June 12, 2024

Magnetic Resources NL (ASX:MAU) (Magnetic or the Company) is pleased to announce that LJN4 northern zone grows to over 600m down plunge.

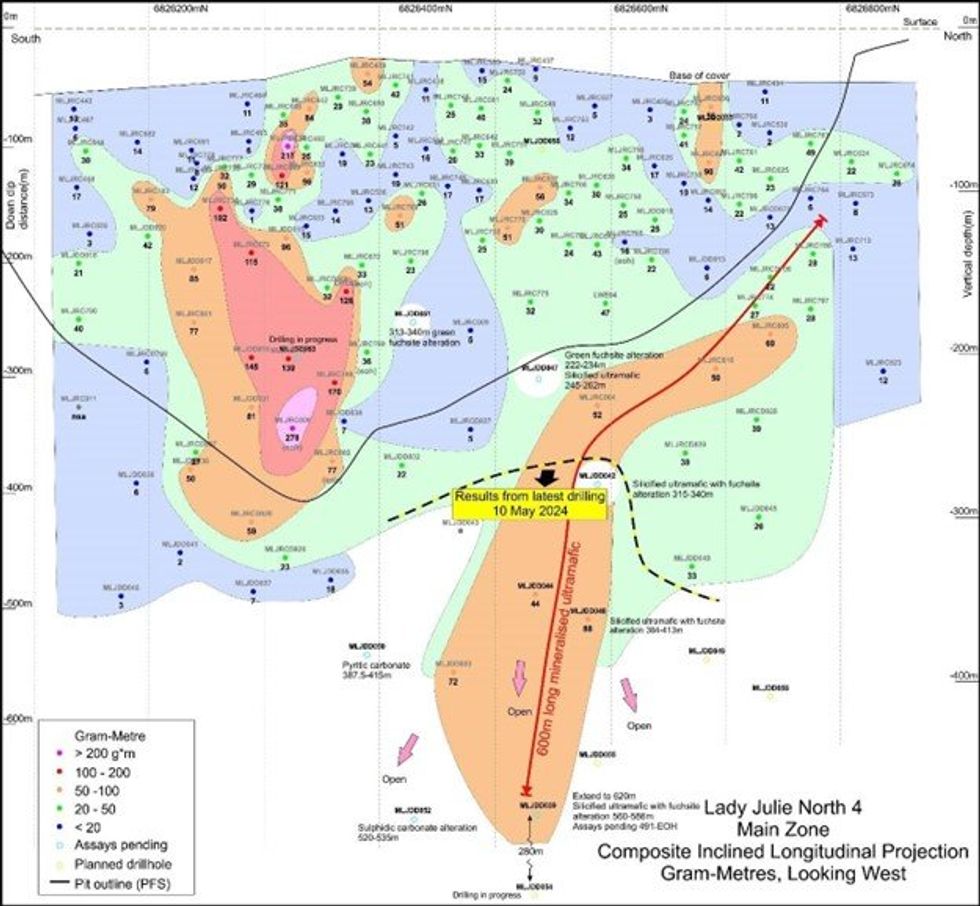

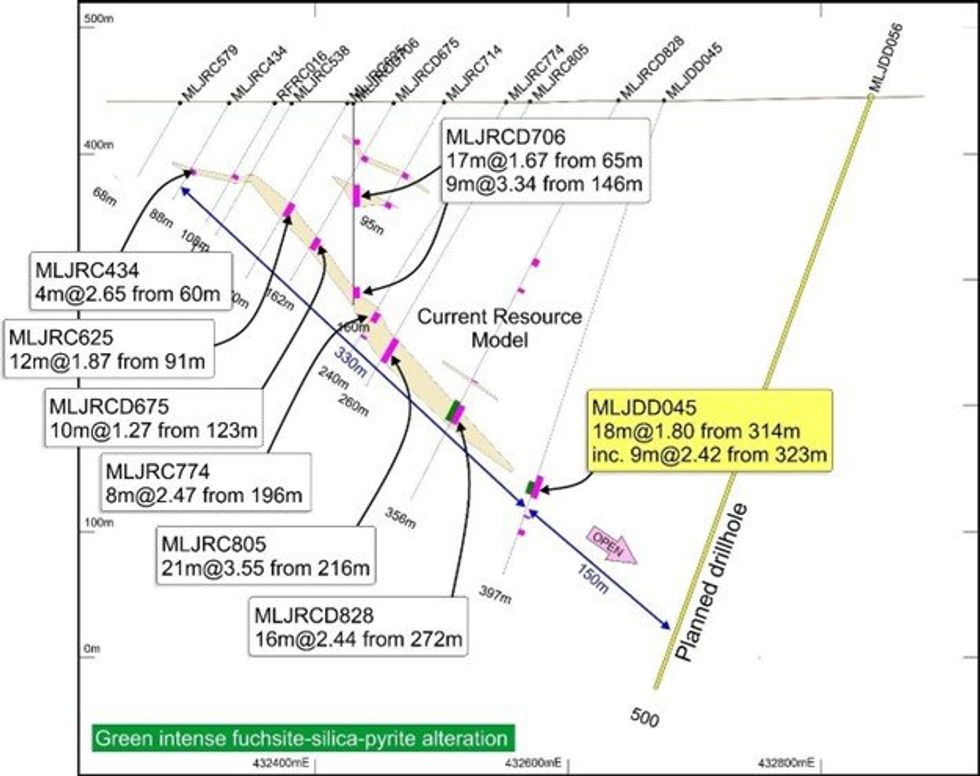

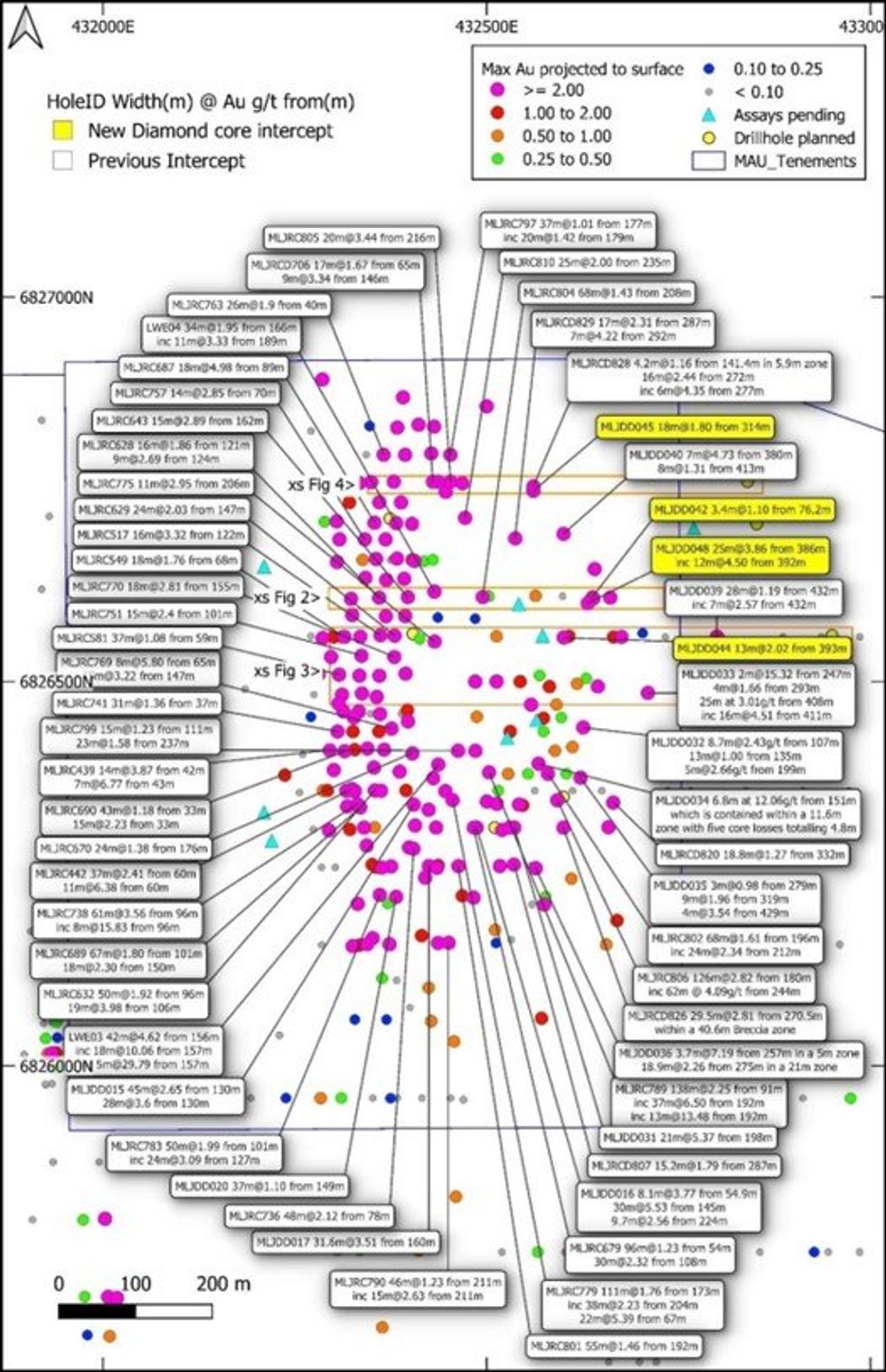

- The 400m northern part of the 750m long LJN4 deposit, has shown after a number of deep drill holes, that it plunges to the SE and is much larger than previously estimated (Figure 1). This northern zone by definition is associated with strong silica and green fuchsite, is also bigger in size than the southern silica pyrite and breccia zone. The dimension of this impressive northern zone is at least 600m down the SE plunge direction, at least 650m down dip and up to 200m long. Additionally it is still open in the down dip and down plunge directions. Deeper drill holes in progress, MLJDD054 and MLJDD055 are designed to test for further down dip extensions by 150m and 100m respectively. This zone keeps expanding and has already grown by 300m since our previous ASX release May 10, 2024(Figure 1).

