Gold Mountain Mining Corp. ("Gold Mountain" or the "Company") (TSXV:GMTN)(OTCQB:GMTNF)(FRA:5XFA) is pleased to announce it has received its Notice of Work ("NoW") permit, allowing it to expand its 2021 exploration program at its 100% owned Elk Gold Project. The NoW permits Gold Mountain to continue chasing it's deep, high-grade mineralization while exploring additional satellite zones throughout the property

Highlights:

- Gold Mountain receives authorization for an expanded Phase 2 exploration program allowing it to drill outside the Siwash North Zone.

- Phase 2 includes 10,000m of drilling and continues to relog high interest historical core.

- The NoW allows the company to continue chasing the deep, high grade mineralization of the "Mother shoot" zone as well as other satellite regions of the property.

"This is fantastic news as we move into our next 10,000m drill program at the Elk," commented CEO, Kevin Smith. "With this Notice of Work, we now have a lot more optionality to target deep, high-grade zones, particularly down-dip of the 1300 vein. It also opens up other satellite areas we've identified as being highly prospective for vein extensions and new discoveries. In this Phase 2 program we have 5 holes planned for our elusive zone with the intention of developing a more bulk tonnage style resource, to compliment our high grade sulphide mineralization. Our focus remains to continue unlocking shareholder value by aggressively growing the Elk deposit, while rapidly moving through development and into commercial production. Stayed tuned for a very exciting second half of 2021 as we continue building out BC's next high grade Gold and Silver producer."

Notice of Work

The Company has received its Notice of Work ("NoW") from the Ministry of Energy Mines and Low Carbon Innovation, allowing them to transition to Phase 2 of their Drill program which targets areas outside the current Mine Permit Area in the south portion of the Siwash North Zone.

Previously, the Company could only drill within its Mine Permit boundaries, hindering its ability to target certain high-grade areas of the Elk Gold Project. With this milestone, Gold Mountain can move its drill pads further south of the Siwash North Zone, allowing the Company to explore high-interest satellite zones and continue chasing the 1300 vein deeper, targeting the high-grade mineralization at the Elk.

Phase 2 Exploration Program

In Phase 1 of Gold Mountain's drill program, the Company focused on the Siwash North Zone with predictable, step out and infill drilling to methodically add ounces to the resource. The Company hit significant mineralized intercepts in 100% of the 41 drill holes completed at the Siwash North Zone, including high-grade mineralization in the zone dubbed the "Mother Shoot" with grades reaching 124 g/t.

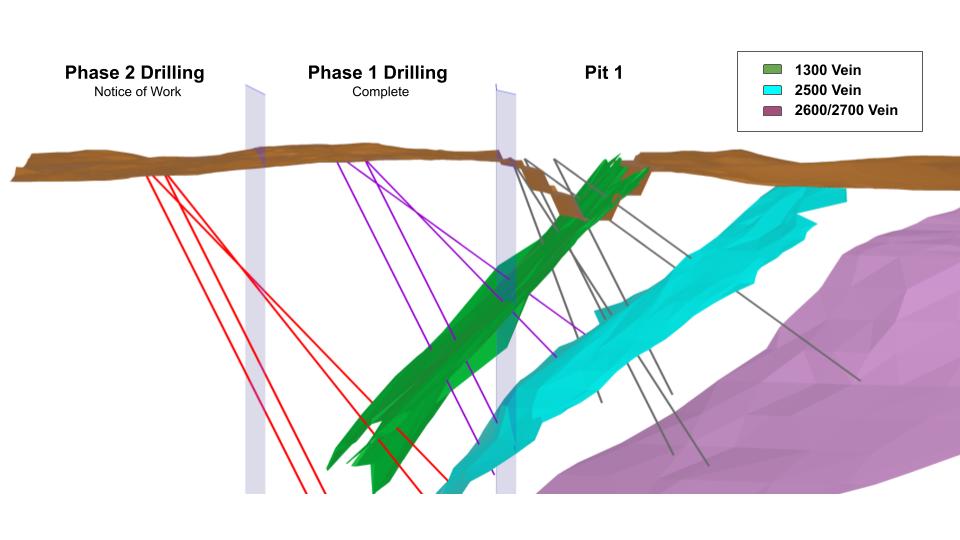

The 10,000m Phase 2 drill program targets extensions of high-grade mineralization the Company consistently encountered during its Phase 1 program. The image below presents a broad overview of the permitted zones and planned targets at Siwash North:

Elk Gold Project's Multi-Phased Drill Program

The Company is also drilling the Elusive Zone located approximately 4km from the Siwash North Zone where historic high-grade soil geochemical samples indicate promising new potential at the Elk Gold Project.

Phase 2 Re-Logging

The Company has begun the Phase 2 process of re-logging historic core, digitizing historic data and updating the geological interpretation. Given the past success of the Phase 1 re-logging of historical core, which unveiled undocumented core samples as high as 216 g/t, Gold Mountain plans to continue to relog and resample core from previous operators in areas identified as high-interest to the Company.

Qualified Person

The foregoing technical information was approved by Grant Carlson, P.Eng., a Qualified Person, as defined under National Instrument 43-101 and the Chief Operating Officer for the Company.

About Gold Mountain Mining

Gold Mountain is a British Columbia based gold and silver exploration and development company focused on resource expansion at the Elk Gold Project, a past-producing mine located 57 KM from Merritt in South Central British Columbia. Additional information is available at www.sedar.com or on the Company's new website at www.gold-mountain.ca.

For further information, please contact:

Gold Mountain Mining Corp.

Kevin Smith, Director and Chief Executive Officer

Phone: 604-309-6340

Email: ks@gold-mountain.ca

Website: www.gold-mountain.ca

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) has reviewed or accepts responsibility for the adequacy or accuracy of this Release

This news release includes certain "forward-looking statements" under applicable Canadian securities legislation. Forward- looking statements include statements that are based on assumptions as of the date of this news release. Forward looking statements in the press release include but are not limited to: the impact of the Phase 2 exploration program on the Company's overall business, . Forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable, are subject to known and unknown risks, uncertainties and other factors which may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking statements. Such factors include, but are not limited to: general business, economic, competitive, political and social uncertainties; delay or failure to receive board, shareholder or regulatory approvals; the price of gold; and the results of current exploration. There can be no assurance that such statements will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. Gold Mountain disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. For a comprehensive overview of all risks that may impact the Company, please see the Filing Statement filed on Gold Mountain's SEDAR profile on December 15, 2020

SOURCE: Gold Mountain Mining Corp.

View source version on accesswire.com:

https://www.accesswire.com/644770/Gold-Mountain-Extends-Permitted-Drilling-Zone-and-Begins-Phase-2-Exploration-Program