BANXA (TSX-V: BNXA) ("BANXA" or "Company") a Payment Service Provider (PSP) focused on providing clients safe, compliant access to the digital assets market, is pleased to announce it has begun trading on the TSX Venture Exchange (TSX) as of today, January 6, 2021 . Banxa's common shares will trade on the TSX under the stock symbol "BNXA.

"It is a significant milestone to list on the TSX Venture Exchange." said Founder & Chairman, Domenic Carosa , "While 2020 and the uncertainty of COVID has been challenging to many businesses, it has also been a period of substantial growth for us. This listing is in line with our core belief that regulation and transparency provides clarity for stakeholders. Our customers want a safe, reliable partner who can give them access to the digital asset market and we provide that to them. We look forward to a successful 2021 and this listing is another step along that path."

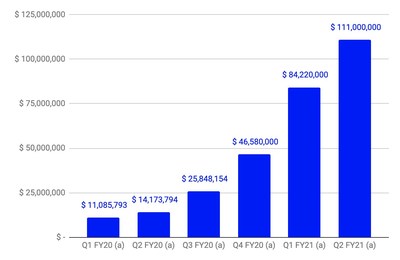

The company's product line consists of a B2B (business-to-business) offering, or wholly owned, B2C (direct-to-consumer) websites. Upcoming products will focus further development of digital payments, transfers and digital financial services. The company's flagship Business to Business (B2B) product reaches over 1.2 million users through its B2B customer network, while the company's Business to Consumer (B2C) product portfolio encompasses a number of brands and has been in operation since 2014. The Company has also reported a record Total Transaction Volume (TTV) result for the December 2020 quarter.

The TTV graph (management prepared) is denoted by $AUD and is based on 30th June financial year. (Q2-FY21 is the December 2020 quarter.)

| ON BEHALF OF THE BOARD OF DIRECTORS | |

| Per: | "DOMENIC CAROSA" |

| | Domenic Carosa |

| | Chairman (+1-888-218-6863) |

About BANXA

"BANXA (TSX-V:BNXA - Banxa Holdings Inc.) is a Payment Service Provider (PSP) with a mission to build the bridge between traditional financial systems, regulation and the digital asset space. Our goal is to onboard the general public to digital currency by building a fully compliant payment infrastructure that enables simple and secure conversion of fiat currency to digital currency. (USD/CAD to BTC/ETH) Banxa has offices in Australia and the Netherlands . For further information go to www.banxa.com "

This news release may contain "forward-looking statements" within the meaning of applicable Canadian securities laws. Forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable by management, are inherently subject to significant business, economic and competitive uncertainties, and contingencies. These statements generally can be identified by the use of forward-looking words such as "may", "should", "will", "could", "intend", "estimate", "plan", "anticipate", "expect", "believe" or "continue", or the negative thereof or similar variations. Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause future results, performance or achievements to be materially different from the estimated future results, performance or achievements expressed or implied by those forward-looking statements and the forward-looking statements are not guarantees of future performance. BANXA's statements expressed or implied by these forward-looking statements are subject to a number of risks, uncertainties, and conditions, many of which are outside of BANXA's control, and undue reliance should not be placed on such statements. Forward-looking statements are qualified in their entirety by the inherent risks and uncertainties of the Company's business, including: BANXA's assumptions in making forward-looking statements may prove to be incorrect; adverse market conditions, including risks related to COVID-19 and risks that future results may vary from historical results. Except as required by securities law, BANXA does not assume any obligation to update or revise any forward-looking statements, whether as a result of new information, events or otherwise.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

For Further Information, see www.banxa.com

SOURCE Banxa Holding Inc

![]() View original content to download multimedia: https://www.newswire.ca/en/releases/archive/January2021/06/c5790.html

View original content to download multimedia: https://www.newswire.ca/en/releases/archive/January2021/06/c5790.html