Summary:

- Chilean Metals Inc. has formally changed its name to "Power Nickel Inc." to reflect its focus on the development of its James Bay High-Grade Nickel Copper Cobalt Palladium "Nisk" Project.

- Effective Monday on July 12 Power Nickel will start trading on the TSXV under the symbol PNPN

- Power Nickel will hereafter create a subsidiary Consolidation Gold and Copper Inc. to be spun out as a separate public company where it will hold our interests in the British Columbia Golden Ivan project and our complete suite of Chilean assets and sufficient capital for one year of operations.

- It is expected that Power Nickel will retain an 80% ownership position in Consolidation Gold and Copper and Shareholders of Power Nickel will directly receive the remaining 20% through a plan of arrangement which we expect to formally announce before the end of July.

Power Nickel Inc. (the "Company" or "Power Nickel") (TSXV:PNPN, OTCBB: CMETF, Frankfurt IVVI) is pleased to announce that it will commence trading under its new symbol PNPN on the TSXV on July 12, 2021

Proposed Transaction Highlights

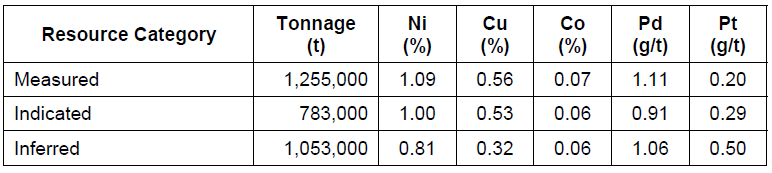

Chilean Metals has formally been renamed Power Nickel Inc. and will focus its efforts on the exploration and development of the James Bay Nisk project. On February 1, 2021, Chilean Metals completed the acquisition of its option to acquire up to 80% of the Nisk project from Critical Elements Lithium Corporation. The below estimates at the Nisk project are of a historic resource and the Company's geology expert team has not completed sufficient work to confirm a NI 43-101 compliant resource. Therefore, caution is appropriate since the estimates cannot, and should not be relied upon. For merely informational purposes see Table 1.

Table ‑1: Historical Resource Estimate figures for respective confidence categories at the NISK-1 deposit, After RSW Inc 2009: Resource Estimate for the NISK-1 Deposit, Lac Levac Property, Nemiscau, Québec.

The information regarding the NISK-1 deposit was derived from the technical report titled "Resource Estimate for the NISK-1 Deposit, Lac Levac Property, Nemiscau, Québec" dated December 2009. The key assumptions, parameters and methods used to prepare the mineral resource estimates described above are set out in the technical report.

The NISK property comprises a large land position (20 kilometres of strike length) with numerous high-grade intercepts outside the current resource area. Power Nickel, formerly Chilean is focused on expanding its current high-grade nickel-copper PGE mineralization historical resource prepared in accordance with NI 43-101, identifying additional high-grade mineralization, and developing a process to potentially produce nickel sulphates responsibly for batteries to be used in the electric vehicles industry.

- Shareholders of Power Nickel will receive shares in Consolidation Gold and Copper Inc. proposed to be carved out by a plan of arrangement, at ratios to be determined by legal, tax and valuation considerations

- Consolidation Gold and Copper is proposed to hold all the historic assets which remain in Chile as follows:

- The 5600-hectare Tierra de Oro (TDO) property is located about 70 Kms south of Copiapo. Historically about $6,000,000 has been spent exploring TDO with the most recent drill program completed and reported in January 2021 which highlighted a 2-metre section that returned 716 grams of silver and .45% copper.

- The 4300-hectare Zulema property located about 50 Kms southwest from Copiapo and adjoining the Candelaria Mine[1] property (Over 950 Million Tonnes Copper, Gold & Silver according to NI- 43101 2018 report on Lundin Mining site)) An exploration program at the property in 2018 highlighted a garnet magnetite skarn with multiple lenses of Copper- Magnetite mineralization. Within the skarn, copper ranged from 0.12- 1.19% Cu and between 0.05 - 0.99g/t Au.

- The 9,000-hectare Palo Negro and Hornitos properties are located in Region 3 about 30 Kms west of the Candelaria mine. The properties are currently the focus of a number of geophysical programs including magnetics and IP over portions of the property which have previously been highlighted to be of interest.

