HIGHLIGHTS

- Strong IP responses defined over more than two kilometres of strike and associated with anomalies in rock and soil sampling

- Shallow anomalies in chargeability and resistivity explain the veins and breccias encountered in Champagne RC drilling and historic mining at Mine Hill area

- A new geophysical model reveals a detachment structure connecting the Mine Hill mineralization to a larger and more deeply rooted anomaly to northwest

Idaho Champion Gold Mines Canada Inc. (CSE:ITKO) (OTCQB:GLDRF) (FSE:1QB1)("Champion" or the "Company") is pleased to report the results of the 2020 induced polarization - resistivity (IP) survey at the Company's Champagne Gold Project near Arco, Idaho ("Champagne"). Champion designed the IP survey (See press release dated Oct 15, 2020) to evaluate the subsurface beneath the extensive alteration across the property, which spans more than 26 square kilometres

"There is a strong IP response at Champagne that can be confidently correlated between profiles over approximately two-kilometres of strike," stated Jonathan Buick, President and CEO. "More importantly, careful 3D modeling of the geophysics and integration with our geological mapping has revealed that shallow anomalies around the historic mining areas are likely detached from a much larger anomaly to the northwest. Our first round of drilling was directed at these historic targets, but our next phase of work will focus on high priority targets with considerable size potential."

