Idaho Champion Gold Mines Canada Inc. (CSE:ITKO)(OTCQB:GLDRF)(FSE:1QB1) ("Idaho Champion" or the 'Company') is pleased to announce that it has signed a binding Property Lease and Option Agreement (the "Agreement") with a private family (the "Lessor") to lease, with an option to acquire, 100% interest in new surface and mineral rights on properties within Idaho Champion's Champagne Gold Project in Idaho, USA

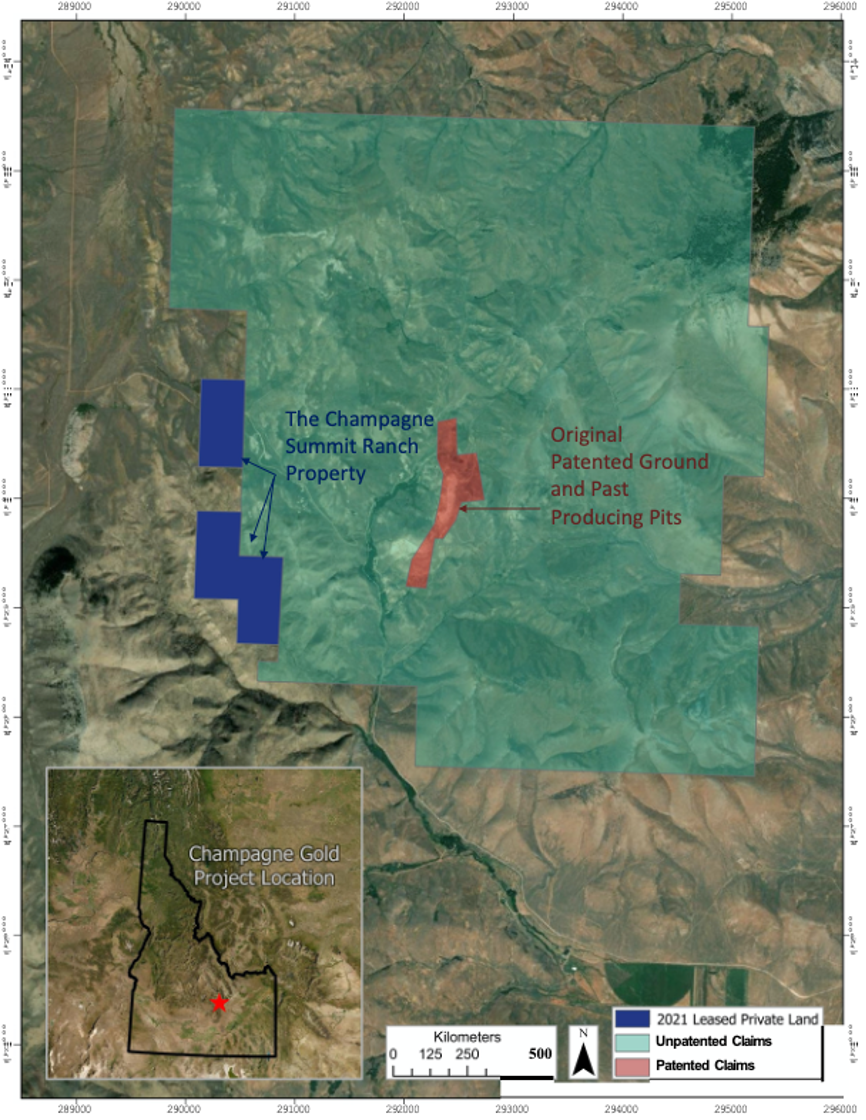

The properties include four (4) parcels of private ground (the "Champagne Summit Ranch" or the "Ranch") (See Figure 1) totalling 240 acres, which is located adjacent to the federal mining claims already controlled by Idaho Champion. The Ranch is located northwest of the past-producing pits and will be instrumental in the Company's 2021 drilling program and ongoing exploration of the large IP anomaly on the project.

"The surface and mineral rights to the Champagne Summit Ranch will have an immediate impact on the Champagne Project. Not only does part of the IP anomaly extend onto this ground, but the new property will also improve our access and infrastructure in the area at a very low cost. Given the rights associated with privately-held surface and mineral rights in Idaho, we can immediately commence work on the leased ground. We also welcome the Lessor family as shareholders and appreciate their trust and support of our exploration strategy, " stated President and CEO, Jonathan Buick.

