Idaho Champion Gold Mines Canada Inc. (CSE:ITKO)(OTCQB:GLDRF)(FSE:1QB1) ("Idaho Champion" or the "Company") is pleased to report the results from its 2020 geochemical soil sampling program at the 100% controlled Champagne Gold Project ("Champagne") near the city of Arco, Butte County, Idaho

2020 Soil Sample Program Highlights:

- Analytical results of 534 samples from seven (7) reconnaissance soil lines including five (5) soil lines overlapping with the previously announced Induced Polarization (IP) survey (See Press Release Dated February 2, 2021).

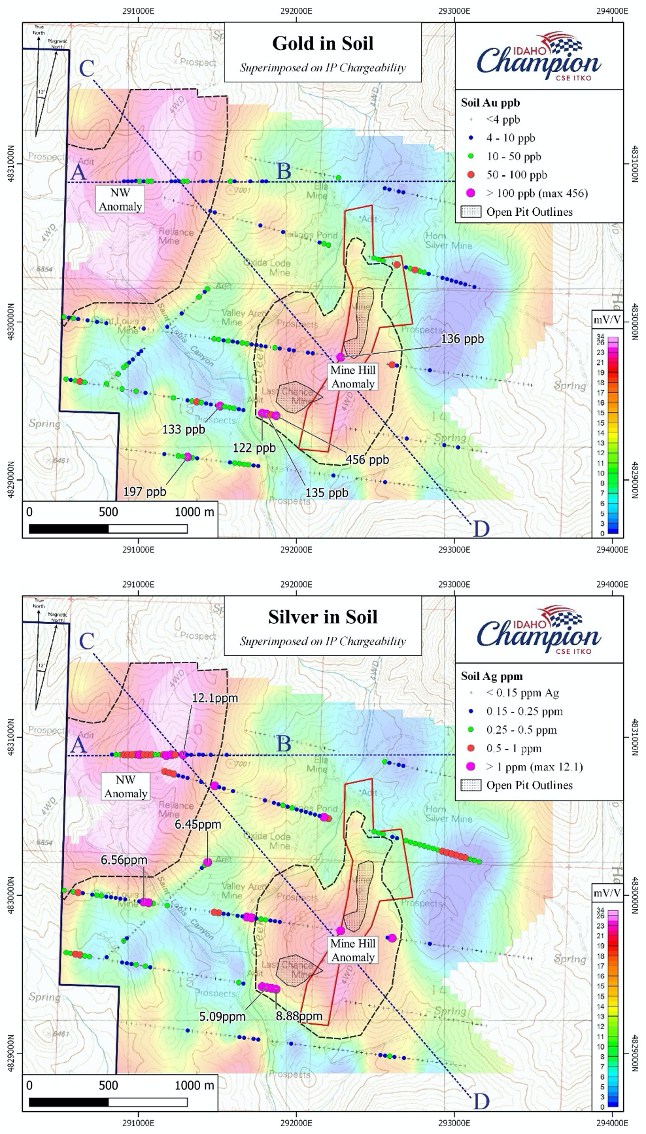

- Anomalous gold (to 19 ppb), silver (to 12.1 ppm, the highest value in the survey), arsenic, tellurium, bismuth, and base metals overlie the large NW Anomaly (Figure 1); an IP chargeability anomaly identified 800 metres northwest of Mine Hill.

- The highest gold value in the survey (456 ppb) and three additional samples greater than 100 ppb gold overlie the Mine Hill IP chargeability anomaly.

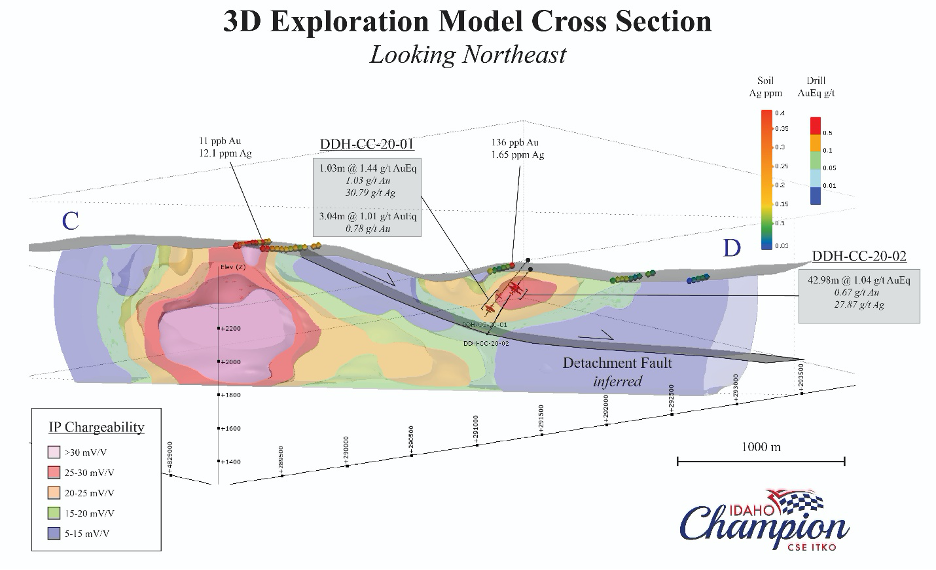

- The Mine Hill Anomaly is inferred to represent the fault-displaced upper portion of the NW Anomaly. Drill testing of the NW Anomaly is a priority in 2021.

