April 08, 2024

On-site processing to underpin gold production at Mt Boppy, with optimised mine schedules and updated Reserves to support silver mining and processing at Wonawinta

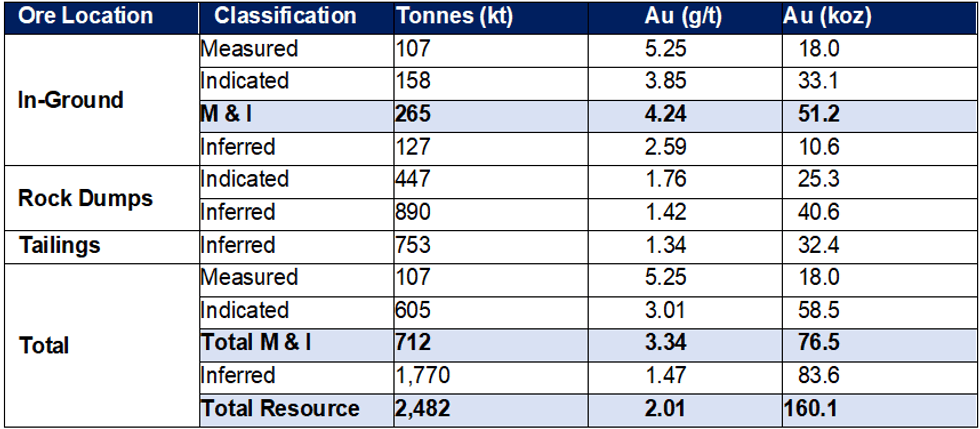

The Mt Boppy Gold Mine is located within the prolific Cobar Basin of New South Wales. Since acquiring Mt Boppy in 2019, Manuka Resources Limited (ASX:MKR, the “Company”) has increased the Resource from 31,000 ounces of gold to 160,000 ounces (see Table 1 below) and produced in excess of 45,000 ounces of gold from ore that has been trucked to and processed through the 850,000tpa CIL plant located at Manuka’s Wonawinta Silver Project, approximately 150km south of Mt Boppy.

Highlights

- Manuka is the 100% owner of the Mt Boppy Gold Mine and Wonawinta Silver Mine, both located in the prolific Cobar Basin of western New South Wales.

- To date, ore mined by Manuka at Mt Boppy has been processed through the 850ktpa processing plant located at Wonawinta, some 150km south of Mt Boppy.

- Based on results received from the sonic-drilling program over the gold-bearing rock dumps and tailings at Mt Boppy, the Company has determined that the establishment of a fit-for-purpose, on-site crush-screen-mill-float-intensive cyanidation facility capable of processing approximately 200,000 tonnes p.a. will materially enhance the economics of the Mt. Boppy Mine and the value of near- mine prospects.

- Manuka anticipates the capital cost of the on-site processing facilities to be in the order of A$10-15M (annual ore haulage alone from Mt Boppy to Wonawinta would equate to ~50% of this capital cost). The processing facilities are scheduled to be installed, commissioned and producing gold dore in calendar Q4 2024. The Mt Boppy site is fully permitted for the proposed processing plant and on-site production.

- An updated Reserve and production plan for the Wonawinta Silver Mine (currently on care and maintenance) is targeted for release in May 2024.

Manuka’s Executive Chairman, Dennis Karp, commented:

“Mt Boppy has historically been one of the richest gold mines in New South Wales, having produced circa 500,000oz of Gold at 15 g/t. Indeed, since acquiring Mt Boppy in June 2019, production performance has largely exceeded our initial forecasts, notwithstanding the fact that we have processed Mt Boppy ore through the Wonawinta Processing Plant.

Our decision to transition to on-site processing at Mt Boppy will increase operational flexibility and deliver lower operating costs. We estimate that the savings in ore haulage alone will be in the order of A$6-7 million per year. The step-change in cost base supports a robust business case for the continued near-term processing of gold bearing rock dumps and tailings and deliver cashflows to fund aggressive brownfields exploration at Mt Boppy and at near-mine prospects such as Pipeline Ridge.

