May 09, 2024

Magnetic Resources NL (ASX:MAU) (Magnetic or the Company) is pleased to announce that LJN4 continues to deliver with deepest intersection at 650m.

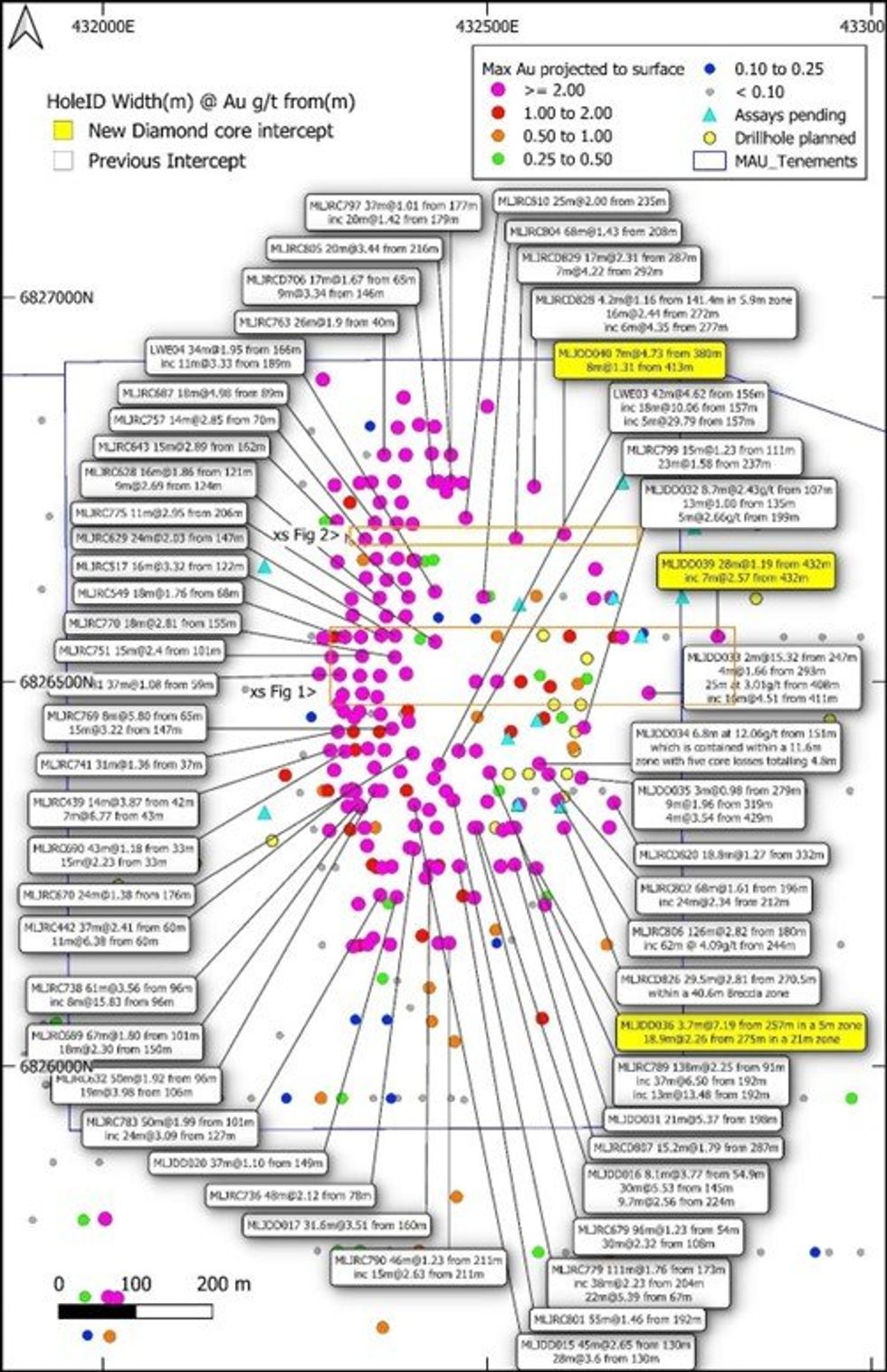

- After a significant intersection of 16m at 4.51g/t from 411m within MLJDD033, which was a very large 200m step out below the current resource (Figures 1 and 4) a further seven deeper diamond holes totalling 2,354m holes averaging 336m were drilled to ascertain the depth continuity in other parts of the LJN4 Deposit. Some compelling intersections are outlined below.

