July 04, 2024

Metals Australia Ltd (ASX: MLS) is ramping up exploration programs across Critical Minerals and gold targets on the three key projects acquired through the purchase of an 80% interest in Payne Gully Gold Pty Ltd (PGG)1.

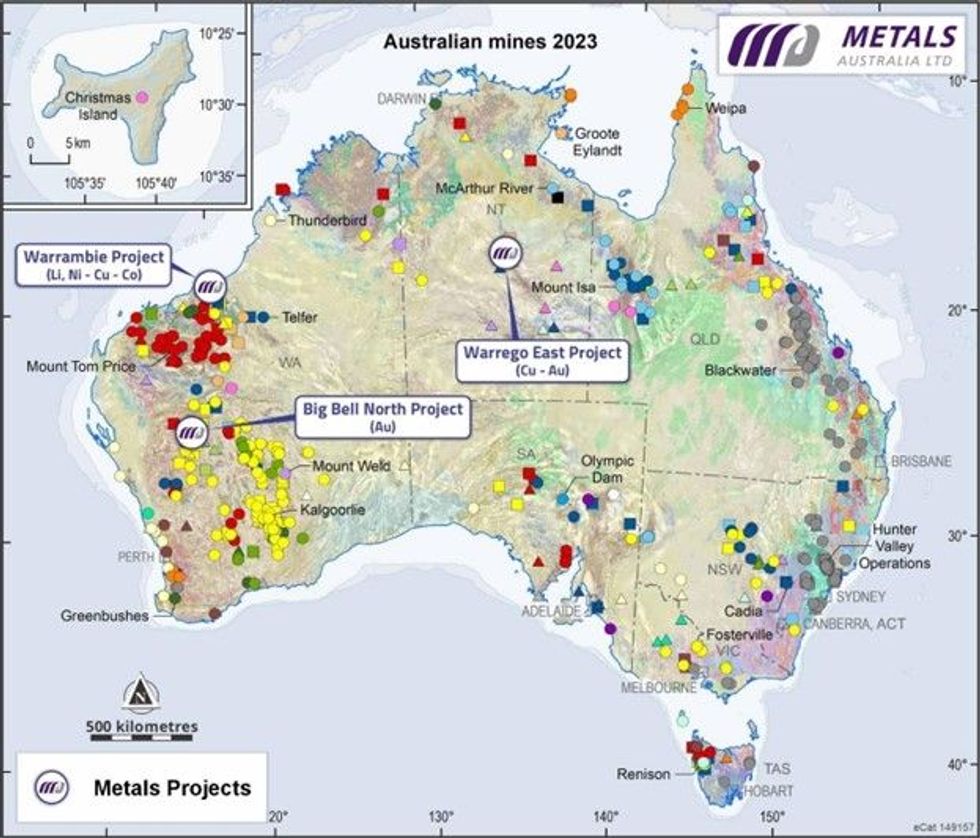

- A series of new drilling and exploration programs have been launched, testing Critical Minerals and gold targets across three key project areas. These projects all lie along strike from major deposits in world-class mineral provinces in Western Australia and the Northern Territory (see locations, Figure 1).

- The exploration programs at these highly prospective projects, acquired through the purchase of an 80% interest in Payne Gully Gold Pty Ltd1, include:

- Initial drilling of un-tested key copper-gold target corridor at the Warrego East Copper-Gold Project within the Tennant Creek Mineral Field (TCMF) in the NT (see Figure 1), which has historically produced 25Mt @ 6.9 g/t Au and 2.8% Cu2. The granted Warrego East EL32725 lies directly east of Warrego, the largest historical mine at Tennant Creek, which produced 6.75Mt @ 1.9% Cu, 6.6 g/t Au2, and covers a fault corridor interpreted from detailed magnetics and the Company’s gravity survey that connects Warrego with the Gecko and Orlando copper-gold deposits (past production and resources 11Mt @ 2.3% Cu, 1.8 g/t Au2,3 – see Figure 2). A Mine Management Plan (MMP) has been submitted to the NT Government for approval for an extensive aircore drilling program and follow-up RC/diamond drilling across ironstone hosted copper-gold targets which have not been previously tested. The Company also has four EL applications in the TCMF, all of which sit on key mineralised corridors (see Figures 2 & 3).

- Initial drilling of lithium-pegmatite targets on the Warrambie Critical Minerals (Li, Ni-Cu-Co) Project in WA’s northwest Pilbara (see Figure 1). Warrambie is located just 10km east of the major Andover lithium discovery which has produced drilling intersections of up to 209m @ 1.42% Li2O4. Targets have been defined by detailed gravity and reprocessed magnetics imagery5 which are analogous to the Andover geophysical signature but have not previously been tested due to the presence of shallow soil cover. A Program of Work (PoW) has been submitted to the WA Department of Energy, Mines, Industry Regulation and Safety (DEMIRS) for approval to drill a series of aircore drilling traverses and follow-up with RC or diamond drilling across identified lithium pegmatite targets (see Figures 4 & 5). This program is expected to commence during H2 2024.

- An aeromagnetic (fixed wing) survey is underway across the granted gold tenements located along strike to the northeast of the 5Moz Big Bell gold deposit in WA’s Murchison Gold Province. (see Figures 1 & 6). The tenements cover a 50km strike length of the regional scale Chunderloo Shear Zone and regional magnetics show potential for greenstone and potentially gold-mineralised splay structures which have not been tested in areas of cover1. The detailed aeromagnetics will define these targets prior to planned aircore drilling to test bedrock targets.

