Tarku Resources Ltd (TSXV: TKU) (FRA: 7TK) (the "Company" or "Tarku") is pleased to announce initial results from its 2021 drilling program on the high-grade Silver Strike Project, Tombstone District, Arizona (the "Project"). Significant results include 213.5 gt Ag and 3.9% Mn over 3.0 m in hole SS21-004 targeting north-south structure located in the historic East Side mine area.

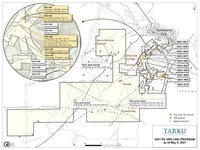

The first phase of 10 drill holes, completed on April 15 th and totaling 3,701 feet, targeted the Silver vein system located in the historical mine areas known as the Lucky Cuss, Luck Sure, East Side and the Bunker Hill historic mines areas. The second phase of the planned 10,000-foot RC drill program, recommenced on May 5 th , will put emphases on the Ground Hog, Sunset, Ace-in-the-Hole, and the Solstice historic mine areas. These holes will target a regional structure known to carry silver, manganese, copper, lead and zinc mineralisation. They will be located between 2-5 km away from the Tombstone historic mines center (see Image 1).

Julien Davy , President and CEO of Tarku, stated: "213 g/t Ag over 3 meters is a great start for a first systematic exploration program on the project since 1930! Although we did not hit all expected mine structures in those first 5 holes, we are very encouraged by the results obtained to date and what maybe found in the next 17 drill holes. It is a learning process for Tarku, and we still have 3/4 of our drilling results to come. We are learning about the complexity of the mineralized vein structures found at the Project, as they are not planar structures as historically reported. The presence of wide near-surface manganese and lead-zinc halos are strong indicators of a manganese-oxide silver replacement horizon. We are now looking forward to building further the knowledge of the Project as drilling continues."

The results received to date include the first 5 holes (SS21-001 to SS21-005) targeting the north-south structures in the Lucky Cuss area. Sampling methodology includes taking of 5 ft long samples and all results represent an average grade over 5 ft. With holes SS21-001 and SS21-002, we learned that the targeted Lucky Cuss veining structure is located further westward than expected because the collars entered directly into wide low-grade Ag and Mn halos. In hole SS21-003, we intersected another north-south sub-parallel structure returning 37.5 g/t Ag and 1.0% Mn over 1.5 m. Holes SS21-004 and SS21-005 targeted the East Side area, located 250 m south of the previous holes, and that is now interpretated to be along the same Lucky Cuss structure . Hole SS21-004 intersected an interesting 10.7 m grading 79.8 g/t Ag and 1.8% Mn, including 213.5 g/t Ag and 3.9% Mn over 3.0 m , showing the high-grade potential of the Lucky Cuss veining system .

Bernard Lapointe , Chairman of Tarku, stated: " This new and impressive land package may have contained some 167 historic mining sites, but very little modern and documented exploration work has been carried out on the Property. These initial and encouraging results announced today warrant us to continuing our work to assess the full potential of the Tombstone area, which experiencing a recent exploration resurgence by Tarku and other juniors."

As shown in Table 1, those holes allow us to identify wide mineralized zones with lower grade material. These results appear to be adjacent to the historical high-grade silver veins, potentially defining a larger epithermal system.

Based on the results to date, the Company intends to complete the remaining 1,600 m of RC drilling (6,600 ft) at Silver Strike by June 2021 , covering the Ground Hog, Sunset, Ace-in-the-Hole, and the Solstice areas. With all results in hand, Tarku will be a in good position to plan the future exploration programs that will encompass soil geochemistry, geophysics surveys, and further major drill programs.

IMPORTANTLY, the above projected exploration activities are subject to COVID-19 restrictions in Arizona . While the Company's recent work programs have been relatively unimpeded, there is a risk that tighter restrictions may impact the Company's ability to conduct fieldwork.

