September 20, 2023

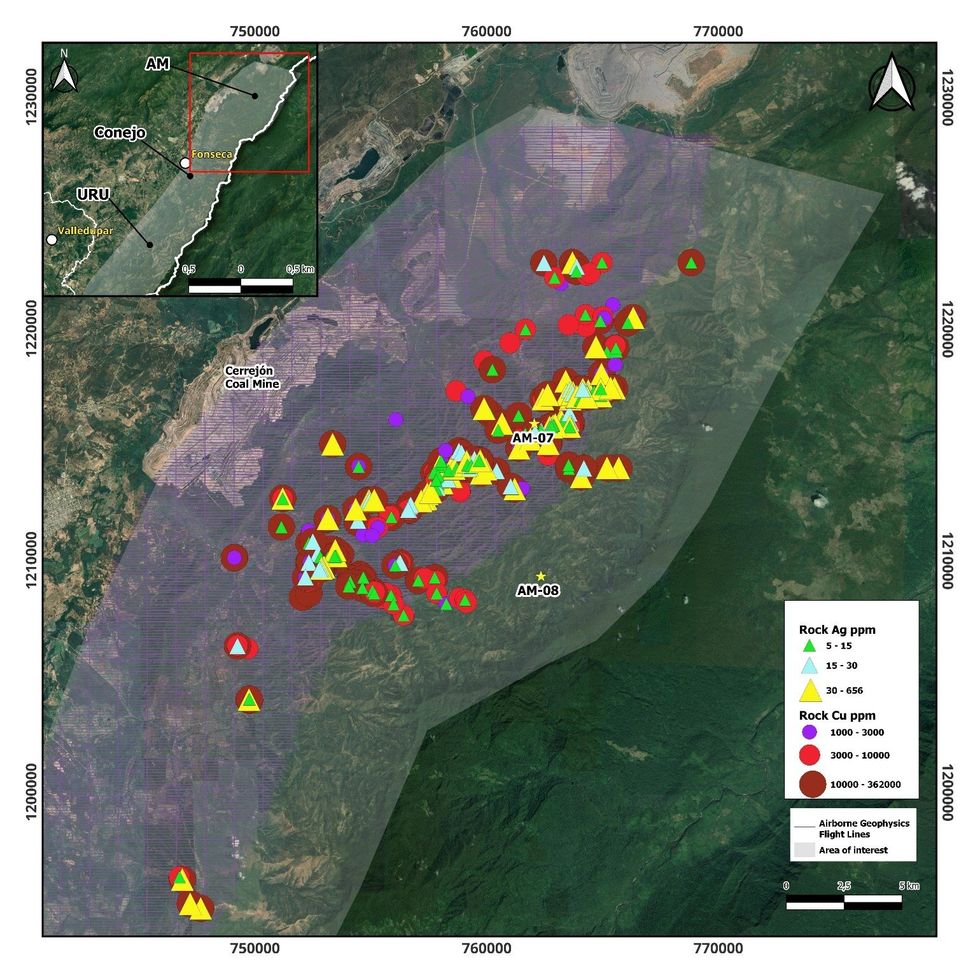

MAX RESOURCE CORP. (TSXV: MAX) (OTC Pink: MXROF) (FSE: M1D2) ("Max" or the "Company") is pleased to report it has discovered another significant mineralized outcrop at its AM District, within its 100% owned Cesar Copper-Silver Project, Northeastern Colombia. The new target, AM-08 is located approximately 7-km southeast of the AM-07 discovery (refer to Figure 2 and Max News Release dated June 22, 2023).