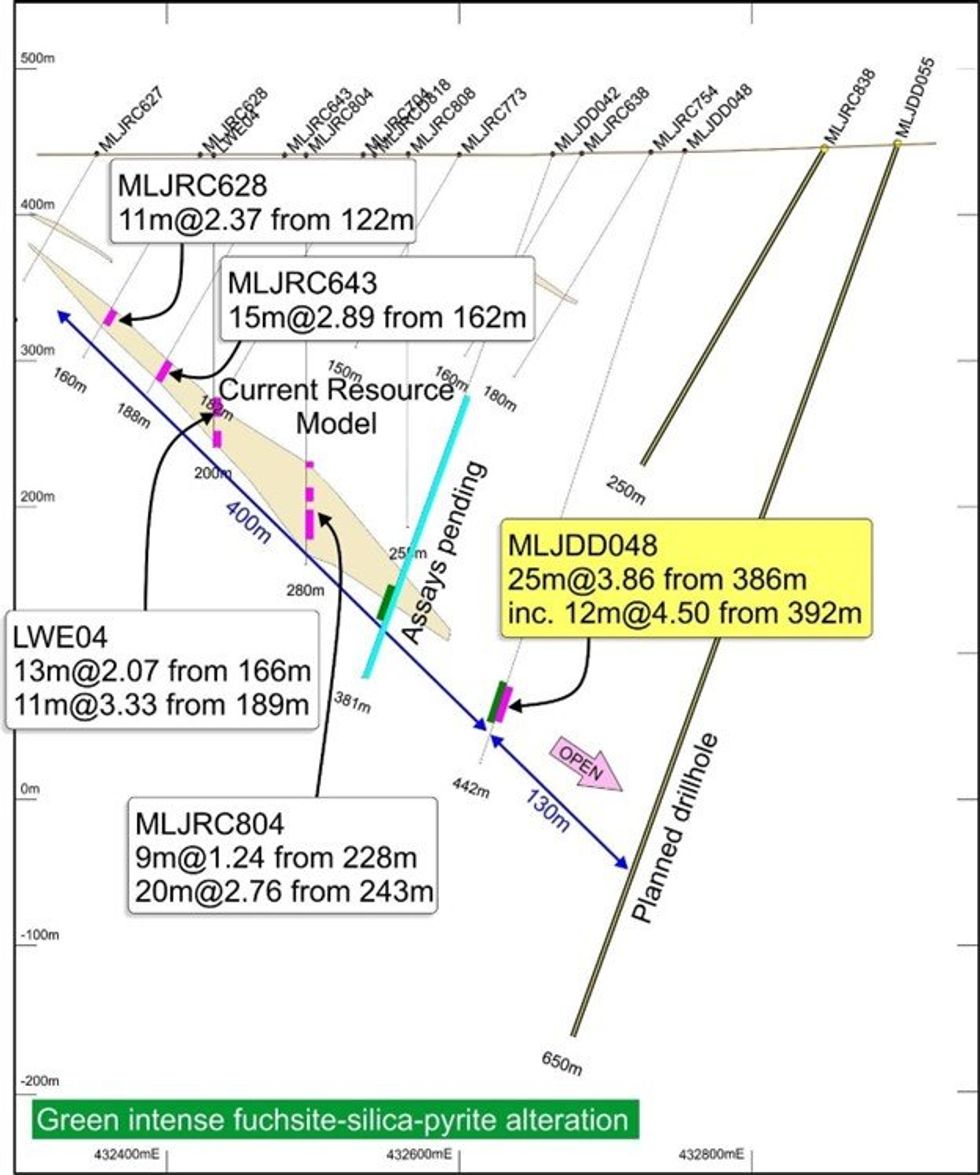

- These impressive intersections continue, MLJDD048 has 25m at 3.86g/t from 386m, which was a very large 200m step out below MLJRC804 of 20m at 2.76g/t from 243m depth (Figure 2). An infill hole within this cross section MLJDD042 has also intersected 25m of fuchsite alteration from 315-340m and results are pending.

