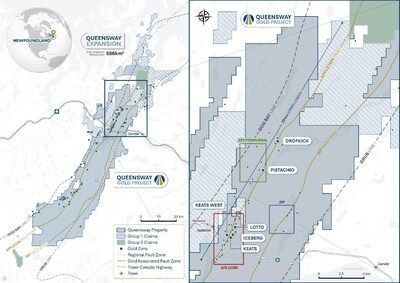

New Found Gold Corp. (" New Found Gold " or the " Company ") (TSXV: NFG) (NYSE-A: NFGC) is pleased to announce that it has entered into a property purchase agreement (the " Agreement ") with Exploits Discovery Corp. (" Exploits ") (CSE: NFLD, OTCQB: NFLDF) providing for the purchase by New Found Gold (the " Transaction ") of a 100% interest in certain mineral claims in Newfoundland and Labrador held by Exploits (the " Claims "). The Claims adjoin New Found's Queensway Gold Project (" Queensway " or the " Project ") and would increase the size of the Project by up to 33%, to a total of 234,050 hectares (" ha "; Figure 1).

Keith Boyle , CEO of New Found Gold commented "The acquisition of these additional highly prospective landholdings in and around Queensway is the next step in building a district-scale land package in central Newfoundland . With this acquisition, New Found Gold will control a key claim block immediately adjacent to the AFZ Core, where we recently announced the results of a positive preliminary economic assessment . In addition, we will add a further 20 km of strike extent along the main structures that control gold mineralization at Queensway. With a recently completed preliminary economic assessment, an exploration team with a proven track record of discovery and a strong treasury, the Company is well-positioned to continue to advance Queensway."

Claims Overview

- Group 1 : 1,984 issued mineral claims (49,600 ha),

- Group 2 : 360 mineral claims under review (9,000 ha),

- The Claims total 58,600 ha : a 33% increase in the size of New Found Gold's landholdings in central Newfoundland .

As consideration for the Claims, New Found Gold will (i) issue 2,821,556 common shares of the Company (the " Shares ") to Exploits; (ii) grant to Exploits a 1% NSR Royalty (as defined below); (iii) within 10 business days following a final determination by the Supreme Court of Newfoundland and Labrador with respect to certain disputed mineral claims, issue 725,543 Shares to Exploits.

Acquisition Advantages

- The Claims represent an important land position both from a development and exploration perspective,

- The acquisition of the Claims provide access to an area immediately adjacent to and along strike of the AFZ Core, where the Company recently announced the results of a preliminary economic assessment (" PEA ") 1 ,

- The combined land packages enhance the district-scale discovery potential of the Project, with the additional 20 km of strike along the Appleton Fault Zone,

- New Found Gold is well-positioned to advance the expanded land position having an experienced exploration team with a proven track record for discovery in the district, existing exploration infrastructure, and the required capital.

| 1 See the New Found Gold news release dated July 21, 2025 . |

| |

Transaction Details

The Transaction requires the approval of 66.67% of the votes cast by holders of common shares of Exploits at a shareholder meeting to be called by Exploits. In addition, the Transaction is subject to customary closing conditions, including the approval of the TSX Venture Exchange (" TSXV "), the NYSE American (the " NYSE-A ") and the Canadian Securities Exchange (the " CSE "). It is anticipated that the closing of the Transaction will occur in the fourth quarter of 2025.

The Agreement includes deal-protection provisions, including customary non-solicitation provisions, a right for New Found Gold to match any superior proposal, and a termination fee of CDN$250,000 , payable by Exploits, in customary circumstances. Directors, officers and certain shareholders of Exploits, owning approximately 15% of Exploits' common shares have entered into voting support agreements pursuant to which they have agreed to vote all the Exploits shares they own, or control, in favour of the Transaction.

