August 31, 2022

Auroch Minerals Limited (ASX:AOU) (Auroch or the Company) is pleased to announce that a JORC (2012) Mineral Resource Estimate (MRE) for the known shallow nickel mineralisation only (above 290mRL) has been successfully completed at the Nepean Nickel Project (Nepean; Auroch Minerals 80%; Lodestar Minerals 20%) in Western Australia.

Highlights

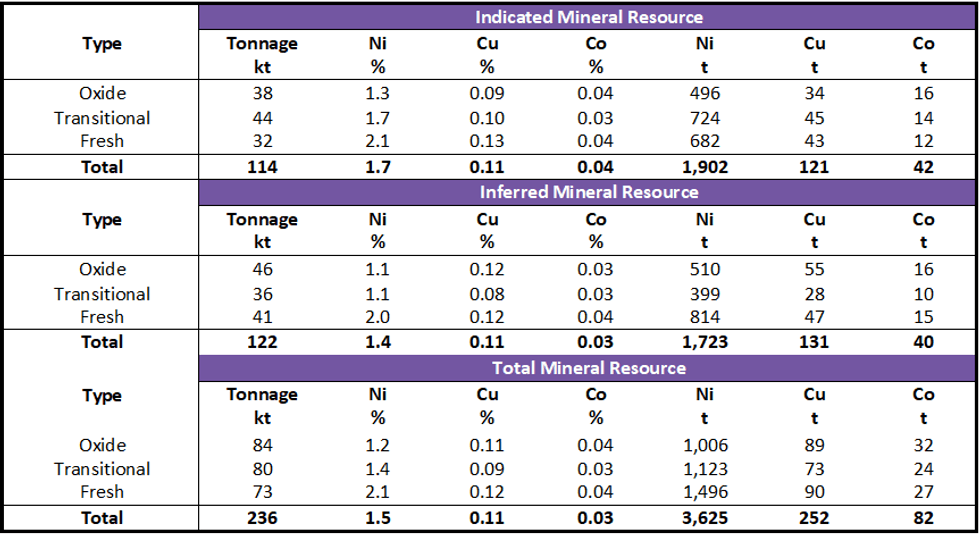

- A JORC (2012) Nepean Nickel Project Mineral Resource Estimate (MRE) has been successfully completed for the known shallow nickel mineralisation only (above 290mRL), resulting in 236kt @ 1.5% Ni and 0.11% Cu for 3,625t of contained nickel (Ni) and 252t of contained copper (Cu)1

- Significantly, approximately 50% of the new shallow Nepean MRE is within the Indicated Resources category, with the potential to increase this proportion significantly with minimal additional drilling

- The JORC (2012) MRE will form the basis of pit optimisations and mine studies as part of the Nepean Scoping Study looking into a potential open-pit mining scenario

- Reverse circulation (RC) drill programme to commence next week targeting the high- priority Induced Polarisation (IP) target at Nepean North

Table 1 – Nepean Mineral Resource Estimate Above 290mRL (0.6% Ni Cut-off Grade) - September 2022

Note: Rounding may cause some computational discrepancies

The JORC (2012) MRE for the shallow nickel mineralisation at the Nepean Nickel Project is based on both historic drill-holes and drill-holes completed by the Company in 2021. The MRE was limited to above the 290mRL (i.e. from surface down to ~120m below surface) and incorporates much of the crown pillar of the historic Nepean underground nickel mine. Importantly, the significant high-grade nickel sulphide mineralisation that exists below the 290mRL has not been included in this MRE.

Auroch Managing Director Aidan Platel commented:

“We are very pleased with the JORC (2012) MRE for the shallow nickel mineralisation at the Nepean Nickel Project. Whilst we know there exists significant high-grade nickel sulphide mineralisation at depth in and around the historic underground mine workings, we are currently focussed on the shallow nickel mineralisation above and around the old mine that could potentially be mined in an open-pit scenario.

Earlier this year we completed metallurgical testwork that confirmed the shallow nickel sulphide mineralisation is amenable to traditional beneficiation techniques for Kambalda-style nickel sulphides.2 Now that we have successfully modelled this small but significant shallow nickel resource, we can commence mine studies and design as part of the Nepean Scoping Study that will assess the potential to fast-track the project towards development and production from a future open pit mining scenario.

We are also pleased to commence exploration drilling at Nepean early next week. The IP target that aligns with the footwall of a high-Mg ultramafic is a high priority nickel sulphide target that we look forward to drill testing, and we will keep the market updated with results as they come to hand.”

As announced in April 2022, the Company has successfully completed metallurgical testwork on the shallow nickel sulphide mineralisation.2 Three composite samples with initial head assay grades ranging between 1.21% Ni to 7.18% Ni were tested, with all three samples returning good nickel recoveries (85 - 94%) and saleable concentrate grades in excess of 13% Ni. The metallurgical test results highlighted the possibility of generating early cash flow from an open-pit mine scenario and was the catalyst to undertake the completion of the shallow JORC (2012) MRE and associated Nepean Scoping Study.

Click here for the full ASX Release

This article includes content from Auroch Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

AOU:AU

The Conversation (0)

23 September 2021

Auroch Minerals

Exploring High-Grade Nickel Sulfides in Western Australia

Exploring High-Grade Nickel Sulfides in Western Australia Keep Reading...

04 February

FPX Nickel Reports Confirmatory Results from Geotechnical Drilling at the Baptiste Nickel Project

FPX Nickel Corp. (TSX-V: FPX, OTCQX: FPOCF) ("FPX" or the "Company") is pleased to report assay results from select drill holes completed during its 2025 engineering field investigation program at the Baptiste Nickel Project ("Baptiste" or the "Project") in central British Columbia.As previously... Keep Reading...

08 January

Nickel Market Recalibrates After Explosive Trading Week

Nickel prices stabilized on Thursday (January 8) after a turbulent week that saw the market swing sharply higher before retreating as traders reassessed the balance between existing supply risks and a growing overhang of inventory.Three-month nickel on the London Metal Exchange (LME) hovered... Keep Reading...

05 January

Nusa Nickel Corp. Provides 2025 Year-End Corporate Update and 2026 Outlook

Nusa Nickel Corp. is pleased to provide a year-end update highlighting key achievements in 2025 and outlining strategic priorities for 2026 as the Company continues to build a vertically integrated nickel business in Indonesia.2025 Year-End Highlights-Successfully advanced into production during... Keep Reading...

22 December 2025

Nickel Price Forecast: Top Trends for Nickel in 2026

Nickel prices were stagnant in 2025, trading around US$15,000 per metric ton (MT) for much of the year.Weighing heavily on the metal was persistent oversupply from Indonesian operations. Meanwhile, sentiment remained weak amid soft demand growth from the construction and manufacturing sectors,... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00