Marvel Discovery Corp. (TSXV:MARV)(Frankfurt:O4T)(OTCQB:MARVF) ("Marvel" or the "Company") is pleased to announce that the Company is planning a till sampling exploration program at its Victoria Lake Property for Q2 2024. The project is being planned as a follow-up to reconnaissance till and soil sampling completed in 2023 that identified anomalous gold. The Victoria Lake Property is situated over more than 15 kilometres of the Victoria Lake Shear Zone (VLSZ), part of an extensive fault corridor within Central Newfoundland that Honsberger et al. (2022)1 identified as emerging as one of the most prospective orogenic gold domains in Atlantic Canada. The project will further follow up on the second highest regional gold-in-till sample identified by the Newfoundland Geoscience Atlas, which reported 785 ppb Au from a sample collected within Marvel's Victoria Lake project

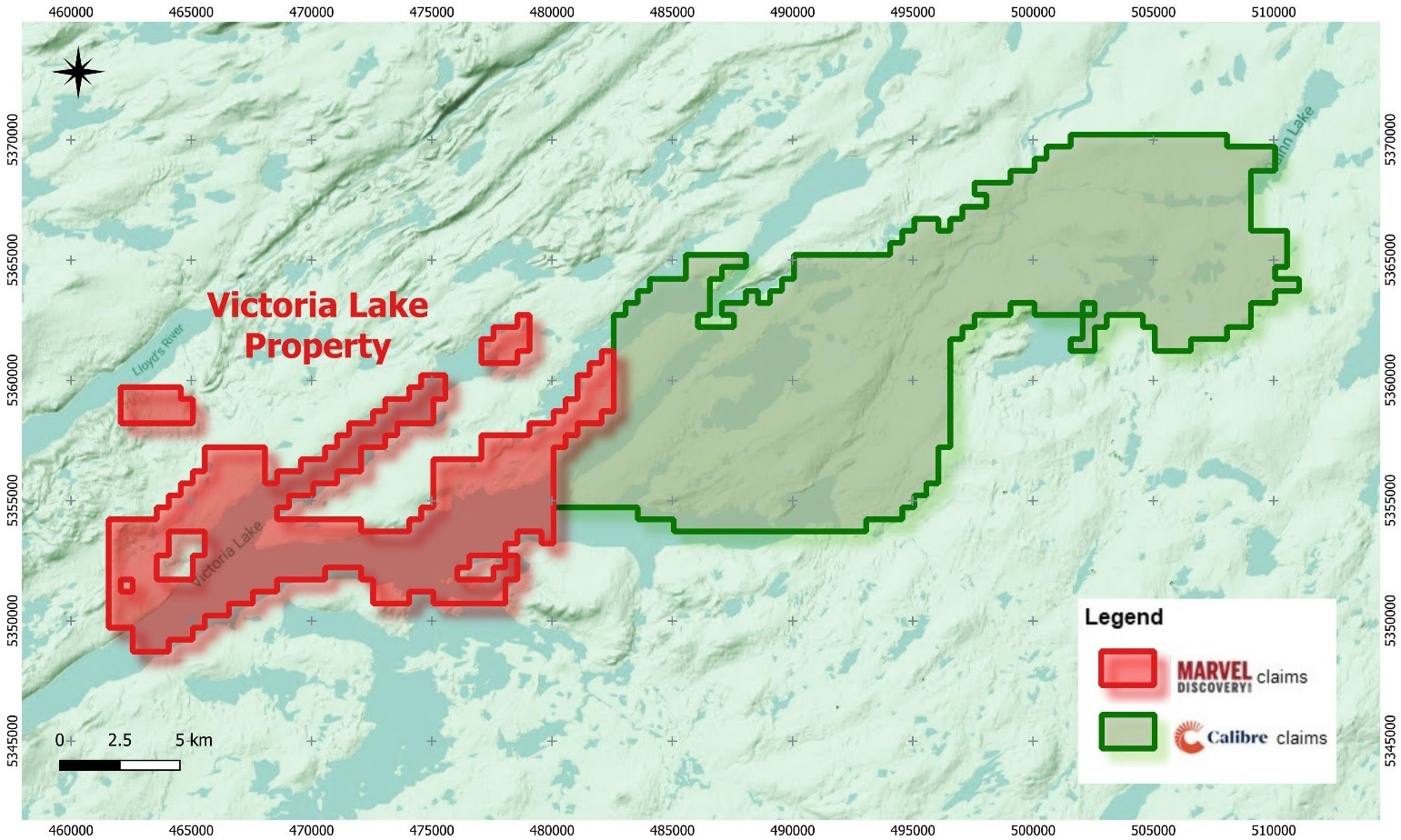

Karim Rayani, Chief Executive Officer, commented; "Results from Marvel's 2023 reconnaissance till and soil sampling program were very exciting, and identified multiple gold anomalies within the western part of the property. The reconnaissance program was intended to investigate the potential for structures associated with the Cape Ray Fault Zone and Victoria Lake Shear Zone. Anomalous gold was identified in over 20% of the 2023 samples, and our 2024 program will follow up with more detailed sampling over anomalous zones. The project is located over an extensive fault and shear zone corridor which is host to numerous gold occurrences that include the nearby Valentine Gold Project. Recent news of the acquisition of the Valentine Gold Project, we believe, is a reaffirmation of our views that this entire area has immense potential for further discovery, and the reason Marvel acquired such a significant land