LevelJump Healthcare Corp. (TSXV: JUMP) (OTCQB: JMPHF) (FSE: 75J) ("Leveljump" or the "Company"), a Canadian leader in B2B telehealth solutions, is pleased to announce today it has reported financial results for the third fiscal quarter ended September 30th, 2021. All amounts are expressed in Canadian dollars.

Financial and Operational Highlights

Revenues from Canadian Teleradiology Services, Inc. ("CTS") operations hit record level with $1,739,465 in revenues in the third quarter.

Gross profit from CTS operations was $356,245 for the quarter, a 20.9% margin.

Year over Year Q3 revenue increase of $221,090, an increase of 14.6%.

Q3 revenue increase compared to Q2 of 6%.

Clean balance sheet with no long-term debt.

2021 Q3 Financial Results for Leveljump

Revenues of $1,739,465 in Q3 and $4,924,559 for the nine months ended September 30, 2021.

CTS net operating profit of $158,344 in Q3. $356,245 for the nine months ended September 30, 2021.

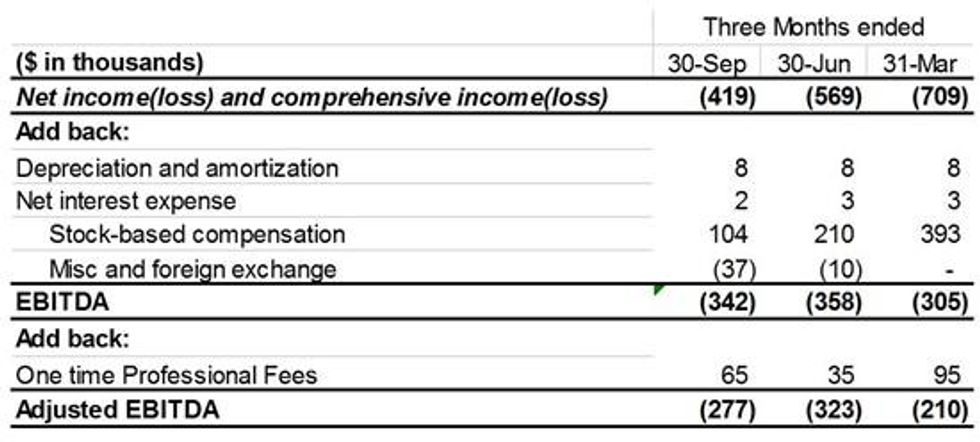

Adjusted EBITDA of $(277,000) for Q3 and $(623,357) for the nine months ended September 30, 2021.

Management Comments

"Our operating subsidiary CTS had a strong third quarter and demonstrated a net profit position. Our negative EBITDA is primarily due to administrative costs for the parent company legal expenses and advertising and marketing, we expect that those costs will be greatly reduced in 2022 and with the revenue stream from acquisitions and the growth of CTS, profits from the operating businesses will overshadow the costs of maintaining the public company," said Rob Landau, CFO.

"Our telehealth services had a fantastic quarter of revenue growth and have set us on a path for our best year on record," said Mitch Geisler, CEO. "With the current operations rapidly growing, and our recent signed acquisitions, we have a positioned the company well for 2022."

Non-IFRS Financial Measures

This news release contains financial terms (such as adjusted EBITDA) that are not considered in IFRS. Such financial measures, together with measures prepared in accordance with IFRS, provide useful information to investors and shareholders, as management uses them to evaluate the operating performance of the Company. The Company's determination of these non-IFRS measures may differ from other reporting issuers, and therefore are unlikely to be comparable to similar measures presented by other companies. Further, these non-IFRS measures should not be considered in isolation or as a substitute for measures of performance or cash flows prepared in accordance with IFRS. These financial measures are included because management uses this information to analyze operating performance and liquidity.

Adjusted EBITDA & Annual Revenue Run Rate

Management believes adjusted EBITDA is a useful supplemental measure to determine the Company's ability to generate cash available for working capital, capital expenditures, debt repayments, interest expense and income taxes.

EBITDA refers to net income (loss) determined in accordance with IFRS, before depreciation and amortization, net interest expense (income) and income tax expense (recovery). The Company defines adjusted EBITDA as EBITDA, plus stock-based compensation expense, restructuring, fair value adjustments, listing expense and transaction costs, impairment and finance income.

A reconciliation of adjusted EBITDA to net income (loss) is as follows:

Table 1

To view an enhanced version of this table, please visit:

https://orders.newsfilecorp.com/files/7249/105520_leveljumptable1.jpg

For further details on the results, please refer to Leveljump's Interim Management, Discussion and Analysis and Unaudited Condensed Interim Consolidated Financial Statements for the quarter ended September 30, 2021, which are available on the Company's website (www.leveljumphealthcare.com) and under the Company's profile on SEDAR (www.sedar.com).

About Leveljump Healthcare

LevelJump Healthcare Corp., (TSXV: JUMP) (OTCQB: JMPHF) (FSE: 75J) is building a national medical diagnostic imaging company and brand, primarily by providing teleradiology (remote radiology) services to its client hospitals and imaging centers. Additionally, JUMP plans to expand through the acquisition of independent healthcare facilities focused on diagnostic imaging as well as acquiring new disruptive imaging technologies.

ON BEHALF OF THE BOARD OF DIRECTORS OF

LevelJump Healthcare Corp.

Mitchell Geisler, Chief Executive Officer

info@leveljumphealthcare.com

(833) 840-2020

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

This news release contains "forward-looking information" within the meaning of applicable securities laws relating to the Company's business plans and the outlook of the Company's industry. Although the Company believes, in light of the experience of its officers and directors, current conditions and expected future developments and other factors that have been considered appropriate, that the expectations reflected in this forward-looking information are reasonable, undue reliance should not be placed on them because the Company can give no assurance that they will prove to be correct. Actual results and developments may differ materially from those contemplated by these statements. The statements in this press release are made as of the date of this release and the Company assumes no responsibility to update them or revise them to reflect new events or circumstances other than as required by applicable securities laws. The Company undertakes no obligation to comment on analyses, expectations or statements made by third-parties in respect of the Company, Canadian Teleradiology Services, Inc., their securities, or their respective financial or operating results (as applicable).

Neither the Exchange nor its Regulation Services Provider (as that term is defined in the policies of the Exchange) accepts responsibility for the adequacy or accuracy of this release.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/105520