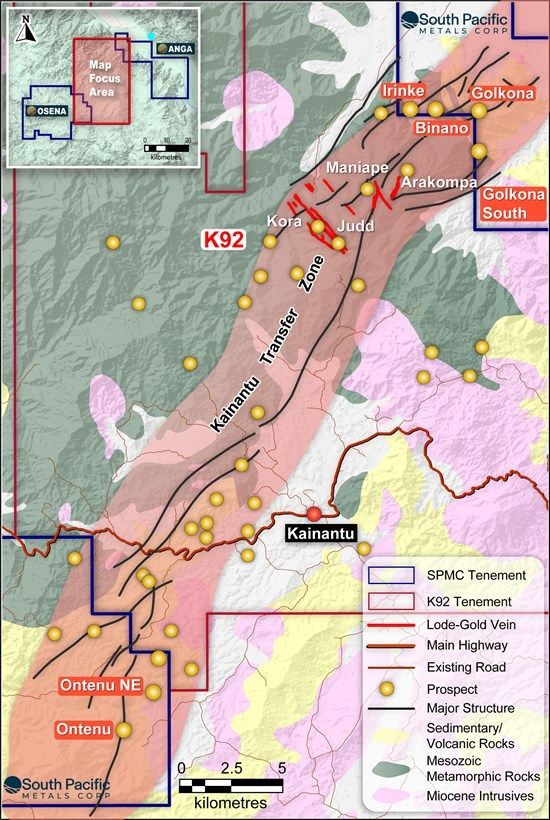

South Pacific Metals Corp. (TSXV: SPMC,OTC:SPMEF) (OTCQB: SPMEF) (FSE: 6J00) ("SPMC" or the "Company") is pleased to announce rock chip assay results from recently discovered mineralized zones, at surface, at the Ontenu NE prospect within its Osena Project. The Project lies within a major NE-SW corridor known as the Kainantu Transfer Zone, which also hosts the large Kainantu Gold-Copper mine being mined by K92 Mining Ltd.

Highlights:

-

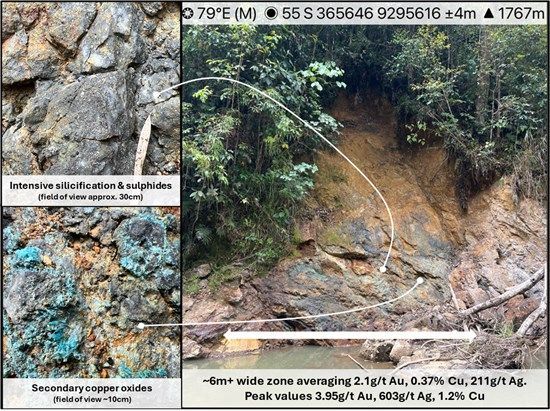

A 1m-2m (est) wide mineralised structure with sulphides and copper oxides was found in a newly discovered outcrop. Six 1m representative rock chip (channel) samples were collected along the exposed strike of the structure. Assay results include individual rock chip samples with:

3.95g/t Au, 1.2% Cu and 603ppm Ag

2.65g/t Au, 0.6% Cu, 337ppm Ag (repeat sample at same location as above)

2.18g/t Au, 0.1% Cu, 100ppm Ag

Au results in these six samples ranged from 1.14g/t Au to 3.95g/t Au

The outcrop is along strike of a >600m long Au-As soil anomaly

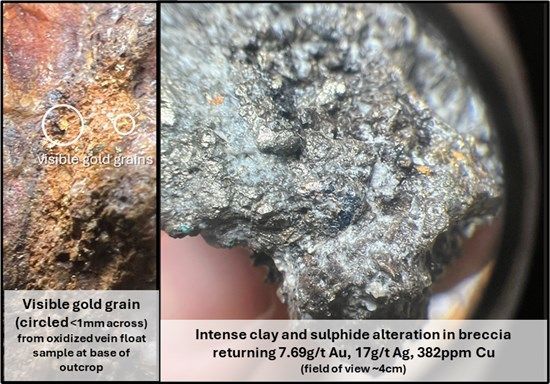

7.69g/t Au in a 10 - 30cm wide vein in a sheared conglomerate outcrop. Minor visible gold was noted at the base of the outcrop

