(TheNewswire)

-

- 2020 soils survey expands anomalous gold values to over 3,000 metres of strike length in prospective Junction Creek Sandstone

- Gold values 0.52 to 6.28 g/t from underground grab samples

- Drill program permitting underway

Vancouver, BC TheNewswire - March 10, 2021 - Alianza Minerals Ltd. ( TSXV:ANZ ) ( OTC:TARSF ) (" Alianza" or the "Company" ) is pleased to report the results of the surface exploration program at the Twin Canyon Gold Project in southwestern Colorado. The Twin Canyon Gold Project hosts disseminated gold mineralization in sandstone and was the site of a small mining operation dating back to the 1950s.

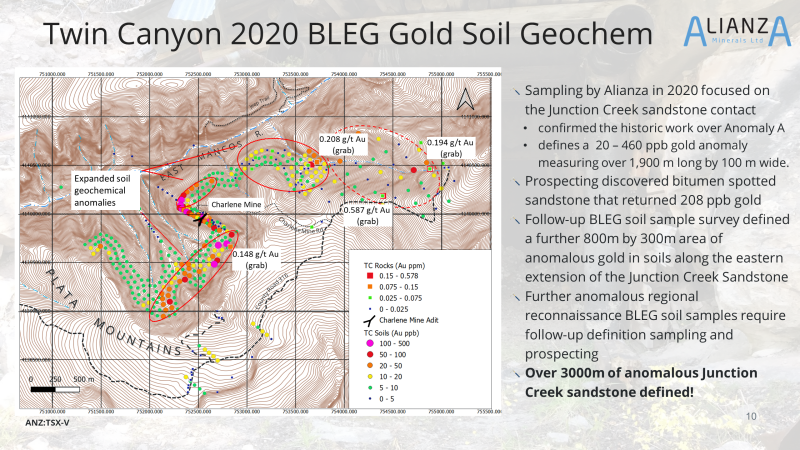

The current program successfully expanded the size of the gold in soil anomaly footprint to over 3,000 metres along the prospective Junction Creek Sandstone. The anomalous values range from 10 ppb – 460 ppb gold. Limited sampling of both the stratigraphically lower Entrada, and stratigraphically higher Dakota, sandstones returned weakly anomalous gold values opening up two new prospective units with potential to host gold mineralization. In light of the successful expansion of the soil geochemical anomalies, Alianza has commenced permitting an initial drill program to test the extent of gold mineralization in the Junction Creek Sandstone and other targets that may be identified.

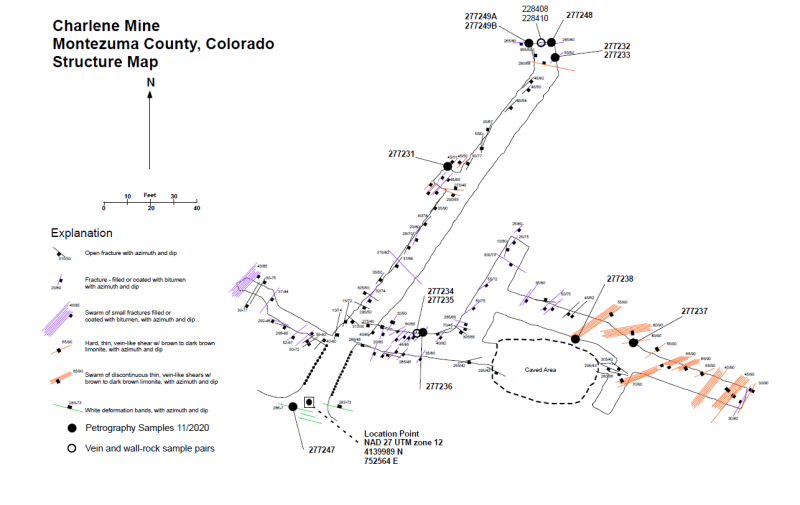

An underground structural mapping and sampling program was also completed and revealed that two types of black bitumen veins and fracture fills along with resistant brown coloured shears are associated with gold mineralization. Gold-bearing veins, fracture fills and shears dominantly strike north-east and dip to the south east. This orientation is approximately orthogonal to the axis of an anticline centred over Twin Canyon. These types of mineralized veins returned 1.15 – 5.66 g/t gold from grab samples, while the immediate wall rock surrounding them consisting of disseminated bitumen-spotted sandstone and hard brown concretions also returned highly anomalous values ranging from 0.52 – 6.28 g/t gold. A sample of white, resistant deformation bands and wall rock with a north-west strike parallel to the strike of the anticline returned 1.45 g/t gold.

