July 08, 2025

New Age Exploration (ASX:NAE) is shaping a focused gold exploration story anchored by high-quality assets in tier-one jurisdictions across Western Australia and New Zealand. The company’s strategy is clear: target proven geological corridors and apply modern, cost-efficient exploration methods to uncover new zones of mineralization.

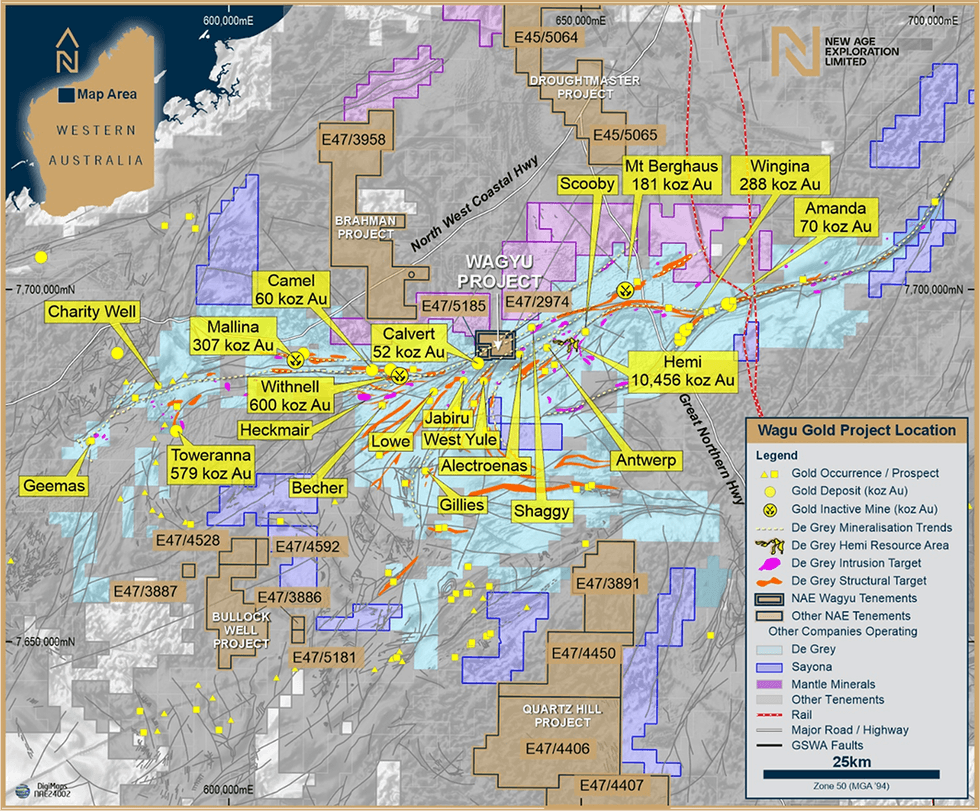

In Western Australia, New Age Exploration’s Wagyu Gold Project sits directly along strike from De Grey Mining’s Hemi discovery, now part of Northern Star Resources (ASX:NST). In New Zealand, its Lammerlaw and Otago Pioneer Quartz projects are positioned within the same regional structure that hosts OceanaGold’s (TSE:OGC) 5 Moz Macraes deposit and Santana Minerals’ (ASX:SMI) fast-growing Rise & Shine system.

Wagyu gold project location map

Wagyu gold project location mapThe Wagyu Gold Project is New Age Exploration’s flagship asset, located in the highly prospective Central Pilbara region of Western Australia. Positioned between Northern Star’s 11.7 Moz Hemi deposit and the Withnell deposit within the Mallina Basin, Wagyu targets the same intrusive-style orogenic gold system. NAE holds a 136 sq km exploration licence (E47/2974) and has completed extensive early-stage work, including reinterpretation of geophysical data to identify Hemi-style intrusions and structurally hosted gold targets.

Company Highlights

- Pilbara and Otago Exposure: Strategic landholdings in two world-class gold regions – Pilbara (WA) and Otago (NZ) – offering dual discovery potential.