9.34g/t Au, 272g/t Ag in a creek float rock sample

-

Ontenu NE is emerging as a potential epithermal Au-Cu target zone with:

NW-SE and N-S structures similar to vein orientations at nearby K92 Mine

Several Au-As (+Cu) soil anomalies up to 1,200m long

Mineralised structures as described above

Mapping and sampling are ongoing (some assays pending)

Trenching and reconnaissance are also continuing on the wider Ontenu Project area prior to drilling

"Our exploration only recently pivoted to Ontenu NE. Within a short time, we have found several new mineralised structures which we suspect could represent the upper levels of epithermal Au-Cu veins," said Timo Jauristo, CEO of the Company. "To encounter high gold, copper and silver in some of these structures is encouraging. These results,with continuing mapping and sampling will guide our drill planning which will be targeting epithermal Au-Cu veins. We hope to start drilling within the next month. These will be the first drill holes in the Ontenu NE area."

Figure 1. New discovery outcrop at Ontenu NE with abundant sulphide, secondary copper oxides and high-grade assay results for gold, silver and copper (samples E21021-E21029)

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/10890/266767_9727e80114c309c1_001full.jpg

Figure 2. Left visible gold in float sample at base of outcrop (not assayed). Right Sample E21038 - with 7.69g/t Au, 17g/t Ag (sample E21038)

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/10890/266767_9727e80114c309c1_002full.jpg

About the Osena Project

Covering 738 km² of strategic ground, the Osena Project is located southwest of and adjacent to K92's tenements that host the Kainantu Gold Mine. Priority prospects include Ontenu, a large-scale cluster of five intrusive Copper-Gold porphyry and epithermal vein targets extending over 5 km x 3 km. The Ontenu Prospect is one of many occurring within a mineralized corridor that extends more than 40 km northeast across the Kainantu District.

Figure 3. Regional location map: Kainantu District with SPMC's Osena Project (SW) and Anga Project (NE) relative to K92 Mining Ltd's deposits.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/10890/266767_9727e80114c309c1_003full.jpg

About South Pacific Metals Corp.

South Pacific Metals Corp is an emerging gold-copper exploration company operating in the heart of Papua New Guinea's proven gold and copper production corridors. With an expansive 3,100 km² land package and four transformative gold-copper projects contiguous with major producers K92 Mining, PanAust and neighbouring Barrick/Zijin, new leadership and experienced in-country teams are prioritizing thoughtful and rigorous technical programs focused on boots-on-the-ground exploration to prioritize discovery across its portfolio projects: Anga, Osena, Kili Teke, and May River.

Immediately flanking K92 Mining's active drilling and gold producing operations to the northeast and southwest, SPMC's Anga and Osena Projects are located within the high-grade Kainantu Gold District - each having the potential to host similar-style lode-gold and porphyry copper-gold mineralization as that present within K92's tenements. Kili Teke is an advanced exploration project situated only 40 km from the world-class Porgera Gold Mine and hosts an existing Inferred Mineral Resource with multiple opportunities for expansion and further discovery. The May River Project is located adjacent to the world-renowned Frieda River copper-gold project, with historical drilling indicating potential for a significant, untapped-gold mineralized system. SPMC common shares are listed on the TSX Venture Exchange (TSXV: SPMC,OTC:SPMEF), the OTCQB Marketplace (OTCQB: SPMEF) and Frankfurt Stock Exchange (FSE: 6J00).

Quality Assurance and Quality Control

Rock Sampling

Rock samples are selective and collected by a consultant geologist and Company geologists in the field. Some samples, as noted in the table 1 in the Appendix, were collected as chip channel samples with a maximum horizontal width of 1 metre. Samples were sent to the ITS (PNG) Ltd (Intertek) Laboratory in Lae. Gold assays were conducted using 50 g charge Fire Assay with Atomic Absorption Spectra finish (Intertek Code FA50/AA), with a detection limit of 0.01ppm. Copper and silver assays were assayed with 3-acid digest (Intertek Code PGGA03). Samples are also being sent for full multi-element assays to be determined using 4-acid digestion with Mass Spectrometry (ICPMS) (Intertek code 4A/MS48).