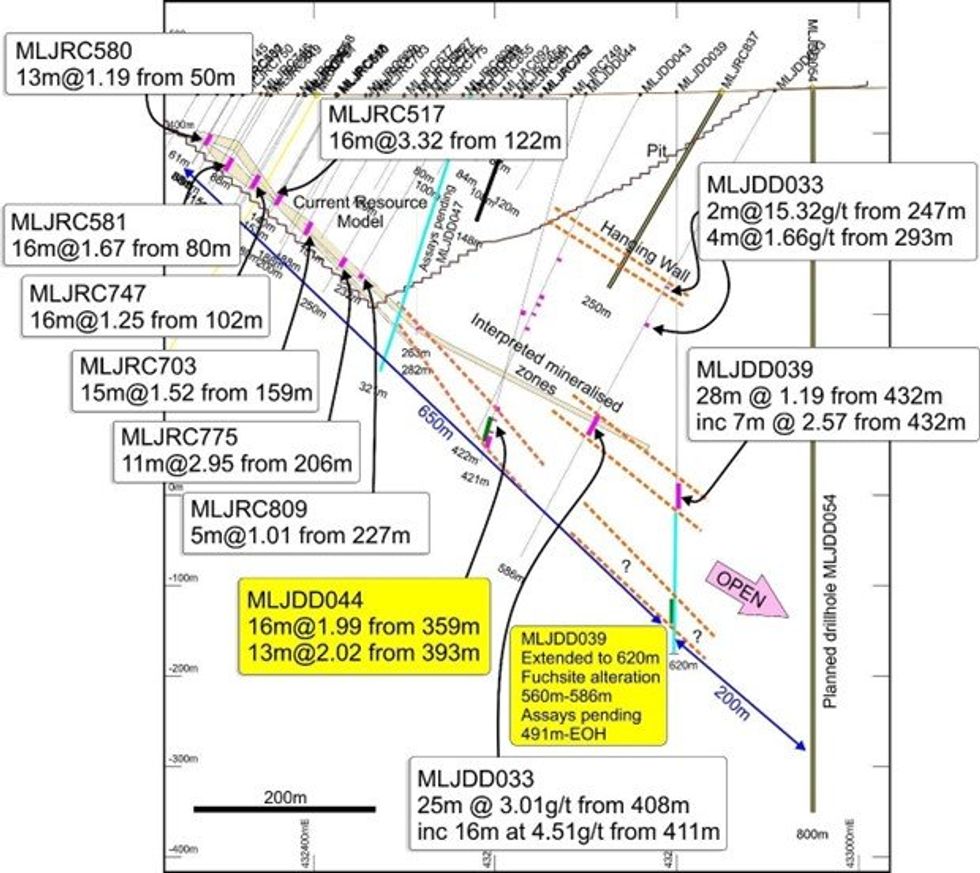

- MLJDD044 intersected 16m at 1.99g/t from 359m and 13m at 2.02g/t from 393m this is all within the green fuchsite northern zone. MLJDD039 which is a 250m down dip step out, has also intersected 26m of green fuchsite alteration. We are also waiting on these results (Figure 3).

