July 03, 2022

Castile Resources Limited (ASX:CST) (“Castile” or “the Company”) is pleased to advise that results from Hole 22CRD001-1 have revealed a new high grade gold zone at the Company’s 100% owned Rover 1 Project. The new gold structure occurs outside, but directly adjacent to, Castile’s current Mineral Resource Estimate (MRE) for Rover 1 in the Jupiter Deeps section of the deposit.

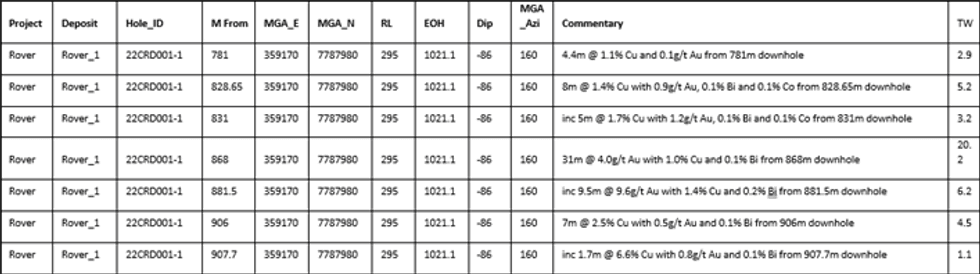

The upper part of Hole22CDR001 has returned an exceptional intercept of IOCG mineralisation of:

- 31m at 4.0 g/t Gold, 1.0% Copper and 0.1% Bi from 868m (TW 20.2m) downhole

This included a high grade core zone of:

- 9.5m at 9.6 g/t Gold with 1.4% Copper and 0.2% Bi from 881.5m downhole

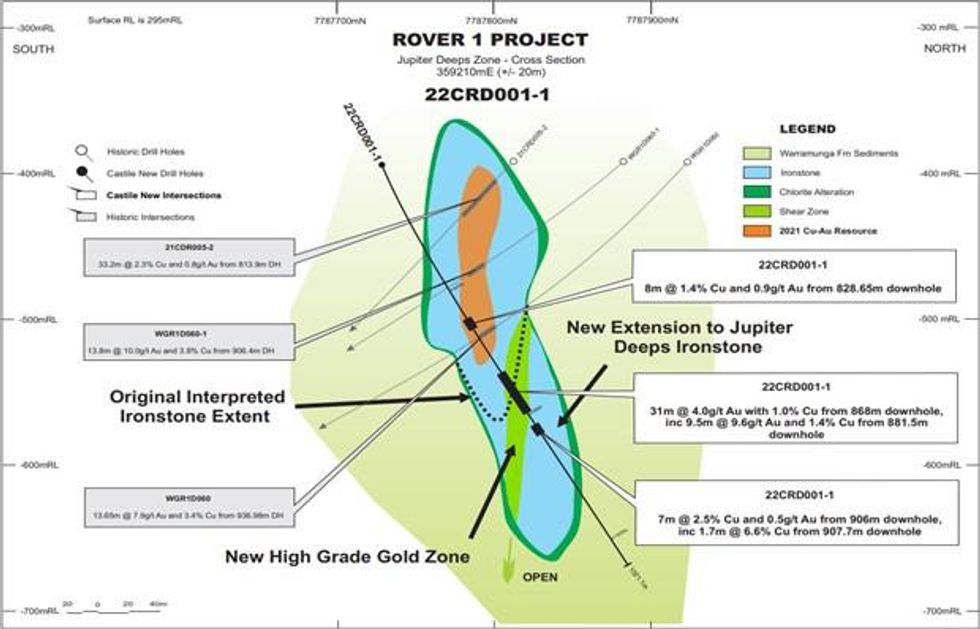

This intercept points to the discovery a new additional high grade gold zone where late stage shears cut the IOCG alteration and also extends the Jupiter Deeps zone further down-dip.

Other results from 22CRD001-1 include:

- 7m @ 2.5% Cu with 0.5g/t Au and 0.1% Bi from 906.0m downhole

- inc 1.7m @ 6.6% Cu with 0.8g/t Au and 0.1% Bi from 907.7m downhole

- 8m @ 1.4% Cu with 0.9g/t Au, 0.1% Bi and 0.1% Co from 828.6m downhole

- inc 5m @ 1.7% Cu with 1.2g/t Au, 0.1% Bi and 0.1% Co from 831m downhole

Additionally, Hole 22CRD001-1 continued in IOCG alteration for 173.4 metres downhole expanding the interpreted true width of the Jupiter Deeps IOCG alteration to 86m (from 66m). The hole exited the IOCG alteration laterally which opens the base of the system for further extensions of the new high-grade copper-gold zones at depth.

Figure 1: Jupiter Deeps Cross Section Showing New Interpreted Gold Zone

Mark Hepburn, Managing Director of Castile commented:

“This is a major new discovery for Castile.

