Canex Metals Inc. ("CANEX" or the "Company") is pleased to announce assay results have been received for 8 additional drill holes from the Company's 2021 reverse circulation drilling program at the Gold Range Project, Arizona

Highlights

- Two zones of gold mineralization have been encountered in hole GR21-25, an upper zone containing 0.3 g/t gold over 10.6 metres starting at 22.9 metres depth, and a higher grade and thicker lower zone containing 1.3 g/t gold over 21.3 metres starting at 54.9 metres.

- The lower zone in hole GR21-25 intersected a higher grade interval containing 2.4 g/t gold over 10.6 metres including 5.1 g/t over 4.5 metres, and the hole ended in mineralization.

- The presence of 2 near surface stacked zones of gold mineralization opens up the size potential of the Eldorado target.

- Results for 21 additional drill holes from the Gold Range Project are pending.

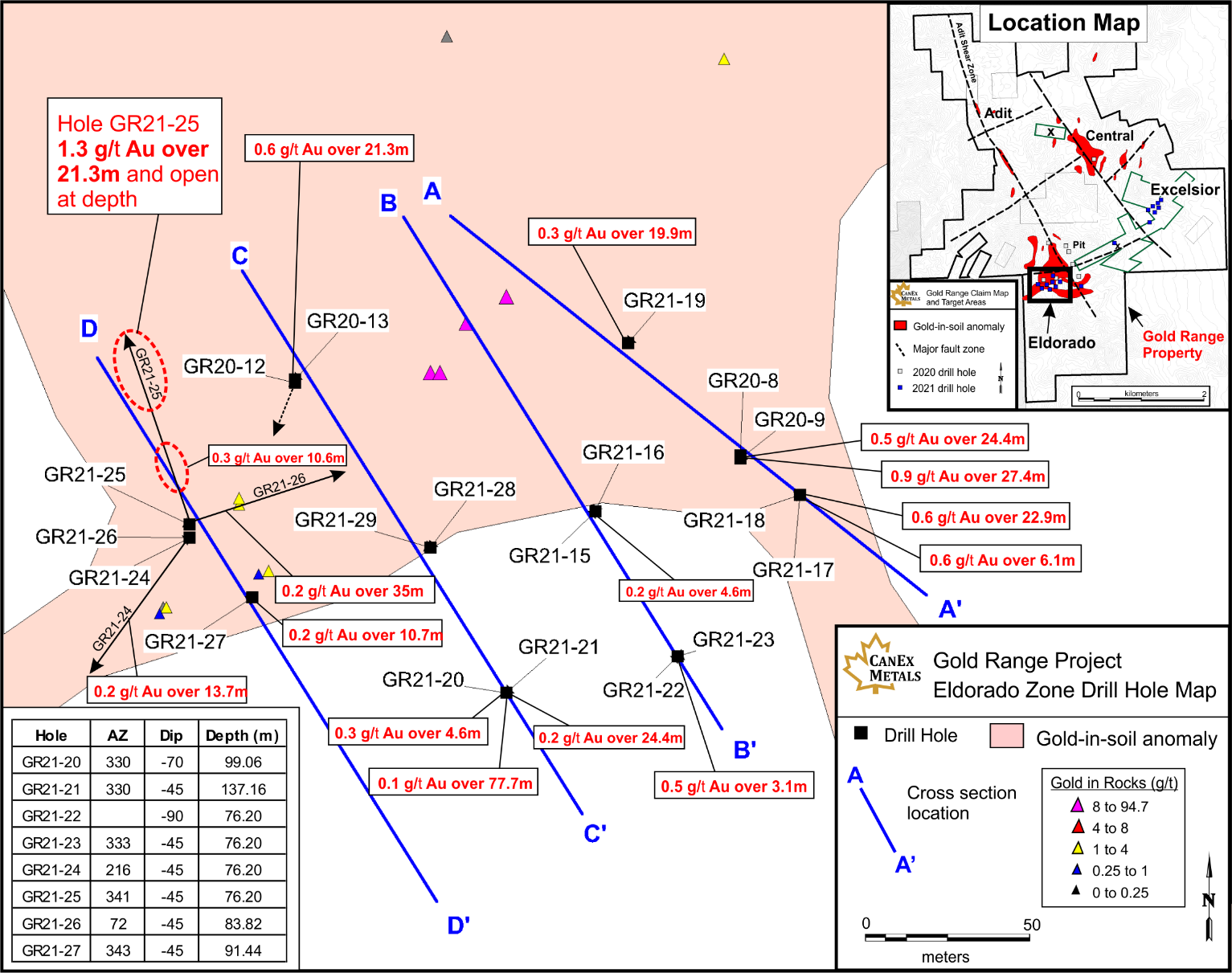

Results for reverse circulation drill holes GR21-20 to 27 from the Company's 2021 drilling program at the Gold Range project have been received and are presented here. These holes were drilled at the Eldorado Zone where the Company discovered bulk tonnage style gold mineralization potential in late 2020 (see CANEX news release dated November 2, 2020). The location, orientation, and total depths of each hole are summarized in Figure 2.

