Chilean Metals Inc. ("Chilean Metals," "CMX" or the "Company") (TSX.V:CMX)(SSE:CMX)(MILA:CMX) is pleased to announce it has agreed to acquire 100% of the Golden Ivan property from Granby Gold Inc., via a payment of 6,500,000 shares of CMX. Golden Ivan is located approximately 3 kilometers to the east of Stewart, BC in the heart of the Golden Triangle. The Golden Ivan property consists of 13 mineral claims, all in good standing, for a total area of approximately 797 hectares. This agreement revises the parties' earlier option agreement

Previously as announced on January 14, 2021, Chilean had agreed to acquire the property by making a series of cash payments totaling $150,000 (the 'Cash Payments') to Granby Gold Inc. (the "Optionor") on or before the dates set out below:

(i) $50,000 on or before September 30, 2021;

(ii) an additional $50,000 on or before September 30, 2022; and

(iii) an additional $50,000 on or before September 30, 2023;

Along with stock payments in aggregate of 11,400,000 Shares to the Optionor (the 'Share Payments'), on or before the dates set out below:

(i) 3,900,000 Shares on the signing of the agreement, which has been completed.

(ii) an additional 2,500,000 Shares on or before September 30, 2021;

(iii) an additional 2,500,000 Shares on or before September 30, 2022; and

(iv) an additional 2,500,000 Shares on or before September 30, 2023.

Chilean, under the prior arrangement, would also have been required to incur an aggregate of $1,800,000 of work expenditures on the Property on or before the dates set out below:

- $450,000 in Work Expenditures on or before September 30, 2021;

- $450,000 in Work Expenditures on or before September 30, 2022;

- $450,000 in Work Expenditures on or before September 30, 2023; and

- $450,000 in Work Expenditures on or before September 30, 2024.

On the performance of the Cash and Share, Payments noted above and completion of the work commitments Chilean Metals Inc. would acquire a 100% interest subject only to a 2.5% NSR royalty. Chilean retains the option to purchase 40% of this royalty for a one-time payment of $1,000,000.

The revised 100% purchase agreement eliminates the cash payments and work commitment and expedites the payment by shares while reducing the overall quantity of shares by 1,000,000 shares from the original agreement. The final share issuance of 6,500,000 shares is subject to a four-month hold period from the date of the share issuance. Approval of this transaction, as revised, is subject to the approval of the TSXV.

Chilean has filed on SEDAR the "Technical Report on the Golden Ivan Property" with an effective date of December 6, 2020, prepared by Derrick Strickland, PGeo and Locke Goldsmith, PGeo, P.Eng.