- In addition, the assays are pending for a further 5 DDH diamond drillholes. MLJDD042 extended from 119 to 381m, MLJDD047, 50, 51 and 52 and 7 RC drillholes totalling 823m (MLJRC866-872). Diamond holes MLJDD054 and 55 are in progress and MLJDD049, 56-58 are planned.

- These intersections in MLJDD039, 44 and 48 are far below the open pit from our PFS study (ASX release 7 March 2024) and are also not included in our current resource, this auger well for the enlargement of the resource, increasing both the potential size of the open pit and now for the first time looking at the underground mining potential of LJN4. An updated economic study is planned.

- As described in the 5 March 2024 ASX release there was a 7.7% increase in overall resource in the Laverton Project to 24.9Mt @1.66g/t totalling 1.33moz of gold at 0.5g/t cut off and LJN4 has increased 11% to 948,200 oz (Table 1). Due to the promising enlargement of the northern zone, we have commenced a resource upgrade.

- Interestingly, similarly to other world class multi- million-dollar deposits in the Laverton region, we have already identified 8 stacked lodes in the central part of LJN4. We have now completed a 714m hole below these stacked lodes and results are pending.

The central and northern part of the 750m long LJN4 deposit has been drilled with very promising results. Highlights of this drilling are shown in Table 4, Figures 1-5.

The follow up deeper diamond holes have tested and are looking to extend up to two and in some cases eight, stacked lodes mainly found in the central parts of LJN4. Hole MLJDD053 is a 714m deep hole and is designed to investigate for further stacked lodes below the current bottom stacked lode. Many of these are outside the existing resource and have potential for the enlargement of the LJN4 (Indicated and Inferred) of 15.4mt at 1.92g/t for 948,200oz at a 0.5g/t cutoff (Table 1).

Click here for the full ASX Release

This article includes content from Magnetic Resources NL, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

MAU:AU

The Conversation (0)

13 December 2023

Magnetic Resources NL

An Exciting Gold Development Play in Western Australia

An Exciting Gold Development Play in Western Australia Keep Reading...

13h

Adrian Day: Gold Dips Bought Quickly, Price Run Not Over Yet

Adrian Day, president of Adrian Day Asset Management, shares his latest thoughts on what's moving the gold price, emphasizing that its bull run isn't over yet. "It's monetary factors that are driving gold — that's what's fundamentally driving gold," he said. "Monetary factors, lack of trust in... Keep Reading...

13h

Brien Lundin: Gold, Silver Stock Run Just Starting, Get in Now

Brien Lundin, editor of Gold Newsletter and New Orleans Investment Conference host, shares his stock-picking strategy at a time when high metals prices are beginning to lift all boats. In his view, gold and silver equities may still only be in the second inning. Don't forget to follow us... Keep Reading...

16h

Venezuela Gold Set for US Market in Brokered Deal

A new US-Venezuela gold deal could soon channel hundreds of kilograms of bullion from the South American nation into American refineries.Venezuela’s state-owned mining company, Minerven, has agreed to sell between 650 and 1,000 kilograms of gold dore bars to commodities trading house Trafigura... Keep Reading...

05 March

Rick Rule: Gold Price During War, Silver Strategy, Oil Stock Game Plan

Rick Rule, proprietor at Rule Investment Media, shares updates on his current strategy in the resource space, mentioning gold, silver, oil and agriculture. He also reminds investors to pay more attention to gold's underlying drivers than to current events.Click here to register for the Rule... Keep Reading...

05 March

Lobo Tiggre: Gold, Oil in Times of War, Plus My Shopping List Now

Lobo Tiggre of IndependentSpeculator.com shares his thoughts on how gold, silver and oil could be impacted by the developing situation in the Middle East. He cautioned investors not to chase these commodities if prices run. Don't forget to follow us @INN_Resource for real-time updates!Securities... Keep Reading...

05 March

TomaGold: New High-grade Deep Discovery at Berrigan Mine

TomaGold (TSXV:LOT) President, CEO and Director David Grondin said the company is focusing on its flagship Berrigan mine in Chibougamau, Québec, following a large, significant discovery at depth.Berrigan is 4 kilometers northwest of the city of Chibougamau and has existed for about 50 years.... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00