holding. Marvel's substantial position in this camp is second only to Calibre (see Figure 1), and includes the crucial southwest extension of the Victoria Lake Shear Zone and fault corridor. In recent months we have announced a strategic reduction of some of Marvel's holdings in the Province of Newfoundland and Labrador, as we focus on our core holdings. The Victoria Lake Project is now regarded as one of our highest priority projects within the province. As gold prices surge and global uncertainties persist, our bullish outlook on gold has never been stronger, and we remain committed to and focused on the acquisition and exploration of Tier One Projects. Exploring a significant portion of one of Newfoundland's most prospective gold-bearing structures is not only thrilling but a discovery at Victoria Lake has the potential to transform Marvel and benefit our loyal shareholders."

Results from Marvel's spring 2023 program were reported on August 14, 2023 (see press release dated August 14, 2023). The 2023 exploration program conducted till sampling over two geological targets as part of the Company's investigation of the potential for structures associated with the Cape Ray Fault - Victoria Lake Shear Zone corridor. Marvel plans to complete an enhanced program of till sampling over the area in late spring-early summer 2024 and will follow up with additional sampling in areas where anomalous gold was identified. The second highest regional gold-in-till sample in the Newfoundland Geoscience Atlas database which reported 785 ppb Au was collected from within Marvel's Victoria Lake project, and the north survey grid for 2024 is intended to follow up on this historic high-grade anomaly.

Figure 1. Location of Marvel's Victoria Lake Property and Calibre Mining Corp's Valentine Gold Project in Central Newfoundland, Canada.