"Our Champagne soil geochemical results show elevated gold, silver, and base metals values over the large anomaly that we discovered during our IP program in 2020, which suggests an intact and zoned hydrothermal system," stated President and CEO, Jonathan Buick. "The NW Anomaly remains undrilled and open to the north. The 2020 IP and geochemical soil sampling program covered only a small portion of the area controlled by Champion. We are excited to expand our exploration program in 2021."

Soil Sampling Results

Gold values in the soils range from below detection limit (1 ppb) to a maximum of 0.456 ppm (456 ppb). Six samples assayed greater than 100 ppb gold. Four of these samples overlie the Mine Hill IP chargeability anomaly, including the highest gold value of 456 ppb (Figure 1). A total of 75 samples assayed 10 ppb gold or greater.

Silver values in the soils range from below detection limit (0.03 ppm) to a maximum of 12.1 ppm. A total of 18 samples assayed 1.00 ppm silver or greater, of which 8 samples overlie the Mine Hill IP chargeability anomaly. The highest silver value of 12.1 ppm and an additional 5 samples that assayed greater than 1.0 ppm silver overlie the NW IP chargeability anomaly (Figure 1). A total of 91 samples assayed 0.25 ppm silver or greater.

Significant base metal enrichments in soil samples are reported. The highest values within the survey include 3,810 ppm lead, 522 ppm zinc, and 77 ppm copper. Elevated values for zinc are particularly widespread, with 185 samples reporting 100 ppm or greater.

Additionally, strongly anomalous values are reported for bismuth (to 29 ppm), arsenic (to 113 ppm), mercury (to 15 ppm), antimony (to 10 ppm), tellurium (to 3 ppm), and selenium (to 4 ppm). The area overlying the NW anomaly is particularly enriched in these elements, including the highest reported values for bismuth and mercury (Figure 2).

Technical Summary

The induced polarization (IP) survey completed by Idaho Champion Gold in 2020 established the presence of a shallow zone of increased chargeability at Mine Hill ("Mine Hill Anomaly") and a deeper, larger chargeable zone approx. 800 metres northwest of Mine Hill ("NW Anomaly"). Based on detailed geologic mapping also completed in 2020, the Mine Hill Anomaly is interpreted to represent the upper portion of the NW Anomaly that has been severed and displaced to the southeast by low-angle detachment faulting (Figures 2 and 3).

At Mine Hill, historic surface and underground mining and significant mineralized intercepts from Idaho Champion's 2020 Phase I drilling establish the spatial coincidence of gold-silver-base metal enrichment near surface and chargeable zones at depth (Idaho Champion news release 16 February 2021). Results of the reconnaissance soil geochemistry lines confirm this spatial coincidence at both the Mine Hill and NW chargeability anomalies.

Overall, soil geochemical results are interpreted to represent a gold-silver-base metals -enriched hydrothermal system with strong affinities to a magmatic source. Further, zonation patterns apparent in the distribution of elevated values for bismuth, arsenic, antimony, and tellurium (Figure 2) suggest this hydrothermal system may be centered on the NW Anomaly, which remains open to the north.

The seven widely spaced soil geochemical orientation lines occupy less than 25% of the area controlled by Idaho Champion at the Champagne Project. Follow-up soil grids are planned for 2021 to both expand and in-fill the soil geochemical coverage.

Drill testing at the NW anomaly and additional exploration targets is planned for Q3 2021.

Soil Sampling Methodology

Soil sampling was completed during the period August-November 2020. A total of 534 soil samples was collected along seven reconnaissance lines at a sample spacing of 30 metres. Survey lines were oriented generally east-west and approximately perpendicular to the strike of mapped faults and breccia zones. Five of the soil survey lines coincided with portions of previously completed induced polarization (IP) lines (Figure 1; see also Idaho Champion news release of 2 February 2021). Field duplicate samples were collected at a rate of roughly 1 in 20 samples. Duplicates were taken from a separate hole dug within 5m of the original sample hole. Field duplicates showed very good repeatability for low levels of gold and expected minor variability for other key trace elements and the base metals.

Soil sample holes were excavated using pickaxes. Samples were collected from the C soil horizon at an average depth of 28 cm. Physical properties of the sample sites were recorded including level of disturbance, color of soil, depth of soil profile, and lithology of loose rock. Samples were sieved in the field using a 10-mesh sieve. The average weight of soil samples collected was 0.70 kg.

Samples were analyzed by ALS Global in Reno, NV. All samples were analyzed for gold by fire assay with an ICP-AES finish (ALS code Au-ICP21: 1 ppb gold detection limit), and 51 element ultra-trace level analysis by ICP-MS with an aqua regia sample digestion (ALS code ME-MS41).