Certified reference material, duplicates and blanks were inserted into the rock sample stream to monitor laboratory performance, with no significant variations from expected results.

Qualified Person

The scientific and technical information disclosed in this release has been compiled by Company geologists and consultants and reviewed and approved by Darren Holden, BSc(Hons) (Geology), PhD, FAusIMM, a "Qualified Person" as defined under the Canadian Institute of Mining National Instrument 43-101 Standards of Disclosure for Mineral Projects. Dr. Holden is a Technical Advisor to the Company.

For further information, please contact:

Michael Murphy, Executive Chair

or

Investor Relations

South Pacific Metals Corp.

Tel: +1-604-653-9464

Email: info@southpacificmetals.ca

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Disclaimer and Forward-Looking Information

Statements contained in this release that are not historical facts are forward-looking statements that involve various risks and uncertainty affecting the business of SPMC. In making the forward-looking statements, SPMC has applied certain assumptions that are based on information available to the Company, including SPMC's strategic plan for the near and mid-term. There is no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Forward-looking statements may involve various risks and uncertainties affecting the business of the Company. These forward-looking statements can generally be identified as such because of the context of the statements, including such words as "believes," "anticipates," "expects," "plans", "may", "estimates", or words of a similar nature. Forward-looking statements or information in this news release relate to, among other things: the start of the drilling within the next month. These forward-looking statements and information reflect the Company's current views with respect to future events and are necessarily based upon a number of assumptions that, while considered reasonable by the Company, are inherently subject to significant operational, business, economic, regulatory, or other unforeseen uncertainties and contingencies. These assumptions include, without limitation: success of the Company's projects, prices for metals remaining as estimated, currency exchange rates remaining as estimated, availability of funds for the Company's projects, capital, decommissioning and reclamation estimates, prices for energy inputs, labour, materials, supplies and services (including transportation), no labour-related disruptions, no unplanned delays or interruptions in scheduled construction and production, all necessary permits, licenses and regulatory approvals are received in a timely manner, and the ability to comply with environmental, health and safety laws. The foregoing list of assumptions is not exhaustive. The Company cautions the reader that forward-looking statements and information involve known and unknown risks, uncertainties and other factors that may cause actual results and developments to differ materially from those expressed or implied by such forward-looking statements or information contained in this news release and the Company has made assumptions and estimates based on or related to many of these factors. Accordingly, readers should not place undue reliance on forward-looking information. Such factors include, without limitation: fluctuations in gold prices, fluctuations in prices for energy inputs, labour, materials, supplies and services (including transportation), fluctuations in currency markets (such as the Canadian dollar versus the U.S. dollar), operational risks and hazards inherent with the business of mineral exploration, inadequate insurance or inability to obtain insurance to cover these risks and hazards, the Company's ability to obtain all necessary permits, licenses and regulatory approvals in a timely manner, changes in laws, regulations and government practices, including environmental, export and import laws and regulations, legal restrictions relating to mineral exploration, increased competition in the mining industry for equipment and qualified personnel, the availability of additional capital, title matters and the additional risks identified in the Company's filings with Canadian securities regulators on SEDAR+ (www.sedarplus.ca). Although the Company has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be as anticipated, estimated, described, or intended. Investors are cautioned against undue reliance on forward-looking statements or information. These forward-looking statements are made as of the date hereof and, except as required under applicable securities legislation, the Company does not assume any obligation to update or revise them to reflect new events or circumstances. Mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on the Company's property.

Appendix 1

Table 1. Latest campaign rock chips from Ontenu NE. with significant Au in the mineralied outcrop described in the text Au highlighted in red. All coordinates in WGS 84 Zone 55.