An Integrated Interpretation of Geophysics and Geology

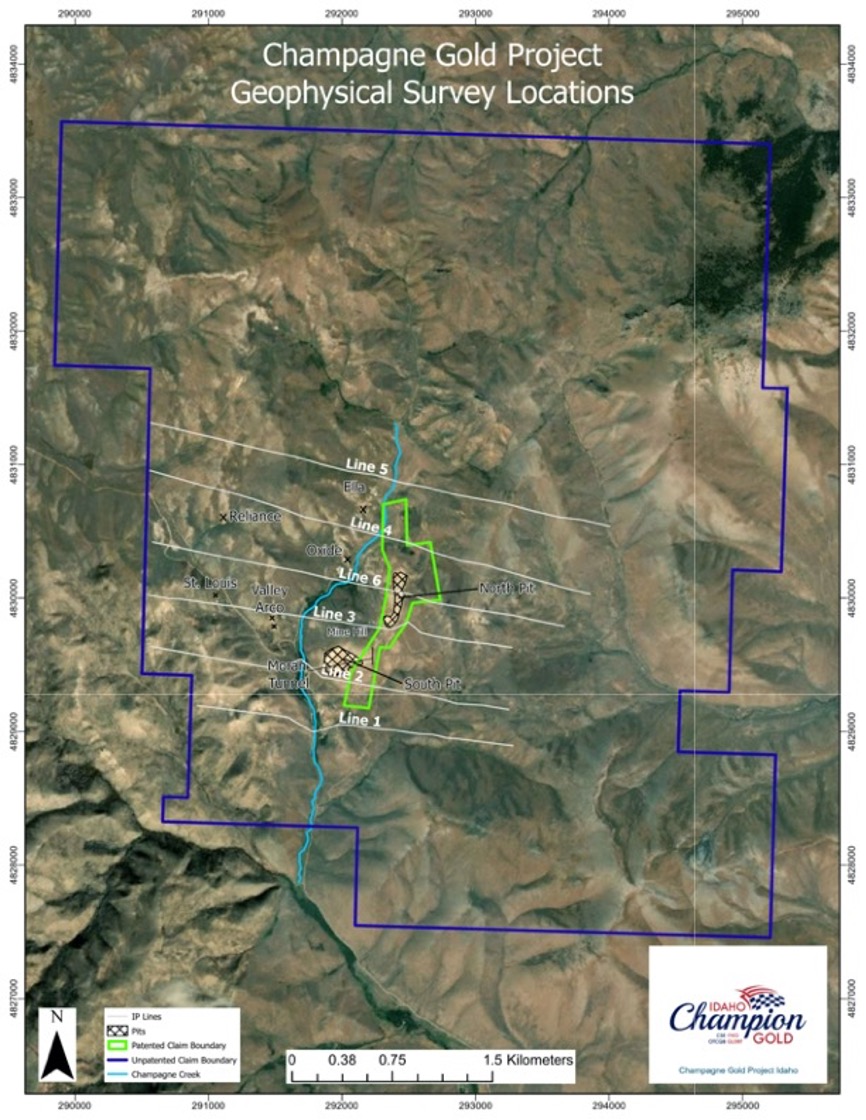

The 2020 IP survey at the Champagne Project consisted of 6 lines oriented almost east-west (azimuth of 280 degrees) and nominally spaced 400 metres apart. Along the lines, the survey employed a 200 metre dipole-dipole array, which yielded an expected depth of investigation of 500 to 600 metres. The survey was originally conceived to include approximately 12 line kilometres, but the scale of the target and early results necessitated almost doubling the survey to 21.4 line kilometres and adding a sixth line. Line 6 ran directly across the North Pit of the historic mine (See Figure 1).

Chargeability and resistivity data across the Champagne Project demonstrated the applicability of the IP technique to mapping the known sulfide-bearing mineralization in and around the historic mines ("Mine Hill"). The survey also identified deeper chargeable and resistive bodies that likely represent the buried roots of the Champagne precious metals system. The new targets are open to the northwest, north and south of the main historic mining areas on the Champage Project .