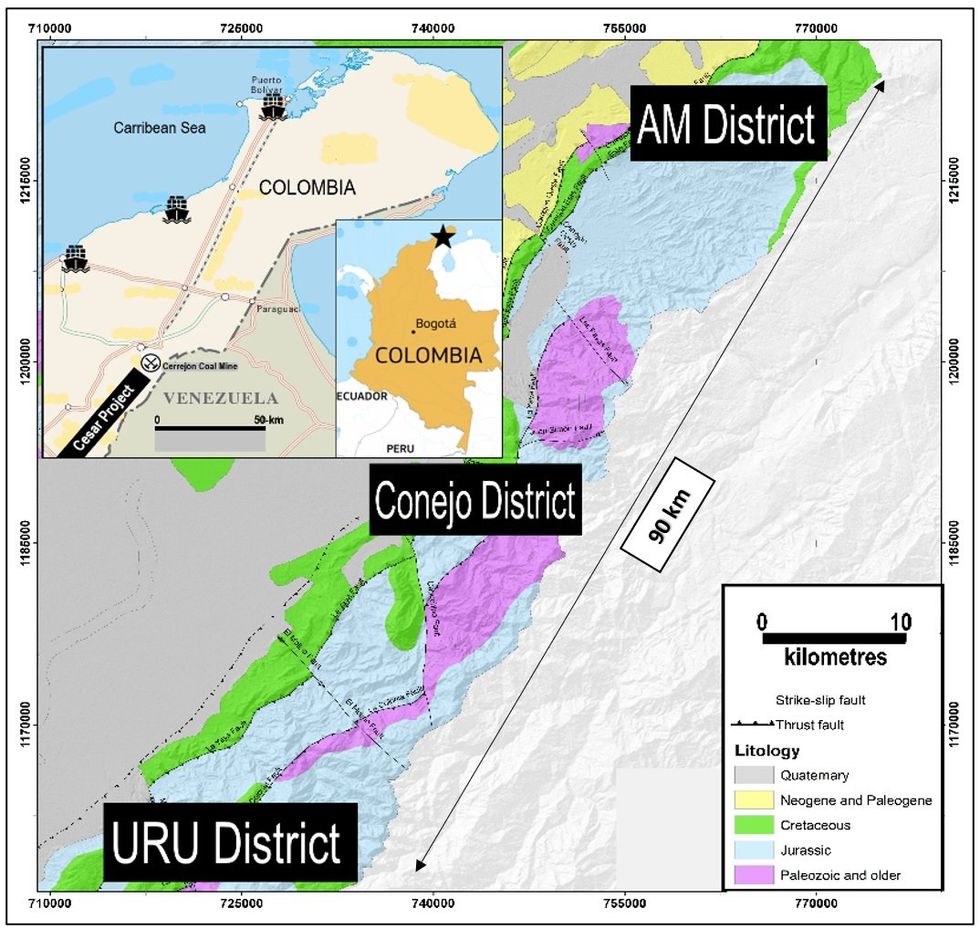

"This new and exciting discovery reinforces Max's thesis that the Cesar Copper-Silver Project may host multiple stand-alone deposits. The Max field team has now identified 22 targets across three separate districts of the 90-km Cesar copper-silver belt: AM, Conejo and URU," commented VP Exploration, Bruce Counts.

"In addition, Max's 4,000-line-km high-resolution airborne magnetic and radiometric survey over the entire AM District is well underway. Survey results will be used to refine existing targets and identify new targets by mapping the lithologies and the geological structures that control mineralization," he concluded.

Figure 1: Images of Outcrop at Target AM-08 and rock specimen with primary copper minerals Chalcocite and Malachite

Preliminary work on the new AM-08 outcrop has determined the copper-silver mineralization is hosted in a steeply dipping structure within a porphyritic rhyolite, a type of felsic volcanic rock, and that it is exposed across a width of 10m before disappearing under cover. Chalcocite and malachite are the most abundant copper minerals observed in the outcrop with minor amounts of chalcopyrite and covellite also present (refer to Figure 1).

Systematic channel sampling of the mineralized outcrop has now commenced, and crews have begun detailed mapping in the vicinity of the new discovery with the goal of extending the footprint of mineralization. Drone video of the AM-08 discovery can be viewed here.