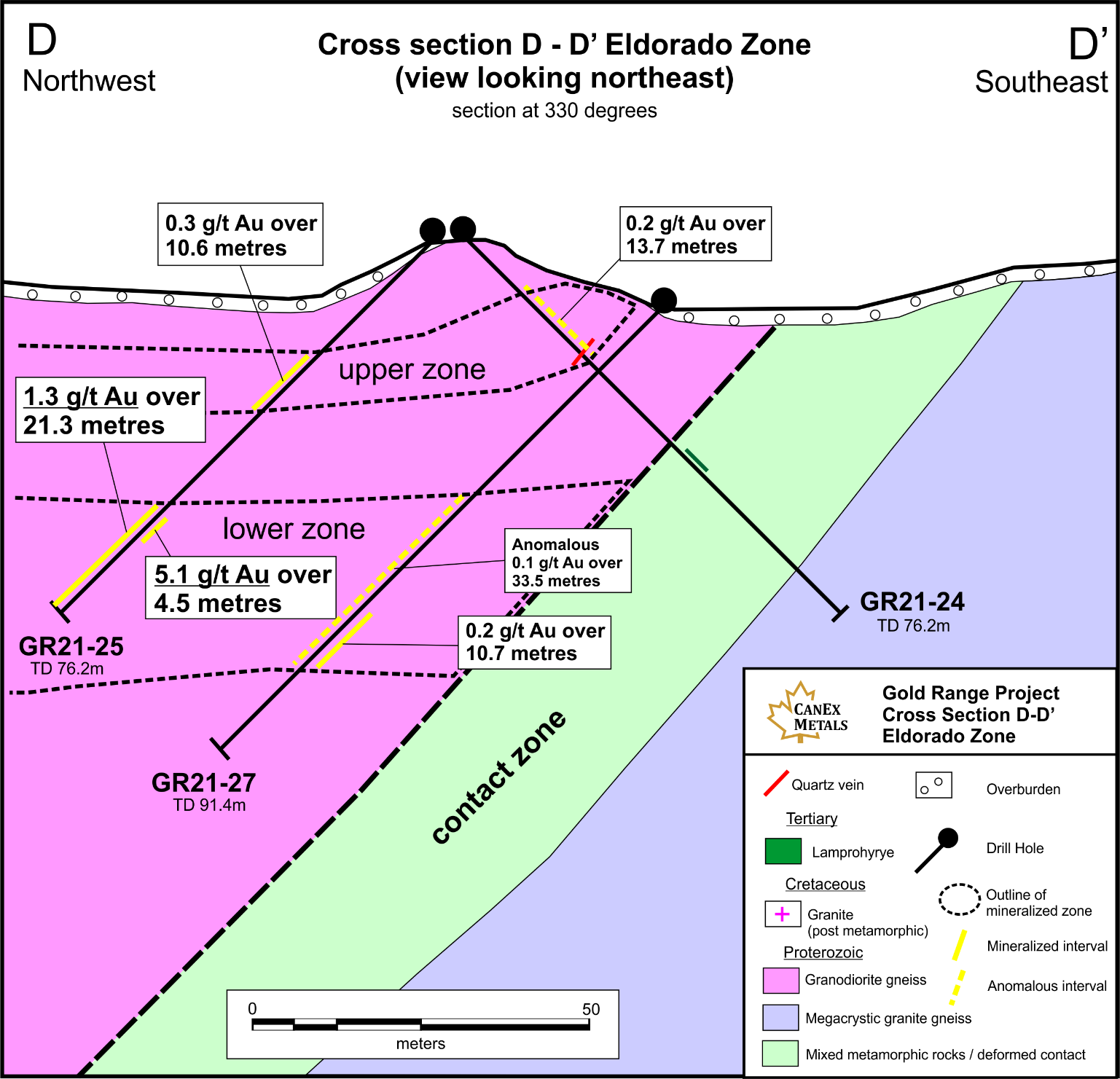

Holes GR21-24, 25 and 26 were all drilled from the same pad and oriented at different azimuths to test a broad area, and all three holes hit gold mineralization. Holes GR21-24, 25, and 27 are shown on cross section D-D' (Figure 3). Hole GR21-25 was oriented towards the north and tested a mostly covered area returning strong gold mineralization in two mineralized zones that are interpreted to be flat dipping. The upper mineralized zone in hole GR21-25 returned 0.3 g/t gold over 10.6 metres starting at 22.9 metre depth, the lower zone returned 1.3 g/t gold over 21.3 metres starting at 54.9 metres depth, with the hole ending in mineralization. The lower zone in hole GR21-25 contains a zone of higher grade mineralization containing 2.4 g/t gold over 10.6 metres, including 5.1 g/t gold over 4.5 metres. The upper and lower mineralized zones appear to increase in grade toward the northwest where they remain open for expansion. Holes GR21-25 and 26 are strongly oxidized over their entire lengths suggesting a deep level of oxidation within the mineralized area.

Dr. Shane Ebert, President of the Company stated, "All of the holes drilled at Eldorado to date have intersected anomalous gold and most have returned significant intervals grading 0.2 g/t and above. This drill program is confirming and expanding our initial discovery and helping us understand the zone which still remains open in multiple directions and at depth. Hole GR21-25 is