- Assay results received for holes J-21-008, 014, 015 and most of 016 from Jupiter zone

- Hole J-21-015 intersected a large, sulphide-bearing quartz-carbonate vein assaying 13.7 g/t Au over 3.6 m, including 25.2 g/t Au over 0.95 m (true widths unknown). The hole was collared 153 m northwest of recent high grade discovery holes

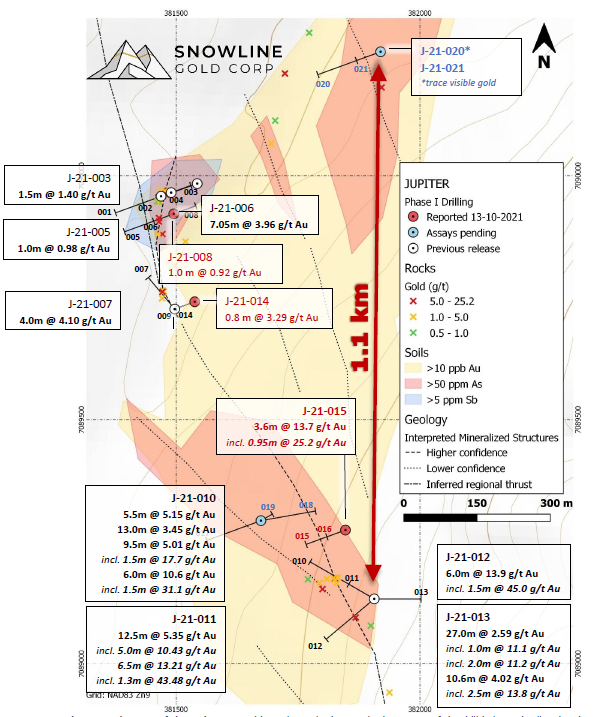

- Assays pending for 5 additional holes at Jupiter, including J-21-020 which intersected visible gold 1.1 km north of discovery holes, within a 3 km gold-in-soil anomaly.

Snowline Gold Corp. (CSE:SGD)(OTCQB:SNWGF) (the "Company" or "Snowline") is pleased to announce additional assay results from Phase I drilling at the Jupiter zone on its district-scale Einarson gold project in the Yukon Territory, Canada. The highlight of these results are from Hole J-21-015, which was collared 153 metres northwest of previous holes J-21-010 to J-21-013 (see Snowline press releases dated August 25, 2021 and October 13, 2021). The hole intersected a wide, mineralized quartz-carbonate breccia which averaged 13.7 gt Au over 3.6 metres beginning at 119.1 metres downhole

Figure 1 - J-21-015, from 119.0 m to 124.2 m downhole. Brecciated and stylolitic textures dominate the quartz carbonate zone. Siltstone wall-rock clasts and acicular arsenopyrite comprise grey areas, with pyrite also present. Sample boundaries on the core are marked in red. The predominantly siltstone section immediately above the main vein (119.1 - 119.75 m) returned 17.5 g/t Au over 0.65 m. The 0.95 m interval at the base of the zone (121.75 - 122.7 m) returned 25.2 g/t Au. The two 1.0 m samples from between these returned 7.17 and 6.89 g/t Au. True width of the zone is not known but is estimated between 50-70% of the downhole width.

"We are excited to intersect additional high-grade gold mineralization in this significant step-out from our discovery holes," said Scott Berdahl, CEO and director of Snowline. "Jupiter is a blind target-it's close to the surface but covered by thin overburden. We did not have a mineralized discovery outcrop to trench nor to drill, so our Phase 1 holes were somewhat random tests of a blind system. Nonetheless, these drill holes are regularly hitting gold, and this latest intersection further expands the footprint of known in-situ mineralization. We still have a lot to learn, and have yet to delineate the length, depth or even the breadth of the gold system. We are eagerly awaiting assay results from the remaining five holes at Jupiter, as well as all four holes from the Valley zone on our Rogue project."

Figure 2 - Plan map of the Jupiter zone with newly received assays in the context of the drill holes and soil and rock geochemical anomalies. Drill holes are labelled with significant assay results received to date. Assay results for five drill holes are still pending. Drill hole collar sites are shown as circles with drill traces shown as solid black lines. Snowline's 2021 drill campaign is the first ever drill testing of the recently identified Jupiter zone on the district-scale Einarson gold project.

