September 22, 2024

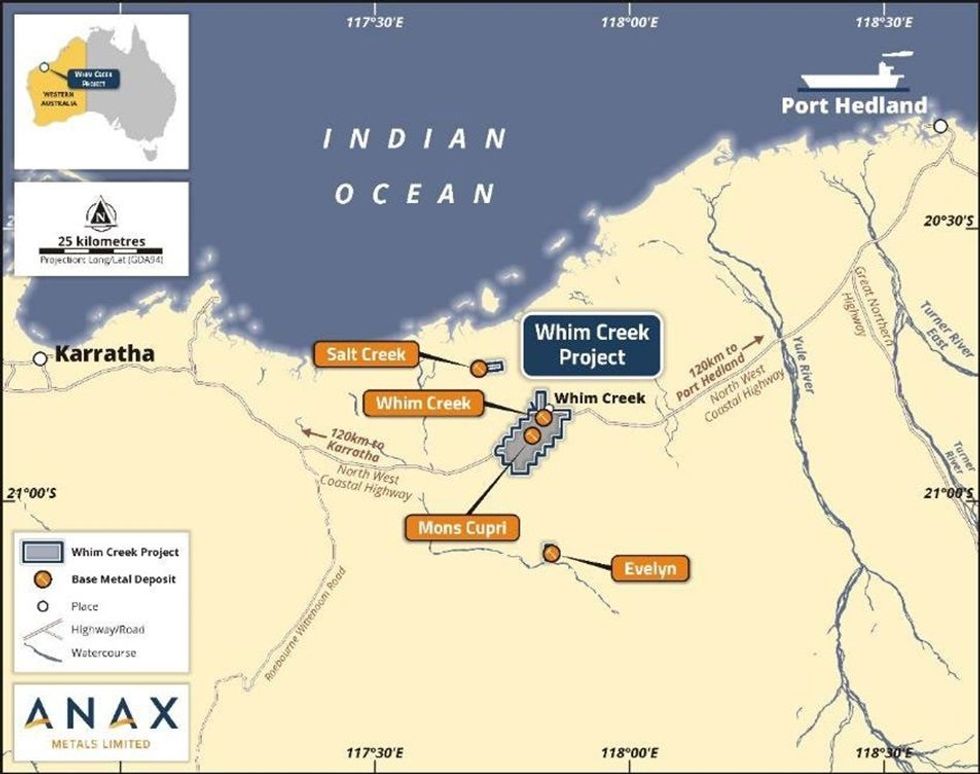

Anax Metals Limited (ASX: ANX, Anax, the Company) is pleased to provide an update on exploration at the Evelyn deposit (Evelyn), part of the Whim Creek Project, located 115km southwest of Port Hedland (Figure 1).

- Evaluation of historical exploration has identified high-potential drill targets & extensive areas in the Evelyn Mining Lease requiring further exploration

- The high-grade Evelyn base metal deposit (590Kt @ 2.54 % Cu, 3.90 % Zn)1 is centrally located within a granted Mining Lease & historical magnetic and EM surveys have defined prospective “event-horizon” stratigraphy that strikes for >3.0 km in the tenement. Approximately 70% of this highly prospective stratigraphy remains largely untested by effective drilling

- Discrete, late-time conductors defined by a VTEM (airborne EM) survey flown in 2007 are located beneath alluvial cover & remain largely untested

- Rock chip results from the recent sampling program at Felsic Dome target returned up to 3.94% Cu and 1.21 g/t Au, demonstrating prospectivity immediately west of Evelyn

- Strong bedrock conductors defined by FLEM (ground EM) surveys occur beneath transported cover with very limited drill testing completed

- Previous exploration ignored geochemical techniques in favour of geophysics

- Surface, auger & litho-geochemical techniques to be used extensively, allowing for fast & efficient exploration to identify further drill targets, mostly within the prospective event-horizon stratigraphy

- RC drilling is proposed to test existing VTEM & FLEM conductivity along with other targets generated by the geochemical program

Anax’s Managing Director, Geoff Laing commented: “Evelyn is a rich, high-value base metal deposit and the discovery of any further ore positions within the granted Mining Lease would add considerably to the overall economics of the broader Whim Creek Project. The exploration team have done well to advance the prospectivity of the area and we look forward to executing a more aggressive discovery strategy going forward”

The Company has undertaken a full review of all historical exploration resulting in the identification of considerable potential to add existing resources with successful exploration.

