October 16, 2024

- Further mapping and sampling planned to extend and define drilling targets to test the new gold zones identified

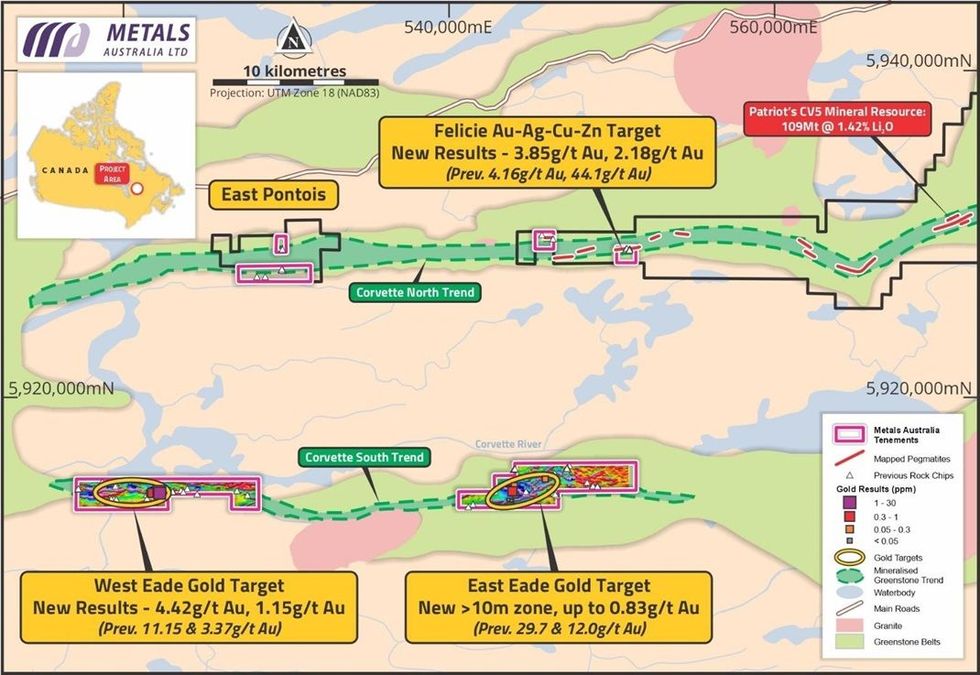

Metals Australia Ltd (ASX: MLS) is pleased to announce the results of its Phase 1 mapping and sampling program on its Corvette River Project1. The program focused on three separate target areas within the broad tenement package, covering over 22km of strike length of the highly prospective Lac Guyer Greenstone Belt, located north and south of the Corvette River in northern Quebec (Figure 1).

The Phase 1 sampling program focussed on three key prospects: Felicie on the Corvette Lithium Trend, which hosts Patriot Battery Metals’ world-class Corvette Lithium Project2, and the West Eade and East Eade claims on the parallel Corvette South Trend (see Figure 1).

The program included mapping and extensive rockchip and channel sampling in areas of previous high-grade gold samples found at West Eade and East Eade, as well as follow up of previous high-grade gold-silver-copper results at the Felicie property. Significant results obtained for each of the key target areas are as follows:

- Felicie Project – New results from the western zone of Felicie included trench sample assays grading up to 3.85g/t gold (Au), 19.8g/t Silver (Ag), 0.14% Copper (Cu), 0.84% Zinc (Zn), 0.5% lead (Pb). These results validate historical rock chip sample results that included grades of up to 4.2 g/t Au, 44.1 g/t Ag, 0.23% Cu, 1.39% Pb and 1.25% Zn3, hosted by a northeast trending shear zone mapped for approximately 200m and open to the NE and SW (see Figure 2, Images 1-4)4.

- West Eade Project – New results grading up to 4.42g/t gold were obtained from rock chip samples, validating gold results from prior programs which have included 11.45 g/t & 8.56 g/t Au (2005), 3.37 g/t Au (2019) & 2.56 g/t Au and 5.5 g/t Au (2020)3. Gold mineralisation has been demonstrated over an east-west trending corridor of over 1000m within a strongly folded and faulted banded iron formation (BIF) up to 300m in width and 2,000 m in length. (see Figure 3, Images 5-8).

- East Eade Project – Trench sample assays revealed broad mineralisation grading >0.3 g/t Au, including 1m @ 0.83 g/t Au associated with quartz veins and up to 15% sulphides within a folded and faulted BIF outcrop. This outcropping mineralised zone extends for >400m, is open to the east and west, and appears to be the source of previous high-grade rock chip samples of outcropping boulders grading 29.7 g/t Au3 and 12 g/t Au3, 160m to the east (See Figure 4, Images 9 - 14).

The new results and extensive field mapping have significantly enhanced focus areas for a Phase 2 program. Planning is underway for an exploration program aimed at further defining and extending the mineralised corridors, including pinpointing priority drilling positions for later work.

Metals Australia CEO Paul Ferguson commented:

“The results we have received from our first phase exploration program at our Corvette River project in Quebec are extremely encouraging, confirming three emerging gold discoveries at our Felicie, West-Eade and East-Eade prospects.

Our sampling program has successfully extended the mineralised zone at Felicie, with the new results validating historical data by demonstrating a broad zone of extensive mineralisation which will now be prioritised for follow-up exploration. While the near-surface gold results are significant, silver, copper, lead and zinc are also consistently present with the gold at highly anomalous levels.