DRILL HOLE DESCRIPTIONS

Massive to brecciated, well-mineralized quartz-carbonate material was intersected in drill hole J-21-015 at 119.1 m downhole, containing grey siltstone fragments and intercalated siltstone layers. Well-developed acicular arsenopyrite crystals (up to 10% locally) occur in and near stylolites in quartz, within mineralized siltstone fragments and in vein selvages. Pyrite occurs as medium to coarse grained crystals in quartz and host rocks. The highest gold grades occur towards and within the margins of the vein system (Figure 1 and Table 1).

Hole J-21-016 was collared from the same drill pad as J-21-015 but drilled at a steeper angle. Assays have been received for the top 174 m of this 233 m hole, while assays below this remain pending. This hole hit zones of hydrothermally altered siltstone and small, non- to subtly mineralized quartz veins. Assay results received from J-21-016 so far end in a zone of low-grade mineralization (0.20-0.87 g/t Au) and similarly veined material extends below; assays pending from the bottom of the hole will provide additional information. The hole provides valuable context for delineating the extent of mineralized system.

Holes J-21-008 and J-21-014 were drilled in the vicinity of earlier holes (J-21-001 to J-21-007 and J-21-009) and they both intersected zones of altered siltstone, and minor mineralized quartz-carbonate veins. J-21-008 intersected quartz veins around a sulphide-bearing fault zone that assayed 1.28 g/t Au over 3.5 m from 66.5 m downhole.

J-21-014 intersected 3.29 g/t Au over 0.8 m from 38.4 m downhole. This interval also returned high antimony (127 ppm) relative to most other holes. Antimony is an important associated element in the highest-grade zones in epizonal orogenic gold systems such as Fosterville in Australia or Queensway in Newfoundland. As such, this information may prove useful in vectoring towards any such centers of the system present at Jupiter, if they are present.

True widths have not yet been determined for these intervals.

Drilling at Jupiter has so far tested only parts of a 1.1 km length within the roughly 3 km long gold-in-soil anomaly. The strongest assay results thus far are from the south end of this partially tested length and visible gold was encountered at its north end. The gold system remains open in all directions.

Jupiter likely represents an epizonal orogenic gold system. It is one of ten target zones prospective for orogenic and/or Carlin-style gold mineralization currently recognized on Snowline Gold's 70%-owned, district-scale Einarson project. Adjacent projects Rogue and Ursa are prospective for intrusion-related gold, and sediment-hosted gold and base metal deposits. No resources nor reserves have been estimated for any of these targets, and while current results are encouraging, they do not guarantee that economically viable ore bodies will be encountered at Jupiter or elsewhere.

Table 1 - Hole details and notable intervals in holes for which assays have been received since Snowline's October 13, 2021 news release. *True widths are not yet known with certainty but in hole J-21-015 are estimated to run between 50 and 70% of reported downhole intervals. **Note that J-21-016 has not yet been assayed in its entirety, with additional assays expected from the bottom of the hole.

Drillhole ID | Coordinates (NAD83 Zn9) | Orientation (True) | Interval* (metres) | Grade (Au g/t) | ||||

| Easting | Northing | Azimuth | Dip | From | To | Width* | ||

| J-21-008 | 381496 | 7089923 | 30 | -75 | 54.0 | 55.0 | 1.00 | 0.92 |

66.5 | 70.0 | 3.50 | 1.29 | |||||

| J-21-014 | 381540 | 7089740 | 250 | -80 | 38.4 | 39.2 | 0.80 | 3.29 |

| J-21-015 | 381845 | 7089277 | 250 | -65 | 112.3 | 113.3 | 1.00 | 0.95 |

119.1 | 122.7 | 3.60 | 13.72 | |||||

| including | 119.1 | 119.8 | 0.65 | 17.50 | ||||

| and | 121.8 | 122.7 | 0.95 | 25.20 | ||||

| remainder |

|

| 2.00 | 7.03 | ||||

134.7 | 136.2 | 1.50 | 1.28 | |||||

| ||||||||

| J-21-016** | 381844 | 7089277 | 250 | -80 | 164.2 | 165.4 | 1.20 | 0.68 |

FORTHCOMING RESULTS

The Company awaits assay information on an additional five drill holes from Jupiter, including J-21-020 which contained visible gold, and other holes with encouraging zones of alteration, quartz-carbonate veins and/or sulphide mineralization.

In addition, the company also awaits assay information for its four drill holes from the Valley zone on the nearby Rogue project. All four holes at Valley intersected trace amounts of visible gold in drill core. Valley is a reduced intrusion-related gold target that presents a bulk-tonnage gold exploration model where gold is hosted in widespread arrays of centimetre-scale sheeted quartz veins within and around a felsic intrusion.

