May 21, 2023

Iceni Gold Limited (ASX: ICL) (Iceni or the Company) is pleased to provide an exploration update on the Guyer Well Target Area.

Highlights

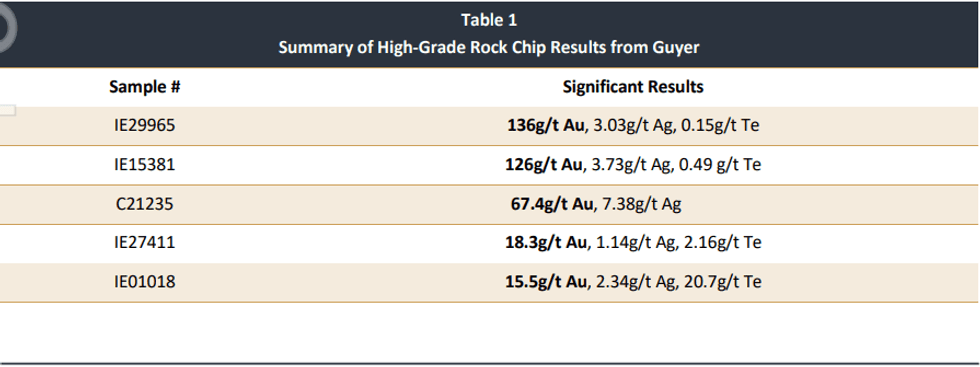

- High-grade rock chip assays have been returned from the Guyer target area with assays including:

136g/t Au 126g/t Au 67.4g/t Au 18.3g/t Au 15.5g/t Au. - Gold bearing rock chips support existing targeting work.

- Ongoing fieldwork has discovered over 700 gold nuggets along the Guyer Trend to date.

- More than 100 gold nuggets have been recovered during the last 4 weeks.

- Results from Guyer South AC drilling have identified bedrock gold anomalism beneath transported cover.

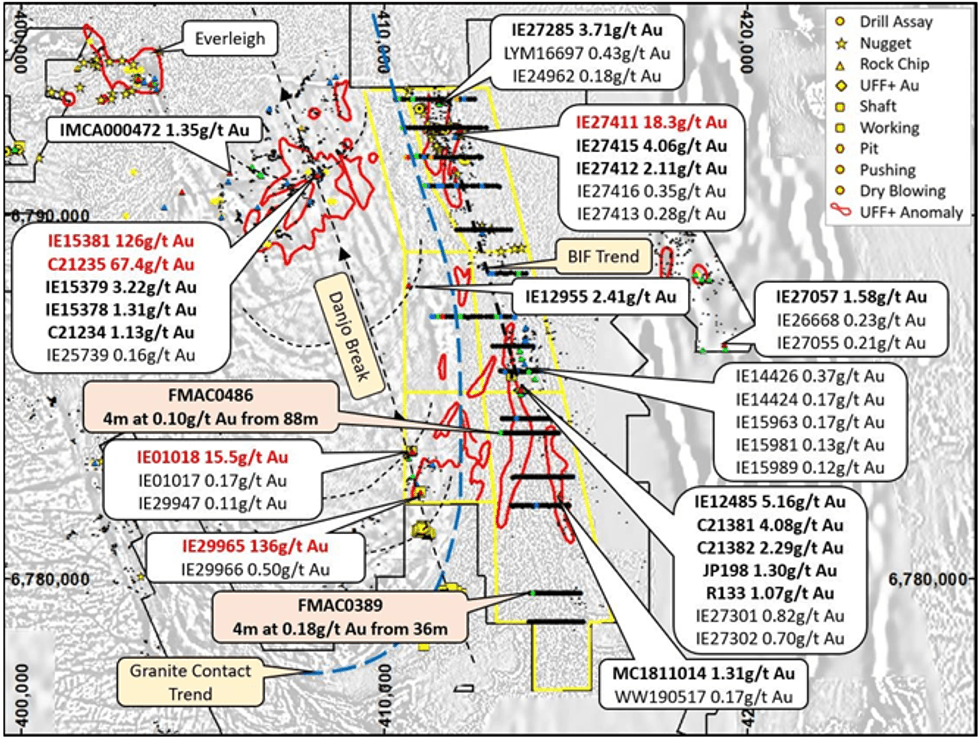

- Exploration work has located historic workings associated with the 11km long granite contact and the 7km long banded iron formation (BIF) Trend at Guyer.