Figure 2: Location of the AM-08 Discovery

Background

The Cesar Copper Silver Project comprises of three districts: AM, Conejo and URU. Collectively the three contiguous districts stretch over 90-km in NNE/SSW direction (refer to Figure 3).

Figure 3: Location of the Cesar Copper Silver Project, NE Colombia

This region provides access to major infrastructure resulting from oil & gas and mining operations, including Cerrejón, the largest coal mine in South America, held by global miner Glencore. Max's twenty mining concessions collectively span over 188-km².

In 2022, Max executed a 2-year co-operation agreement with Endeavour Silver Corp. (TSX: EDR, NYSE: EXK), which assists to expand its 100% owned landholdings, Endeavour will hold an underlying 0.5% NSR.

AM District

Starting in the far north of the Jurassic basin, classic stacked red bed outcrops with extensive lateral continuity have been rock sampled over many kilometres within the AM District. Highlight values of 34.4% copper and 305 g/t silver have been documented in the sedimentary red bed sequences. The Company confirmed that stratiform mineralization continues at depth with two scout drill holes completed earlier this year (Max News Release dated April 4, 2023). In addition, Colombian field crews continue to discover and sample new mineralized outcrops including at the recently identified AM-7 target (Max News Release dated May 25, 2023 and Max News Release dated June 22, 2023).

Conejo District

Midway south, the Conejo District is the most recent to be recognized and is characterized by structurally controlled mineralization hosted in intermediate and felsic volcanic rocks. Numerous mineralized outcrops have been discovered over 3.7-km at the primary target in the district with surface samples averaging 4.9% copper (2% cut-off). No drilling has been conducted at Conejo, but it has emerged as an area of focus for the Company.

URU District

Mineralization within the URU District is hosted in intermediate volcanic rocks and is structurally controlled, similar to deposits in the Central African Copper Belt. At URU-C, a 9.0m of 7.0% copper and 115 g/t silver surface discovery was confirmed at depth by drill hole URU-12, which intersected 10.6m of 3.4% copper and 48 g/t silver. At the URU-CE target, 750m to the east, 19.0m of 1.3% copper discovered in outcrop was confirmed by drill hole URU-9, which intersected a broad zone of copper oxide returning 33.0m of 0.3% copper from 4.0m, including 16.5m of 0.5% copper (Max News Release date January 24, 2023).

CESAR Target Evaluation

Max has identified and is evaluating 22 targets along the Cesar 90-km-long belt for potential drill testing. The Company is focused on expanding, refining, and prioritizing these targets in preparation for a drill program. Initial efforts have been concentrated on those targets with the greatest size potential with work that includes the following field activities:

- Systematic chip and channel sampling of the mineralized outcrops.

- Detailed geological and structural mapping of each showing.

- Target scale prospecting and soil sampling.

- Airborne Magnetic/Radiometric Surveys.

Regional Exploration

Max has demonstrated that the Cesar basin is fertile for copper-silver mineralization over a large area; however, only a fraction of the basin has been explored. As a result, Max has dedicated on of its geological teams to regional exploration with the goal of discovering additional copper-silver prospects over 1,000 sq-km.

Qualified Person

The Company's disclosure of a technical or scientific nature in this news release was reviewed and approved by Tim Henneberry, PGeo (British Columbia), a member of the Max Resource advisory board, who serves as a qualified person under the definition of National Instrument 43-101.

About Max Resource Corp.

Max Resource Corp. (TSXV: MAX) is a mineral exploration company advancing the newly discovered district-scale Cesar copper-silver project. The wholly owned Cesar project sits along the Colombian portion of the world's largest producing copper belt (Andean belt), with world class infrastructure and the presence of global majors (Glencore and Chevron).