Under the terms of the Agreement, the parties have agreed to a five (5) year term of the lease, during which Idaho Champion will pay to the Lessor total consideration of US$240,000 and 500,000 common shares of the Company, structured as follows:

- A committed initial payment of US$10,000 and 50,000 common shares of the Company;

- Annual payments of US$10,000 cash and 50,000 common shares of the Company on each of the first through fourth-anniversary dates of the Agreement, each of which is an option paid at the sole discretion of the Company; and

- On or before the fifth anniversary, Idaho Champion has the option pay the Lessor a final payment of US$190,000 in cash and 200,000 common shares of the Company.

As long as it maintains its option to lease the Ranch, Idaho Champion has also agreed to pay the annual property taxes on behalf of the Lessor. Upon full execution of the Agreement, Idaho Champion will hold 100% fee simple interest in the Ranch and its mineral rights.

Figure 1: Champagne Project and Champagne Summit Ranch Property Location

About the Champagne Project

The Champagne Mine* was operated by Bema Gold as a heap leach operation on an epithermal gold-silver system that occurs in volcanic rocks. Bema Gold drilled 72 shallow reverse circulation holes on the project, which complement drilling and trenching from other previous operators. The property has had no deep drilling or significant modern exploration since the mine closure in early 1992.

The Champagne Deposit contains epigenetic style gold and silver mineralization that occurs in strongly altered Tertiary volcanic tuffs and flows of acid to intermediate composition. Champagne has a near-surface cap of gold-silver mineralization emplaced by deep-seated structures that acted as conduits for precious metal-rich hydrothermal fluids. Higher grade zones in the Champagne Deposit appear to be related to such feeder zones.

* The Company cautions that the information about the past-producing mine may not be indicative of mineralization on Champion's property, and if mineralization does occur, that it will occur in sufficient quantity or grade that would result in an economic extraction scenario. The historic data were simply used to evaluate the prospective nature of the property. The Company has not yet conducted sufficient exploration to ascertain if a mineral resource is present on the property.

Qualified Person

The technical information in this press release has been reviewed and approved by Peter Karelse P.Geo., a consultant to the Company, who is a Qualified Person as defined by NI 43-101. Mr. Karelse has more than 30 years of experience in exploration and development.

About Idaho Champion Gold Mines Inc.

Idaho Champion is a discovery-focused gold exploration company that is committed to advancing its 100%-owned highly prospective mineral properties located in Idaho, United States. The Company's shares trade on the CSE under the trading symbol "ITKO", on the OTCQB under the trading symbol "GLDRF", and on the Frankfurt Stock Exchange under the symbol "1QB1". Idaho Champion is vested in Idaho with the Baner Project in Idaho County, the Champagne Project located in Butte County near Arco, and four cobalt properties in Lemhi County in the Idaho Cobalt Belt. Idaho Champion strives to be a responsible environmental steward, stakeholder and a contributing citizen to the local communities where it operates. Idaho Champion takes its social license seriously, employing local community members and service providers at its operations whenever possible.

ON BEHALF OF THE BOARD

"Jonathan Buick"

Jonathan Buick, President and CEO

For further information, please visit the Company's SEDAR profile at www.sedar.com or the Company's corporate website at www.idahochamp.com.

For further information please contact:

Nicholas Konkin, Marketing and Communications

Phone: (416) 567- 9087

Email: nkonkin@idahochamp.com

THIS PRESS RELEASE DOES NOT CONSTITUTE AN OFFER TO SELL OR THE SOLICITATION OF AN OFFER TO BUY ANY SECURITIES IN ANY JURISDICTION, NOR SHALL THERE BE ANY OFFER, SALE, OR SOLICITATION OF SECURITIES IN ANY STATE IN THE UNITED STATES IN WHICH SUCH OFFER, SALE, OR SOLICITATION WOULD BE UNLAWFUL.

Cautionary Statements

Neither the Canadian Securities Exchange nor its regulation services provider has reviewed or accepted responsibility for the adequacy or accuracy of this press release This press release may include forward-looking information within the meaning of Canadian securities legislation, concerning the business of the Company. Forward-looking information is based on certain key expectations and assumptions made by the management of the Company, including suggested strike extension. Although the Company believes that the expectations and assumptions on which such forward-looking information is based on are reasonable, undue reliance should not be placed on the forward-looking information because the Company can give no assurance that they will prove to be correct. Forward-looking statements contained in this press release are made as of the date of this press release. The Company disclaims any intent or obligation to update publicly any forward-looking information, whether as a result of new information, future events or results or otherwise, other than as required by applicable securities laws.

SOURCE: Idaho Champion Gold Mines Canada Inc.

View source version on accesswire.com:

https://www.accesswire.com/653470/Idaho-Champion-Gold-Acquires-Private-Surface-and-Mineral-Rights-at-Champagne-Project