especially significant as the recognition of multiple stacked gold zones further increases the size potential of the system. The intercept of 1.3 g/t gold over 21.3 metres seen in hole GR21-25 is a highly encouraging grade in the context of bulk tonnage oxidized gold targets in the Western United States, which can have cut off grades below 0.2 g/t and average grades around 0.5 g/t gold".

Highlights from reverse circulation drill holes GR21-20 to 27

Drill Hole | From (m) | To (m) | Width (m)* | Au g/t |

GR21-21 | 6.1 | 30.5 | 24.4 | 0.2 |

including | 24.4 | 29.0 | 4.6 | 0.3 |

GR21-23 | 39.6 | 42.7 | 3.1 | 0.5 |

GR21-23 | 64.0 | 67.1 | 3.1 | 0.3 |

GR21-24 | 10.7 | 24.4 | 13.7 | 0.2 |

GR21-24 | 19.8 | 24.4 | 4.6 | 0.3 |

GR21-25 | 22.9 | 33.5 | 10.6 | 0.3 |

GR21-25 | 54.9 | 76.2 EOH | 21.3 | 1.3 |

including | 54.9 | 65.5 | 10.6 | 2.4 |

including | 54.9 | 59.4 | 4.5 | 5.1 |

GR21-26 | 3.1 | 7.6 | 4.5 | 0.4 |

GR21-26 | 48.8 | 83.8 | 35.0 | 0.2 |

including | 64.0 | 77.7 | 13.7 | 0.3 |

GR21-27 | 62.5 | 73.2 | 10.7 | 0.2 |

*Drill hole intercepts, true widths have not been determined. Grades have not been capped in the averaging.

Figure 1. Left, RC drilling at the Eldorado Zone. Right, Reverse circulation drill chips collected from hole GR21-25 showing the lower mineralized interval. Note the highly oxidized red hematite-stained nature of the rock chips containing fragments of quartz throughout the mineralized interval.

Figure 2. Eldorado Zone drill hole location map.