Figure 1: Geophysical Survey Locations

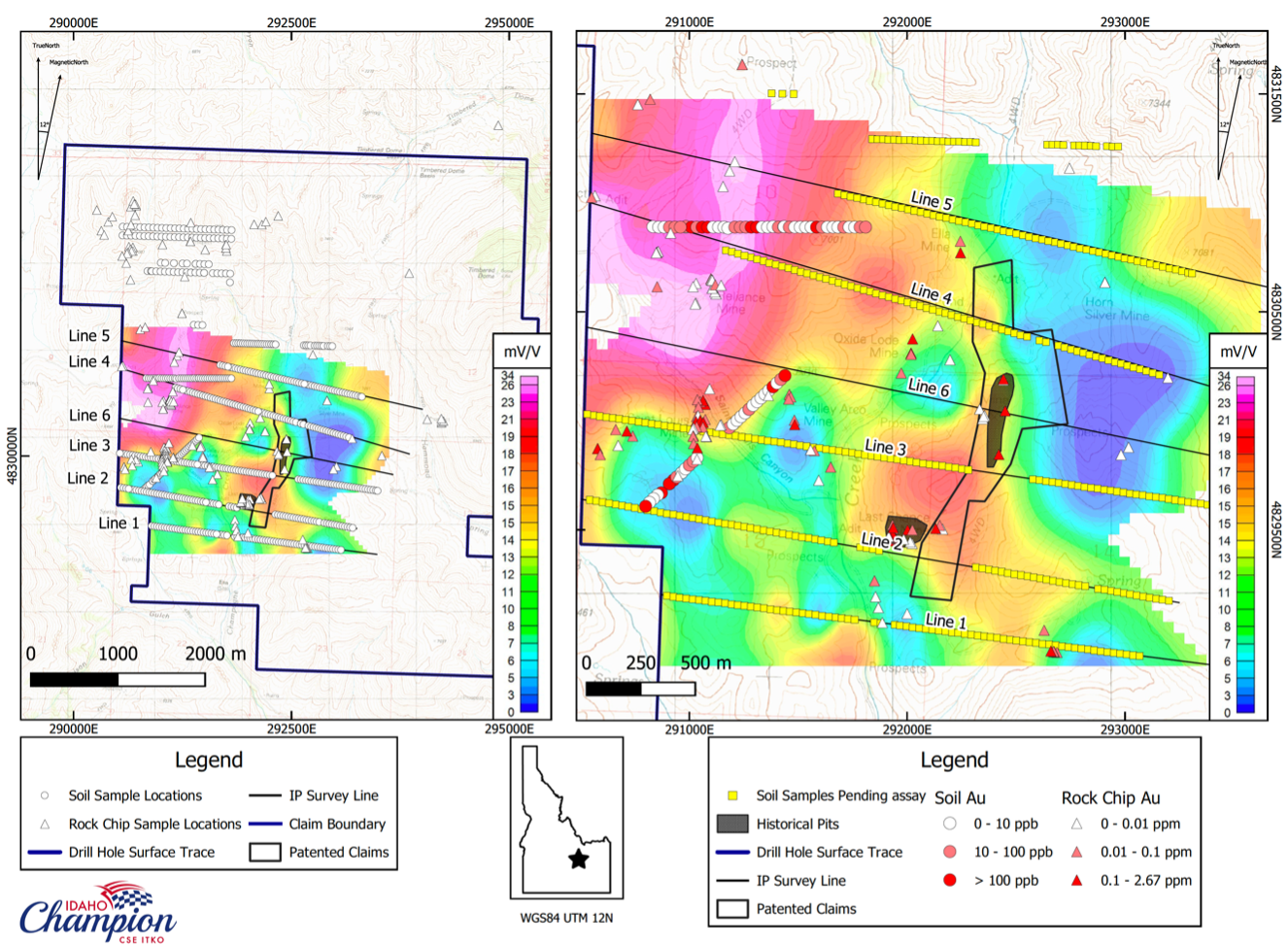

The Champion technical team identified a very strong (+20 to 30 mV/V) and wide IP response positioned to the west of Mine Hill. There are weaker and more limited anomalies associated with the historic mines, but the response in both chargeability and resistivity is much stronger to the northwest. These anomalies correlate well with surface anomalies in rock and soil geochemistry (See Figure 2). The technical team collected two orientation soil survey lines and numerous rock samples across the district. These samples yielded anomalies in Au, Ag, As, Hg, Te, Cu, Pb, and Zn associated with structures in and around the main IP feature. A total of 454 soil samples are still pending laboratory analyses.