Metals Australia CEO Paul Ferguson commented:

“These new exploration programs are important steps in advancing our extensive and highly prospective Critical Minerals and gold projects in WA and the NT, which are all located along strike from major deposits in world-class mineralised terranes.

High-quality drilling targets have been identified by our geological team at the Tennant Creek project, east of the high-grade Warrego copper-gold mine, and at our Warrambie project in the northwest Pilbara, which is only 10km east of the major Andover lithium discovery. We have also commenced a detailed aeromagnetic survey across a large project area located directly along strike from the 5-million-ounce Big Bell mine in WA’s Murchison district.

With exploration programs across five key projects in Australia and Canada, the second half of 2024 will be an extremely exciting period for the Company as we look to unlock the value of our portfolio.”

The target areas being tested are all located along strike from major mineral deposits (see Figure 1, below).

Warrego East Copper-Gold Targets, Tennant Creek, NT

The Company’s Tennant Creek Project includes granted EL32725 at Warrego East and four EL applications, EL32397, EL32837, EL32410 and the more recent EL33853, located in the Tennant Creek Mineral Field (TCMF) (see Figure 2 below).

The TCMF has produced 25Mt @ 6.9 g/t gold (Au) & 2.8% copper (Cu) historically2, the equivalent of more than 8.5Moz or $20 billion worth of gold at current prices, with all production coming from deposits in outcropping areas.

Click here for the full ASX Release

This article includes content from Metals Australia Ltd, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

MLS:AU

Sign up to get your FREE

Metals Australia Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

02 July 2025

Metals Australia

High-quality graphite development project with an accelerated pathway to production, complemented by a diversified portfolio of critical, precious and base metals assets in tier-1 jurisdictions across Canada and Australia.

High-quality graphite development project with an accelerated pathway to production, complemented by a diversified portfolio of critical, precious and base metals assets in tier-1 jurisdictions across Canada and Australia. Keep Reading...

17 February

High Grade Assays Verify the Emerging Manindi VTM Project

Metals Australia (MLS:AU) has announced High Grade Assays Verify the Emerging Manindi VTM ProjectDownload the PDF here. Keep Reading...

29 January

Quarterly Activities/Appendix 5B Cash Flow Report

Metals Australia (MLS:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

27 January

Graphite Project Links to Quebec's Critical Minerals Plan

Metals Australia (MLS:AU) has announced Graphite Project Links to Quebec's Critical Minerals PlanDownload the PDF here. Keep Reading...

18 December 2025

High Copper Anomalies Show Deeper Potential at Warrego East

Metals Australia (MLS:AU) has announced High Copper Anomalies Show Deeper Potential at Warrego EastDownload the PDF here. Keep Reading...

16 December 2025

Titanium-Vanadium-Magnetite Discovery Extended over 1km

Metals Australia (MLS:AU) has announced Titanium-Vanadium-Magnetite Discovery Extended over 1kmDownload the PDF here. Keep Reading...

27 February

UK Enters Commercial Lithium Production with Geothermal Plant Launch

The UK has entered commercial lithium production for the first time as Geothermal Engineering Ltd (GEL) began operations in its plant at Cornwall, anchoring the government's hopes of a domestic battery metals supply chain.The Redruth-based facility marks the country’s first commercial-scale... Keep Reading...

26 February

Zimbabwe Imposes Immediate Ban on Raw Mineral and Lithium Exports

Zimbabwe has imposed an immediate ban on exports of all raw minerals and lithium concentrates, halting shipments already in transit as the government tightens control over the country’s mining sector.Mines and Mining Development Minister Polite Kambamura announced Wednesday that the suspension... Keep Reading...

19 February

Top Australian Mining Stocks This Week: Lithium Valley Results Boost Gold Mountain

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.Mining giant BHP (ASX:BHP,NYSE:BHP,LSE:BHP) reported strong half-year copper results, saying that its copper operations accounted for... Keep Reading...

17 February

Howard Klein Doubles Down on Strategic Lithium Reserve as Project Vault Takes Shape

Before the Trump administration revealed plans for Project Vault, Howard Klein, co-founder and partner at RK Equity, proposed the idea of a strategic lithium reserve. “The goal of a strategic lithium reserve is to stabilize prices and allow the industry to develop,” he told the Investing News... Keep Reading...

17 February

Sigma Lithium Makes New Lithium Fines Sale, Unlocks US$96 Million Credit Facility

Sigma Lithium (TSXV:SGML,NASDAQ:SGML) has secured another large-scale sale of high-purity lithium fines and activated a production-backed revolving credit facility as it ramps up operations in Brazil.The lithium producer announced it has agreed to sell 150,000 metric tons (MT) of high-purity... Keep Reading...

12 February

Albemarle Lifts Lithium Demand Forecast as Energy Storage Surges

Albemarle (NYSE:ALB) is raising its long-term lithium demand outlook after a breakout year for stationary energy storage, underscoring a shift in the battery materials market that is no longer driven solely by electric vehicles.The US-based lithium major reported fourth quarter 2025 net sales of... Keep Reading...

Latest News

Sign up to get your FREE

Metals Australia Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00