that cut across the stratigraphy. These were grouped into seven domains, separated by two erosional unconformities.

Figure 1, Model of litho-geochemical units on cross-section B-B' on the southwest arm of Esperança South, where the mafic dykes cross. NOTE: except for silica, the specific elements used in the names of the clusters are not major constituents; they occur only in minor and trace quantities, but the machine learning cluster analysis identifies them as important discriminators.

To view an enhanced version of Figure 1, please visit:

https://orders.newsfilecorp.com/files/4509/77398_be9d808d548c2878_002full.jpg

Block model

The resource block model uses 20×20×4m blocks, the horizontal dimension of the blocks is slightly less than half of the 50m drill spacing. The block height is the same as the bench height chosen for the Preliminary Economic Assessment done in 2018.

In each block, the volumetric contribution of the seven domains was calculated directly from the litho-geochemical wireframes and the erosional unconformities. Approximately half of the blocks lie entirely inside a single domain; the other half have a mixture of two or more domains.

All rock in the resource model is assumed to have a dry bulk density of 2.68 t/m3, the average of the density measurements done on drill core in 2018.

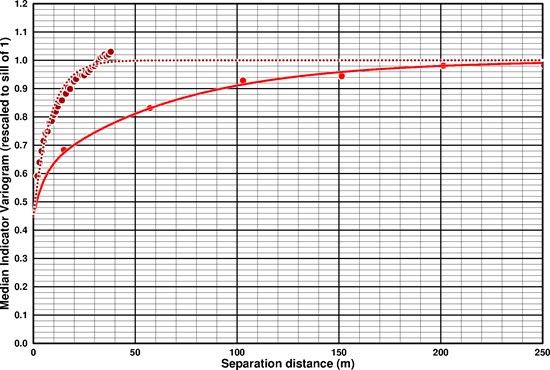

For each domain that contributes to a block, Multiple Indicator Kriging (MIK) was used to estimate the gold grade distribution of its selective mining units (SMUs) using nearby samples from the same domain, with the SMU size based on planned equipment size, bench height, blast hole spacing, and on the experience of the operating mine at Tarkwa, in the same type of paleo-placer gold deposit. A 200×200×25m search ellipsoid was used for the MIK estimates for every domain in every block, aligned with the variogram model for the dominant domain.

Figure 2, Median indicator variography for the ferrous sediments, with the red line showing the omnidirectional variogram in the bedding plane and the dotted dark red line showing the variogram perpendicular to bedding.

To view an enhanced version of Figure 2, please visit:

https://orders.newsfilecorp.com/files/4509/77398_be9d808d548c2878_003full.jpg

Classification of Mineral resources

The mineral resources in Table 1 are constrained by open pit shells to meet the requirement that resources have "reasonable prospects for eventual economic extraction". Within the pit shell material above a cut-off grade of 0.3 g/t was classified as Indicated in blocks for which grade estimation was able to use data from at least two separate drill holes in four octants, and for which the average distance to the nearby data was less than half the variogram range; these criteria are almost always met only in the areas where the drill holes are more closely spaced than 50m. All other blocks with grade estimates were classified as Inferred resources; since the search ellipse was aligned with the variogram ranges, Inferred blocks must have at least one sample within the range of the dominant domain variogram. These block-by-block classification codes were then spatially smoothed to avoid inconsistent classification of isolated blocks.

Qualified Person

Mo Srivastava (P.Geo.) VP of TriStar the Qualified Person for the mineral resource estimates presented in this press release, has approved its publication.

About TriStar

TriStar Gold is an exploration and development company focused on precious metals properties in the Americas that have the potential to become significant producing mines. The Company's current flagship property is Castelo de Sonhos in Pará State, Brazil. The Company's shares trade on the TSX Venture Exchange under the symbol TSG and on the OTCQX under the symbol TSGZF. Further information is available at www.tristargold.com.

On behalf of the board of directors of the company:

Nick Appleyard

President and CEO

For further information, please contact:

TriStar Gold Inc.

Nick Appleyard

President and CEO

480-794-1244

info@tristargold.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. No stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein.

Forward-Looking Statements

Certain statements contained in this press release may constitute forward-looking statements under Canadian securities legislation which are not historical facts and are made pursuant to the "safe harbour" provisions under the United States Private Securities Litigation Reform Act of 1995. Generally, forward-looking information can be identified by the use of forward-looking terminology such as "expects" or "it is expected", or variations of such words and phrases or statements that certain actions, events or results "will" occur. Forward looking statements in this press release include, the scope and success of the planned exploration program at the Castelo de Sonhos project and the Company's opinion that it has clear title to the Castelo de Sonhos property Such forward-looking statements are based upon the Company's reasonable expectations and business plan at the date hereof, which are subject to change depending on economic, political and competitive circumstances and contingencies. Readers are cautioned that such forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause a change in such assumptions and the actual outcomes and estimates to be materially different from those estimated or anticipated future results, achievements or position expressed or implied by those forward-looking statements. Risks, uncertainties and other factors that could cause the Company's plans to change include changes in demand for and price of gold and other commodities (such as fuel and electricity) and currencies; changes or disruptions in the securities markets; legislative, political or economic developments in Brazil; the need to obtain permits and comply with laws and regulations and other regulatory requirements; the possibility that actual results of work may differ from projections/expectations or may not realize the perceived potential of the Company's projects; risks of accidents, equipment breakdowns and labour disputes or other unanticipated difficulties or interruptions; the possibility of cost overruns or unanticipated expenses in development programs; operating or technical difficulties in connection with exploration, mining or development activities; the speculative nature of gold exploration and development, including the risks of diminishing quantities of grades of reserves and resources; and the risks involved in the exploration, development and mining business. Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. The Company disclaims any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise, except as required by applicable securities laws.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/77398