- Mineralisation associated with granite contacts or BIF trends occur at major regional mines such as King of the Hills, Mt Morgans, Granny Smith and Sunrise Dam.

- Elevated tellurium (Te) in Guyer rock chip results is similar to nearby gold deposits known to have tellurides, like the Sunrise Dam, Wallaby and Jupiter gold deposits.

- The Guyer North target is presently being prepared for the commencement of exploration drilling.

Technical Director David Nixon commented:

“New high-grade gold results have been discovered within the Guyer target area, providing strong evidence of deeper buried mineralisation being revealed at surface by the Company’s ongoing exploration work.

The high-grade rock chip results from in-situ outcrop are exciting because they confirm and support the existing gold UFF+ soil anomalies.

The Guyer South AC drilling results also demonstrate that gold anomalism is concealed beneath deep transported cover.

The Guyer target area continues to deliver in-situ gold bearing rock chips and significant numbers of gold nuggets over key areas, and these results continue to strengthen the previous results from broad spaced Air Core holes, specifically at Guyer North, where a number of significant targets are being prepared for future exploration drilling”.

Ongoing rock chip sampling across the Guyer target area has delivered several significant gold results, that include several high-grade gold results at Granite Contact South, Guyer North and East Well. The gold anomalism is supported by multi-element geochemistry, which reinforces the anomalies.

The majority of gold anomalous samples are hosted by quartz veining in granite, andesite or sediments, sometimes displaying evidence of sulphides or boxworks after sulphides.

Peak gold values from rock chip sampling include the following results:

Guyer North

Rock chip samples from the Guyer North prospect returned significant gold results that support the existing gold anomalies. Gold mineralisation was associated with quartz veining in andesite on the eastern side of the ridge at Guyer North. A number of these samples had anomalously high silver values when compared to gold. This geochemical relationship could be indicative of an earlier epizonal style of mineralisation.

Click here for the full ASX Release

This article includes content from Icenic Gold, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

06 March

Adrian Day: Gold Dips Bought Quickly, Price Run Not Over Yet

Adrian Day, president of Adrian Day Asset Management, shares his latest thoughts on what's moving the gold price, emphasizing that its bull run isn't over yet. "It's monetary factors that are driving gold — that's what's fundamentally driving gold," he said. "Monetary factors, lack of trust in... Keep Reading...

06 March

Brien Lundin: Gold, Silver Stock Run Just Starting, Get in Now

Brien Lundin, editor of Gold Newsletter and New Orleans Investment Conference host, shares his stock-picking strategy at a time when high metals prices are beginning to lift all boats. In his view, gold and silver equities may still only be in the second inning. Don't forget to follow us... Keep Reading...

06 March

Venezuela Gold Set for US Market in Brokered Deal

A new US-Venezuela gold deal could soon channel hundreds of kilograms of bullion from the South American nation into American refineries.Venezuela’s state-owned mining company, Minerven, has agreed to sell between 650 and 1,000 kilograms of gold dore bars to commodities trading house Trafigura... Keep Reading...

05 March

Rick Rule: Gold Price During War, Silver Strategy, Oil Stock Game Plan

Rick Rule, proprietor at Rule Investment Media, shares updates on his current strategy in the resource space, mentioning gold, silver, oil and agriculture. He also reminds investors to pay more attention to gold's underlying drivers than to current events.Click here to register for the Rule... Keep Reading...

05 March

Lobo Tiggre: Gold, Oil in Times of War, Plus My Shopping List Now

Lobo Tiggre of IndependentSpeculator.com shares his thoughts on how gold, silver and oil could be impacted by the developing situation in the Middle East. He cautioned investors not to chase these commodities if prices run. Don't forget to follow us @INN_Resource for real-time updates!Securities... Keep Reading...

05 March

TomaGold: New High-grade Deep Discovery at Berrigan Mine

TomaGold (TSXV:LOT) President, CEO and Director David Grondin said the company is focusing on its flagship Berrigan mine in Chibougamau, Québec, following a large, significant discovery at depth.Berrigan is 4 kilometers northwest of the city of Chibougamau and has existed for about 50 years.... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00