- Assets also include a 3% NSR royalty interest on any future production from the Copaquire Cu-Mo deposit, previously sold to a subsidiary of Teck Resources Inc. ("Teck"). Under the terms of the sale agreement, Teck has the right to acquire one-third of the 3% NSR for $3 million dollars at any time. The Copaquire property borders Teck's producing Quebrada Blanca copper mine[2] in Chile's First Region.

- The property hosts two known mineral showings (Gold Ore, and Magee), and a portion of the past-producing Silverado Mine, which was reportedly exploited between 1921 and 1939. These mineral showings are described to be Polymetallic veins that contain quantities of Silver, Lead, Zinc +/- Gold +/- Copper. Numerous additional mineral occurrences, showings, and past-producing mines are located in the immediate areas surrounding the property, further supporting the sense of a presence of widespread mineralization in the areas.

- The property is relatively underexplored. In 2018 Precision Geophysics completed an 88-line kilometre combined magnetic and gamma-ray spectrometry survey on behalf of the vendor (who sold to Chilean Metals) Granby Gold Inc. Standard magnetic and radiometric data products were prepared and additional interpolate structural analyses were performed on the collected data. A number of areas of coincident magnetic and radiometric anomalism have been identified, additionally ‘structurally prepared' zones are identified from the structural analysis interpolates. Such characteristics are widely regarded as favorable indicators of widespread hydrothermal alteration aka Porphyries and may aid in vectoring toward any causative source intrusions that may be located on the property. Three preliminary target areas of merit are established as a result of that survey and will be the focus of initial explorations at the site.

- Consolidation Gold & Copper Inc. will also hold the previously purchased asset we have called the Golden Ivan project in the Golden Triangle. The Golden Triangle is host to numerous past and current mining operations and the region has reported mineral resources that total up to 67 million oz of gold, 569 million oz of silver, and 27 billion pounds of copper. Recent mineral development activity within the local area includes Ascot Resources recently funded Premier Gold mine[3] (2.3 Million oz gold), which has received $105 million in project construction financing for the development of renewed operations at the historic exploited Premier Gold deposit. Other notable active projects in the local area include the neighbouring Silverado project, and Red Mountain, and Homestake projects amongst many others.[4] Further to the north Pretivm's Bruce Jack mine[5] (4.2 million oz gold), and the neighboring KSM and Eskay deposits also have significant gold, silver, and copper resources that are yet to be realized.

- Shareholders of the proposed Consolidation Gold and Copper Inc. should benefit from an increased focus on core opportunities that appeal to each different investor base. As Chilean Metals, now Power Nickel grew through the acquisition of NISK and Golden Ivan, it is anticipated that the new public company could similarly benefit on a go-forward basis.

Company CEO and Director Mr. Terry Lynch stated, "The result of this proposed transaction will be two stand-alone companies with attractive assets focused on specific opportunities to grow and create value for their shareholders. The driving force behind the change is to communicate in a very clear way our shift in primary focus on the NISK Battery Metals project. It is rare to find a project with a historical resource that we believe has a credible chance to become a mine. The electrification movement in Automobiles and Industry is growing more and more every day and this growth will be very supportive to the price curves in Nickel, Copper, Cobalt, and Palladium. We look forward to concentrating our efforts on NISK and moving it from Historical resource through the mine development process as quickly as possible. We are currently evaluating a newly prepared 3D Model of the NISK project and will finalize our drilling program in the next week and announce a Q3 start of an expected 3-4,000 metre drill program. We would expect after this round of drilling to have a revised 43-101 available in Q4 2021."

Board and Management Team

Power Nickel will feature the same board as Chilean Metals today.

Consolidation Gold and Copper Inc. will have the same board with the valuable addition of Hugh Maddin to the Board. Hugh Maddin is a distinguished and accomplished retired lawyer and an experienced mining investor. Hugh Maddin owns Granby Gold, from whom Chilean Metals purchased the Golden Ivan project in 2020.

Transaction Details

The proposed transactions will be carried out by way of a court-approved plan of arrangement under the Business Corporations Act (British Columbia) and are subject to a number of conditions being satisfied or waived at or prior to closing, including approval of the shareholders of Power Nickel and receipt of all necessary regulatory, TSXV and court approvals and the satisfaction of certain other closing conditions customary for a transaction of this nature.