Table 1: Drill Hole Assay Results - News Release May 6, 2021

| Hole # | Target | From | To | Drilled | Ag (g/t) | Mn (g/t) | Pb (%) | Zn (%) |

| SS21-001 | Lucky Cuss | 3.0 | 18.3 | 15.2 | 5.5 | 2,684 | na | na |

| | | 42.7 | 51.8 | 9.1 | 4.3 | 1,630 | na | na |

| SS21-002 | Lucky Cuss | 0.0 | 42.7 | 42.7 | 4.4 | 5,053 | na | na |

| | incl. | 0.0 | 3.0 | 3.0 | 12.4 | 2,550 | 0.5 | 0.3 |

| SS21-003 | Luck Sure | 47.2 | 48.8 | 1.5 | 37.5 | 10,200 | 0.1 | 0.2 |

| SS21-004 | East Side | 62.5 | 73.2 | 10.7 | 79.8 | 17,970 | 0.1 | na |

| | incl. | 70.1 | 73.2 | 3.0 | 213.5 | 38,700 | 0.1 | na |

| SS21-004 | | 80.8 | 86.9 | 6.1 | 21.2 | 7,560 | 0.1 | na |

| | incl. | 82.3 | 86.9 | 4.6 | 28.4 | 8,347 | 0.2 | na |

| SS21-005 | East Side | 123.4 | 125 | 1.5 | 35.7 | 7,450 | 0.2 | na |

| SS21-006 | Lucky Cuss | | | | Assays Pending | | | |

| SS21-007 | Lucky Cuss | | | | Assays Pending | | | |

| SS21-008 | Bunker Hill | | | | Assays Pending | | | |

| SS21-009 | Bunker Hill | | | | Assays Pending | | | |

| SS21-010 | Bunker Hill | | | | Assays Pending | | | |

Table 2: Drill Hole Locations – News Release May 5, 2021

| Hole ID | Target | Azimuth | Dip | Length | Length | Coord_X (utmZ12N) | Coord_Y (utmZ12N) |

| SS21-001 | Lucky Cuss | 135 | 50 | 400 | 121.9 | 587,663.0 | 3,507,702.0 |

| SS21-002 | Lucky Cuss | 95 | 50 | 439 | 133.8 | 587,663.0 | 3,507,702.0 |

| SS21-003 | Luck Sure | 95 | 50 | 525 | 160.0 | 587,516.0 | 3,507,262.0 |

| SS21-004 | East Side | 95 | 50 | 292 | 89.0 | 587,614.0 | 3,507,537.0 |

| SS21-005 | East Side | 95 | 56 | 435 | 132.6 | 587,614.0 | 3,507,537.0 |

| SS21-006 | Lucky Cuss | 95 | 55 | 220 | 67.1 | 587,663.0 | 3,507,702.0 |

| SS21-007 | Lucky Cuss | 95 | 90 | 325 | 99.1 | 587,663.0 | 3,507,702.0 |

| SS21-008 | Bunker Hill | 325 | 50 | 440 | 134.1 | 588,756.6 | 3,506,613.4 |

| SS21-009 | Bunker Hill | 325 | 50 | 225 | 68.6 | 588,670.2 | 3,506,564.6 |

| SS21-010 | Bunker Hill | 325 | 60 | 400 | 121.9 | 588,670.2 | 3,506,564.6 |

| | | | TOTAL | 3,701 | 1,128.1 | | |

Drilling Sample Method and Quality Assurance / Quality Control

The first phase (3,701 ft) was conducted by Major Drilling of Salt Lake City , Utah. Drill samples were collected by reverse circulation drilling using a face sampling, centre return, downhole hammer that collects rock samples directly from the drill face, thereby reducing downhole contamination. Each sample was collected using a binary splitter that directs half the sample into a sample bag which is sent for analysis, while the other half is bagged and kept in storage as a field duplicate. Samples collected varied in weight from 15-20 kilograms.

Shipping of samples, to the ALS Minerals prep lab facility in Tucson, AZ , involved a direct chain of custody (CoC) from the drill site to the ALS minerals transport truck and then directly to the prep lab. CoC forms are maintained at each change of custody - in this case from the locked storage area at site direct to the lab's transport truck.

At the prep lab, each sample is then crushed to greater than 70% passing -2mm (10 mesh), and then a Boyd rotary split of 1 kilogram is pulverized to greater than 85% passing 75 microns (200 mesh). The sample is then treated with aqua regia and analyzed by ICP-MS for 51 elements including Silver (Ag), Copper (Cu), Lead (Pb), Zinc (Zn) and Gold (Au). Note that the Gold analysis by this method is semi-quantitative due to the small sample size used.

Overlimit samples for gold and silver are analyzed by 30g Fire assay with a gravimetric finish. Overlimit samples for copper, lead, manganese and zinc are treated with aqua regia and analyzed by ICP-OES (Inductively Coupled Plasma Optical Emission Spectroscopy).

