October 31, 2023

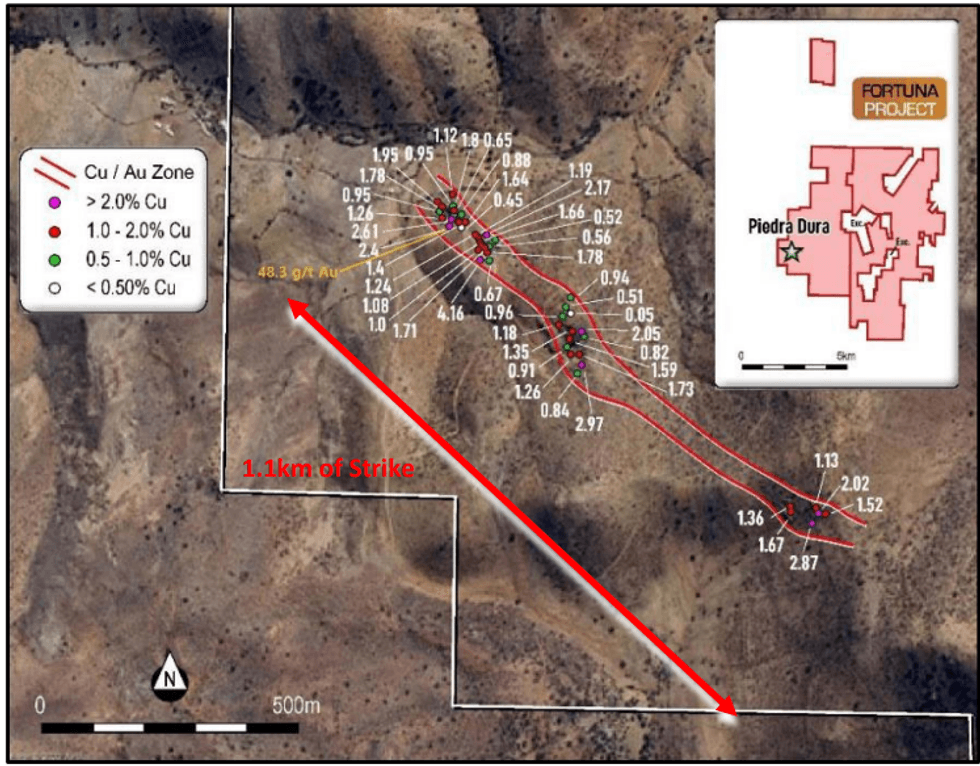

Culpeo Minerals Limited (“Culpeo” or the “Company”) (ASX:CPO, OTCQB:CPORF) is pleased to announce that it has identified a new copper-gold trend extending for 1.1km along strike and containing high-grade rock chip samples assaying up to 4.16% Cu and 48.3g/t Au at the Piedra Dura Prospect within its Fortuna Project (the Project).

HIGHLIGHTS

- The first field program has been completed at the Piedra Dura Prospect, returning high- grade copper and gold rock chips from surface and identifying a 1.1km long by 100m wide copper-gold structure.

- Assays returned up to 4.16% Cu and 48.3g/t Au, with 31 of the 47 rock chip samples collected returning assays of greater than 1% Cu.

- Drilling to commence at El Quillay during November 2023.

Culpeo Minerals’ Managing Director, Max Tuesley, commented:

“These are outstanding results from our first exploration program at Fortuna with high- grade outcropping copper and gold mineralisation discovered at Piedra Dura in a parallel structure to that previously identified at Vaca Muerta and El Quillay.

“To find high-grade outcrop on surface grading up to 4.16% Cu and 48.3g/t Au highlights the enormous potential of the Project.

“We acquired the Fortuna Project to complement the Lana Corina Project and build on our district copper strategy. These results clearly demonstrate the potential for an additional discovery proximal to Lana Corina. Exploration programs are continuing, with drill programs planned to further test the potential of Fortuna”.

Click here for the full ASX Release

This article includes content from Culpeo Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

CPO:AU

The Conversation (0)

03 April 2024

Culpeo Minerals

Exploring High-grade Outcropping Copper-Gold Projects in Chile

Exploring High-grade Outcropping Copper-Gold Projects in Chile Keep Reading...

23h

Is Now a Good Time to Invest in Copper? Experts Tout Bullish Fundamentals

Copper prices surged to an all-time high in January after a tumultuous 2025. Although there was some panic buying in the sector at a couple of points last year, prices began to trade on market fundamentals in the third and fourth quarters, driven by significant supply disruptions.At this year's... Keep Reading...

10 February

Nine Mile Metals Intersects 44 Meters of Copper Mineralization and Provides Drill Program Update

Nine Mile Metals LTD. (CSE: NINE,OTC:VMSXF) (OTC Pink: VMSXF) (FSE: KQ9) (the "Company" or "Nine Mile") is pleased to provide the details of drill hole WD-25-05 in addition to a summary of the 2025 drill program completed in December at the Wedge Project.Drillhole WD-25-05:DDH WD-25-05 collared... Keep Reading...

09 February

Rio Tinto and Glencore Walk Away from Mega-Merger, but Mining M&A Marches On

The collapse of merger talks between Rio Tinto (ASX:RIO,NYSE:RIO,LSE:RIO) and Glencore (LSE:GLEN,OTCPL:GLCNF) has ended what would have been the mining industry’s largest-ever deal.The two companies confirmed last week that discussions over a potential US$260 billion combination have been... Keep Reading...

06 February

Top 5 Canadian Mining Stocks This Week: Giant Mining Gains 70 Percent

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV and CSE, starting with a round-up of Canadian and US news impacting the resource sector.Statistics Canada released January’s jobs report on Friday (February 6). The data shows that... Keep Reading...

05 February

Top Australian Mining Stocks This Week: Solstice Minerals Soars on Strong Copper Drill Results

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.In global news, Australia took part in a ministerial meeting hosted by the US this week. The gathering was aimed at exploring a... Keep Reading...

04 February

Glencore Signs MOU with Orion Consortium on Potential US$9 Billion DRC Asset Deal

Glencore (LSE:GLEN,OTCPL:GLCNF) has entered into preliminary talks with a US-backed investment group over the potential sale of a major stake in two of its flagship copper and cobalt operations in the Democratic Republic of Congo (DRC).In a joint statement, Glencore and the Orion Critical... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00