Canex Metals Inc. ("CANEX" or the "Company") is pleased to announce assay results have been received for 6 additional drill holes from the Company's 2021 reverse circulation drilling program at the Gold Range Project, Arizona

Highlights

- Hole GR21-45 from the historic Excelsior Mine returned 1.1 g/t gold over 19.8 metres , including 1.8 g/t gold over 10.7 metres .

- Holes GR21-42 and 43 intersected the mineralized zone roughly 150 metres northeast of previously release hole GR21-37 (1.6 g/t gold Au over 35.1 metres), confirming good continuity to the mineralized system over the length tested.

- An amended exploration permit has been received allowing the Company to conduct a third round of exploratory and expansion drilling at Gold Range.

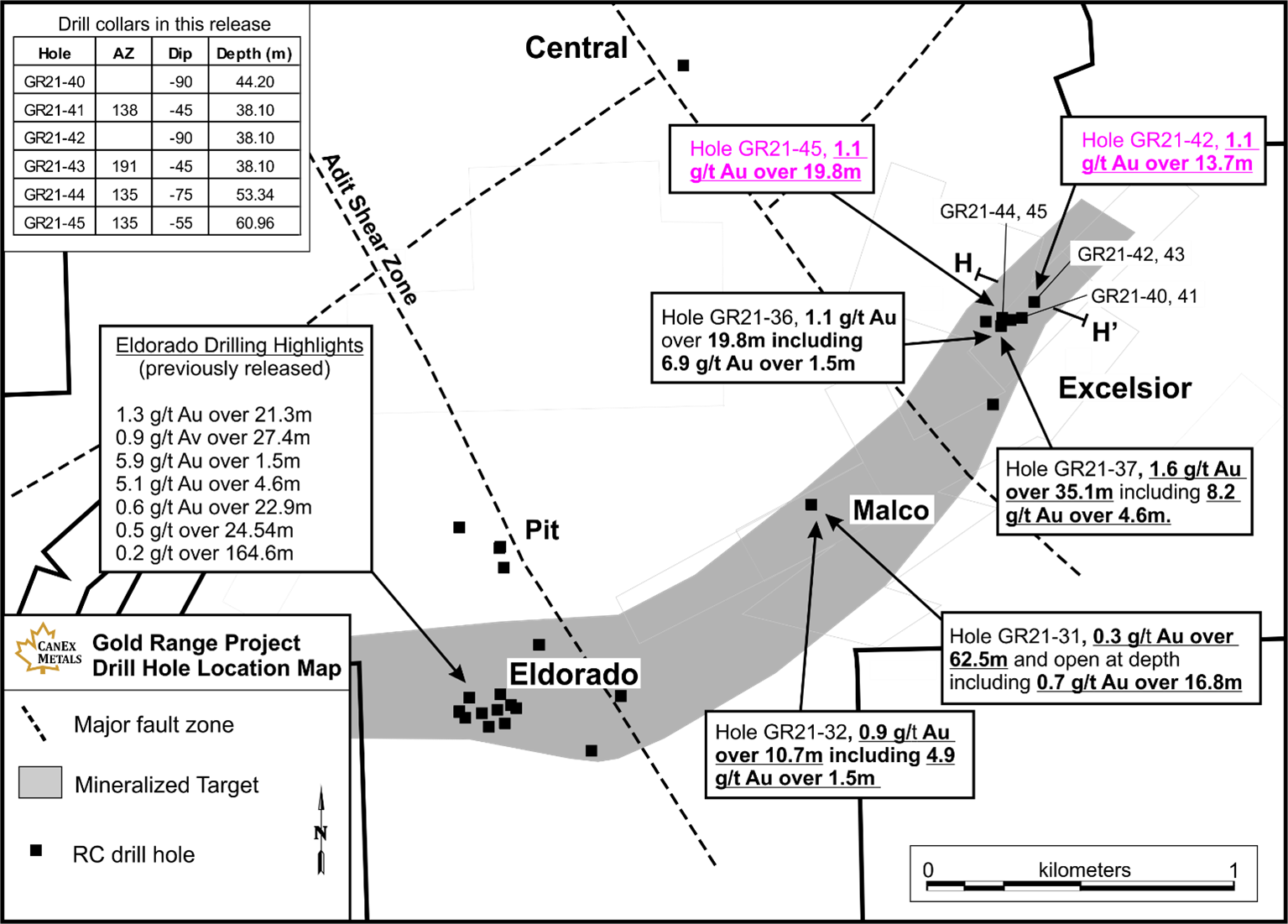

Results for reverse circulation drill holes GR21-40 to 45 from the Company's 2021 drilling program at the Gold Range project have been received and are presented here. A map showing drill hole locations is shown on Figure 1.