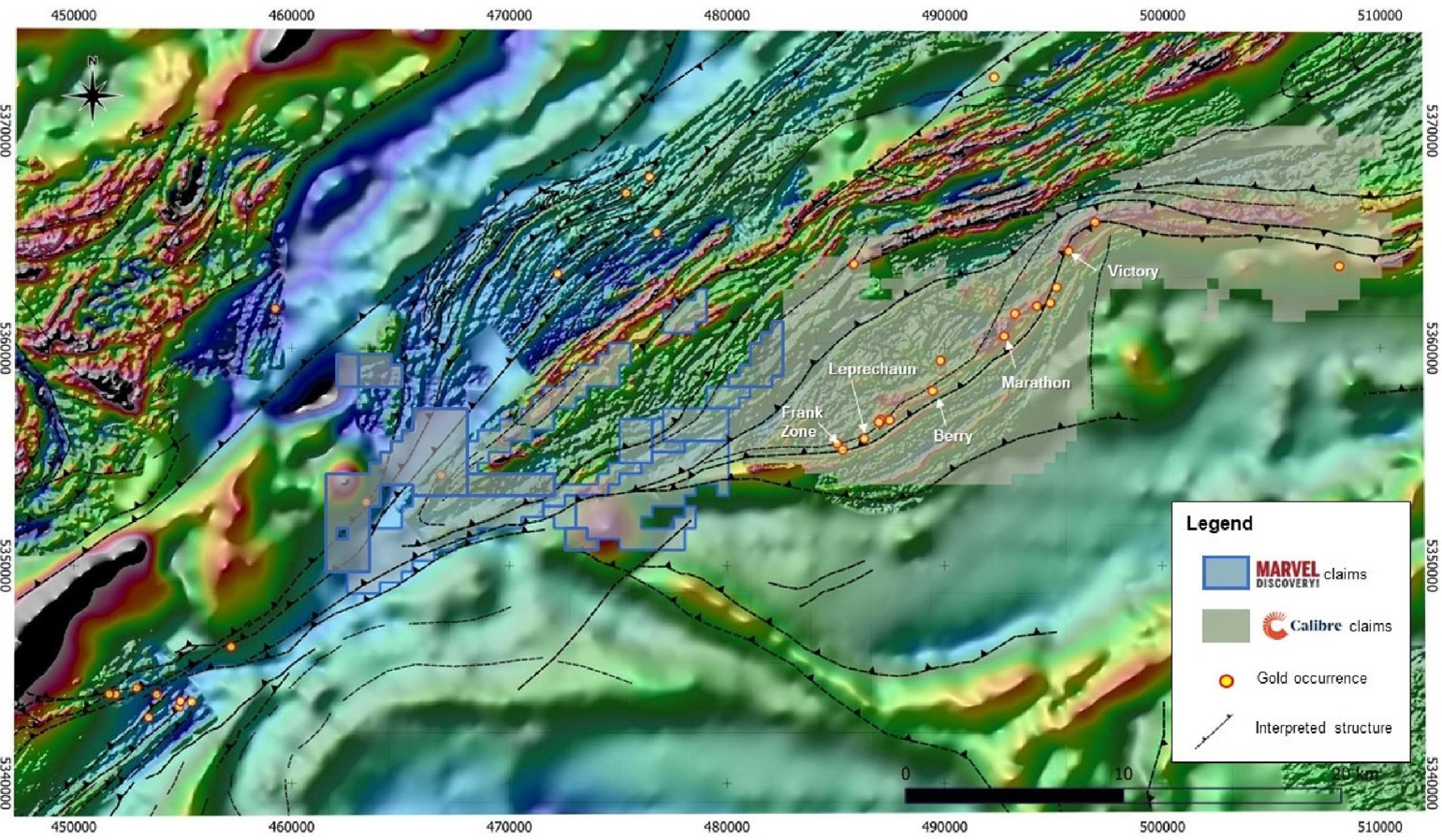

The Cape Ray Fault is an extensive fault corridor that is well recognized as being highly fertile for structural gold mineralization and is host to well-known gold occurrences that include the Cape Ray Deposit, the Valentine Gold Deposit, and the Wilding Lake Prospect. Marvel's Victoria Lake Property represents one of the largest land packages on strike and contiguous to Calibre Mining Corp.'s ("Calibre") Valentine Gold Project. The recent purchase of Marathon by Calibre (Calibre Mining Completes Acquisition of Marathon Gold - Junior Mining Network) marked a significant milestone for this entire area with their intention for an accelerated mine development phase. The Valentine Gold Project is anticipated to contribute an expected annual gold production of 195,000 ounces at a cost of USD$1,007 per ounce during the first 12 years of production starting in 2025. (https://calibremining.com/news/calibre-and-marathon-announce-combination-to-creat-6555/) The Valentine Lake shear zone plays a pivotal role in hosting gold mineralization within this entire camp with ongoing exploration and studies providing a greater understanding of this regional scale structure (https://journals.lib.unb.ca/index.php/ag/article/view/32972). Marvel's detailed studies of this area have demonstrated the potential for the continuation of this major structure to continue across the Victoria Lake Property (see Figure 2).