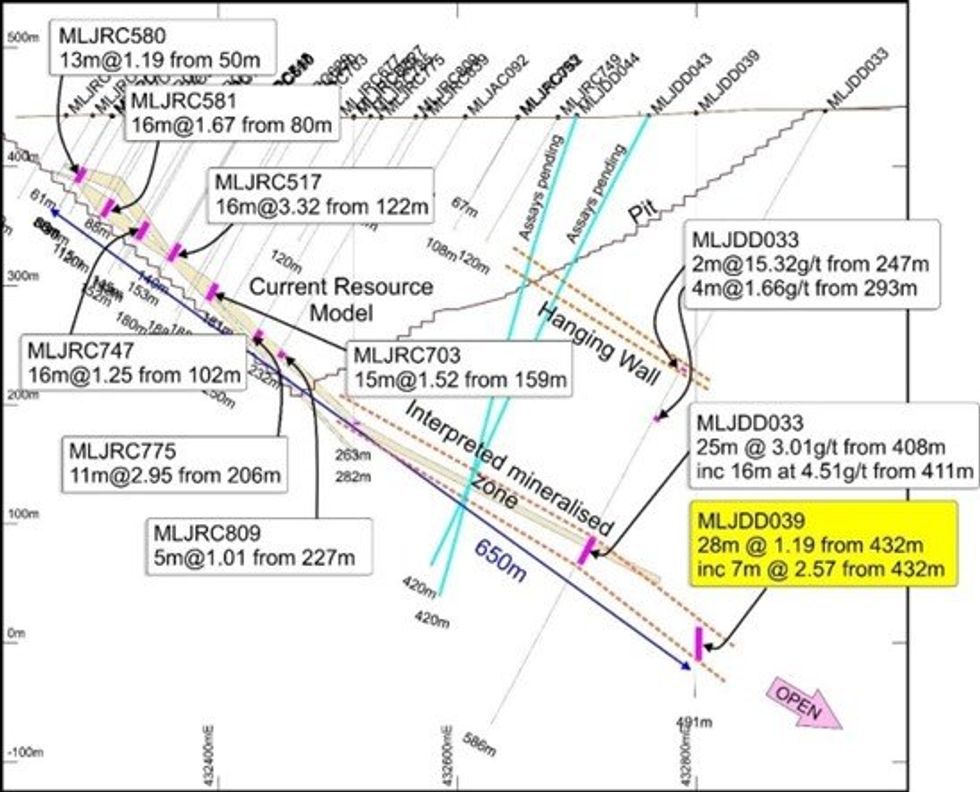

- MLJDD039 has the deepest intersection to date of 28m at 1.19g/t from 432m including 7m at 2.57g/t from 432m and is 100m down dip of MLJDD033 which intersected 25m at 3.01g/t from 408m and includes 16m at 4.51g/t from 411m. These intersections (Figure 1) are part of a 650m down dip, 45-degree mineralised zone, which is the longest so far within the 750m long LJN4 deposit.

