- NORTH AMERICA EDITIONAustraliaNorth AmericaWorld

November 01, 2024

Mawson Finland (TSXV:MFL) is a mining development company focused on gold-cobalt in northern Finland advancing its the Rajapalot gold-cobalt project in the Lapland region. Driven by a highly experienced local management and technical team, and supported by a strong Finnish investor ownership, the company is poised to become a key player in the gold-cobalt market.

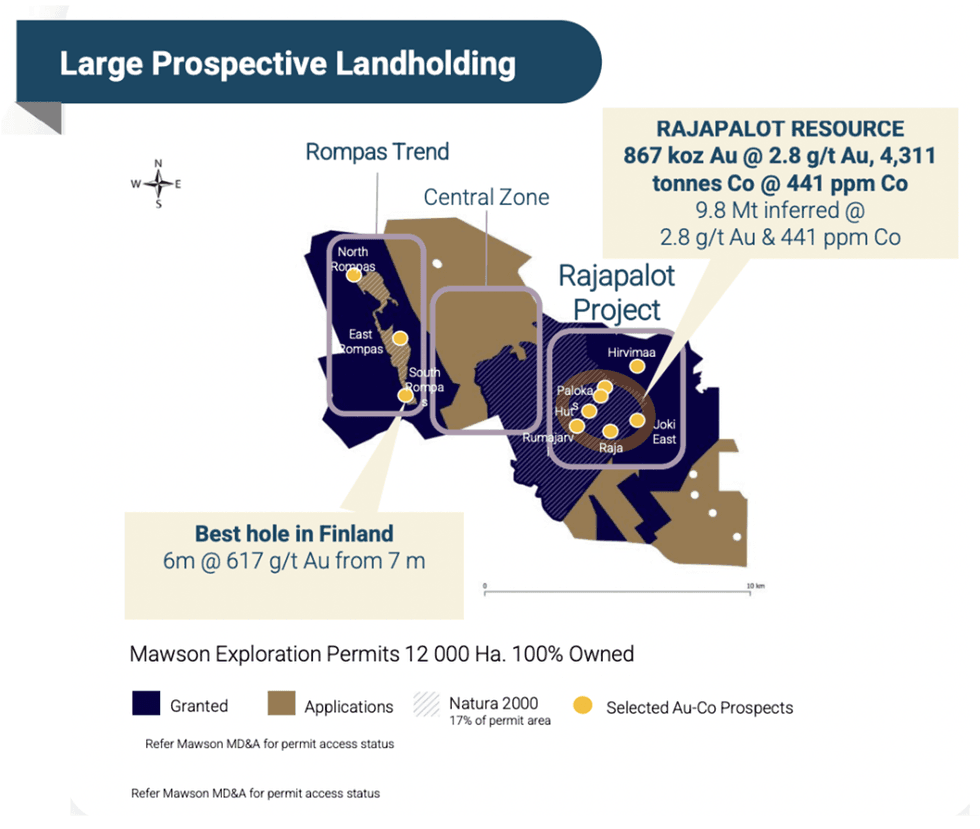

Mawson Finland's Rajapalot project spans 18,000 hectares and boasts an inferred resource of 9.8 Mt consisting of 867,000 oz gold at 2.8 g/t and 4,311 tonnes of cobalt at 441 parts per million (ppm). A completed preliminary economic assessment (PEA) estimated a net present value (NPV) of US$211 million and a 27 percent internal rate of return (IRR) based on US$1,700 gold price, with significant upside from greenfield exploration.

The Rajapalot gold-cobalt project is the company's cornerstone asset. Covering approximately 18,000 hectares, Rajapalot is distinguished by its significant gold and cobalt mineralization, making it one of the notable dual-commodity projects in Europe.

Company Highlights

- Mawson Finland is a newly listed exploration company focused on advancing its gold-cobalt project in the Lapland Region of Finland, a tier 1 mining jurisdiction.

- The project hosts multiple high-grade zones, which have been the focus of extensive exploration activities.

- The completed PEA on Rajapalot has an inferred resource of 9.78 million tonnes containing 867,000 ounces of gold and 4,311 tonnes of cobalt with grades of 2.8 g/t and 441 ppm, respectively. Additionally, the PEA includes an NPV (5 percent) of US$ 211 million with a 27 percent IRR.

- Cobalt, a key by-product of the Rajapalot project, is crucial for the manufacturing of electric vehicle (EV) batteries and renewable energy storage solutions.