Figure 2. Total Magnetic Intensity Map of Victoria Lake Regional Area Showing Interpreted Location of Valentine Lake Shear Zone and Documented Gold Occurrences

Qualified Person

Greg Robinson, P.Geo., an independent qualified person as defined in National Instrument 43-101, has reviewed and approved the technical contents of this news release on behalf of the Company.

The QP and the Company have not completed sufficient work to verify the historical information on the properties comprising the Victoria Lake Shear Zone, particularly regarding historical exploration, neighbouring companies, and government geological work. The QP and the Company further acknowledge that the presence of mineral occurrences within property adjacent to Marvel's Victoria Lake Property cannot be used as an indication for mineralization to occur within Marvel's property itself.

About Marvel Discovery Corp.

Marvel, listed on the TSX Venture Exchange for more than 25 years, is a Canadian-based emerging resource company. The Company is systematically exploring its extensive property positions in:

- Newfoundland (Gander East, Gander South, Victoria Lake, Baie Verte, and Hope Brook

- Au Prospects) - Atikokan, Ontario (BlackFly - Au Prospect)

- Elliot Lake, Ontario (East Bull - Ni-Cu-PGE Prospect)

- Quebec (Duhamel -Ni-Cu-Co prospect & Titanium, Vanadium, and Chromium Prospect)

- Prince George, British Columbia (Wicheeda North - Rare Earth Elements Prospect)

The Company's website is: https://marveldiscovery.ca/

ON BEHALF OF THE BOARD

Marvel Discovery Corp.

"Karim Rayani"

Karim Rayani

President & Chief Executive Officer, Director

Tel: 604 716 0551

Email: k@r7.capital

Website: www.marveldiscovery.ca

Twitter: @marveldcorp

Facebook: @marveldiscoverycorp

LinkedIn: @marveldiscoverycorp

Instagram: @marveldiscoverycorp

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Disclaimer for Forward-Looking Information:

Certain statements in this release are forward-looking statements that reflect the expectations of management. Forward-looking statements consist of statements that are not purely historical, including any statements regarding beliefs, plans, expectations, or intentions regarding the future. Forward-looking statements in this press release relate to, among other things: the completion of the proposed Arrangement. Actual future results may differ materially. There can be no assurance that such statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements. There is no assurance any of the conditions for closing will be met. Forward-looking statements reflect the beliefs, opinions, and projections on the date the statements are made and are based upon a number of assumptions and estimates that, while considered reasonable by the respective parties, are inherently subject to significant business, economic, competitive, political, and social uncertainties, and contingencies. Readers should not place undue reliance on the forward-looking statements and information contained in this news release concerning these times. Except as required by law, the Company does not assume any obligation to update the forward-looking statements of beliefs, opinions, projections, or other factors, should they change, except as required by law.

1. Honsbergerm I.W. , Bleeker, W., Kamo, S.L., Sandeman, H.A.I., Evans, D.T.W., Rogers, N., van Staal, C.R., and

Dunning, G.R. (2022) Latest Silurian syntectonic sedimentation and magmatism and Early Devonian orogenic gold mineralization, central Newfoundland Appalachians, Canada: Setting, structure, lithogeochemistry, and high-precision U-Pb geochronology. Geological Society of America Bulletin, March 2022, 25 pages. http://pubs.geoscienceworld.org/gsa/gsabulletin/article-pdf/doi/10.1130/B36083.1/5557466/b36083.pdf

SOURCE: Marvel Discovery Corp.

View the original press release on accesswire.com