Figure 3. Eldorado Zone cross section D-D' showing geology and gold distribution.

January-February Gold Range Drill Program

In early 2021 the Company successfully completed 34 reverse circulation drill holes across 2.5 kilometres of strike length along the southern portion of the Gold Range Property. In total 2357.6 metres were drilled in holes ranging from 38 to 137 metres deep. Fifteen holes were drilled at the Eldorado Zone to test and expand the Company's previously announced bulk tonnage oxide discovery, 5 holes tested various targets across the southern part of the property and 14 holes tested the Excelsior Mine area.

Results for an additional 21 drill holes are pending and will be released as they are received, compiled, and interpreted.

Quality Control

Reverse circulation drill cuttings were collected in numbered cloth sample bags from 5 foot (1.52m) intervals during drilling and were picked up from site and analyzed by Skyline Assayers and Laboratories in Tucson, Arizona (which is ISO/IEC 17025 accredited). A 1000g pulp was prepared and gold was assayed using a 50g fire assay with an atomic absorption finish (method FA-01-50g). Gold samples greater than 5 g/t are redone using a 50g fire assay method with a gravimetric finish (method FA-02 50g). Twenty-four additional elements were analyzed using a multi acid digestion and inductively coupled plasma (method TE-4). The Company included certified reference standards, blanks, and duplicates in every sample batch and then checked to ensure proper quality assurance and quality control.

About Canex Metals

Canex Metals (TSX.V:CANX) is a Canadian junior exploration company focused on advancing its Gold Range Project in Northern Arizona. Led by an experienced management team, which has made three notable porphyry and bulk tonnage discoveries in North America, CANEX has identified and tested several targets which host the potential for bulk tonnage oxide gold mineralization at its Gold Range Project. Drilling in 2020 identified near surface bulk tonnage gold potential at the Eldorado Zone with Hole GR20-9 returning 0.9 g/t gold over 27.3 metres including 5.9 g/t gold over 1.5 metres. The new discovery correlates with a strong gold in soil anomaly and sheeted quartz veinlets and stockworks within metamorphic rocks. CANEX has recently entered into an LOI to acquire the Excelsior Mine, located 2.5 kilometres from Eldorado on the eastern side of the Gold Range Property. Excelsior has seen historic underground and open pit mining along a zone 200 metres long and open along strike. Gold mineralization is centered along the shallow dipping high grade Excelsior Vein which is surrounded by a halo of sheeted quartz and quartz carbonate veins 20 to 50 metres wide.

The Company remains focused on testing and advancing key exploration targets on the Gold Range Property through continued exploration and drilling.

Dr. Shane Ebert P.Geo., is the Qualified Person for Canex Metals and has approved the technical disclosure contained in this news release.

"Shane Ebert"

Shane Ebert

President/Director

Neither the TSX Venture Exchange nor its regulation services provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Except for the historical and present factual information contained herein, the matters set forth in this news release, including words such as "expects", "projects", "plans", "anticipates" and similar expressions, are forward-looking information that represents management of Canex Metals Inc. internal projections, expectations or beliefs concerning, among other things, future operating results and various components thereof or the economic performance of CANEX. The projections, estimates and beliefs contained in such forward-looking statements necessarily involve known and unknown risks and uncertainties, which may cause CANEX's actual performance and financial results in future periods to differ materially from any projections of future performance or results expressed or implied by such forward-looking statements. These risks and uncertainties include, among other things, those described in CANEX's filings with the Canadian securities authorities. Accordingly, holders of CANEX shares and potential investors are cautioned that events or circumstances could cause results to differ materially from those predicted. CANEX disclaims any responsibility to update these forward-looking statements.

For Further Information Contact:

Shane Ebert at 1.250.964.2699 or

Jean Pierre Jutras at 1.403.233.2636

Web: https://www.canexmetals.ca

SOURCE: Canex Metals Inc.

View source version on accesswire.com:

https://www.accesswire.com/642118/Canex-Intersects-13-gt-Gold-Over-213-Metres-Including-51-gt-Gold-Over-45-Metres-at-the-Eldorado-Bulk-Tonnage-Oxide-Gold-Target