The two Eade prospects cover a combined strike length of over 20km. The program was focused on mapping and trenching to extend areas near historical mineralisation. Focus in West Eade was on a Banded Iron stone (BIF) unit over 2km long which hosts disseminated sulphides that had yielded gold results previously. The program extended those results with a best result of 4.42 g/t gold. We are now seeing good mineralisation across approximately 1km of surface strike length extent. These results also warrant further work in this area.

East Eade also contains a large, banded iron formation of over 3.6km strike-length trending east- west. Gold had been found in veins within the BIF unit previously. Numerous channel and rock chip samples in our program yielded gold results up to 0.83g/t within an over 10m wide mineralised zone. Significantly, a large outcrop ridge was identified of sheared, folded and faulted silicate, oxide and sulphide facies within the BIF that also supports further investigation.

The results further underline the prospectivity of the three zones tested for gold, silver and base metals. All three areas warrant more detailed investigation, and our team is working closely with the local Magnor Exploration team on defining next steps for a follow-up program, including further systematic trenching and targeted sampling.

The Corvette River results also demonstrate the value our work programs are generating across our suite of projects in known mineralised zones in Canada and Australia. Our short to near term pipeline of news flow remains strong, with Warambie drilling samples now in the laboratory, drilling at Big Bell North project set to commence this month and Warrego East in the Northern Territory also approaching drill-ready status. Our flagship Lac Carheil project continues to develop as one of the leading graphite projects in North America today, with excellent progress being made across key studies to advance it towards prefeasibility.

Few companies our size have such a portfolio of high-quality projects and even fewer have the technical and financial capability to progress them as we are doing. This places us in an enviable position to be able to unlock significant value from multiple parallel workstreams in the near term.“

Click here for the full ASX Release

This article includes content from Metals Australia Ltd, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

MLS:AU

Sign up to get your FREE

Metals Australia Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

02 July 2025

Metals Australia

High-quality graphite development project with an accelerated pathway to production, complemented by a diversified portfolio of critical, precious and base metals assets in tier-1 jurisdictions across Canada and Australia.

High-quality graphite development project with an accelerated pathway to production, complemented by a diversified portfolio of critical, precious and base metals assets in tier-1 jurisdictions across Canada and Australia. Keep Reading...

17 February

High Grade Assays Verify the Emerging Manindi VTM Project

Metals Australia (MLS:AU) has announced High Grade Assays Verify the Emerging Manindi VTM ProjectDownload the PDF here. Keep Reading...

29 January

Quarterly Activities/Appendix 5B Cash Flow Report

Metals Australia (MLS:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

27 January

Graphite Project Links to Quebec's Critical Minerals Plan

Metals Australia (MLS:AU) has announced Graphite Project Links to Quebec's Critical Minerals PlanDownload the PDF here. Keep Reading...

18 December 2025

High Copper Anomalies Show Deeper Potential at Warrego East

Metals Australia (MLS:AU) has announced High Copper Anomalies Show Deeper Potential at Warrego EastDownload the PDF here. Keep Reading...

16 December 2025

Titanium-Vanadium-Magnetite Discovery Extended over 1km

Metals Australia (MLS:AU) has announced Titanium-Vanadium-Magnetite Discovery Extended over 1kmDownload the PDF here. Keep Reading...

27 February

UK Enters Commercial Lithium Production with Geothermal Plant Launch

The UK has entered commercial lithium production for the first time as Geothermal Engineering Ltd (GEL) began operations in its plant at Cornwall, anchoring the government's hopes of a domestic battery metals supply chain.The Redruth-based facility marks the country’s first commercial-scale... Keep Reading...

26 February

Zimbabwe Imposes Immediate Ban on Raw Mineral and Lithium Exports

Zimbabwe has imposed an immediate ban on exports of all raw minerals and lithium concentrates, halting shipments already in transit as the government tightens control over the country’s mining sector.Mines and Mining Development Minister Polite Kambamura announced Wednesday that the suspension... Keep Reading...

19 February

Top Australian Mining Stocks This Week: Lithium Valley Results Boost Gold Mountain

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.Mining giant BHP (ASX:BHP,NYSE:BHP,LSE:BHP) reported strong half-year copper results, saying that its copper operations accounted for... Keep Reading...

17 February

Howard Klein Doubles Down on Strategic Lithium Reserve as Project Vault Takes Shape

Before the Trump administration revealed plans for Project Vault, Howard Klein, co-founder and partner at RK Equity, proposed the idea of a strategic lithium reserve. “The goal of a strategic lithium reserve is to stabilize prices and allow the industry to develop,” he told the Investing News... Keep Reading...

17 February

Sigma Lithium Makes New Lithium Fines Sale, Unlocks US$96 Million Credit Facility

Sigma Lithium (TSXV:SGML,NASDAQ:SGML) has secured another large-scale sale of high-purity lithium fines and activated a production-backed revolving credit facility as it ramps up operations in Brazil.The lithium producer announced it has agreed to sell 150,000 metric tons (MT) of high-purity... Keep Reading...

12 February

Albemarle Lifts Lithium Demand Forecast as Energy Storage Surges

Albemarle (NYSE:ALB) is raising its long-term lithium demand outlook after a breakout year for stationary energy storage, underscoring a shift in the battery materials market that is no longer driven solely by electric vehicles.The US-based lithium major reported fourth quarter 2025 net sales of... Keep Reading...

Latest News

Sign up to get your FREE

Metals Australia Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00