- Hemi-style Intrusion Targets: The Wagyu Gold Project shares geological features and proximity with De Grey Mining’s 11.7 Moz Hemi discovery, increasing the likelihood of a major find.

- High-grade Intercepts: Recent drilling at Wagyu returned standout intercepts including 11.2 g/t gold and 1m @ 15.6 g/t gold.

- Emerging New Zealand Gold Revival: Positioned at the forefront of a regional exploration resurgence in New Zealand’s South Island, supported by rising gold prices and favorable regulatory conditions.

- Strong Cash Position: Recently raised AU$1.96 million to fund ongoing drilling, with multiple near-term catalysts expected.

This New Age Exploration profile is part of a paid investor education campaign.*

Click here to connect with New Age Exploration (ASX:NAE) to receive an Investor Presentation

NAE:AU

Sign up to get your FREE

New Age Exploration Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

07 July 2025

New Age Exploration

High potential for large-scale discovery in prolific gold regions in Western Australia and New Zealand

High potential for large-scale discovery in prolific gold regions in Western Australia and New Zealand Keep Reading...

01 March

CEO Appointment and NSW Silver Project Acquisition

New Age Exploration (NAE:AU) has announced CEO Appointment and NSW Silver Project AcquisitionDownload the PDF here. Keep Reading...

11 February

New Drill Assays Support Gold Discovery at Wagyu

New Age Exploration (NAE:AU) has announced New Drill Assays Support Gold Discovery at WagyuDownload the PDF here. Keep Reading...

08 February

Trading Halt

New Age Exploration (NAE:AU) has announced Trading HaltDownload the PDF here. Keep Reading...

05 February

New Options Prospectus

New Age Exploration (NAE:AU) has announced New Options ProspectusDownload the PDF here. Keep Reading...

28 January

Drill Program Completed at Wagyu Gold Pilbara

New Age Exploration (NAE:AU) has announced Drill Program Completed at Wagyu Gold PilbaraDownload the PDF here. Keep Reading...

3h

RUA GOLD Files 43-101 Technical Reports for the Reefton and Glamorgan Projects in New Zealand

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZX: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce the filing on SEDAR+ of independent Technical Reports for its Reefton Project ("Reefton Technical Report") on the South Island and Glamorgan Project ("Glamorgan Technical Report") on... Keep Reading...

5h

Blackrock Silver Receives First of Three Key Permits for the Tonopah West Project

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce the issuance by the Nevada Department of Environmental Protection (NDEP), through the Bureau of Air Pollution Control, the Class II Air Quality and Surface Disturbance... Keep Reading...

02 March

As Gold Investment Surges, Fake Platforms and AI Drive New Fraud Wave

As gold prices continue to soar past record highs, investors are pouring billions into bars, coins, and digital tokens. However, regulators and analysts warn that the same rally is fueling a surge in scams that are quietly draining retirement accounts and life savings.Gold has long been marketed... Keep Reading...

02 March

Peruvian Metals Announces the 10-Year Renewal of the Use of Surface Rights at the Aguila Norte Processing Plant

Peruvian Metals Corp (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals" or the "Company") is pleased to announce that the Company has renewed the lease on the use of the surface rights at its 80-per-cent-owned Aguila Norte processing plant ("Aguila Norte" or the "Plant") located in... Keep Reading...

27 February

American Eagle Announces $23 Million Strategic Investment Backed by Eric Sprott

Highlights:The investment adds a third strategic investor, when combined with investments by mining companies South32 Group Operations PTY Ltd. and Teck Resources LimitedThe Offering funds significantly expanded drill programs for 2026 and 2027 at the Company's NAK copper-gold porphyry project... Keep Reading...

27 February

Lahontan Gold Eyes Resource Update as Production Nears

Lahontan Gold (TSXV: LG,OTCQB:LGCXF) is drawing investor attention as it advances toward renewed production at its historic Santa Fe Mine in Nevada. A revised mineral resource estimate is expected soon, offering a potential catalyst, according to a recent report by News Financial.... Keep Reading...

Latest News

Sign up to get your FREE

New Age Exploration Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00