| Sample ID | Easting | Northing | Sample Type | Summary Description | Silver (g/t Ag) | Gold (g/t Au) | Copper (ppm) | Copper (%) |

| E21021 | 365645 | 9295635 | CHANNEL (1m) | fault breccia, graphitic sediments, quartz, sulphides | 60 | 0.85 | 156 | 0.02 |

| E21022 | 365645 | 9295633 | CHANNEL (1m) | fault breccia, graphitic sediments, quartz, sulphides | 56 | 1.47 | 153 | 0.02 |

| E21023 | 365646 | 9295632 | CHANNEL (1m) | fault breccia, graphitic sediments, quartz, sulphides | 28 | 1.21 | 233 | 0.02 |

| E21024 | 365646 | 9295631 | CHANNEL (1m) | fault breccia, graphitic sediments, quartz, sulphides | 100 | 2.18 | 1,427 | 0.14 |

| E21025 | 365646 | 9295629 | CHANNEL (1m) | fault breccia, graphitic sediments, quartz, sulphides | 337 | 2.65 | 6,312 | 0.63 |

| E21026 | 365646 | 9295629 | CHANNEL (1m duplicate) | fault breccia, graphitic sediments, quartz, sulphides | 603 | 3.95 | 11,824 | 1.18 |

| E21027 | 365647 | 9295628 | CHANNEL (1m) | fault breccia, graphitic sediments, quartz, sulphides | 142 | 1.14 | 2,249 | 0.22 |

| E21028 | 365646 | 9295626 | CHANNEL (1m) | Oxidized limonite/hematite veinlets after sulphides (fault breccia) | 6 | 0.11 | 319 | 0.03 |

| E21029 | 365645 | 9295625 | CHANNEL (1m) | Oxidized limonite/hematite veinlets after sulphides (fault breccia) | 54 | 0.32 | 113 | 0.01 |

| E21030 | 365639 | 9295667 | Rock Chip | 1m wide shear with bleached meta-sediments. Gossanous layers | 2 | 0.05 | 44 | 0.00 |

| E21031 | 365655 | 9295696 | Rock Chip | Oxidized / gossanous vein 0.5m on porphyry dyke contact | 5 | 0.26 | 101 | 0.01 |

| E21032 | 365696 | 9295800 | Rock Chip (float) | Quartz vein with limonite and sulphides | 39 | 0.42 | 268 | 0.03 |

| E21033 | 365748 | 9295851 | Rock Chip | Strong altered chlorite-sericite-pyrite (basalt?) | 1 | 0.03 | 137 | 0.01 |

| E21035 | 365687 | 9295922 | Rock Chip | 10-70cm wide breccia vein with boxwork silica limonite/hematite vugs | 8 | 0.70 | 18 | 0.00 |

| E21036 | 365719 | 9295936 | CHANNEL (1m) | Breccia in conglomerate with sulphide in clasts and veinlets in matrix | 0.5 | 0.03 | 561 | 0.06 |

| E21037 | 365955 | 9296330 | Rock Chip | Massive sulphide vein in clay-silica within conglomerate | 4 | 0.43 | 74 | 0.01 |

| E21038 | 365984 | 9296346 | Rock Chip | 10-30cm wide vein with sulphide | 17 | 7.69 | 382 | 0.04 |

| E21039 | 365693 | 9296109 | Rock Chip | oxidized hornblende porphyry, disseminated to blebby sulphide | 1 | 0.09 | 205 | 0.02 |

| E21040 | 365688 | 9296107 | Rock Chip | Fractures in meta sediments / basalt with disseminated sulphide | 1 | 0.02 | 149 | 0.01 |

| E21041 | 365684 | 9296116 | Rock Chip | Hornblende porphyry with sulphides | 0.5 | 0.02 | 106 | 0.01 |

| E21042 | 365684 | 9296106 | Rock Chip (float) | Smoky quartz vein with vugs and sulphides | 272 | 9.34 | 1,096 | 0.11 |

| E21043 | 366263 | 9296432 | Rock Chip | Porphyry diorite with chlorite-sericite and sulphide & malachite | 20 | 1.48 | 1,158 | 0.12 |

| E21044 | 366267 | 9296436 | Rock Chip | Diorite with leached sulphides, vuggy breccia veins | 5 | 0.06 | 175 | 0.02 |

| E21045 | 366272 | 9296436 | Rock Chip | Diorite porphyry with trace pyrite and alteration | 0.5 | 0.01 | 65 | 0.01 |

| E21046 | 366349 | 9296603 | Rock Chip | Polymict breccia with porphyry and shale clasts | 0.5 | 0.03 | 119 | 0.01 |

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/266767