May 29, 2025

Lithium Africa is a next-generation exploration company purpose-built to seize the opportunities of the coming lithium supercycle. With a focus on early-stage land acquisition, rapid drilling, and a landmark joint venture with Ganfeng Lithium, the company delivers maximum exploration efficiency, capital leverage, and de-risked discovery potential at scale.

Lithium Africa’s mission is to discover, de-risk, and monetize Tier 1 hard rock lithium assets through data-driven targeting, aggressive fieldwork, and disciplined exit strategies. Its partnership with Ganfeng—one of the world’s leading lithium producers—anchors its strategy with industrial expertise and financial strength from the earliest phases of project development.

Lithium Africa is the first company to implement a systematic, multi-jurisdictional discovery strategy across the continent, combining world-class geology with capital discipline and strategic focus to unlock the next generation of globally significant lithium deposits.

Company Highlights

- Exploration-focused Model: Lithium Africa focuses purely on discovery and value creation, with no intention to develop or operate a mine

- Strategic 50/50 JV with Ganfeng Lithium: Doubles exploration spending and provides access to processing expertise and long-term downstream offtake partners.

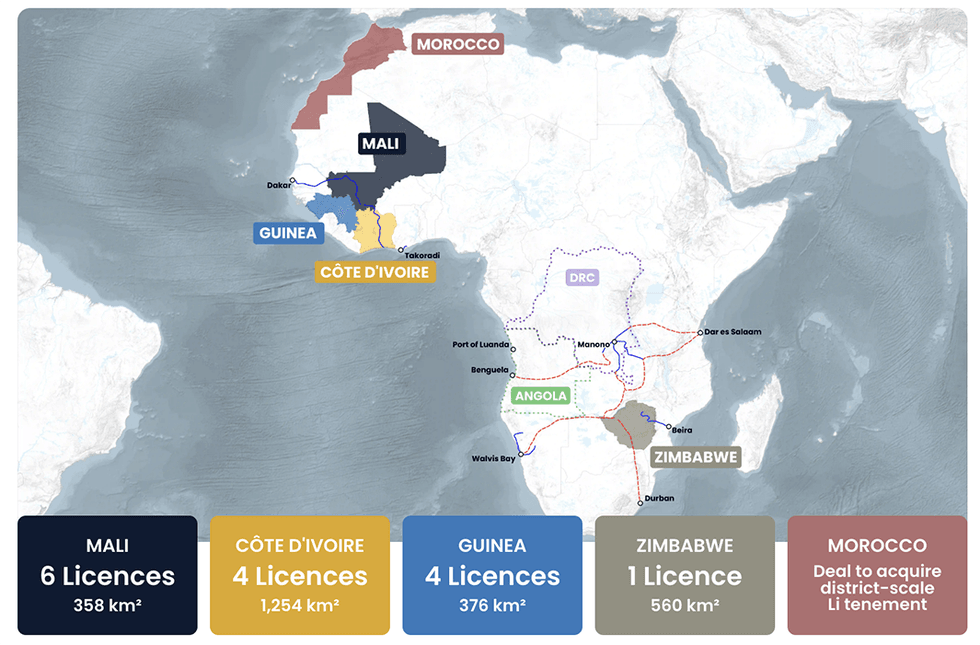

- Pan-African Footprint: Over 8,000 sq km of tenure across Zimbabwe, Morocco, Mali, Côte d’Ivoire, Guinea, and others – enabling diversification in discovery strategy.

- Contrarian, Countercyclical M&A: Well-capitalized and positioned to roll up distressed lithium juniors during a downcycle

- Rapid Permitting & Scalability: Target jurisdictions offer 3- to 4-year discovery-to-mine timelines versus 10 to 15 years in North America.

- RTO & Listing Expected by August 2025: Tight structure, early institutional support and significant near-term drilling catalysts

This Lithium Africa profile is part of a paid investor education campaign.*

Click here to connect with Lithium Africa to receive an Investor Presentation

Sign up to get your FREE

Flow Metals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

26 February

Flow Metals

Advancing gold and copper projects in the Yukon and BC, Canada

Advancing gold and copper projects in the Yukon and BC, Canada Keep Reading...

27 February

UK Enters Commercial Lithium Production with Geothermal Plant Launch

The UK has entered commercial lithium production for the first time as Geothermal Engineering Ltd (GEL) began operations in its plant at Cornwall, anchoring the government's hopes of a domestic battery metals supply chain.The Redruth-based facility marks the country’s first commercial-scale... Keep Reading...

26 February

Zimbabwe Imposes Immediate Ban on Raw Mineral and Lithium Exports

Zimbabwe has imposed an immediate ban on exports of all raw minerals and lithium concentrates, halting shipments already in transit as the government tightens control over the country’s mining sector.Mines and Mining Development Minister Polite Kambamura announced Wednesday that the suspension... Keep Reading...

19 February

Top Australian Mining Stocks This Week: Lithium Valley Results Boost Gold Mountain

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.Mining giant BHP (ASX:BHP,NYSE:BHP,LSE:BHP) reported strong half-year copper results, saying that its copper operations accounted for... Keep Reading...

17 February

Howard Klein Doubles Down on Strategic Lithium Reserve as Project Vault Takes Shape

Before the Trump administration revealed plans for Project Vault, Howard Klein, co-founder and partner at RK Equity, proposed the idea of a strategic lithium reserve. “The goal of a strategic lithium reserve is to stabilize prices and allow the industry to develop,” he told the Investing News... Keep Reading...

17 February

Sigma Lithium Makes New Lithium Fines Sale, Unlocks US$96 Million Credit Facility

Sigma Lithium (TSXV:SGML,NASDAQ:SGML) has secured another large-scale sale of high-purity lithium fines and activated a production-backed revolving credit facility as it ramps up operations in Brazil.The lithium producer announced it has agreed to sell 150,000 metric tons (MT) of high-purity... Keep Reading...

12 February

Albemarle Lifts Lithium Demand Forecast as Energy Storage Surges

Albemarle (NYSE:ALB) is raising its long-term lithium demand outlook after a breakout year for stationary energy storage, underscoring a shift in the battery materials market that is no longer driven solely by electric vehicles.The US-based lithium major reported fourth quarter 2025 net sales of... Keep Reading...

Latest News

Sign up to get your FREE

Flow Metals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00