May 01, 2022

Impact Minerals (ASX:IPT) has released its March 2022 quarterly report.

- BROKEN HILL PROJECT (IPT 100%-IGO earning 75%)

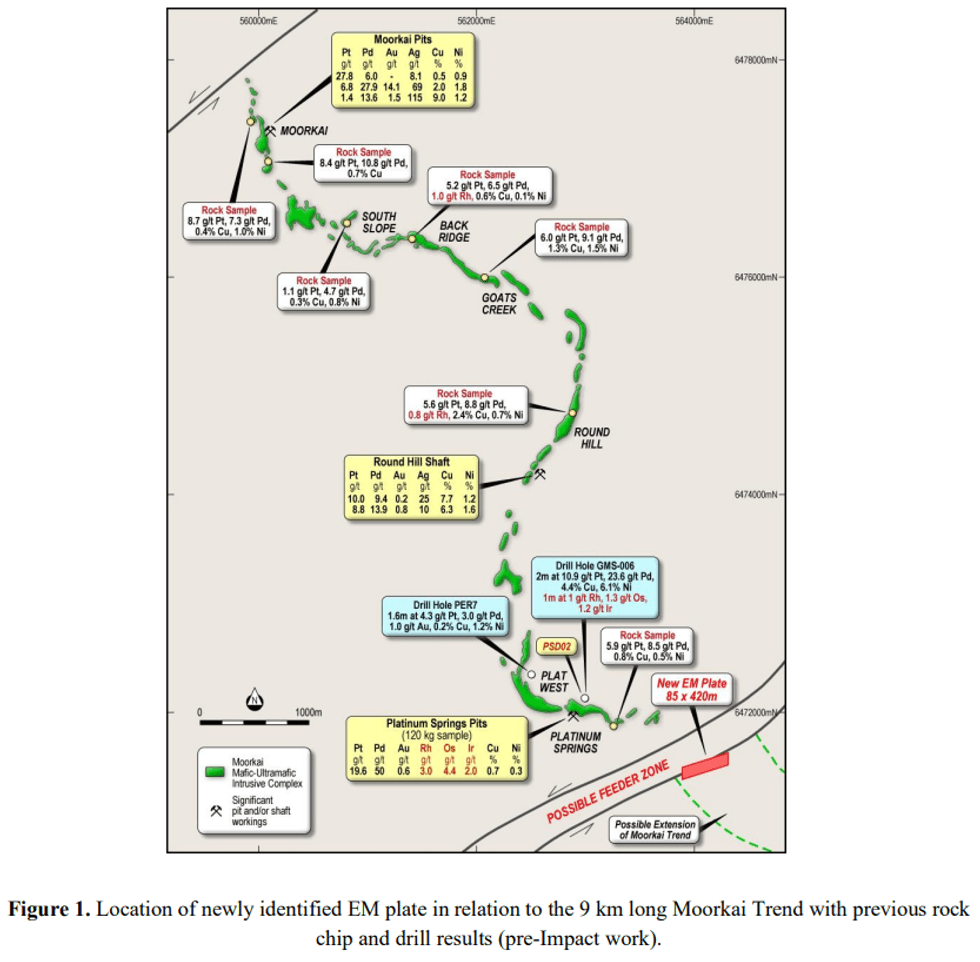

- A large strong EM conductor 420 m by 85 m in dimension identified 350 m below surface at the Platinum Springs prospect in joint venture with IGO.

- The conductor is about 1,000 metres along trend from, and with similar conductance to, a narrow drill intercept of massive sulphide which returned: 0.6 metres at 11.5 g/t platinum, 25.6 g/t palladium, 1.4 g/t gold, 7.6% copper, 7.4% nickel and 44.3 g/t silver from 57.1 metres down hole

- The conductor lies within a possible feeder zone for the extensively mineralised nine-kilometre long Moorkai Trend and is a prime drill target.

- HOPETOUN PROJECT (IPT earning 80%)

- Diamond drilling of the Top Knotch and Silverstar copper-gold-silver targets commenced and still in progress.

- The Hopetoun Project interpreted to cover an interpreted extension of the Ravensthorpe greenstone belt which contains multiple mines and deposits of lithium, nickel and copper-gold.

- JUMBO (IPT earning 80%)

- High priority targets for nickel-copper-Platinum Group Elements (PGM) (3), lithium-caesium-tantalum (LCT) pegmatites (3), Rare Earth Metals (REE) and extensive areas of anomalous rubidium identified in a reconnaissance soil geochemistry survey.

- The soil anomalies occur over significant areas of at least several hundred metres. Further anomalies are expected with more comprehensive coverage of the project area.

- Very high success rate of anomaly identification targets validates Impact’s targeting methodology working in conjunction with its joint venture partner.