In hole V-21-001, sheeted quartz veins were observed across its entire 161 m length. Thirty-one of the many veins observed in this hole contained trace amounts of visible gold, with up to five gold grains observed in a given vein. Visible-gold bearing veins were distributed roughly evenly across the length of the hole.

QA/QC AND QUALIFIED PERSON

On receipt from the drill site, drill core was systematically logged for geological attributes, photographed and sampled. Smaller sample lengths were used to isolate zones of interest, otherwise a default 1.5 m downhole sample length was used. The holes in this release were not sampled top to bottom. Core was cut in half lengthwise, with one half collected for analysis and one half stored as a record. Standard reference materials, blanks and duplicate samples were inserted by Snowline personnel at regular intervals into the sample stream. Bagged samples were sealed with security tags to ensure integrity during transport. They were delivered by expeditor and by Snowline personnel to ALS Laboratories' preparatory facility in Whitehorse, Yukon, with analysis completed in Vancouver.

ALS is accredited to ISO 17025:2005 UKAS ref 4028 for its laboratory analysis. Samples were crushed by ALS to >70% passing below 2 mm and split using a riffle splitter. 250 g splits were pulverized to >85% passing below 75 microns. An aqua regia digest with an inductively coupled plasma mass spectroscopy (ICP-MS) finish was used for 51-element analysis on 50 g samples (ALS code: Au-ME-TL44). Any sample returning >50 ppb Au was re-analysed for gold content by fire assay with an inductively coupled plasma atomic emission spectroscopy (ICP-AES) finish on 30 g samples (ALS code: Au-ICP21). Over-limit samples of >10 g/t Au were analyzed by fire assay with a gravimetric finish again on a 30 g sample (ALS code: Au-GRA21). Where more than one gold assay exists for a sample, assays reported herein prioritize these methods in reverse order.

Information in this release has been prepared and approved by Scott Berdahl, P. Geo., Chief Executive Officer of Snowline and a Qualified Person for the purposes of National Instrument 43-101.

ABOUT Snowline Gold Corp.

Snowline Gold Corp. is a Yukon Territory focused gold exploration company with a seven-project portfolio covering >100,000 ha. The Company is exploring its flagship 72,000 ha Einarson and Rogue gold projects in the highly prospective yet underexplored Selwyn Basin. Snowline's project portfolio sits within the prolific Tintina Gold Province, host to multiple million-ounce-plus gold mines and deposits including Kinross' Fort Knox mine, Newmont's Coffee deposit, and Victoria Gold's Eagle Mine. Snowline's first-mover land position provides a unique opportunity for investors to be part of multiple discoveries and the creation of a new gold district.

ON BEHALF OF THE BOARD

Scott Berdahl, MSc, MBA, PGeo

CEO & Director

For further information, please contact:

Snowline Gold Corp.

+1 778 650 5485

info@snowlinegold.com

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This news release contains certain forward-looking statements, including statements about the Company reviewing its newly acquired project portfolio to maximize value, reviewing options for its non-core assets, including targeted exploration and joint venture arrangements, conducting follow-up prospecting and mapping this summer and plans for exploring and expanding a new greenfield, district-scale gold system. Wherever possible, words such as "may", "will", "should", "could", "expect", "plan", "intend", "anticipate", "believe", "estimate", "predict" or "potential" or the negative or other variations of these words, or similar words or phrases, have been used to identify these forward-looking statements. These statements reflect management's current beliefs and are based on information currently available to management as at the date hereof.

Forward-looking statements involve significant risk, uncertainties and assumptions. Many factors could cause actual results, performance or achievements to differ materially from the results discussed or implied in the forward-looking statements. Such factors include, among other things: risks related to uncertainties inherent in drill results and the estimation of mineral resources; and risks associated with executing the Company's plans and intentions. These factors should be considered carefully, and readers should not place undue reliance on the forward-looking statements. Although the forward-looking statements contained in this news release are based upon what management believes to be reasonable assumptions, the Company cannot assure readers that actual results will be consistent with these forward-looking statements. These forward-looking statements are made as of the date of this news release, and the Company assumes no obligation to update or revise them to reflect new events or circumstances, except as required by law.

SOURCE: Snowline Gold Corp.

View source version on accesswire.com:

https://www.accesswire.com/673554/Snowline-Gold-Extends-High-Grade-Footprint-with-137-Grams-Per-Tonne-Gold-over-36-metres-at-Its-Jupiter-Zone-Einarson