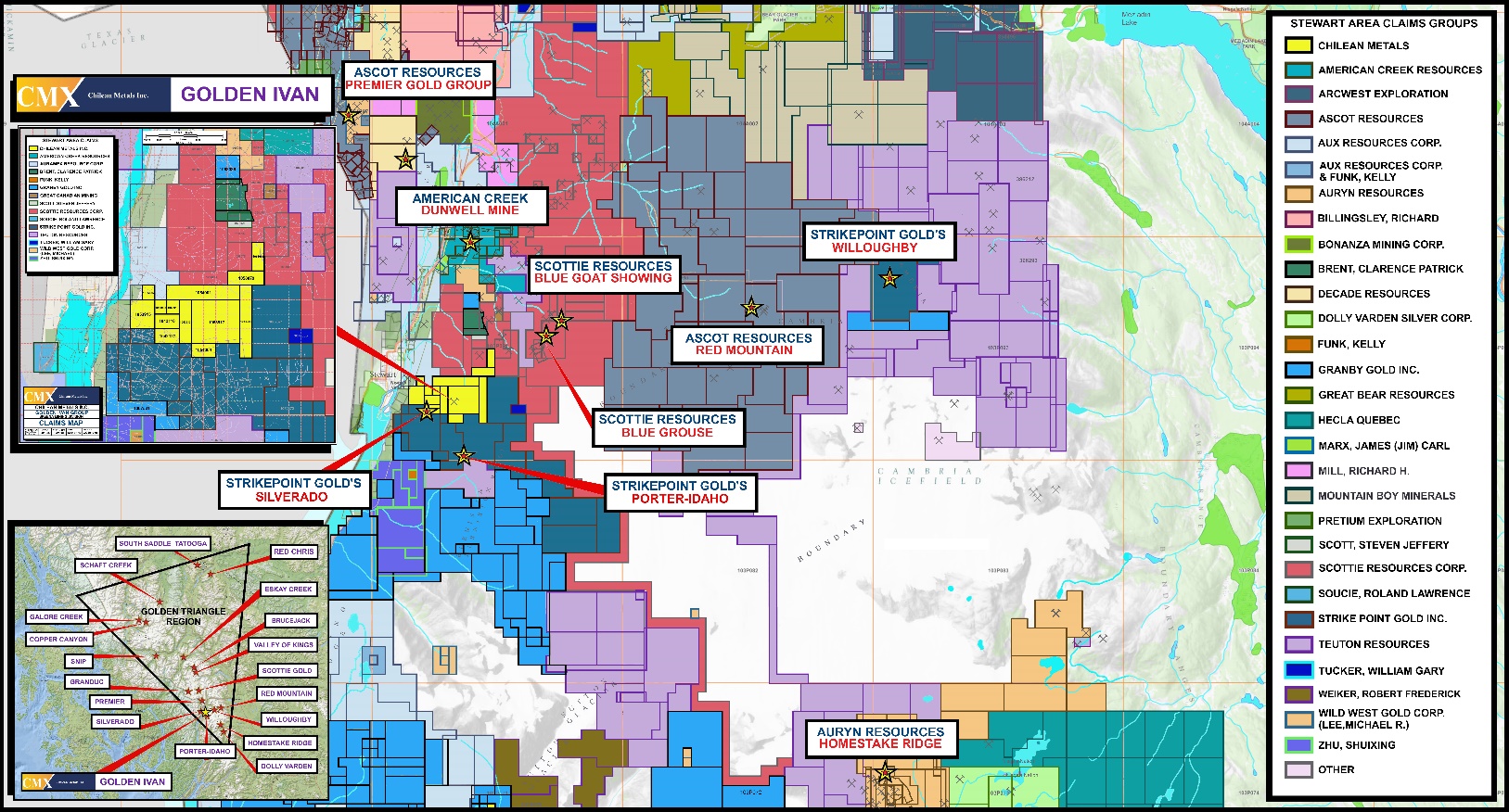

Figure 1 - Golden Ivan as noted in Maps above is located in the heart of Golden Triangle & Close to Stewart

"Recent events made a complete acquisition of Golden Ivan project under the revised terms the best strategic move for Chilean at this time. Two subsequent developments made this arrangement beneficial. First Chilean entered into an option agreement to acquire 80% of the NISK Nickel project as announced here https://chileanmetals.com/wp-content/uploads/2021/02/CMX-closes-on-Nisk-Final-Feb23-converted.pdf. The potential of developing NISK as a Nickel Sulphate deposit has prompted Chilean Metals to change its focus to Battery Metals from Copper Gold. During the same time period, Chilean has announced plans to change its name to Power Nickel and to explore a Plan of Arrangement to spin off its Copper Gold assets. With these proposed steps in mind converting the option agreement on Golden Ivan to an actual acquisition provides a much more valuable asset to take public via the execution of the proposed Plan of Arrangement now in development. Secondly, the area around Golden Ivan has gotten a lot more interesting with the advancement of Ascot Resources (AOT:TSE), Scottie Resources (SCOT:TSXV), and Strikepoint Gold ( SKP:TSXV). These unrelated Companies surround our Golden Ivan project and the market increasingly is excited about the development potential for these companies and this interest may be transferred inferentially to our undrilled Golden Ivan project. The ability for Chilean to lock in the Golden Ivan project at a reduced ultimate share cost, cash cost but with increased development flexibility made this an agreement we were excited to conclude. commented Terry Lynch Chilean CEO.

The Company cautions that references to nearby unrelated properties are for general information purposes only and there are no assurances that the Company will obtain similar results and benefits at the Golden Ivan property.

About the Golden Ivan Property

The Golden Ivan property is situated toward the south of British Columbia's prolific ‘Golden Triangle', which hosts numerous profitable mineral deposits and is known to be highly prospective for large-scale mineral systems, including large-scale porphyry systems, high-grade gold and silver veins, and volcanogenic massive sulphides. The Golden Triangle is host to numerous past and current mining operations and has reported mineral resources which total up to 67 million oz of gold, 569 million oz of silver, and 27 billion pounds of copper. Recent mineral development activity within the local area includes Ascot Resources' recently funded Premier Gold mine (2.3 Million oz gold), which has received $105 million in project construction financing for the development of renewed operations at the historic exploited Premier Gold deposit. Other notable active projects in the local area include the neighboring Silverado project, and Red Mountain, and Homestake projects amongst many others. Further to the north Pretivm's Bruce Jack mine (4.2 million oz gold), and the neighboring KSM and Eskay deposits also have significant gold, silver, and copper resources that are yet to be realized.

The Golden Ivan property is located approximately 15km southwest of the Red Mountain Gold/Silver deposit and 30 km south of the historic Premier Gold mine. Immediately to the south of the property significant Silver resources have recently been established at the Porter-Idaho deposit, along several mineralized veins that strike onto the Golden Ivan property.