Royalty Agreement

As partial consideration for the Claims, New Found Gold will also grant to Exploits a 1.0% net smelter returns royalty on certain of the mineral claims (the " NSR Royalty ") on the products derived from certain of the mineral licenses forming part of the Claims pursuant to a royalty agreement (the " Royalty Agreement "). For three years from the date of the Royalty Agreement, New Found Gold retains the right and option to purchase 0.5% of the Royalty for a price equal to CDN$750,000 .

About New Found Gold

New Found Gold is a well-financed advanced-stage exploration company that holds a 100% interest in Queensway, located in Newfoundland and Labrador , a Tier 1 jurisdiction with excellent infrastructure and a skilled local workforce.

The Company has completed an initial mineral resource estimate and PEA at Queensway (see New Found Gold news releases dated March 24, 2025 and July 21, 2025 ).

Recent drilling continues to yield new discoveries along strike and down dip of known gold zones, pointing to the district-scale potential of the 175,450 ha Project that covers a 110 km strike extent along two prospective fault zones.

New Found Gold has a new management team in place, a solid shareholder base, which includes an approximately 23.1% holding by Eric Sprott , and is focused on growth and value creation at Queensway.

Keith Boyle , P.Eng.

Chief Executive Officer

New Found Gold Corp.

Follow us on social media at

https://www.linkedin.com/company/newfound-gold-corp

https://x.com/newfoundgold

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statement Cautions:

This press release contains certain "forward-looking statements" within the meaning of Canadian securities legislation, relating to the Transaction and the Company; the advantages of the Transaction, including the Company's exploration plans, project synergies and mineral potential; the satisfaction of closing conditions and the approval the Transaction by the of shareholders of Exploits, TSXV, NYSE-A and CSE approval of the Transaction; the timing of the Transaction; future exploration and the focus and timing of same; and the merits of Queensway. Although the Company believes that such statements are reasonable, it can give no assurance that such expectations will prove to be correct. Forward-looking statements are statements that are not historical facts; they are generally, but not always, identified by the words "expects", "plans", "anticipates", "believes", "interpreted", "intends", "estimates", "projects", "aims", "suggests", "indicate", "often", "target", "future", "likely", "pending", "potential", "encouraging", "goal", "objective", "prospective", "possibly", "preliminary", and similar expressions, or that events or conditions "will", "would", "may", "can", "could" or "should" occur, or are those statements, which, by their nature, refer to future events. The Company cautions that forward-looking statements are based on the beliefs, estimates and opinions of the Company's management on the date the statements are made, and they involve a number of risks and uncertainties. Consequently, there can be no assurances that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Except to the extent required by applicable securities laws and the policies of the TSXV, the Company undertakes no obligation to update these forward-looking statements if management's beliefs, estimates or opinions, or other factors, should change. Factors that could cause future results to differ materially from those anticipated in these forward-looking statements include risks associated with obtaining the required approvals for the Transaction, satisfying the other conditions to the Transaction, possible accidents and other risks associated with mineral exploration operations, the risk that the Company will encounter unanticipated geological factors, risks associated with the interpretation of exploration results and the results of the metallurgical testing program, the possibility that the Company may not be able to secure permitting and other governmental clearances necessary to carry out the Company's exploration plans, the risk that the Company will not be able to raise sufficient funds to carry out its business plans, and the risk of political uncertainties and regulatory or legal changes that might interfere with the Company's business and prospects. The reader is urged to refer to the Company's Annual Information Form and Management's discussion and Analysis, publicly available through the Canadian Securities Administrators' System for Electronic Document Analysis and Retrieval (SEDAR+) at www.sedarplus.ca for a more complete discussion of such risk factors and their potential effects

![]() View original content to download multimedia: https://www.prnewswire.com/news-releases/new-found-gold-expands-queensway-gold-project-enters-into-property-purchase-agreement-to-acquire-additional-mineral-claims-302548609.html

View original content to download multimedia: https://www.prnewswire.com/news-releases/new-found-gold-expands-queensway-gold-project-enters-into-property-purchase-agreement-to-acquire-additional-mineral-claims-302548609.html

SOURCE New Found Gold Corp.

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/September2025/08/c6446.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/September2025/08/c6446.html