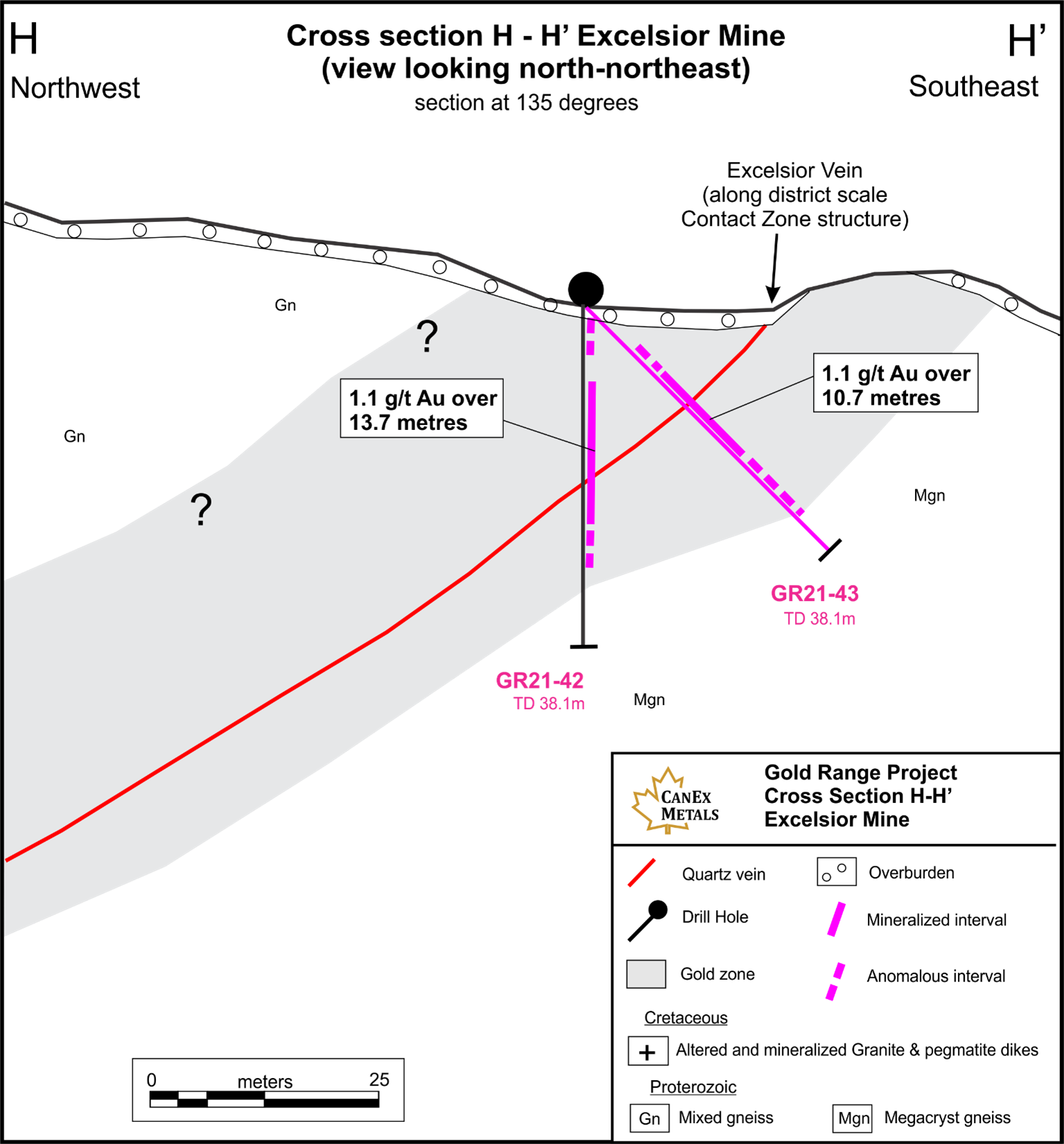

Holes GR21-40, 41, 44 and 45 all tested the middle portion of the Excelsior area and all holes returned strong mineralization as summarized in table 1. Hole GR21-45 intersected 1.1 g/t gold over 19.8 metres starting at 29 metres depth including 1.8 g/t gold over 10.7 metres . Holes GR21-42 and 43 were the northern most test of the Excelsior zone and both returned strong mineralization demonstrating the system is open for expansion to the northeast. Due to access constraints both holes GR21-42 and 43 were collared close to the Excelsior Vein and tested a limited portion of the hangingwall of the system.

The maiden drill program at Excelsior has now demonstrated good continuity and grade in all locations tested and the zone is open for expansion along strike to the northeast, southwest, and at depth.

The Bureau of Land Management (BLM) has approved a permit amendment allowing the Company to construct 20 additional drill pads on BLM administered lands, with multiple drill holes allowed from each pad. In addition, the Company now controls 2 patented claims (private land) where several additional holes are also be planned. Details for the next round of drilling at Gold Range will be announced once they are finalized.