With gold and silver markets buoyant, we are excited by the immediate opportunity to re- establish ourselves as an ASX precious metals producer in the Cobar Basin, whilst progressing in parallel the development of our world-class Taranaki VTM Iron Sands Project in New Zealand.”

Background

Manuka completed a sonic-drilling program in December 2023 across the gold bearing rock dumps and dry tailings to improve confidence in grade distribution within the respective Resources and therefore the ability to selectively mine higher grade regions in each.

Based on positive preliminary results from the sonic drill program, Manuka has decided to progress an updated production strategy whereby a fit-for-purpose, 200,000tpa on-site crush- screen-mill-float-intensive cyanidation capability will be established on site at Mt Boppy.

Initial discounted cashflow calculations using the Mt Boppy updated production strategy and Wonawinta optimisation study supports the carrying amount of the Cobar assets as noted in the December 2023 Interim Financial Report.

The Company is currently in advanced negotiations to secure a process plant and anticipates the capital cost to be in the order of A$10-15M fully commissioned. The capital cost equates to less than 2 years of the current cost for transporting ores from Mt Boppy to Wonawinta at the proposed rate of production. The Mt Boppy site includes an existing 48-person mining camp, power and water, administration office, exploration office and is permitted for the processing plant and on-site production.

Manuka aims to be producing gold dore from the new plant at Mt Boppy by Q4 2024.

Wonawinta Silver Mine Update

A dedicated processing facility at Mt Boppy will allow for dual revenue streams by freeing up the Wonawinta processing plant to process ore from the Wonawinta Silver Mine (currently on care & maintenance) and associated stockpiles.

Click here for the full ASX Release

This article includes content from Manuka Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Sign up to get your FREE

Valeura Energy Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

04 February

Valeura Energy

Positioned for organic growth and accretive M&A in Southeast Asia’s offshore oil sector

Positioned for organic growth and accretive M&A in Southeast Asia’s offshore oil sector Keep Reading...

06 February

Editor's Picks: Is Gold and Silver's Price Correction Over?

It's been a wild couple of weeks for gold and silver. After surging to record highs at the end of January, prices for both precious metals saw significant corrections, creating turmoil for market participants.This week brought some relief, with gold bouncing back from its low point and even... Keep Reading...

06 February

Blackrock Silver to Present at the Precious Metals and Critical Minerals Virtual Investor Conference on February 10th 2026

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce that Andrew Pollard, President & Chief Executive Officer of the Company, will present live at the Precious Metals & Critical Minerals Virtual Investor Conference hosted... Keep Reading...

05 February

Experts: Gold's Fundamentals Intact, Price Could Hit US$7,000 in 2026

Gold took center stage at this year's Vancouver Resource Investment Conference (VRIC), coming to the fore in a slew of discussions as the price surged past US$5,000 per ounce. Held from January 25 to 26, the conference brought together diverse experts, with a focus point being the "Gold... Keep Reading...

05 February

Barrick Advances North American Gold Spinoff After Record 2025 Results

Toronto-based company Barrick Mining (TSX:ABX,NYSE:B) said it will move ahead with plans to spin off its North American gold assets after a strong finish to 2025.The company's board has authorized preparations for an initial public offering (IPO) of a new entity that would house its premier... Keep Reading...

05 February

Peruvian Metals Secures 6 Year Agreement with Community at Mercedes Project

Peruvian Metals Corp. (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals or the "Company") is pleased to announce that the agreement between San Maurizo Mines Ltd. ("San Maurizo"), a private Manitoba company which holds a 100% direct interest in the Mercedes Property, and Comunidades... Keep Reading...

05 February

TomaGold Borehole EM Survey Confirms Berrigan Deep Zone

Survey also validates significant mineralization and unlocks new targets Highlights Direct correlation with mineralization : The modeled geophysical plates explain the presence of semi-massive to massive sulfides intersected in holes TOM-25-009 to TOM-25-015. Priority target BER-14C :... Keep Reading...

Latest News

Sign up to get your FREE

Valeura Energy Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Trading Halt

5h

Equity Metals Exhibiting at the 2026 PDAC

06 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00