"We are excited by the results of our sampling programs at Twin Canyon," stated Jason Weber, P.Geo., President and CEO of Alianza. "We have now demonstrated a large anomalous gold footprint over 3,000 metres in length with multiple prospective altered host stratigraphic horizons. A key component of the program was gaining an understanding of structural controls for gold mineralization, which we have achieved along with returning numerous multi-gram-per-tonne gold analyses. This knowledge will be utilized in designing and re fining drill targets at Twin Canyon and will be integral to finding a partner to advance the project through drilling."

Alianza launched the 2020 fall program to follow up the successful first field program at Twin Canyon. Highlights of that work included expansion of the property to over four square kilometres, definition of a large gold in soil anomaly ranging from 20 – 460 ppb gold and measuring over 1,900 metres long by 100 metres wide, and the discovery of new areas of gold mineralization through limited prospecting. Results included 0.208 g/t gold in a grab sample of bitumen-spotted altered Junction Creek Sandstone.

Gold mineralization occurs at Twin Canyon in areas where the host sandstone unit is bleached and spotted with bitumen, with small amounts of limonite after pyrite. Optical and microprobe work carried out on mineralized samples indicate a direct gold – bitumen association raising the novel possibility that the mineralizing process at Twin Canyon is related to those associated with petroleum basin development. A small underground gold mine (the Charlene Mine) operated at Twin Canyon dating back to the mid-1950s. Historical sampling of the underground workings has returned grab samples ranging from 0.1 to 15.77 g/t gold. Twenty-eight historical channel samples 1.5 to 10 metres in length were anomalous in gold, eight of which exceeded 2 g/t gold (including a highlight of 8.1 g/t gold over 3 metres).

Figure 1 . Twin Canyon Soil and Rock Geochemistry Plan

Figure 2 . Plan map of 2020 underground sampling and structural mapping

Table 1: Twin Canyon – Charlene Structural Mapping – Grab Sample Results.

| Sample # | Au g/t | Description |

| 228408 | 4.50 | bitumen vein type 1 |

| 228410 | 0.952 | wall rock - bitumen vein type 1 |

| 277231 | 0.861 | wall rock - hard brown shear |

| 277232 | 2.22 | hard brown concretion |

| 277233 | 1.465 | wall rock - bitumen vein type 1 |

| 277234 | 5.66 | bitumen vein type 1 |

| 277235 | 6.28 | wall rock - bitumen vein type 1 |

| 277236 | 3.86 | wall rock - bitumen vein type 2 |

| 277237 | 0.518 | wall rock - hard brown shear |

| 277238 | 3.03 | wall rock and shear - hard brown shear |

| 277247 | 1.445 | white deformation bands w/ wall rock |

| 277248 | 0.52 | wall rock - bitumen vein type 1 |

| 277249 | 1.145 | wall rock - bitumen vein type 1 & 2 |

About Alianza Minerals Ltd.

Alianza employs a hybrid business model of joint venture funding and self-funded projects to maximize opportunity for exploration success. The Company currently has gold, silver and base metal projects in Yukon Territory, British Columbia, Nevada and Peru. Alianza currently has one project (Tim, Yukon Territory) optioned out to Coeur Mining, Inc. and is actively seeking partners on other projects.

The Company is listed on the TSX Venture Exchange under the symbol "ANZ" and trades on the OTC market in the US under the symbol TARSF.

Mr. Jason Weber, P.Geo., President and CEO of Alianza Minerals Ltd. is a Qualified Person as defined by National Instrument 43-101. Mr. Weber supervised the preparation of the technical information contained in this release.

For further information, contact:

| Jason Weber, President and CEO Sandrine Lam, Shareholder Communications Tel: (604) 807-7217 Fax: (888) 889-4874 Renmark Financial Communications Inc. Melanie Barbeau mbarbeau@renmarkfinancial.com Tel: (416) 644-2020 or (514) 939-3989 To learn more visit: www.alianzaminerals.com |

NEITHER THE TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE. STATEMENTS IN THIS NEWS RELEASE, OTHER THAN PURELY HISTORICAL INFORMATION, INCLUDING STATEMENTS RELATING TO THE COMPANY'S FUTURE PLANS AND OBJECTIVES OR EXPECTED RESULTS, MAY INCLUDE FORWARD-LOOKING STATEMENTS. FORWARD-LOOKING STATEMENTS ARE BASED ON NUMEROUS ASSUMPTIONS AND ARE SUBJECT TO ALL OF THE RISKS AND UNCERTAINTIES INHERENT IN RESOURCE EXPLORATION AND DEVELOPMENT. AS A RESULT, ACTUAL RESULTS MAY VARY MATERIALLY FROM THOSE DESCRIBED IN THE FORWARD-LOOKING STATEMENTS.

Copyright (c) 2021 TheNewswire - All rights reserved.