Highlights from reverse circulation drill holes GR21-33 to 39

| Drill Hole | From (m) | To (m) | Width (m)* | Au g/t |

| GR21-40 | 12.19 | 22.86 | 10.7 | 0.6 |

| GR21-41 | 10.67 | 13.72 | 3.1 | 1.1 |

| GR21-42 | 10.67 | 24.38 | 13.7 | 1.1 |

| GR21-43 | 12.19 | 22.86 | 10.7 | 1.1 |

| including | 18.29 | 21.34 | 3.0 | 2.4 |

| GR21-44 | 27.43 | 33.53 | 6.1 | 0.5 |

| GR21-44 | 44.20 | 47.24 | 3.0 | 0.4 |

| GR21-45 | 28.96 | 48.77 | 19.8 | 1.1 |

| including | 32 | 42.67 | 10.7 | 1.8 |

| including | 41.15 | 42.67 | 1.5 | 4.2 |

*Drill hole intercepts, true widths have not been determined. Grades have not been capped in the averaging.

Figure 1. Gold Range Property showing drill holes in this release and the location of cross section H - H' at the historic Excelsior Mine.

Figure 2. Cross section H - H' through the Excelsior Mine.

January-February Gold Range Drill Program

In early 2021 the Company successfully completed 34 reverse circulation drill holes across 2.5 kilometres of strike length along the southern portion of the Gold Range Property. In total 2357.6 metres were drilled in holes ranging from 38 to 137 metres deep. Fifteen holes were drilled at the Eldorado Zone to test and expand the Company's previously announced bulk tonnage oxide discovery, 5 holes tested various targets across the southern part of the property and 14 holes tested the Excelsior Mine area.

To date 31 holes from the 2021 drill program have been received and released and results for an additional 3 drill holes are pending and will be released as they are received, compiled, and interpreted.

Quality Control

Reverse circulation drill cuttings were collected in numbered cloth sample bags from 5 foot (1.52m) intervals during drilling and were picked up from site and analyzed by Skyline Assayers and Laboratories in Tucson, Arizona (which is ISO/IEC 17025 accredited). A 1000g pulp was prepared and gold was assayed using a 50g fire assay with an atomic absorption finish (method FA-01-50g). Gold samples greater than 5 g/t are redone using a 50g fire assay method with a gravimetric finish (method FA-02 50g). Twenty-four additional elements were analyzed using a multi acid digestion and inductively coupled plasma (method TE-4). The Company included certified reference standards, blanks, and duplicates in every sample batch and then checked to ensure proper quality assurance and quality control.

About Canex Metals

Canex Metals (TSX.V:CANX) is a Canadian junior exploration company focused on advancing its Gold Range Project in Northern Arizona. Led by an experienced management team, which has made three notable porphyry and bulk tonnage discoveries in North America, CANEX has identified and tested several targets which host the potential for bulk tonnage oxide gold mineralization at its Gold Range Project. Recent drilling has identified near surface bulk tonnage gold potential at the Eldorado and Excelsior Zones with Hole GR21-37 from Excelsior returning 1.6 g/t gold over 35.1 metres including 8.2 g/t gold over 4.6 metres . These new discoveries occur along a 3 kilometre long highly prospective mineralized trend that has seen limited modern exploration.

The Company remains focused on testing and advancing key exploration targets on the Gold Range Property through continued exploration and drilling.

Dr. Shane Ebert P.Geo., is the Qualified Person for Canex Metals and has approved the technical disclosure contained in this news release.

"Shane Ebert",

Shane Ebert

President/Director

For Further Information Contact:

Shane Ebert at 1.250.964.2699 or

Jean Pierre Jutras at 1.403.233.2636

Web: https://www.canexmetals.ca

Neither the TSX Venture Exchange nor its regulation services provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Except for the historical and present factual information contained herein, the matters set forth in this news release, including words such as "expects", "projects", "plans", "anticipates" and similar expressions, are forward-looking information that represents management of Canex Metals Inc. internal projections, expectations or beliefs concerning, among other things, future operating results and various components thereof or the economic performance of CANEX. The projections, estimates and beliefs contained in such forward-looking statements necessarily involve known and unknown risks and uncertainties, which may cause CANEX's actual performance and financial results in future periods to differ materially from any projections of future performance or results expressed or implied by such forward-looking statements. These risks and uncertainties include, among other things, those described in CANEX's filings with the Canadian securities authorities. Accordingly, holders of CANEX shares and potential investors are cautioned that events or circumstances could cause results to differ materially from those predicted. CANEX disclaims any responsibility to update these forward-looking statements.

SOURCE: Canex Metals Inc.

View source version on accesswire.com:

https://www.accesswire.com/653256/Canex-Intersects-11-GT-Gold-Over-198-Metres-at-the-Excelsior-Mine-Gold-Range-Project-Arizona