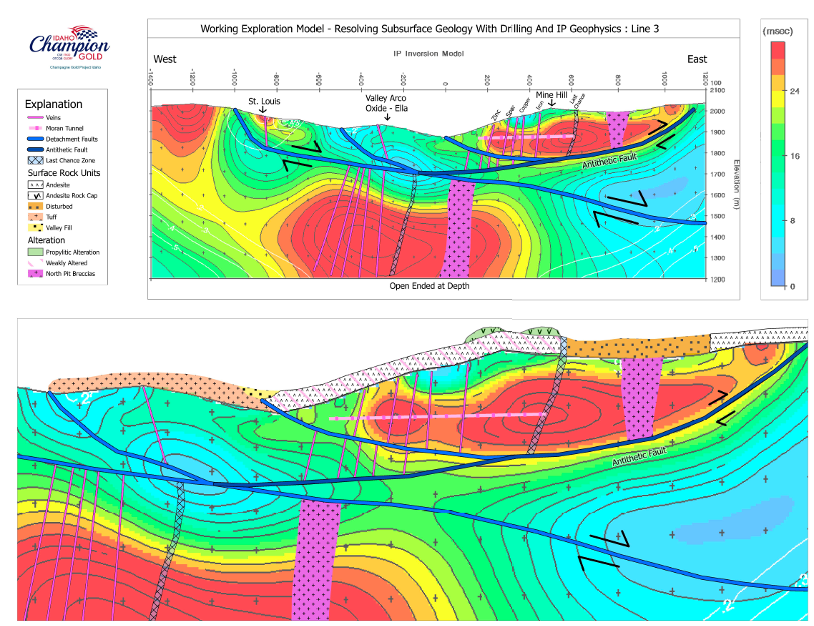

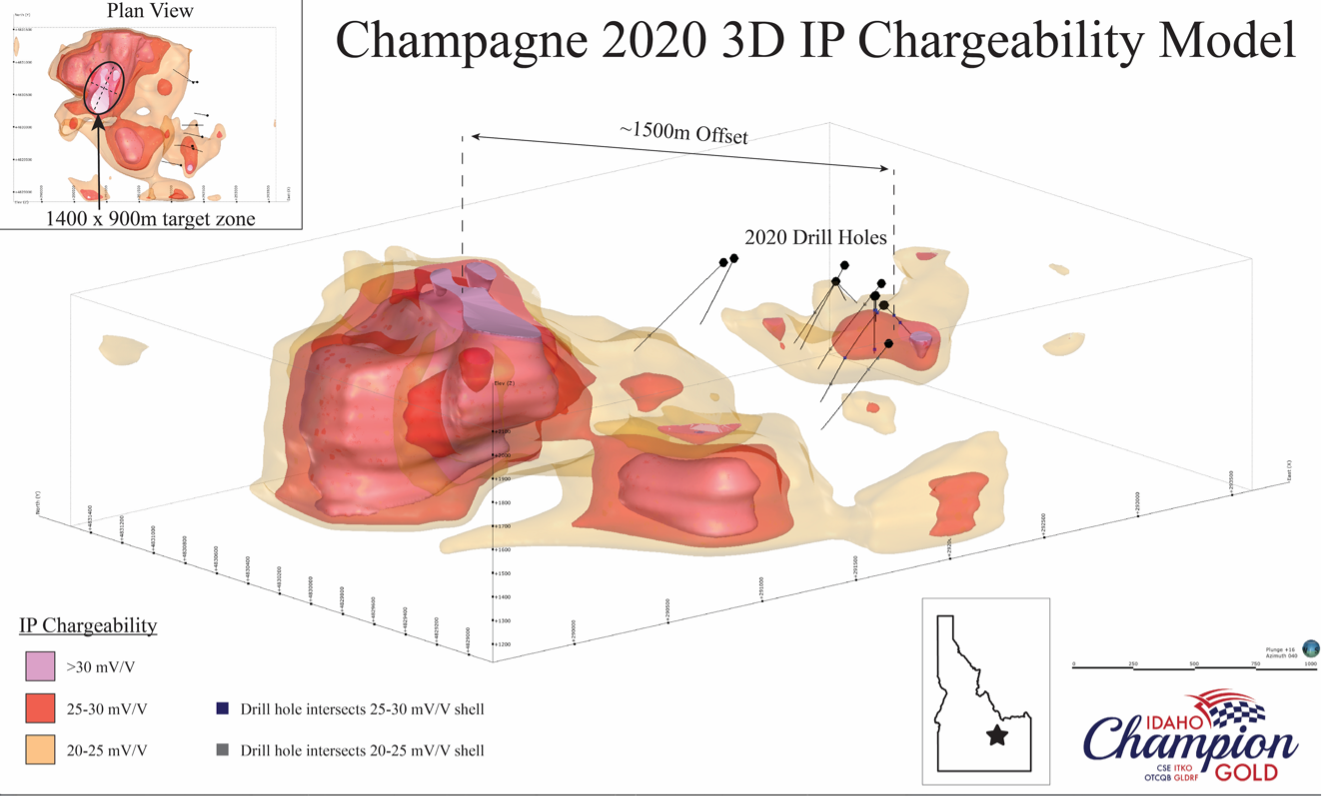

An interpretation of the IP chargeability pseudo-sections reveals that the anomaly beneath the Mine Hill breccias and sheeted veins is abruptly cut off just beneath the Moran Tunnel level (Figure 3). The eastern lobe of the anomaly is rootless, whereas the larger chargeable feature to the northwest is deeper rooted and has an apparent gap nearer surface (Figure 4). The Champion team has developed a working model that links the Mine Hill mineralization to the deeper rooted system on the west via a low angle detachment structure. The upper Mine Hill block (allochtonous) is interpreted to have been displaced approximately 800 meters eastward. This also explains the relatively shallow termination of surface and shallow underground mining at Mine Hill despite historic indications of good grade and thickness.

Figure 2: Surface Geochemistry Superimposed on IP Chargeability at 1700m Elevation

Figure 3: Working Exploration Model

Figure 4: 3D IP Chargeability Model Looking Northeast

This model suggests that the Mine Hill breccia veins, North and South open pit deposits, plus some of the outlying breccia and veins to the west (Arco Valley, Oxide, and Ella Mines) are all positioned in the upper (allocthonous) block and have been displaced by a considerable distance. An integrated interpretation of the IP data with geologic mapping and geochemical sampling reveals exciting potential on the western and northwestern portions of the Champagne property (Figure 2). Lines 4, 5, and 6 demonstrate that the chargeable and resistive target comes close to surface, and surface geochemical anomalies are abundant in the target area.

The Champagne mineral system covers a large area and boasts significant precious and base metal enrichment in Champion sampling of altered rocks and historical prospects, up to: 294 g/t Ag, 2.67 g/t Au, 2.79% Zn, 6.58% Pb, and 0.29% Cu. It is important to put these results into context with the evolving 3D model of the system in order to focus the next phase of exploration on the highest priority targets.