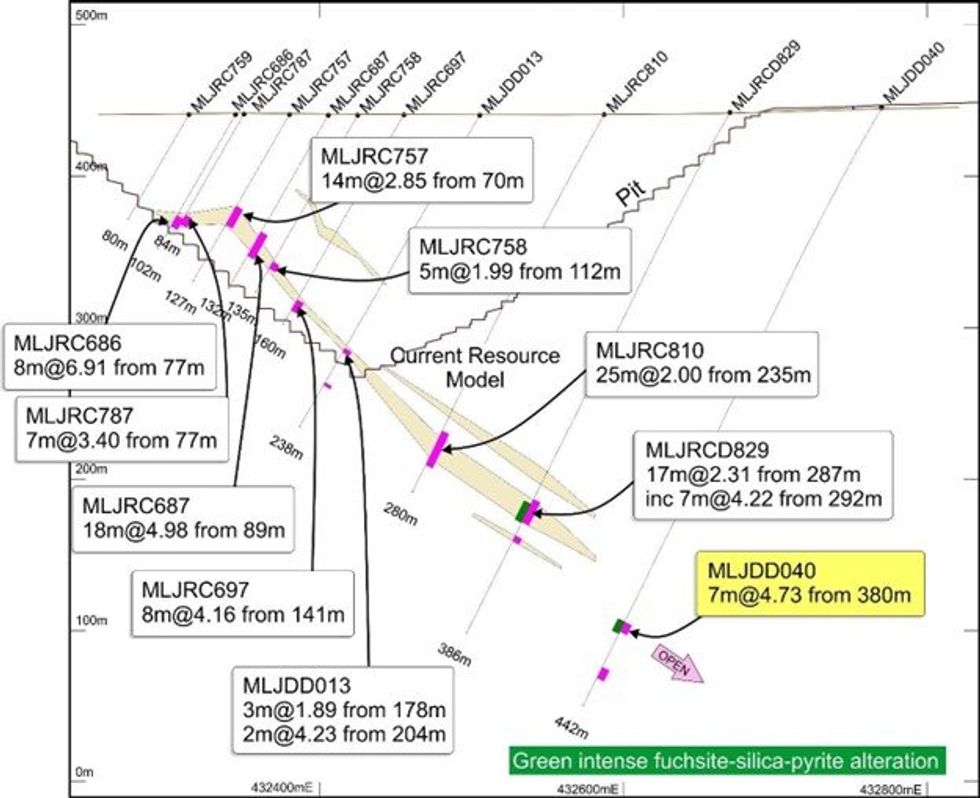

- In the northern part of LJN4 there is a strong green fuchsite-silica-pyrite alteration within the ultramafic. Drill holes MLJDD040 intersected 7m at 4.73g/t from 380m (Figure 2 ) and contained silicified ultramafic with fuchsite and quartz veins. This intersection is 100m down dip of MLJRCD829 which intersected 17m at 2.31g/t from 287m which includes 7m at 4.22g/t from 292m (which is also intensely fuchsite altered with quartz veins). The extend of this down dip zone is 450m and is still open at depth.

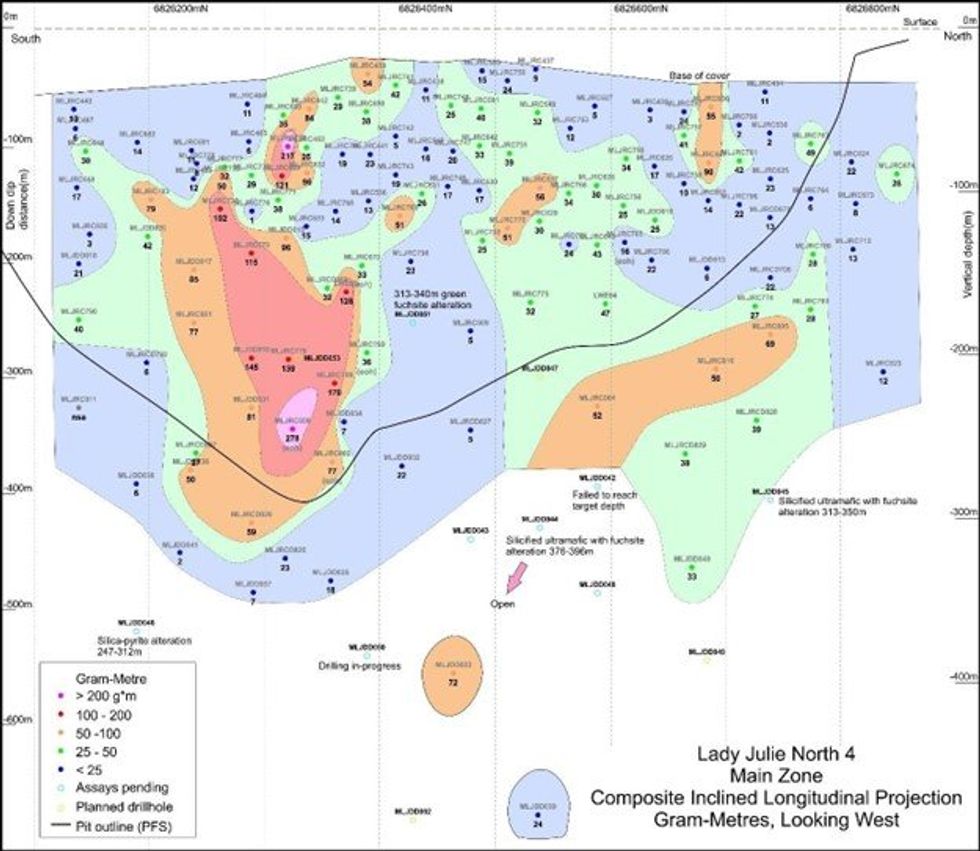

- This ultramafic alteration is much more prevalent and occurs within the 350m long northern part of LJN4 (Figure 3) and is also present in holes MLJDD044 (from 376-396m), MLJDD045 (from 313-350m) and MLDD051 (from 313-340m), which have assays pending. The central and northern parts of LJN4 are still open at depth and there is a suggestion that the zones plunge to the SE (Figure 3).