In addition, Max controls the RT Gold project (100% earn-in) in Peru, encompassing a bulk tonnage primary gold porphyry zone, and 3-km to the NW, a gold bearing massive sulphide zone. Historic drilling in 2001, returned values ranging 3.1 to 118.1 g/t gold over core lengths ranging from 2.2 to 36.0m.

Max is proactive, with the corporate goal of transitioning the Cesar basin towards the mining of copper, the key metal for Colombia's transition to clean energy. The safety of our people and the communities where we operate is most important. We conduct exploration in a manner which supports protection of ecosystems through responsible environmental stewardship.

Source: NI 43:101 Geological Report RT Gold Project for Max Resource Corp. by Luis Rodrigo Peralta, Mar. 8, 2023. NI 43:101 Geological Report Rio Tabaconas Gold Project for Golden Alliance Resources Corp. by George Sivertz, Oct.3, 2011.

For more information visit: https://www.maxresource.com/

For additional information contact:

Tim McNulty E: info@maxresource.com T: (604) 290-8100

Rahim Lakha E. rahim@bluesailcapital.com

Brett Matich T: (604) 484 1230

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Except for statements of historic fact, this news release contains certain "forward-looking information" within the meaning of applicable securities law.

Forward-looking information is frequently characterized by words such as "plan", "expect", "project", "intend", "believe", "anticipate", "estimate" and other similar words, or statements that certain events or conditions "may" or "will" occur. Forward-looking statements are based on the opinions and estimates at the date the statements are made and are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those anticipated in the forward-looking statements including, but not limited to delays or uncertainties with regulatory approvals, including that of the TSXV. There are uncertainties inherent in forward-looking information, including factors beyond the Company's control. There are no assurances that the commercialization plans for Max Resources Corp. described in this news release will come into effect on the terms or time frame described herein.

The Company undertakes no obligation to update forward-looking information if circumstances or management's estimates or opinions should change except as required by law. The reader is cautioned not to place undue reliance on forward-looking statements. Additional information identifying risks and uncertainties that could affect financial results is contained in the Company's filings with Canadian securities regulators, which filings are available at www.sedarplus.ca.

MAX:CA

The Conversation (0)

04 March

Teck VP Highlights China's Major Role in Evolving Copper Markets

Copper prices have surged since the middle of 2025, as tariffs, rising demand and supply disruptions came together to create the perfect storm for metals traders.These factors are helping raise awareness of the challenges copper producers will face in the coming years, as supply deficits are... Keep Reading...

04 March

BHP: Targeted AI Platforms Boost Efficiency, Safety and More

Modern society has a metals problem. The demands of modern consumer culture, the energy transition and the emergence of artificial intelligence (AI) and robotics have created a dilemma.As demand rises, the supply of many metals is at a bottleneck brought about by a number of factors, from... Keep Reading...

04 March

VIDEO - BTV Visits Atlas Salt, Graphene Manufacturing, Telescope Innovations, Nevada Organic Phosphate, Maple Gold, Intrepid Metals and Nine Mile Metals

Watch on BNN Bloomberg nationalWednesday, March 4 at 7:30 PM EST & Saturday, March 7 at 8 PM EST Tune into BTV and Discover Investment Opportunities. As the resource cycle accelerates, BTV Business Television highlights companies turning exploration, innovation and strategic growth into... Keep Reading...

03 March

Hudbay to Acquire Arizona Sonoran, Creating North America’s Third Largest Copper District

Hudbay Minerals (TSX:HBM,NYSE:HBM) is doubling down on Arizona, striking a deal to acquire Arizona Sonoran Copper Company in a transaction that would create North America’s third-largest copper district.The deal gives Hudbay 100 percent ownership of the Cactus project in southern Arizona, adding... Keep Reading...

03 March

Top 10 Copper Producers by Country

In 2025, supply disruptions highlighted a growing concern as copper mines in the top copper-producing countries were aging without new mines to replace them.Additionally, copper demand from electrification is expected to rise significantly in the coming years.The competing forces of the global... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00