Quality Assurance/Quality Control (QAQC) blanks and sample pulps were inserted into the sample stream and lab performance was validated by company geologists. QAQC standards from Shea Clark Smith / MEG, Inc, Reno, NV were used. Pure silica pool filter sand was used as blank material.

Figure 1. Plan maps indicating gold-in-soil and silver-in-soil overlying IP chargeability grids. A-B and C-D are cross section lines used in Figures 2 and 3, respectively. IP Chargeability grid represents IP response at 1800 mRL.

Figure 2. East-West cross sections looking North, showing the zonation of surface soil geochemistry distribution of silver, gold, lead, arsenic, antimony, and tellurium, and the strong relationship with the NW Anomaly.

Figure 3. Oblique 3D section showing the relationship of surface silver-in-soil geochemistry values, 3D IP chargeability model, and drill hole results from holes DDH-CC-20-01 and -02 (refer to Idaho Champion news release dated 16 February, 2021).

About the Champagne Project

The Champagne Mine* was operated by Bema Gold as a heap leach operation on an epithermal gold-silver system that occurs in volcanic rocks. Bema Gold drilled 72 shallow reverse circulation holes on the project, which complement drilling and trenching from other previous operators. The property has had no deep drilling or significant modern exploration since the mine closure in early 1992.

The Champagne Deposit contains epigenetic style gold and silver mineralization that occurs in strongly altered Tertiary volcanic tuffs and flows of acid to intermediate composition. Champagne has a near surface cap of gold-silver mineralization emplaced by deep-seated structures that acted as conduits for precious metal rich hydrothermal fluids. Higher grade zones in the Champagne Deposit appear to be related to such feeder zones.

* The Company cautions that the information about the past-producing mine may not be indicative of mineralization on Champion's property, and if mineralization does occur, that it will occur in sufficient quantity or grade that would result in an economic extraction scenario. The historic data were simply used to evaluate the prospective nature of the property. The Company has not yet conducted sufficient exploration to ascertain if a mineral resource is present on the property.

Qualified Person

The technical information in this press release has been reviewed and approved by Peter Karelse P.Geo., a consultant to the Company, who is a Qualified Person as defined by NI 43-101. Mr. Karelse has more than 30 years of experience in exploration and development.

About Idaho Champion Gold Mines Inc.

Idaho Champion is a discovery-focused gold exploration company that is committed to advancing its 100%-owned highly prospective mineral properties located in Idaho, United States. The Company's shares trade on the CSE under the trading symbol "ITKO", on the OTCQB under the trading symbol "GLDRF", and on the Frankfurt Stock Exchange under the symbol "1QB1". Idaho Champion is vested in Idaho with the Baner Project in Idaho County, the Champagne Project located in Butte County near Arco, and four cobalt properties in Lemhi County in the Idaho Cobalt Belt. Idaho Champion strives to be a responsible environmental steward, stakeholder and a contributing citizen to the local communities where it operates. Idaho Champion takes its social license seriously, employing local community members and service providers at its operations whenever possible.

ON BEHALF OF THE BOARD

"Jonathan Buick"

Jonathan Buick, President and CEO

For further information, please visit the Company's SEDAR profile at www.sedar.com or the Company's corporate website at www.idahochamp.com.

For further information, please contact:

Nicholas Konkin, Marketing and Communications

Phone: (416) 477- 7771 ext. 205

Email: nkonkin@idahochamp.com

THIS PRESS RELEASE DOES NOT CONSTITUTE AN OFFER TO SELL OR THE SOLICITATION OF AN OFFER TO BUY ANY SECURITIES IN ANY JURISDICTION, NOR SHALL THERE BE ANY OFFER, SALE, OR SOLICITATION OF SECURITIES IN ANY STATE IN THE UNITED STATES IN WHICH SUCH OFFER, SALE, OR SOLICITATION WOULD BE UNLAWFUL.

Cautionary Statements

Neither the Canadian Securities Exchange nor its regulation services provider has reviewed or accepted responsibility for the adequacy or accuracy of this press release This press release may include forward-looking information within the meaning of Canadian securities legislation, concerning the business of the Company. Forward-looking information is based on certain key expectations and assumptions made by the management of the Company, including suggested strike extension. Although the Company believes that the expectations and assumptions on which such forward-looking information is based on are reasonable, undue reliance should not be placed on the forward-looking information because the Company can give no assurance that they will prove to be correct. Forward-looking statements contained in this press release are made as of the date of this press release. The Company disclaims any intent or obligation to update publicly any forward-looking information, whether as a result of new information, future events or results or otherwise, other than as required by applicable securities laws.

SOURCE: Idaho Champion Gold Mines Canada Inc.

View source version on accesswire.com:

https://www.accesswire.com/639391/Idaho-Champion-Gold-Reports-Gold-Silver-Soil-Anomalies-Correlating-with-Large-Geophysical-Drill-Target-at-Champagne