Physiography and Access: The property covers dominantly high alpine areas situated between Mt Rainy and Mt Maggie and is located adjacent to the Cambria Icefield. Several small glaciers occur on the property, which is otherwise typified by rock outcrop and glacial debris, with forested areas at lower elevations toward the west. The property is accessible by Helicopter from the town of Stewart, and is amenable to seasonal exploration from June onwards. Stewart has deep seaport access, road access, and is a regional hub for mineral exploration services.

Capsulate Geology: Based on the limited publicly available information; the property is located within Stikine Terrane (Stikinia) of the Canadian Cordillera and is underlain by felsic to intermediate volcanogenic sediments of the Jurassic Hazelton Group, which are unconformably overlain by Bowser Basin sediments. The property is understood to be situated over steeply dipping overturned sediments within the Mt Rainy syncline and is located adjacent to a significant E-W fault (the Silverado fault) located toward the south of the property. The local area additionally hosts several intrusive complexes of the Coast Crystalline Belt; including Hyder and Glacier creek plutons. Numerous dykes are reported to cross the property in a general northwest direction.

Previous Work: The property hosts two (2) known mineral showings (Gold Ore, and Magee), and a portion of the past-producing Silverado Mine, which was reportedly exploited between 1921 and 1939. These mineral showings are described to be Polymetallic veins that contain quantities of Silver, Lead, Zinc +/- Gold +/- Copper. Numerous additional mineral occurrences, showings, and past procuring mines are located in the immediate areas surrounding the property, further supporting the presence of widespread mineralization in the areas.

The property is relatively under-explored. Work that was completed by previous operators from the 1980s to 2011, included prospecting, limited geochemical sampling, some ground-based geophysics surveys; limited sampling from the historical workings at the Silverado Mine was also performed.

In 2018 Precision Geophysics completed an 88-line kilometer combined magnetic and gamma-ray spectrometry survey on behalf of the vendor Granby Gold Inc. Standard magnetic and radiometric data products were prepared and additional interpolate structural analyses were performed on the collected data. A number of areas of coincident magnetic and radiometric anomalism have been identified, additionally ‘structurally prepared' zones are identified from the structural analysis interpolates. Such characteristics are widely regarded as favorable indicators of widespread hydrothermal alteration aka Porphyries, and may likely aid in vectoring toward any causative source intrusions that may be located on the property. Three preliminary target areas of merit are now established as a result of the survey and will be the focus of initial explorations at the site.

Future Exploration: The Company intends to focus future exploration efforts to determine the potential causative source intrusions of the mineralization observed across the property, and surrounding areas. The initial phase of exploration is anticipated to include systematic geological and structural and alteration mapping, as well as geochemical sampling across the property to determine any local areas of anomalism. This would be followed by ground-based geophysics to confirm local structural trends prior to proceeding with an initial drill program in the summer/fall of 2021.

Qualified Person

Qualified Person Luke van der Meer, P.Geo. (Licence # 37848), Independent Geological Consultant., is a Qualified Person under NI 43- 101 on standards of disclosure for mineral projects, has reviewed and approved the technical content of this release.

About Chilean Metals,

www.chileanmetals.com/

Chilean Metals Inc. is a Canadian Junior Exploration Company focusing on high potential Copper Gold prospects in Chile and Canada.

Chilean Metals Inc is 100% owner of five properties comprising over 50,000 acres strategically located in the prolific IOCG ("Iron oxide-copper-gold") belt of northern Chile. It also owns a 3% NSR royalty interest on any future production from the Copaquire Cu-Mo deposit, relatively recently sold to a subsidiary of Teck Resources Inc. ("Teck"). Under the terms of the sale agreement, Teck has the right to acquire one-third of the 3% NSR for $3 million dollars at any time. The Copaquire property borders Teck's producing Quebrada Blanca copper mine in Chile's First Region.

ON BEHALF OF THE BOARD OF DIRECTORS OF

Chilean Metals Inc.

"Terry Lynch"

Terry Lynch, CEO

Contact: terry@chileanmetals.com

Forward-looking Statements: This news release may contain certain statements that may be deemed 'forward-looking statements'. All statements in this release, other than statements of historical fact, that address events or developments that CMX expects to occur, are forward-looking statements. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words 'expects', 'plans', 'anticipates', 'believes', 'intends', 'estimates', 'projects', 'potential' and similar expressions, or that events or conditions 'will', 'would', 'may', 'could' or 'should' occur. Forward-looking statements in this document include statements regarding current and future exploration programs, activities, and results. Although CMX believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results may differ materially from those in forward-looking statements. Factors that could cause the actual results to differ materially from those in forward-looking statements include market prices, exploitation and exploration success, continued availability of capital and financing, inability to obtain required regulatory or governmental approvals, and general economic, market, or business conditions. Investors are cautioned that any such statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the forward-looking statements.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accept responsibility for the adequacy or accuracy of this release.

SOURCE: Chilean Metals, Inc.

View source version on accesswire.com:

https://www.accesswire.com/650831/Chilean-Metals-Acquires-Golden-Ivan