It is expected that the required special meeting of Chilean Metals shareholders to approve the proposed Transaction will be held in August 2021 with closing shortly thereafter. The Company continues to plan the final structure to address regulatory, accounting, tax, corporate, and securities matters in Canada, the United States (where Chilean, now Power Nickel has some resident shareholders) and Chile, where certain assets, as well as shareholders, are located

Further information regarding the transactions will be contained in a management information circular to be prepared by the Company and mailed to shareholders in connection with an annual general and special meeting of shareholders to consider the transactions. All shareholders of the Company are urged to read the information circular once available, as it will contain important additional information concerning the transactions.

About Power Nickel Inc.

Power Nickel is a Canadian junior exploration company focusing on high-potential copper, gold, and battery metal prospects in Canada and Chile.

On February 1, 2021 Power Nickel (then called Chilean Metals) completed the acquisition of its option to acquire up to 80% of the Nisk project.

The NISK property comprises a large land position (20 kilometres of strike length) with numerous high-grade intercepts outside the current resource area. Chilean is focused on expanding its current high-grade nickel-copper PGE mineralization historical resource prepared in accordance with NI 43-101, identifying additional high-grade mineralization and developing a process to potentially produce nickel sulphates responsibly for batteries for the electric vehicles industry.

Power Nickel (then called Chilean Metals) announced on June 8th, 2021 that an agreement has been made to complete the 1oo% acquisition of its Golden Ivan project in the heart of the Golden Triangle. The Golden Triangle has reported mineral resources (past production and current resources) in a total of 67 million ounces of gold, 569 million ounces of silver, and 27 billion pounds of copper. This property hosts two known mineral showings (gold ore and magee), and a portion of the past-producing Silverado mine, which was reportedly exploited between 1921 and 1939. These mineral showings are described to be Polymetallic veins that contain quantities of silver, lead, zinc, plus/minus gold, and plus/minus copper.

Power Nickel, pre proposed Plan of Arrangement is the 100-per-cent owner of five properties comprising over 50,000 acres strategically located in the prolific iron-oxide-copper-gold belt of northern Chile. It also owns a 3-per-cent NSR royalty interest on any future production from the Copaquire copper-molybdenum deposit, recently sold to a subsidiary of Teck resources Inc. Under the terms of the sale agreement, Teck has the right to acquire one-third of the 3-per-cent NSR for $3-million at any time. The Copaquire property borders Teck's producing Quebrada Blanca copper mine in Chile's first region.

Qualified Person

Qualified Person Luke van der Meer, P.Geo. (Licence # 37848), Independent Geological Consultant, Qualified Person under NI 43-101, has reviewed and approved the technical content of this release.

ON BEHALF OF THE BOARD OF DIRECTORS

Power Nickel Inc.

Terry Lynch, CEO

647-448-8044

For further information, readers are encouraged to contact:

Power Nickel Inc.

The Canadian Venture Building

82 Richmond St East, Suite 202

Toronto, ON

Terry Lynch & CEO terry@powernickel.com

Cautionary Note Regarding Forward-Looking Statement

This news release may contain certain statements that may be deemed 'forward-looking statements'. All statements in this release, other than statements of historical fact, that address events or developments that PNPN expects to occur, including details related to the proposed spin-out transactions, are forward-looking statements. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words 'expects', 'plans', 'anticipates', 'believes', 'intends', 'estimates', 'projects', 'potential' and similar expressions, or that events or conditions 'will', 'would', 'may', 'could' or 'should' occur. Forward-looking statements in this document include statements regarding current and future exploration programs, activities and results. Although PNPN believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results may differ materially from those in forward-looking statements. Factors that could cause the actual results to differ materially from those in forward-looking statements include market prices, exploitation and exploration success, continued availability of capital and financing, inability to obtain required regulatory or governmental approvals and general economic, market or business conditions. Investors are cautioned that any such statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the forward-looking statements. Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accept responsibility for the adequacy or accuracy of this release.

[1] Reference to the nearby Candelaria mine is for information purposes only and there are no assurances that the Company's properties will achieve similar results.

[2] Reference to the nearby Quebrada Blanca mine is for information purposes only and there are no assurances that the Company's properties will achieve similar results.

[3] Reference to the nearby Premier Gold mine is for information purposes only and there are no assurances that the Company's properties will achieve similar results.

[4] Reference to these nearby properties is for information purposes only and there are no assurances that the Company's properties will achieve similar results.

[5] Reference to the nearby Bruce Jack mine is for information purposes only and there are no assurances that the Company's properties will achieve similar results.

SOURCE: Chilean Metals, Inc.

View source version on accesswire.com:

https://www.accesswire.com/655082/Chilean-Metals-is-Now-Power-Nickel-PNPNTSXV