December 02, 2024

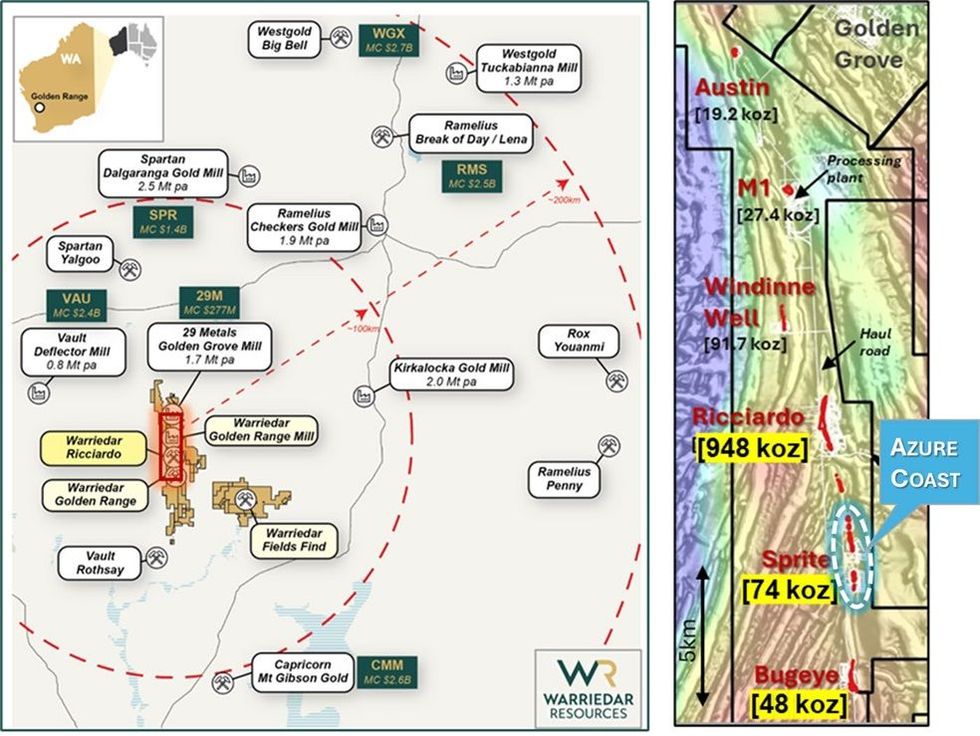

Warriedar Resources Limited (ASX: WA8) (Warriedar or the Company) provides further assay results from RC drilling at its Golden Range Project, located in the Murchison region of Western Australia (refer Figure 1).

HIGHLIGHTS:

- Drillhole AZRC003 from current RC drilling at the Golden Range Project was fast- tracked to the lab after significant antimony pXRF readings and visible stibnite.

- Assays for drillhole AZRC003 returned high-grade antimony including:

- 8m @ 2.17% Sb from 106m

- 2m @ 1.92% Sb from 122m

- Represents new antimony discovery approx. 250m north of the historic St Tropez pit, which is part of the group of historic pits now called ‘Azure Coast’ and which are located approx. 4km south of the main Ricciardo gold and antimony deposit.

- As with Ricciardo, gold was the sole focus of historical exploration at Azure Coast; antimony potential now to be assessed via systematic evaluation of historical data.

- Highlights clear potential for high-grade antimony mineralisation to be far more extensive (ie multiple deposits) along the main 70km-long shear at Golden Range.

- Ricciardo maiden antimony Mineral Resource Estimate underway.

- Current RC drill program is now complete with all residual assays pending.

The assays reported in this release are results for the first RC hole (AZRC003) of a nine-hole scout program (for 1470m drilled) along the group of five historic pits at Azure Coast. The existing gold Mineral Resource Estimate (MRE) for this area is named Monaco-Sprite (refer Appendix 1) and no antimony mineralisation has previously been reported for Azure Coast (refer Figure 2).

Visible stibnite was reported in AZRC003 and antimony content was observed in initial pXRF evaluation (utilised on all holes). Samples from this hole were fast-tracked for laboratory analysis, with the returned assay results delivering an excellent interval of 8 metres at +2% Sb coincident with the zone where visible stibnite was observed.

Warriedar Managing Director and CEO, Amanda Buckingham, commented:

“The discovery of high-grade antimony mineralisation approximately 4km south of Ricciardo substantially enhances the prospectivity of the broader ‘Golden Corridor’ for this critical metal, along with the entire shear of the broader Golden Range Project. This outcome also follows the highly encouraging initial antimony metallurgical testwork results for Ricciardo that we released last week. While we are excited about this emerging opportunity, I want to emphasise again that pursuit of this opportunity will be in parallel with our growth-focussed gold drilling at Golden Range, which remains our current core focus.”

Scout drilling and new high-grade antimony discovery at Azure Coast

The ‘Golden Corridor’ is located within Warriedar’s flagship Golden Range Project in the Murchison region of Western Australia (refer Figure 1). The Ricciardo deposit is the largest deposit within the ‘Golden Corridor’, with its Mineral Resource Estimate (MRE) recently doubling to 948 koz gold (refer Appendix 1).

Following the success of the growth-focussed gold drilling on Ricciardo through 2024, the final RC drilling campaign for this year has focussed on scout drilling at Azure Coast (a group of historical pits located approximately 4 km south of Ricciardo and extending across a slightly longer strike length of approx. 2.6 km).

This nine-hole scout program (refer Figure 2 for drill hole collar locations) was designed to assess broader potential at Azure Coast (which has only historically been drilled to a typical depth of 120m, with a select few holes reaching approx. 170m below surface) and evaluate whether it should be the focus of a dedicated growth drilling campaign in 2025.

Click here for the full ASX Release

This article includes content from Warriedar Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

WA8:AU

The Conversation (0)

09 April 2024

Warriedar Resources

Advanced gold and copper exploration in Western Australia and Nevada

Advanced gold and copper exploration in Western Australia and Nevada Keep Reading...

18 November 2024

Targeted Exploration Focus Delivers an Additional 471koz or 99% Increase in Ounces, and a Higher Grade for Ricciardo

Warriedar Resources Limited (ASX: WA8) (Warriedar or the Company) is pleased to report on an updated MRE for its flagship Ricciardo Gold Deposit, part of the broader Golden Range Project located in the Murchison region of Western Australia. HIGHLIGHTS:Updated Mineral Resource Estimate (MRE) for... Keep Reading...

30 September 2024

Continued Delivery of High Grade Antimony Mineralisation at Ricciardo

Warriedar Resources Limited (ASX: WA8) (Warriedar or the Company) provides an update on its initial review of the antimony (Sb) potential at the Ricciardo deposit, located within its Golden Range Project in the Murchison region of Western Australia. HIGHLIGHTS:Review of the antimony (Sb)... Keep Reading...

29 September 2024

Further Strong Extensional Diamond Drill Results from Ricciardo

Warriedar Resources Limited (ASX: WA8) (Warriedar or the Company) provides further assay results from its Golden Range Project, located in the Murchison region of Western Australia. HIGHLIGHTS:All residual assay results received from the recent 2,701m (27 holes) diamond drilling program at... Keep Reading...

26 August 2024

Further Step-Out Gold Success and High-Grade Antimony Discovery

Warriedar Resources Limited (ASX: WA8) (Warriedar or the Company) provides further assay results from its Golden Range Project, located in the Murchison region of Western Australia. The results reported in this release are for a further 6 of the 27 diamond holes drilled in the current program at... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00