Not only does the interpretation suggest the discovery of a new bonanza gold zone at Rover 1, it appears the IOCG system is expanding at depth. This newly discovered gold zone sits adjacent to our current Indicated Mineral Resource in the Jupiter Deeps area and provides us with enormous potential for growth.

In addition, the discovery of the extension of ironstone into the hanging wall approximately 120m below existing drilling is significant, indicating the Jupiter Deeps ironstone is more extensive than previously thought and suggests known Cu-Au mineralisation may also continue down dip further than has currently been interpreted. Paired with the new high grade gold zone identified, this hole has changed our understanding of the Jupiter Deeps ironstone zone considerably.”

The drilling program continued with another wedge cut from this hole with the aim of testing the Ganymede high grade gold zones in the hanging-wall of the main IOCG zone. (See ASX:CST 2022 Drilling And Fieldwork Program Commences). This wedge has been completed and the core is being prepared for assay. These results will be presented to the market as they are received.

Mark Hepburn

Managing Director

Castile Resources Limited

For further information please contact: info@castile.com.au

Phone: +61 89488 4480

Castile Resources Limited

7/189 St Georges Terrace Perth, WA, 6000

This announcement was approved for release by the Castile Resources Board of Directors

Table 1: Significant Intersections Returned From Hole 22CRD001-1

Competent Person Statement

The exploration results contained in this report are based on, and fairly and accurately represent the information and supporting documentation prepared by Mark Savage. Mr Savage is a full-time employee of Castile, and a Member of The Australasian Institute of Mining and Metallurgy. Mr Savage has sufficient experience which is relevant to the style of mineralisation and type of deposit under consideration, and to the activity being undertaken to qualify as a Competent Person as defined in the 2012 Edition of the Australasian Code for Reporting of Exploration Results, Exploration Targets, Mineral Resources and Ore Reserves. Mr Savage consents to the inclusion in the report of the matters based on the exploration results in the form and context in which they appear.

Forward Looking Statements

Certain statements in this report relate to the future, including forward looking statements relating to Castile’s financial position and strategy. These forward-looking statements involve known and unknown risks, uncertainties, assumptions, and other important factors that could cause the actual results, performance, or achievements of Castile to be materially different from future results, performance or achievements expressed or implied by such statements

Actual events or results may differ materially from the events or results expressed or implied in any forward- looking statement and deviations are both normal and to be expected. Other than required by law, neither Castile, their officers nor any other person gives any representation, assurance or guarantee that the occurrence of the events expressed or implied in any forward-looking statements will occur. You are cautioned not to place undue reliance on those statements.

Click here for the full ASX Release

This article includes content from Marquee Resources Limited (ASX: MQR), licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

11h

High-Grade Extensions at BD Deposits for Resource Growth

Aurum Resources (AUE:AU) has announced High-Grade Extensions at BD Deposits for Resource GrowthDownload the PDF here. Keep Reading...

12h

Precious Metals Price Update: Gold, Silver, PGMs Stage Recovery After Crash

It's been a wild week of ups and downs for precious metals prices.Gold, silver and platinum have already recorded new all-time highs in 2026. But this week, the rally reversed course — only briefly, but in a big way, as is the case with such highly volatile markets.Let’s take a look at what got... Keep Reading...

14h

Centurion Minerals Ltd. Announces Revocation of MCTO

CENTURION MINERALS LTD. (TSXV: CTN) ("Centurion" or the "Company") announces that the British Columbia Securities Commission ("BCSC") has revoked the management cease trade order ("MCTO") previously issued on December 1, 2025 under National Policy 12-203 - Management Cease Trade Orders.The... Keep Reading...

03 February

Fabi Lara: What to Do When Commodities Prices Go Parabolic

Speaking against a backdrop of record-high gold and silver prices, Fabi Lara, creator of the Next Big Rush, delivered a timely reality check at this year’s Vancouver Resource Investment Conference. Addressing a packed room that included a noticeable influx of first-time attendees, she urged... Keep Reading...

03 February

Joe Cavatoni: Gold Price Drop — Why it Happened, What's Next

Joe Cavatoni, senior market strategist, Americas, at the World Gold Council, breaks down gold's record-setting run past US$5,500 per ounce as well as its correction. "At the end of this, you're looking at a lot of people who were pushing the price higher — speculative in nature — pulling back... Keep Reading...

03 February

Gold-Copper Consolidation Continues as Eldorado Moves to Acquire Foran

Eldorado Gold (TSX:ELD,NYSE:EGO) and Foran Mining (TSX:FOM,OTCQX:FMCXF) have agreed to combine in a share-based transaction that will create a larger, diversified gold and copper producer with two major development projects that are set to enter production in 2026.Following completion under a... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00