This Mawson Finland's profile is part of a paid investor education campaign.*

Click here to connect with Mawson Finland (TSXV:MFL) to receive an Investor Presentation

MFL:CC

The Conversation (0)

31 October 2024

Mawson Finland Limited

Gold and cobalt exploration in Tier 1 Lapland Region in Northern Finland

Gold and cobalt exploration in Tier 1 Lapland Region in Northern Finland Keep Reading...

05 March

Mawson Finland Announces Closing of Brokered Private Placement for $6.0 Million

NOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES Mawson Finland Limited (" Mawson " or the " Company ") (TSX-V: MFL) is pleased to confirm the closing of its previously announced brokered private placement financing (the " Offering ") for gross... Keep Reading...

14 February

Mawson Finland Announces Upsize of Brokered Private Placement

/NOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES / Mawson Finland Limited (" Mawson " or the " Company ") (TSXV: MFL) is pleased to announce that due to significant demand, it has entered into an agreement with Stifel Nicolaus Canada Inc. (the "... Keep Reading...

12 February

Canadian Investment Regulatory Organization Trade Resumption - MFL

Trading resumes in: Company: Mawson Finland Limited TSX-Venture Symbol: MFL All Issues: Yes Resumption (ET): 8:00 am 2/13/2025 CIRO can make a decision to impose a temporary suspension (halt) of trading in a security of a publicly-listed company. Trading halts are implemented to ensure a fair... Keep Reading...

12 February

Mawson Finland Announces Brokered Private Placement for Up to C$5,000,000

/NOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES / Mawson Finland Limited (" Mawson " or the " Company ") (TSXV: MFL) is pleased to announce that it has entered into an agreement with Stifel Nicolaus Canada Inc. (the " Agent ") to act as lead... Keep Reading...

15 January

Mawson Finland Begins 2025 Drill Program, Mobilizing Multiple Drill Rigs at Rajapalot

Mawson Finland Limited ("Mawson" or the "Company") (TSX-V:MFL) is pleased to announce the mobilization of four diamond drill rigs, and a ‘base-of-till' (BOT) drilling rig to site, kicking-off the 2025 drill program at the Company's wholly-owned Rajapalot gold-cobalt project in Finland... Keep Reading...

5h

Diamond Drilling Commenced at Paranaíta Gold Project

Visually mineralised targets being drilled to build on existing resource

Jangada Mines Plc (AIM: JAN), a Brazil focused natural resource development company, is pleased to announce that its 15-hole 1,800m diamond drilling ("DD") programme has commenced at the 7,211-hectare Paranaíta Gold Project ("Paranaíta" or the "Project") located in Brazil's historically... Keep Reading...

14h

Metals Focus: Gold to Average US$4,560 in 2026 on Unpredictable US Trade Policy and Potential Stagflation

Leading gold analysis firm Metals Focus published its annual Precious Metals Investment Focus report on Saturday (October 25).The report outlines the investment options available for those interested in leveraging rising demand for precious metals such as gold and silver. The report also... Keep Reading...

19h

Blackrock Silver Drills 5.03 Metres of 750 g/t AgEq and Reports Multiple Thick Mineralized Zones in First Assays from Eastern Expansion Drill Program at Tonopah West

The Eastern Expansion Drill Program Is Targeting Prospective Shallow Mineralization Encountered in Scout Drilling Across a 1.2 Kilometre Trend EASTERN EXPANSION PROGRAM HIGHLIGHTS: TXC25-166 cut 5.03 metres grading 750 grams per tonne (g/t) silver equivalent (AgEq) (306.8 g/t silver (Ag) & 4.06... Keep Reading...

27 October

MBK Update - HAS Gold Assets Acquisition

Metal Bank Limited (‘MBK’ or ‘the Company’) is pleased to advise the successful completion of the phase one drilling program by Hastings Technology Metals Ltd (HAS) at the Seven Leaders prospect, one of the multiple targets at the Whiteheads Gold project in WA near Kalgoorlie. The Whiteheads... Keep Reading...

24 October

Editor's Picks: Gold Price Recovers from Biggest One-Day Drop in 12 Years

The gold price declined from its recent all-time highs this week, sinking to nearly US$4,000 per ounce and recording its biggest one-day decline in more than 12 years.Silver took a similar hit, slipping back below the US$50 per ounce level.The drops have been attributed to factors like a... Keep Reading...

Latest News

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00