While awaiting additional surface geochemistry data from the lab, the technical team is hard at work designing the exploration program for 2021 to include additional geophysics, mapping, sampling, and drilling into the main body of the IP target.

About the Champagne Project

The Champagne Mine* was operated by Bema Gold as a heap leach operation on a high sulfidation gold system that occurs in volcanic rocks. Bema Gold drilled 72 shallow reverse circulation holes on the project, which complement drilling and trenching from other previous operators. The property has had no deep drilling or significant modern exploration since the mine closure in early 1992.

The Champagne Deposit contains epigenetic style gold and silver mineralization that occurs in strongly altered Tertiary volcanic tuffs and flows of acid to intermediate composition.

Champagne has a near-surface cap of gold-silver mineralization emplaced by deep-seated structures that acted as conduits for precious metal rich hydrothermal fluids. Higher grade zones in the Champagne Deposit appear to be related to such feeder zones.

* The Company cautions that the information about the past-producing mine may not be indicative of mineralization on Champion's property, and if mineralization does occur, that it will occur in sufficient quantity or grade that would result in an economic extraction scenario. The historic data were simply used to evaluate the prospective nature of the property. The Company has not yet conducted sufficient exploration to ascertain if a mineral resource is present on the property.

Qualified Person

The technical information in this press release has been reviewed and approved by Peter Karelse P.Geo., a consultant to the Company, who is a Qualified Person as defined by NI 43-101. Mr. Karelse has more than 30 years of experience in exploration and development.

About Idaho Champion Gold Mines Inc.

Idaho Champion is a discovery-focused gold exploration company that is committed to advancing its 100% owned highly prospective mineral properties located in Idaho, United States. The Company's shares trade on the CSE under the trading symbol "ITKO", on the OTCQB under the trading symbol "GLDRF", and on the Frankfurt Stock Exchange under the symbol "1QB1". Idaho Champion is vested in Idaho with the Baner Project in Idaho County, the Champagne Project located in Butte County near Arco, and four cobalt properties in Lemhi County in the Idaho Cobalt Belt. Idaho Champion strives to be a responsible environmental steward, stakeholder and a contributing citizen to the local communities where it operates. Idaho Champion takes its social license seriously, employing local community members and service providers at its operations whenever possible.

ON BEHALF OF THE BOARD

"Jonathan Buick"

Jonathan Buick, President and CEO

For further information, please visit the Company's SEDAR profile at www.sedar.com or the Company's corporate website at www.idahochamp.com.

For further information please contact:

Nicholas Konkin, Marketing and Communications

Phone: (416) 477 7771 ext. 205

Email: nkonkin@idahochamp.com

THIS PRESS RELEASE DOES NOT CONSTITUTE AN OFFER TO SELL OR THE SOLICITATION OF AN OFFER TO BUY ANY SECURITIES IN ANY JURISDICTION, NOR SHALL THERE BE ANY OFFER, SALE, OR SOLICITATION OF SECURITIES IN ANY STATE IN THE UNITED STATES IN WHICH SUCH OFFER, SALE, OR SOLICITATION WOULD BE UNLAWFUL.

Cautionary Statements

Neither the Canadian Securities Exchange nor its regulation services provider has reviewed or accepted responsibility for the adequacy or accuracy of this press release This press release may include forward-looking information within the meaning of Canadian securities legislation, concerning the business of the Company. Forward-looking information is based on certain key expectations and assumptions made by the management of the Company, including suggested strike extension. Although the Company believes that the expectations and assumptions on which such forward-looking information is based on are reasonable, undue reliance should not be placed on the forward-looking information because the Company can give no assurance that they will prove to be correct. Forward-looking statements contained in this press release are made as of the date of this press release. The Company disclaims any intent or obligation to update publicly any forward looking information, whether as a result of new information, future events or results or otherwise, other than as required by applicable securities laws.

SOURCE: Idaho Champion Gold Mines Canada Inc.

View source version on accesswire.com:

https://www.accesswire.com/627276/Idaho-Champion-Reports-Significant-IP-Anomalies-and-Develops-New-Model-for-2021-Targets-at-Champagne-Gold-Project