- These intersections in MLJDD039 and 40 are far below the open pit from our PFS study (ASX release 7 March 2024) and are also not included in our current resource, this augers well for the enlargement of the resource, increasing both the potential size of the open pit and the accompanying positive economic studies.

- MLRDD036 intersected 18.9m at 2.26 g/t from 275M within a 21m zone, which is a 40m step out down dip from MLJRCD807 which intersected 15.2m at 1.79g/t from 287m (Figure 4).

- As described in the 5 March 2024 ASX release there was a 7.7% increase in overall resource in the Laverton Project to 24.9Mt @1.66g/t totalling 1.33moz of gold at 0.5g/t cut off and LJN4 has increased 11% to 948,200 oz (Table 1).

- It is particularly interesting that we have 8 stacked lodes in the central part of LJN4 and we have one planned 600m hole that will be testing for stacked lodes beneath the current mineralised stacked lodes.

- A number of deeper step out holes have now been carried out to see whether the LJN4 resource appears to extend further at depth and there are assays pending for 7 diamond drillholes totalling 1980m averaging 396m and include MLJDD042-46, 48, 50, 51) and 14 RC drillholes totalling 946m (MLJRC839-859). In addition, there are 6 holes being drilled in this current programme totalling 2800m and averaging 466m and are expected to be completed by the end of May 2024 with three diamond rigs operating.

The central and northern part of the 750m long LJN4 deposit has been drilled with very promising results. Highlights of this drilling are shown in Table 4, Figures 1-4.

The follow up deeper diamond holes have tested and are looking to extend up to two and in some cases eight, stacked lodes mainly found in the central parts of LJN4. Hole MLJDD053 is a 600m deep hole and is designed to investigate for further stacked lodes below the current bottom stacked lode. Many of these are outside the existing resource and have potential for the enlargement of the LJN4 (Indicated and Inferred) of 15.4mt at 1.92g/t for 948,200oz at a 0.5g/t cutoff (Table 1).

Click here for the full ASX Release

This article includes content from Magnetic Resources NL, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

MAU:AU

The Conversation (0)

13 December 2023

Magnetic Resources NL

An Exciting Gold Development Play in Western Australia

An Exciting Gold Development Play in Western Australia Keep Reading...

1h

Fabi Lara: What to Do When Commodities Prices Go Parabolic

Speaking against a backdrop of record-high gold and silver prices, Fabi Lara, creator of the Next Big Rush, delivered a timely reality check at this year’s Vancouver Resource Investment Conference. Addressing a packed room that included a noticeable influx of first-time attendees, she urged... Keep Reading...

1h

Joe Cavatoni: Gold Price Drop — Why it Happened, What's Next

Joe Cavatoni, senior market strategist, Americas, at the World Gold Council, breaks down gold's record-setting run past US$5,500 per ounce as well as its correction. "At the end of this, you're looking at a lot of people who were pushing the price higher — speculative in nature — pulling back... Keep Reading...

9h

Gold-Copper Consolidation Continues as Eldorado Moves to Acquire Foran

Eldorado Gold Corporation (NYSE:EGO,TSX:ELD) and Foran Mining (TSX:FOM,OTCQX:FMCXF) have agreed to combine in a share-based transaction that would create a larger, diversified gold and copper producer with two major development projects set to enter production in 2026Under the deal, Eldorado... Keep Reading...

10h

Stellar AfricaGold Intersects Multiple Gold-Bearing Zones and Confirms Structural Controls at Tichka Est, Morocco - Drilling Resumed on January 30, 2026

(TheNewswire) Vancouver, BC TheNewswire - February 3rd, 2026 Stellar AfricaGold Inc. ("Stellar" or the "Company") (TSX-V: SPX | FSE: 6YP | TGAT: 6YP) is pleased to report additional assay results and an updated interpretation from its ongoing diamond drilling program at the Tichka Est Gold... Keep Reading...

02 February

Gold and Silver Prices Take a U-Turn on Trump's Fed Chair Nomination

Gold and silver prices have experienced one of their most savage corrections in decades. After hitting a record high of close to US$5,600 per ounce in the last week of January, the price of gold took a dramatic U-turn on January 30, dropping as low as US$4,400 in early morning trading on Monday... Keep Reading...

02 February

Bold Ventures Kicks Off 2026 with Diamond Drilling Program at Burchell Base and Precious Metals Project

Bold Ventures (TSXV:BOL) has launched a diamond drilling program at its Burchell base and precious metals property in Ontario, President and COO Bruce MacLachlan told the Investing News Network.“We just started drilling a couple of weeks ago, and we’ll be drilling for a while,” MacLachlan said,... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00