Quality Assurance / Quality Control (QA/QC) samples included the use of field duplicates, blank material samples, and certified reference materials (CRM) for Au, Ag, and Cu. QA/QC samples were controlled by Tarku field staff at all-times. Field duplicates were collected as the second sample from the drill cyclone and made up 5% of the sample stream. Blank material included pure marble chips from a commercial source and made up 2.5% of the sample stream. CRMs made up 2.5% of the sample stream and were obtained from Shea-Clark Smith of Reno, NV. QA/QC additions to the sample stream total an additional 10% of the samples for analysis.

Analysis of the QA/QC materials are conducted as soon as analytical results are received. Statistically identified failures will be brought to the attention of ALS Minerals for re-testing.

Qualified persons

Julien Davy , P.Geo., M.Sc, MBA, President and Chief Executive Officer of Tarku, the qualified person under National Instrument 43-101 Standards of Disclosure for Mineral Projects, prepared, supervised and approved the technical information in this news release.

Update on the Silver Strike Transaction

On October 12, 2020 , Tarku signed the final option agreement with arm's length parties (the "Vendors") under which Tarku can earn up to 75% interest over 3 years in 1,250 hectares of unpatented mineral claims (the "Unpatented Claims Agreement") in the Tombstone mining District, Arizona . Pursuant to the agreement, to earn the 75% interest in the Property, the Company shall issue 3,000,000 common shares (issued), pay US$ 175,000 (of which a minimum of US$50,000 will be a cash payment and US$125,000 will be paid either in shares or in cash at the Company's discretion), and incur up to US$3 million in project expenditures to earn the interest, as follows:

- Tarku will acquire 25% of the Property after spending US$ 1,000,000 in exploration expenses within the first year of earn-in period (in progress),

- Tarku will acquire an additional 26% (total of 51%) of the Property after spending an additional US$ 1,000,000 in exploration expenses and the production of a 43-101 report on the Property within the first 2 years of earn-in period,

- Tarku will acquire an additional 24% (total of 75%) of the Property after spending an additional US$ 1,000,000 for a cumulative US$ 3,000,000 in exploration expenses within the first 3 years of earn-in period.

At the end of this Earn-in Period, the Vendors and Tarku will become JV partners on the Property, 75% Tarku, 25% the Vendors. Should the Vendors elect to dispose of their remaining interest, Tarku will keep a Right of First Refusal.

In addition, the signing of this agreement, also allows Tarku to acquire additional 33 patented claims in the historical area of Tombstone under agreement between third parties and the Vendors, namely the Rohe, Corkran, and Turner Options (The "Options"). These agreements are separate and independent from the Unpatented Claims Agreement. These Options require various cash payments with a total cost of US$ 700,000 . The payments are spread out until July 2025 for the Rohe Option, until October 2021 for the Corkran Option, and July 2023 for the Turner Option. Tarku will also issue 50,000 shares for the Corkran Option. At the end of each Option acquisition, the patented claims will be added to the above Unpatented Claim Agreement to form the 75% Tarku, 25% Vendor JV Partnership.

About Tarku Resources Ltd. (TSX.V: TKU - FRA: 7TK)

Tarku is an exploration company focused on making new discoveries in favourable mining jurisdictions as Quebec and Arizona . In Quebec , Tarku owns 100% on the " Three A 's" exploration projects, (Apollo, Admiral and Atlas Projects), in the Matagami greenstone belt, which has been interpreted by management as the eastern extension of the Detour Belt, and which has seen recent exploration successes by Midland Exploration Inc., Wallbridge Mining Company Ltd., Probe Metals Inc. In Arizona , in the Tombstone district, Tarku owns the option to acquire 75% on 20km2 in the Silver Strike Project.

Please follow @TarkuResources on LinkedIn, Facebook, Twitter and Instagram.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This press release may contain forward-looking statements that are subject to known and unknown risks and uncertainties that could cause actual results and activities to vary materially from targeted results and planning. Such risks and uncertainties include those described in Tarku's periodic reports including the annual report or in the filings made by Tarku from time to time with securities regulatory authorities.

SOURCE Tarku Resources Ltd.

![]() View original content to download multimedia: https://www.newswire.ca/en/releases/archive/May2021/06/c4961.html

View original content to download multimedia: https://www.newswire.ca/en/releases/archive/May2021/06/c4961.html