Geological Overview

The Evelyn deposit exhibits many characteristics typical of a Volcanogenic Massive Sulphide (VMS) style of mineralisation. The ore is comprised predominantly of massive pyrrhotite, chalcopyrite, sphalerite and minor quantities of galena and pyrite. Almost no gangue exists within the ore and the interconnectivity of the sulphide minerals results in strong electrical conductivity providing an excellent target for ground, airborne and downhole electrical geophysical techniques.

Click here for the full ASX Release

This article includes content from Anax Metals Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

ANX:AU

The Conversation (0)

28 July 2025

Quarterly Activities/Appendix 5B Cash Flow Report

Anax Metals Limited (ANX:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

02 July 2025

Anax withdraws from arbitration

Anax Metals Limited (ANX:AU) has announced Anax withdraws from arbitrationDownload the PDF here. Keep Reading...

05 May 2025

ANX secures commitment for funding from cornerstone investor

Anax Metals Limited (ANX:AU) has announced ANX secures commitment for funding from cornerstone investorDownload the PDF here. Keep Reading...

01 May 2025

Trading Halt

Anax Metals Limited (ANX:AU) has announced Trading HaltDownload the PDF here. Keep Reading...

30 April 2025

Quarterly Activities/Appendix 5B Cash Flow Report

Anax Metals Limited (ANX:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

6h

Faraday Copper Signs LOI to Acquire BHP’s San Manuel Mine in Arizona

Faraday Copper (TSX:FDY,OTCQX:CPPKF) has signed a letter of intent (LOI) to acquire BHP's (ASX:BHP,NYSE:BHP,LSE:BHP) historic San Manuel property, combining the two adjacent assets into a single US-focused copper district.Under the deal, Faraday would acquire 100 percent of the San Manuel... Keep Reading...

22h

ASX Copper Mining Stocks: 5 Biggest Companies in 2026

Copper prices have been volatile throughout 2025 and into 2026, fueled by economic uncertainty from an ever-changing US trade policy and strong supply and demand fundamentals. The International Copper Study Group, the leading copper market watcher, reported an apparent refined copper surplus of... Keep Reading...

22h

What Was the Highest Price for Copper?

Strong demand in the face of looming supply shortages has pushed copper to new heights in recent years.With a wide range of applications in nearly every sector, copper is by far the most industrious of the base metals. In fact, for decades, the copper price has been a key indicator of global... Keep Reading...

19 February

Northern Dynasty Shares Plunge as DOJ Backs EPA Veto of Alaska’s Pebble Mine

Northern Dynasty Minerals (TSX:NDM,NYSEAMERICAN:NAK) shares plunged on Wednesday (February 18) after the US Department of Justice (DOJ) filed a court brief backing the Environmental Protection Agency’s (EPA) January 2023 veto of the company’s long-contested Pebble project in Alaska.The brief... Keep Reading...

18 February

BHP Reports Strong Half-Year Copper Results, Boosts Guidance for 2026

BHP (ASX:BHP,NYSE:BHP,LSE:BHP) has published its financial results for the half-year ended December 31, 2025.The mining giant said its copper operations, which span multiple continents, accounted for the largest share of its overall earnings for the first time, coming in at 51 percent of... Keep Reading...

17 February

Nine Mile Metals Announces Certified Assays from DDH-WD-25-02 of 2.78% CUEQ over 32.10 METERS, Including 4.78% CUEQ over 11.52 Meters and 5.64% CUEQ over 6.02 Meters

Nine Mile Metals LTD. (CSE: NINE,OTC:VMSXF) (OTC Pink: VMSXF) (FSE: KQ9) (the "Company" or "Nine Mile") is pleased to announce it has received certified assays for drill hole WD-25-02 at the Wedge Mine situated in the renowned Bathurst Mining Camp, New Brunswick (BMC). WD-25-02 HIGHLIGHTS: DDH... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00