- OTHER PROJECTS

- Arkun Ni-Cu-PGM, WA (IPT 100%)

- Land Access Negotiations in progress with about 30 land holders.

- Follow up soil geochemistry completed at Beau. Results due in May.

- Narryer-Dalgaranga

- No work done.

- Arkun Ni-Cu-PGM, WA (IPT 100%)

- CORPORATE

- Placement completed raising $2 million before costs.

- $1.7 million cash as at 31st March 2022

- BROKEN HILL PROJECT

A significant electromagnetic (EM) conductor was identified in the extensive ground EM survey that is still in progress at the company’s Broken Hill Project in NSW and which is being funded by joint venture partner IGO Limited (ASX:IGO) (Figure 1 and ASX Releases 9 th November 2021 and 27th January 2022).

The new EM conductor has been modelled to have a high conductance of about 8,000 siemens and with the top edge of the modelled EM plate centred at a depth of about 350 metres below surface. It has a length of about 420 metres and extends for at least 85 metres down dip moderately to the south.

The conductor is considered prospective for massive sulphide mineralisation based on its discrete dimensions and modelled high conductance. It is a priority target for follow-up work.

Click here for the full ASX Release

This article includes content from Impact Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

IPT:AU

The Conversation (0)

22 October 2024

Impact Minerals Limited

Developing the lowest-cost HPA project in Australia

Developing the lowest-cost HPA project in Australia Keep Reading...

27 March 2025

Successful Completion of the Renounceable Rights Issue

Impact Minerals Limited (IPT:AU) has announced Successful Completion of the Renounceable Rights IssueDownload the PDF here. Keep Reading...

19 March 2025

Renounceable Rights Issue Closing Date

Impact Minerals Limited (IPT:AU) has announced Renounceable Rights Issue Closing DateDownload the PDF here. Keep Reading...

13 March 2025

Major drill targets identified at the Caligula Prospect

Impact Minerals Limited (IPT:AU) has announced Major drill targets identified at the Caligula ProspectDownload the PDF here. Keep Reading...

09 March 2025

NFM: Sale of Broken Hill East Project to Impact Minerals

Impact Minerals Limited (IPT:AU) has announced NFM: Sale of Broken Hill East Project to Impact MineralsDownload the PDF here. Keep Reading...

04 March 2025

Update on the Renounceable Rights Issue to raise $5.2M

Impact Minerals Limited (IPT:AU) has announced Update on the Renounceable Rights Issue to raise $5.2MDownload the PDF here. Keep Reading...

4h

How to Invest in Gold Royalty and Streaming Stocks

Gold royalty companies offer investors exposure to gold and silver with the benefits of diversification, lower risk and a steady income stream. Royalty companies operating in the resource sector will typically agree to provide funding for the exploration or development of a resource in exchange... Keep Reading...

4h

How Would a New BRICS Currency Affect the US Dollar?

The BRICS nations, originally composed of Brazil, Russia, India, China and South Africa, have had many discussions about establishing a new reserve currency backed by a basket of their respective currencies. The creation of a potentially gold-backed currency, known as the "Unit," as a US dollar... Keep Reading...

8h

Toronto to Host Global Mineral Sector for PDAC 2026, March 1 – 4

The Prospectors & Developers Association of Canada (PDAC) will bring together the mineral exploration and mining community in Toronto for its 94th annual Convention, taking place March 1 – 4, 2026, at the Metro Toronto Convention Centre (MTCC).As the World’s Premier Mineral Exploration & Mining... Keep Reading...

11h

THE SIGNAL ARCHITECTURE: 5 Stocks Calibrating the 2026 Infrastructure Cycle

USANewsGroup.com Market Intelligence Brief — WHAT'S HAPPENING: The infrastructure holding the global economy together is being stress-tested in real time: Gold at $5,552 per ounce as central banks loaded another 755 tonnes into reserves [1]The G7 issued formal guidance treating the quantum... Keep Reading...

23 February

Mining’s New Reality: Strategic Nationalism, Gold Records and a Fractured Cost Curve

The era of “smooth globalization” is over, and mining is entering a more fragmented, politically charged phase defined by strategic nationalism, according to speakers at S&P Global’s latest webinar.Jason Holden, who opened the “State of the Market: Mining Q4 2025” session with a macro overview,... Keep Reading...

23 February

Brazilian State Firm Seeks Injunction to Block Equinox Gold-CMOC Asset Sale

A Brazilian state-run mining company is seeking an emergency court injunction to block the sale of one of Equinox Gold's (TSX:EQX,NYSEAMERICAN:EQX) Brazilian assets. Bloomberg reported that Companhia Baiana de Produção Mineral (CBPM) has asked the Bahia State Court of Justice to immediately... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00